Drinkable Yogurts Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.80 % |

| Fastest Growing Market | Europe |

| Largest Market | Asia Pacific |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Drinkable Yogurts Market Analysis

Global drinkable yogurt market is growing at a CAGR of 4.8% during the forecast period (2020-2025).

- The market is mainly driven by the rising demand for probiotic foods and healthier snacking food products among health-conscious consumers including both adults and children. Also, recent launches of formulated functional products with new flavors have further fueled the global market, such as drinkable yogurt fortified with omega 3, collagen, aloe vera, plant sterols, and soy isoflavones. For instance, Morinaga Nutritional Foods Inc. launched a low-fat Japanese-style yogurt drink under its popular Alove brand in three flavors- original aloe vera, strawberry banana and coconut in March 2018. Also, new drinkable yogurt flavor, such as the savory flavor of vegetables- carrots, beetroot, and tomatoes, have become popular among consumers. In addition, consumers are seeking more healthier and natural ingredients in drinkable yogurts, such as stevia, instead of bulk sweeteners, to reduce calories.

- However, the major challenge in this sector is the regulations claimed by the regulatory bodies, for instance, the U.S. Department of Agriculture recommends limiting the yogurt drinks to 3 cups per day, which includes not just yogurt but any milk, cheese or other dairy products.

Drinkable Yogurts Market Trends

This section covers the major market trends shaping the Drinkable Yogurt Market according to our research experts:

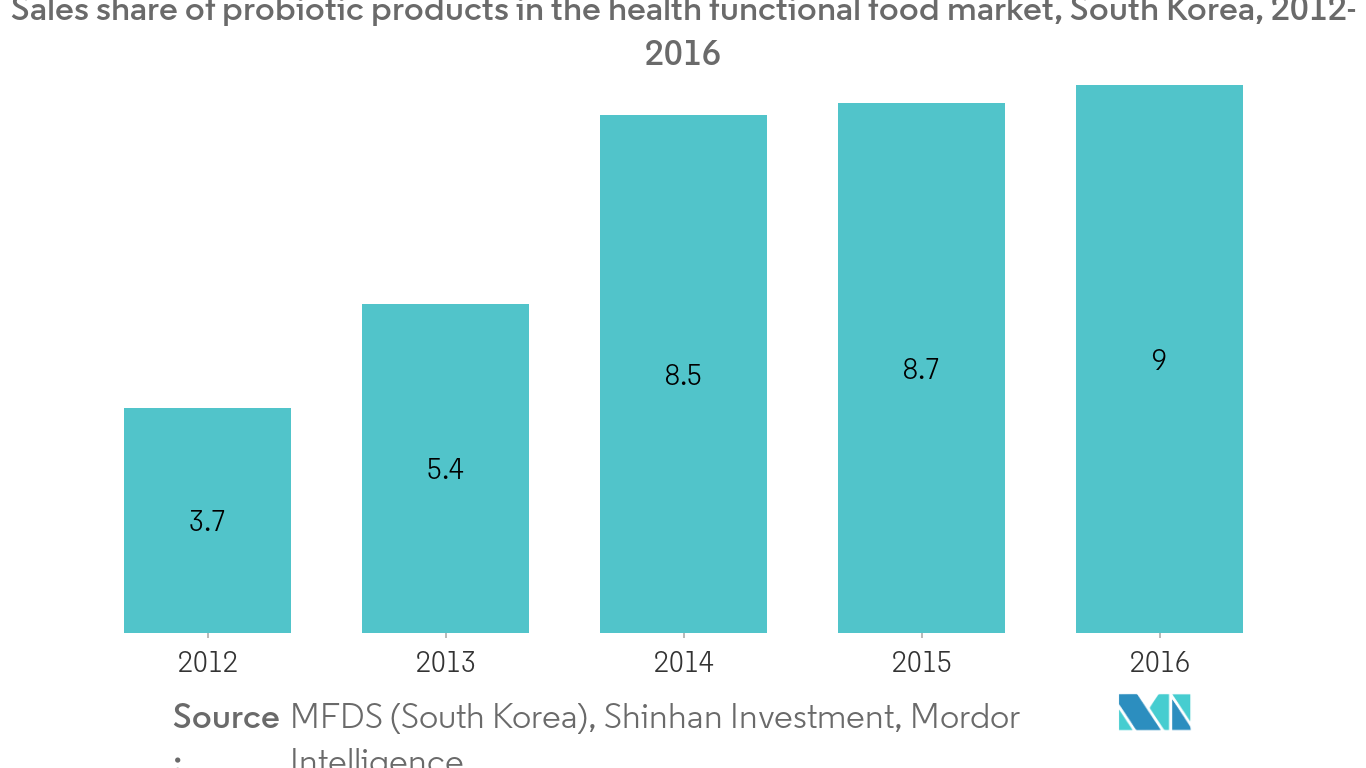

Rising demand for probiotic foods and supplements

The probiotic foods are mainly driven by the robust demand for health-based products, among consumers, as probiotics are a part of functional foods and beverages, and are known for improving gut functionality, along with other benefits, including immunity boost and so on. Therefore, yogurt is one of the highest consumed probiotic food products, its market has been witnessed with a significantly increasing trend. Also, with the increasing internet penetration, the online market for the purchase of food items including probiotic foods and supplements has seen rapid growth globally in the last 3-4 years. This category has attracted a few vertical specialists like Amazon, Walmart, Carrefour, etc. who are riding on increasing e-retailing growth and vying for a significant pie in online yogurt space.

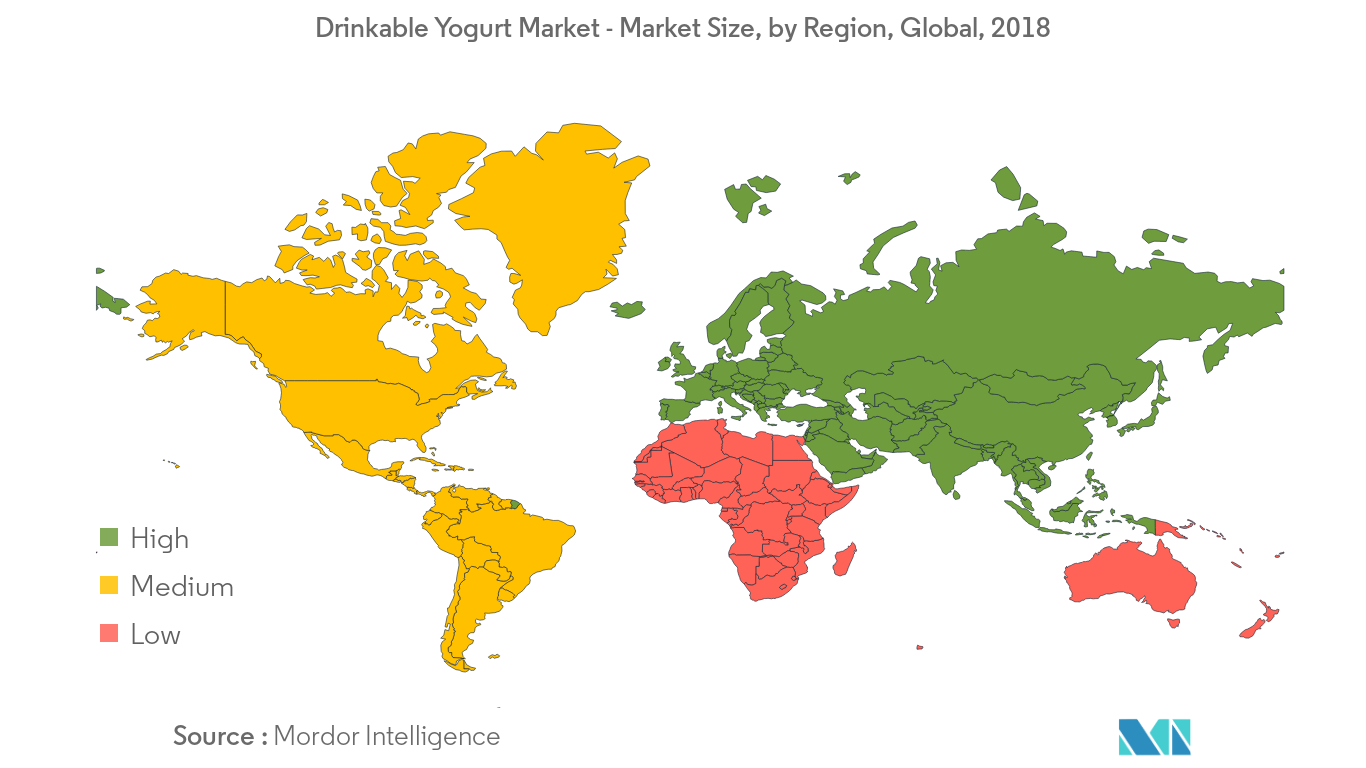

Asia Pacific region to the drive the global drinkable yogurt market

Asia-Pacific is the dominant market for drinkable yogurt, driven by the consumer awareness of probiotic products and supported regulatory environment. The region accounts for a market share of 40%, globally. Drinkable yogurt sales started in Japan with the introduction of Yakult in 1935. The supported FOSHU (Foods for Specified Health Uses) regulation in Japan has driven the market. China and India are the fastest-growing markets, in Asia, driven by changing lifestyles, rising income among the young population, and growing health concerns among consumers. Trust among foreign brands has increased significantly, which has encouraged companies to launch new flavors in the market.

Drinkable Yogurts Industry Overview

The global drinkable yogurt market is highly competitive in nature having a large number of domestic and multinational players competing for market share and with innovation in products being a major strategic approach adopted by leading players. Additionally, merger, expansion, acquisition, and partnership with other companies are the common strategies to enhance the company presence and boost the market. For instance, in March 2018, Archway Food Group, with its brand Pillars, introduced drinkable Greek yogurt which contains probiotic live cultures as well as prebiotic fiber that boosts digestive health and is made up of stevia and non-GMO grass-fed cow milk that supports the natural claim.

Drinkable Yogurts Market Leaders

-

Danone Groupe SA

-

Chobani, LLC.

-

Morinaga Nutritional Foods, Inc.

-

General Mills Inc.

-

Pillars Yogurt

*Disclaimer: Major Players sorted in no particular order

Drinkable Yogurts Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Category

- 5.1.1 Dairy-based yogurt

- 5.1.2 Non-dairy based yogurt

-

5.2 By Type

- 5.2.1 Plain yogurt

- 5.2.2 Flavored yogurt

-

5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Stores

- 5.3.5 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Active Companies

- 6.3 Most Adopted Strategy

-

6.4 Company Profiles

- 6.4.1 Danone S.A

- 6.4.2 Nestlé S.A

- 6.4.3 General Mills Inc.

- 6.4.4 Chobani LLC

- 6.4.5 Royal FrieslandCampina N.V.

- 6.4.6 Groupe Lactalis

- 6.4.7 Pillars Yogurt

- 6.4.8 Morinaga Nutritional Foods, Inc

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityDrinkable Yogurts Industry Segmentation

The global drinkable yogurt market has been segmented by category into dairy-based and non-dairy based; by type into plain and flavored yogurt; and by distribution into hypermarket/supermarket, convenience stores, specialty stores, online channel and others. Also, the study provides an analysis of the drinkable yogurtmarket in the emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| By Category | Dairy-based yogurt | |

| Non-dairy based yogurt | ||

| By Type | Plain yogurt | |

| Flavored yogurt | ||

| By Distribution Channel | Supermarkets/Hypermarkets | |

| Convenience Stores | ||

| Specialty Stores | ||

| Online Stores | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Russia | ||

| Spain | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia Pacific | India |

| China | ||

| Japan | ||

| Australia | ||

| Rest of Asia Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East and Africa |

Drinkable Yogurts Market Research FAQs

What is the current Drinkable Yogurt Market size?

The Drinkable Yogurt Market is projected to register a CAGR of 4.80% during the forecast period (2024-2029)

Who are the key players in Drinkable Yogurt Market?

Danone Groupe SA, Chobani, LLC., Morinaga Nutritional Foods, Inc., General Mills Inc. and Pillars Yogurt are the major companies operating in the Drinkable Yogurt Market.

Which is the fastest growing region in Drinkable Yogurt Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Drinkable Yogurt Market?

In 2024, the Asia Pacific accounts for the largest market share in Drinkable Yogurt Market.

What years does this Drinkable Yogurt Market cover?

The report covers the Drinkable Yogurt Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Drinkable Yogurt Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Yogurt Drink Industry Report

Statistics for the 2024 Yogurt Drink market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Yogurt Drink analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.