Digital Potentiometer Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 4.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Digital Potentiometer Market Analysis

The Digital Potentiometer market was valued at USD 320 million in 2020, a CAGR of 4.2% over the forecast period (2021 - 2026). Digital potentiometer offers various advantages over mechanical potentiometers, and thus, has become widely accepted in modern systems. Its reliability, flexibility, and ease of use make it a popular replacement for traditional potentiometer.

- There is an increasing demand for the digital potentiometer in the market as it can be used in place of the mechanical potentiometer for various purposes such as sensor trimming, calibration, and audio level control for matching line impedances. This potentiometer is also used to adjust the level in programmable power supplies and in automotive electronics. Moreover, these are smaller and can fit in tiny IC packages measuring due to which it is easy to carry.

- With the rising demand for computers, cellular phones, or video games, the demand for flat-panel liquid crystal displays (LCDs) is growing even larger. Commonly, all these applications use the potentiometer to control contrast or brightness.

- This potentiometer offers a precise outcome when the correct current supply is provided to it. Otherwise, its readings differ from that of the mechanical potentiometer, thus, resulting in error. Such factors are expected to limit the growth of the market.

Digital Potentiometer Market Trends

This section covers the major market trends shaping the Digital Potentiometer Market according to our research experts:

Automotive is Expected to Hold a Significant Share

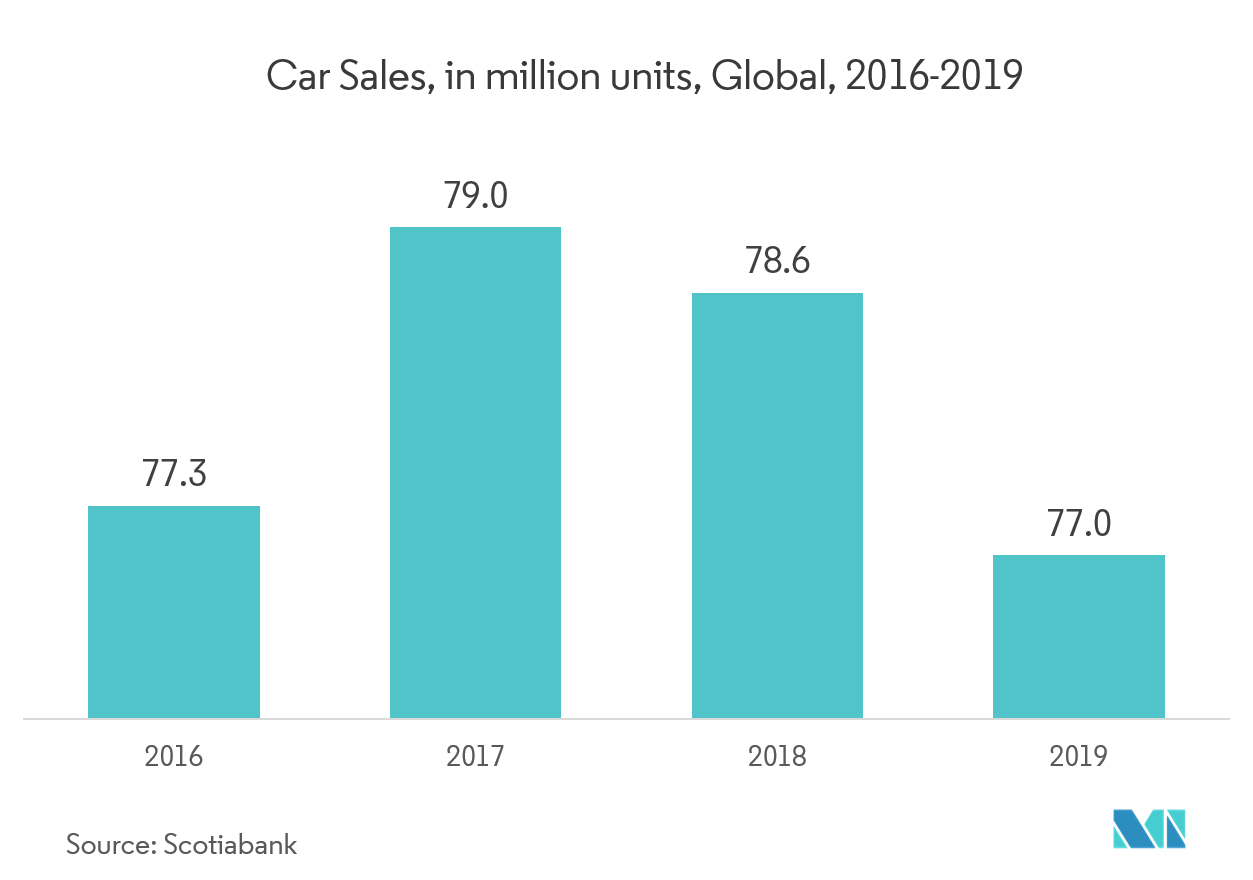

- In the automotive sector, a digital potentiometer is used in the engine control unit, actuator control, actuator controls, instrumentation controls, and navigation/entertainment display adjustments. The automotive industry has grown significantly in the past years, aided by the growth in unit volumes and the emergence of high innovation companies. According to Scotiabank, the automotive sector expects to sell around 77 million automobiles by the end of 2019. Owing to the increasing purchase of cars across the world, the demand for digital potentiometer is likely to increase over the forecast period.

- Along with the factors above, increasing adoption of electric vehicles is also favoring the market growth. An electric car comprises of a motor that needs a controller and battery pack to run. The controller shifts electrical power in pulses from the batteries to the motor. The amount of power to transfer is directed to the controller by a pair of potentiometers attached to the gas pedal. These cars have two potentiometers for safety purposes. The controller checks whether the readings from both the potentiometers are the same. If they are not equal, the controller will not operate. This is designed to avoid situations where one potentiometer might be faulty and could send a signal for the power transfer which is not necessary.

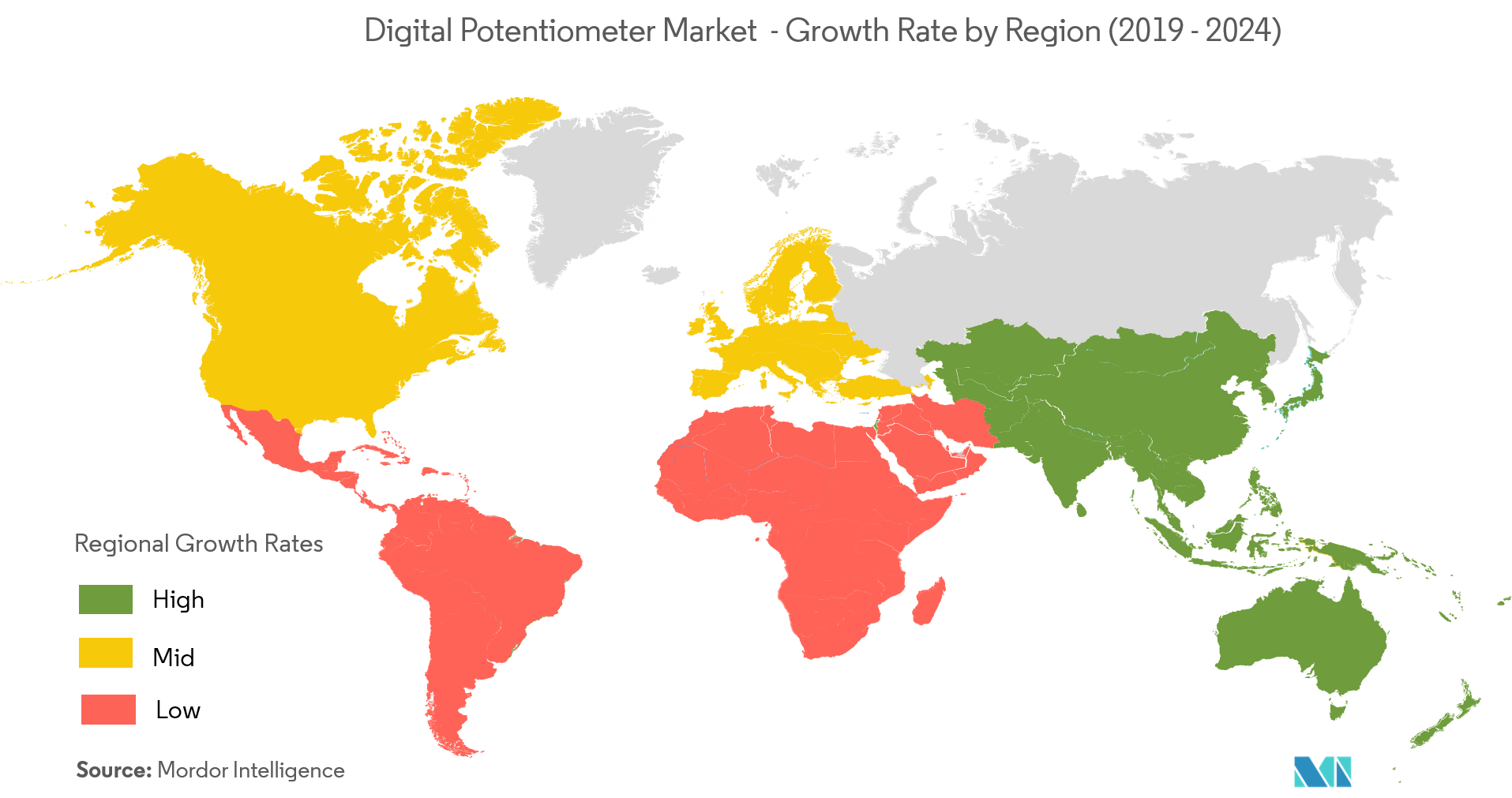

Asia-Pacific is Expected to Experience Rapid Growth

- Asia-Pacific is expected to experience rapid growth in the market, owing to the established electronics industry, in the region. The increased adoption of smartphones, computers, and vehicle automation are the prime factors driving the growth of the Asia-Pacific segment. Increasing smartphone adoption rates have made the region, one of the largest mobile markets in the world. As per the GSMA, in 2018, 2.8 billion people in the region subscribed to mobile services and it is expected by 2025, 370 million new mobile subscribers will be added. With the rising demand for such devices, the demand for LCDs is expected to increase, thereby, influencing the digital potentiometer market in the region.

- Another driving force is the growth of the automotive sector in this region. In Asia-Pacific, major motor vehicle production plants are in China, India, Japan, and South Korea. As per the OICA (International Organization of Motor Vehicle Manufacturers), in 2018, around 3.7 million passenger vehicles were produced in South Korea.

- The growing government regulations in favor of electric vehicles market is also a significant factor for market growth over the forecast period. For instance in India, the NITI Aayog action plan for Clean Transportation released in 2018 has already recommended eliminating all permit requirements for EVs to encourage electric mobility.

Digital Potentiometer Industry Overview

The digital potentiometermarket is competitive and consists of several major players. Companies in the market are continuously investing in introducing new products, expandingtheir operations, and entering into strategic mergers and acquisitions to increasetheir market presence.

- April 2018 -Tangio Printed Electronics launched a new range of force-sensingpotentiometers, with, 2D sensor, force-sensing resistor, touch sensing and with many other upgradations. These potentiometers are easy to integrate, low-power, high resolution, and are ideal for a wide range of applications and markets.

Digital Potentiometer Market Leaders

-

Analog Devices Inc.

-

Renesas Electronics Corporation

-

Microchip Technology Inc.

-

Texas Instruments Inc.

-

Maxim Integrated

*Disclaimer: Major Players sorted in no particular order

Digital Potentiometer Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Overview

- 4.1.1 Low Vulnerable to Physical Tampering

-

4.2 Market Restraints

- 4.2.1 Technical Limitations

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot (Programmable and Non Programmable Potentiometer)

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Automotive

- 5.1.2 Industrial and Instrumentation

- 5.1.3 Consumer Electronics

- 5.1.4 IT and RF Communication

- 5.1.5 Other Applications

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Analog Devices Inc.

- 6.1.2 Microchip Technology Inc.

- 6.1.3 Texas Instruments Inc.

- 6.1.4 Renesas Electronics Corporation

- 6.1.5 Parallax Inc.

- 6.1.6 Maxim Integrated

- 6.1.7 ON Semiconductor (Semiconductor Components Industries LLC)

- 6.1.8 VSI Electronics Pvt Ltd.

- 6.1.9 Nidec Copal Electronics Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. INVESTMENT ANALYSIS

** Subject To AvailablityDigital Potentiometer Industry Segmentation

Potentiometers are a crucial component that are used to vary the resistance in a circuit. A digital potentiometer has the same function as a normal potentiometer, but instead of mechanical action, it uses digital signals and switches. They are convenient for use where environmental factors can adversely affect a mechanical pot. These are better protected from the environment as they can be encapsulated. They are also less vulnerable to vibration, less accessible to physical tampering, and offer more features as compared to a mechanical pot.

| By Application | Automotive |

| Industrial and Instrumentation | |

| Consumer Electronics | |

| IT and RF Communication | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World |

Digital Potentiometer Market Research FAQs

What is the current Digital Potentiometer Market size?

The Digital Potentiometer Market is projected to register a CAGR of 4.20% during the forecast period (2024-2029)

Who are the key players in Digital Potentiometer Market?

Analog Devices Inc., Renesas Electronics Corporation, Microchip Technology Inc., Texas Instruments Inc. and Maxim Integrated are the major companies operating in the Digital Potentiometer Market.

Which is the fastest growing region in Digital Potentiometer Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Digital Potentiometer Market?

In 2024, the North America accounts for the largest market share in Digital Potentiometer Market.

What years does this Digital Potentiometer Market cover?

The report covers the Digital Potentiometer Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Digital Potentiometer Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Digital Potentiometer Industry Report

Statistics for the 2024 Digital Potentiometer market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Digital Potentiometer analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.