Dairy Blends Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 7.80 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

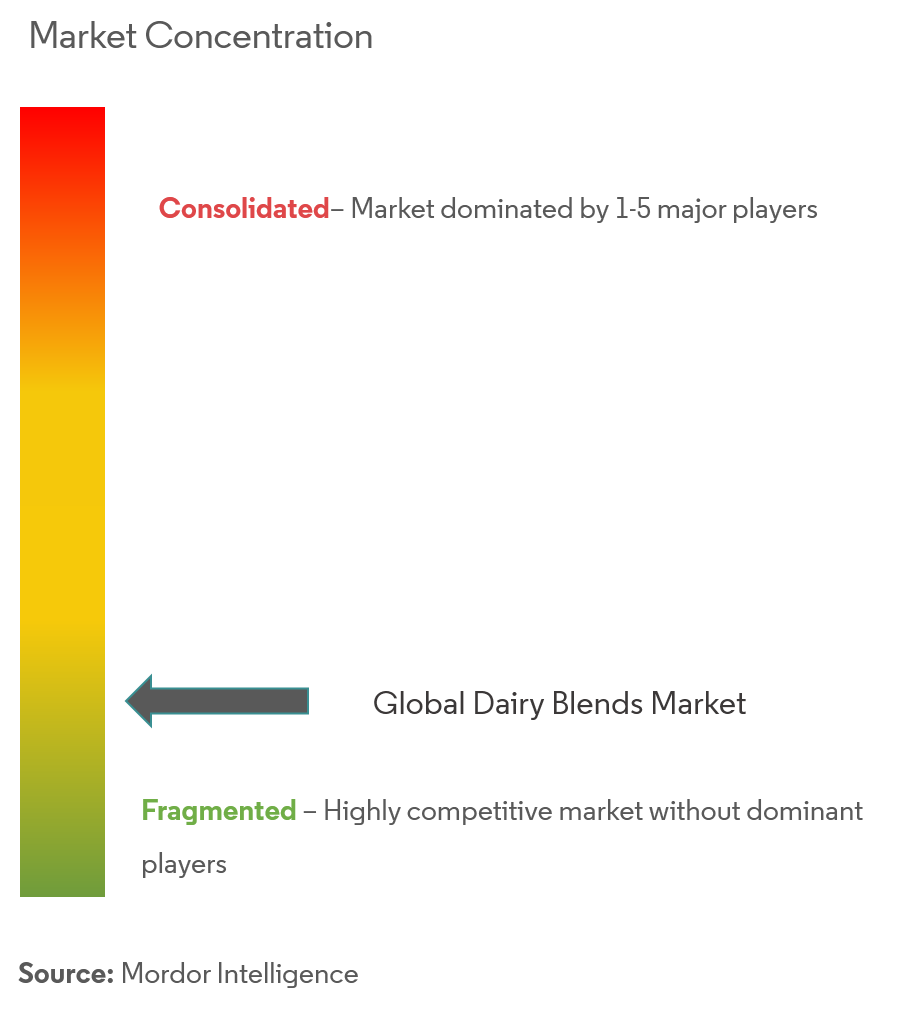

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Dairy Blends Market Analysis

The dairy blends market is projected to register a CAGR of 7.8% during the forecast period (2023-2028).

The COVID-19 outbreak had a negligible negative impact on the dairy blends market. As they are essentially used in the food and beverage sector, the demand for dairy blends increased due to the demand for different processed foods. According to the International Trade Administration (ITA), in 2019, the Chinese food and beverage industry experienced a 7.8% increase than in 2018, with an expected growth of 16% in 2021. The food and beverage sector and the constant demand for infant solutions added to the stable demand for dairy blends.

The increasing health consciousness among customers and the nutritional benefits of these products have encouraged the consumers to opt for dairy blends, as they have various health benefits like enhanced immune function and a reduced risk of several diseases, like diabetes. The presence of essential nutrients with lesser fat content adds to the surging growth of dairy blends in the market.

The availability of numerous flavors also fuels the demand for dairy blends. Companies are trying to experiment with various combinations of flavors to cater to the growing demand for innovation. Moreover, dairy blends can be used in various forms in different industries. For instance, powdered dairy blends can be used as sweeteners and stabilizers in many yogurts and ice creams.

Dairy Blends Market Trends

Demand for Dairy Blends in Numerous Industries

The demand for dairy blend products is increasing rapidly due to their multiple uses in different industries, including food and beverage and infant formula. The most prominent use of dairy blends can be seen in the food and beverage industry. These dairy blends also act as functional ingredients in many processed foods. The combination of non-dairy and dairy ingredients is the most popular dairy blend, with additional health benefits and rich nutrition content. Due to changes in social and economic patterns and growing awareness about healthy foods, functional dairy blends are being applied in many food processing units. The production of ready-to-eat and convenience food requires dairy blends, adding to their surging demand. The rising demand for protein dairy blends like whey protein blends in the nutraceutical industry is also boosting their demand.

Asia-Pacific May Witness Significant Growth in Dairy Blends Market

The growing demand for dairy proteins in the food industry due to their nutritional benefits further boosted the market for dairy blends worldwide. Asia-Pacific is expected to witness the highest growth in the dairy blends market during the forecast period due to the growing preference for dairy-based products. The Asia-Pacific dairy market shows a growing interest in dairy blends as the standard demand for milk fat grows. In contrast to vegetable fats, milk fat is a natural product and offers a better taste. Therefore, the production of dairy blends satisfies the growing demand. Counties like India produces the highest amount of milk and milk fats in the region, adding to the dairy blends market.

Dairy Blends Industry Overview

The dairy blends market is highly competitive, with the presence of numerous domestic and global players. The private-label brands have been gaining a competitive advantage in terms of product differentiation and cost-efficient solutions. The market studied is dominated by All American Foods, Batory Foods, Royal Frieslandcampina NV, Kerry Group, Dana Foods Inc., and Cargill. The market is fragmented, and many players are focused on new product developments and expansion to maintain their market positions. Companies are focused on catering to newer industries and expanding the application of dairy blend ingredients.

Dairy Blends Market Leaders

-

All American Foods

-

Kerry Group

-

Royal Frieslandcampina N.V.

-

Cargill Inc.

-

Royal Frieslandcampina NV

*Disclaimer: Major Players sorted in no particular order

Dairy Blends Market News

In 2022, International Flavors & Fragrances Inc. and Health & Biosciences expanded their YOY MIX ViV product portfolio by adding four new cultures to satisfy the needs of yogurt manufacturers. These new cultures aim to solve the problems of the manufacturers, enabling the formation of high-quality products.

In 2021, Arla Foods Ingredients launched Lacprodan premium ALPHA-10, a dry-blend protein ingredient that can be useful for infant formula manufacturers. This blend has whey protein from human milk consisting of essential amino acids.

In 2021, International Flavors & Fragrances Inc. launched a new solution, YO-MIX ViV, for yogurt and other fermented drinks manufacturers in Asia-Pacific, especially China.

Dairy Blends Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Application

- 5.1.1 Food

- 5.1.1.1 Bakery

- 5.1.1.2 Confectionery

- 5.1.1.3 Ice Cream

- 5.1.1.4 Cheese

- 5.1.1.5 Yogurt

- 5.1.2 Beverages

- 5.1.3 Infant Formula

- 5.1.4 Other Application

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Italy

- 5.2.2.6 Spain

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 All American Foods Inc.

- 6.3.2 Cargill Inc.

- 6.3.3 Royal Frieslandcampina NV

- 6.3.4 Kerry Group

- 6.3.5 Advanced Food Products LLC

- 6.3.6 Cape Food Ingredients

- 6.3.7 AAK Foodservice

- 6.3.8 Dana Foods Inc.

- 6.3.9 Batory Foods

- 6.3.10 Fonterra Cooperative Group Co. Ltd

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityDairy Blends Industry Segmentation

Dairy blends are used by industries like food and beverage, nutrition, and infant solutions to prepare dairy protein products. These dairy blends are majorly used as functional ingredients and as a mixture of non-dairy and dairy ingredients. The dairy blends market is segmented by application and geography. Based on Application, the market is segmented into food, beverages, infant formula, and other applications. Furthermore, food application is bifurcated into the bakery, confectionery, ice cream, and yogurt. On the basis of geography, the dairy blends market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. For each segment, the market sizing and forecast have been done based on value (in USD million).

| Application | Food | Bakery |

| Confectionery | ||

| Ice Cream | ||

| Cheese | ||

| Yogurt | ||

| Application | Beverages | |

| Infant Formula | ||

| Other Application | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Russia | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle-East and Africa | United Arab Emirates |

| South Africa | ||

| Rest of Middle-East and Africa |

Dairy Blends Market Research FAQs

What is the current Dairy Blends Market size?

The Dairy Blends Market is projected to register a CAGR of 7.80% during the forecast period (2024-2029)

Who are the key players in Dairy Blends Market?

All American Foods, Kerry Group, Royal Frieslandcampina N.V., Cargill Inc. and Royal Frieslandcampina NV are the major companies operating in the Dairy Blends Market.

Which is the fastest growing region in Dairy Blends Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Dairy Blends Market?

In 2024, the North America accounts for the largest market share in Dairy Blends Market.

What years does this Dairy Blends Market cover?

The report covers the Dairy Blends Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Dairy Blends Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Dairy Blends Industry Report

Statistics for the 2024 Dairy Blends market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Dairy Blends analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.