Market Trends of Diaphragm Valve Industry

This section covers the major market trends shaping the Diaphragm Valve Market according to our research experts:

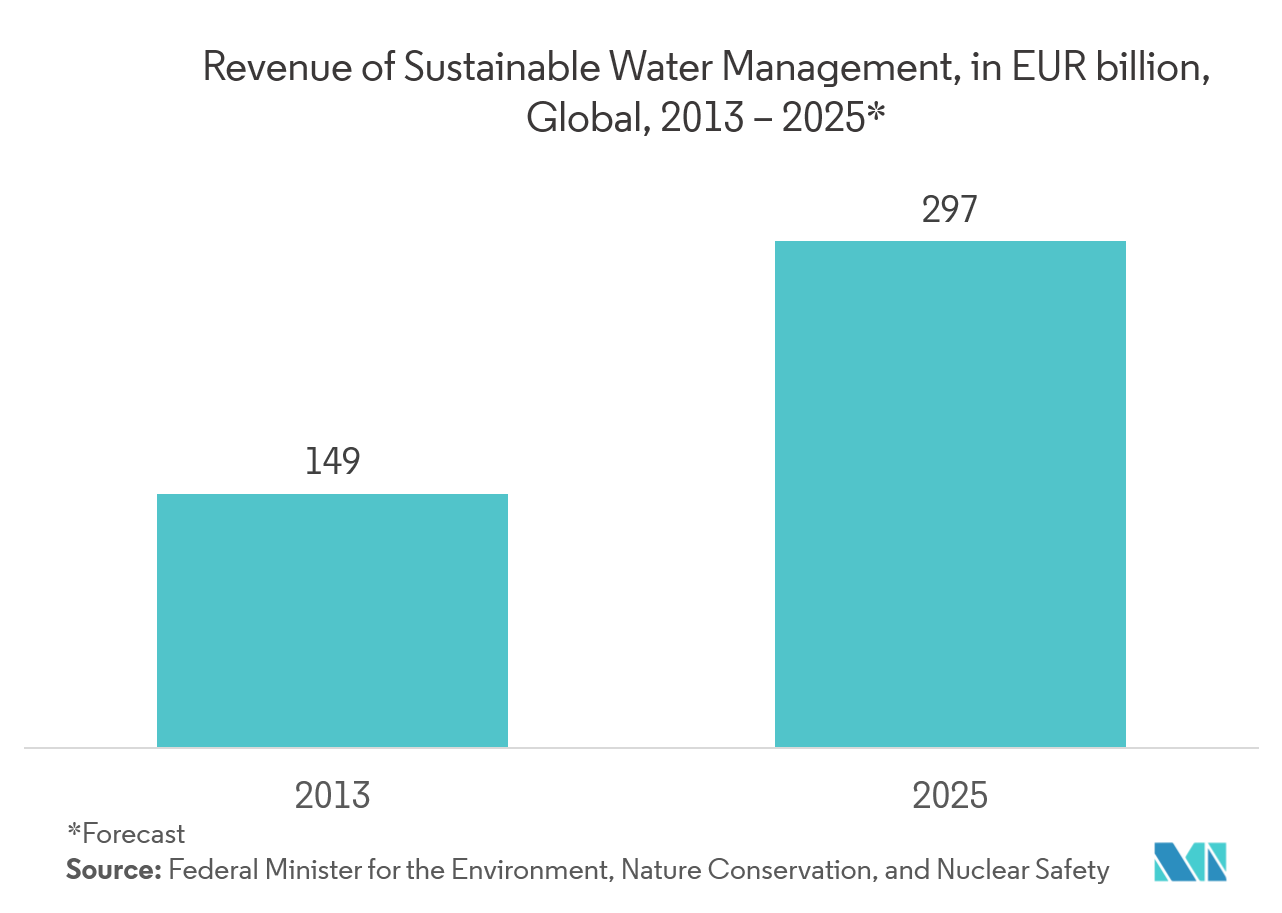

Demand of Water Treatment to Drive the Market Demand

- Water treatment applications are typically high-purity applications requiring minimal contact of the valve body. Diaphragm valves are ideally suited for these applications as these are the ideal solution for applications in conveying corrosive, abrasive media, or media containing solids in suspension or in high-purity applications.

- In many applications of metal processing companies, deionized water (DI-Water) with very low conductivity values is required. With an ion-exchange system, the water can be treated economically for the processes. The company Gross Wassertechnik GmbH, based in Pforzheim, Germany, is a specialist which specializes in industrial water treatment plants and wastewater treatment.

- Solenoid operated diaphragm valves are ideal for handling water both in the intake and treatment process of wastewater, especially in sewage treatment to remove contaminants from wastewater and household sewage.

- Full bore diaphragm valves are primarily used in the fields of water and waste water treatment. It gives an advantage over other conventional shut-off valves, particularly when working with viscous liquids such as slurry and liquids with a high solid or fibre content. The full bore diaphragm valves is the GEMÜ 657 of Gemu company, which gives specific emphasis on achieving the highest Kv values.

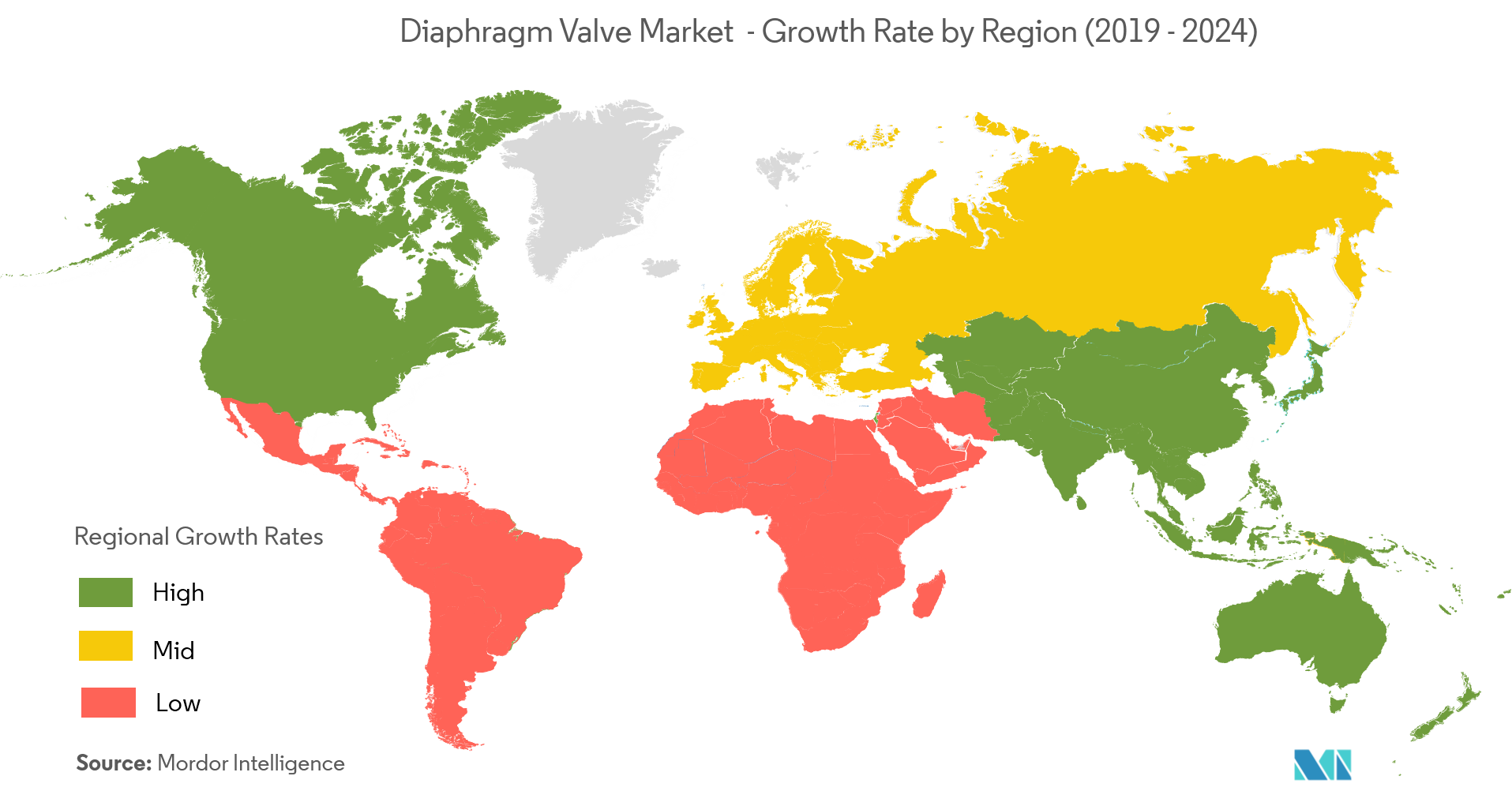

Asia-Pacific is Expected to Witness Highest Growth

- Asia-Pacific is witnessing highest growth due to investment in different industries, including food and beverage, power plants, and chemical.

- Oil & gas application is the largest segment in India because of the pipeline installations, monitoring and controlling, by which the demand of diaphragm valve is growing significantly.

- According to Engineering Export Promotion Council India (Eepc India), in India, Indian industrial valve market expected to reach USD 3 billion by 2023, as the key area of development is 'smart' control valves, to which 90 percent of offshore players are expected to devote research and development resources over the next few years.

- In July 2018, NLC India planned to increase its power generation capacity. Furthermore, chemical companies in the region are investing to expand their facility in the Asia-Pacific region, owing to low-cost labor and rapidly increasing demand of diaphragm valve.

- For instance, in July 2018, BASF signed a MoU to launch its production plant in China, which will be fully-owned by the company. As a result, the utilization and integration of diaphragm valve is expected to increase exponentially in the region, over the forecast period.