Dicamba Herbicide Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 1.95 % |

| Largest Market | Europe |

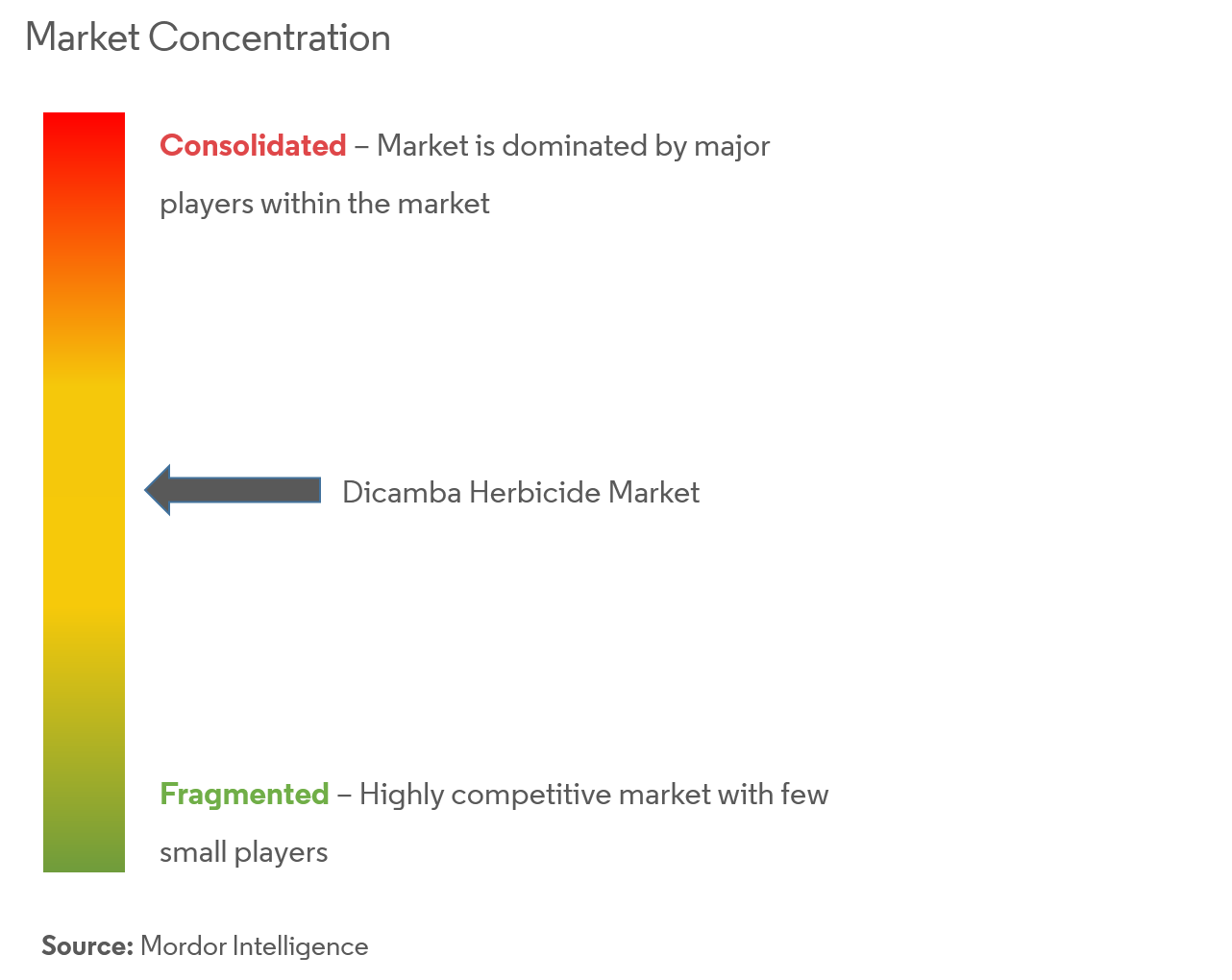

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Dicamba Herbicide Market Analysis

Dicamba Herbicide market is witnessing a CAGR of 1.95% during the forecast period (2020-2025).

- The shrinkage in arable land, changes in climatic conditions and an increase in prominence for pre-emergence herbicides are the major factors driving the global Dicamba Herbicide market.

- The tendency ofherbicide drift and increase in resistance of weeds towards herbicides are some of the major factors restraining the growth of the market studied.

- Bayer AG (The Monsanto Company),The dow chemical company,Basf SE andThe dow chemical company are some of the major players who are operating in this market.

Dicamba Herbicide Market Trends

This section covers the major market trends shaping the Dicamba Herbicide Market according to our research experts:

Shrinkage in Arable Land and Increase in Food Demand

The global population is increasing at an exponential rate which is around 75 million annually or 1.1% per year. According to the U.S Census Bureau, the world population is projected to reach 9 billion by 2044, an increase of 50% over the next 45 years. The critical area of concern is to meet the food demand for these burgeoning populations while farmland continues to shrink. Additionally, the growth of various pests across crops is further declining crop productivity. Hence there is a demand for crop protection chemicals including herbicides to meet this global food security. There is a significant increase in the application of dicamba herbicides across the globe as a pre-emergence herbicide in agriculture owing to its ability to control the growth of perennial weeds in cropland.

North America is Leading the market

North America is projected to reach the largest market for Dicamba herbicides during the forecast period (2019-2024). In North America, glyphosate is extensively used as a herbicide. However, the emergence of glyphosate-resistant weeds has propelled the farmers to adopt dicamba as an alternative herbicide. In addition, glyphosate has been identified with carcinogenic characteristics by the International Agency for Research For Cancer. This, in turn, has created the demand for dicamba herbicide in the region and the demand is projected to increase further during the forecast period.

Dicamba Herbicide Industry Overview

Bayer AG (The Monsanto Company), The dow chemical company, Basf SE and The dow chemical company are some of the major players who are operating in this market. These players are entering into expansion and partnership as their key market strategies to expand their presence across the globe. In Apr 2016, companies such as Monsanto Company invested USD 975 million to expand its manufacturing facility at its Luling plant in the United States. The expansion is to deliver strong Dicamba Herbicides formulations to growers and strengthen its position in critical weed management in the region.

Dicamba Herbicide Market Leaders

-

Bayer AG (The Monsanto Company)

-

Basf SE

-

Corteva Agriscience

-

Nufarm Ltd

-

Marubeni Corporation

*Disclaimer: Major Players sorted in no particular order

Dicamba Herbicide Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Form

- 5.1.1 Liquid

- 5.1.2 Dry

-

5.2 By Application

- 5.2.1 Cereals & Seeds

- 5.2.2 Oil Seeds & Pulses

- 5.2.3 Pastures & Forage Crops

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Bayer AG (The Monsanto Company)

- 6.4.2 Basf SE

- 6.4.3 Corteva Agriscience

- 6.4.4 Nufarm Ltd

- 6.4.5 Marubeni Corporation

- 6.4.6 Albaugh LLC

- 6.4.7 Alligare, LLC

- 6.4.8 ADAMA Ltd

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityDicamba Herbicide Industry Segmentation

The agricultural production is decreasing every year due to the climatic changes and the changing lifestyle decreasing the area under cultivation. The scope of the Dicamba Herbicide market includes form type and by Crop Type and Geography.

| By Form | Liquid | |

| Dry | ||

| By Application | Cereals & Seeds | |

| Oil Seeds & Pulses | ||

| Pastures & Forage Crops | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| United Arab Emirates | ||

| Rest of Middle East and Africa |

Dicamba Herbicide Market Research FAQs

What is the current Dicamba Herbicide Market size?

The Dicamba Herbicide Market is projected to register a CAGR of 1.95% during the forecast period (2024-2029)

Who are the key players in Dicamba Herbicide Market?

Bayer AG (The Monsanto Company), Basf SE, Corteva Agriscience, Nufarm Ltd and Marubeni Corporation are the major companies operating in the Dicamba Herbicide Market.

Which region has the biggest share in Dicamba Herbicide Market?

In 2024, the Europe accounts for the largest market share in Dicamba Herbicide Market.

What years does this Dicamba Herbicide Market cover?

The report covers the Dicamba Herbicide Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Dicamba Herbicide Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Dicamba Herbicide Industry Report

Statistics for the 2024 Dicamba Herbicide market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Dicamba Herbicide analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.