Duty-Free And Travel Retail Market Size

| Study Period | 2020-2029 |

| Market Size (2024) | USD 76.20 Billion |

| Market Size (2029) | USD 108.02 Billion |

| CAGR (2024 - 2029) | 7.23 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Duty-Free And Travel Retail Market Analysis

The Global Duty-free And Travel Retail Market size is estimated at USD 76.20 billion in 2024, and is expected to reach USD 108.02 billion by 2029, growing at a CAGR of 7.23% during the forecast period (2024-2029).

One of the primary drivers fueling the expansion of the duty-free and travel retail markets is the growing popularity of the travel and tourist sector. Duty-free and travel retail offer short-term areas that give customers more time following security check-in so they may enjoy entertainment and the atmosphere of shopping for goods from other countries. The market may see an increase in sales as a result of the growing emphasis on digitizing the retailing process to help businesses maximize their earnings. The duty-free and travel retail markets are expanding due in part to the rising demand for retail chains that carry luxury and premium brands of a variety of goods.

Due to the increase in airport visitation worldwide, there is a growing number of inbound and leaving travelers. Increased domestic and international business and sports travel is a major driver of the size of the duty-free shopping market. The UEFA Champions League, UEFA Euro, UEFA Summer Olympics, and Premier Leagues are a few of the big events that draw throngs of tourists from all over the world. Sporting events are held annually in a variety of nations across the world, bringing in more foreign visitors and tourists. This boosts retail sales of luxury and branded goods, particularly through duty-free shops.

The COVID-19 pandemic caused a sharp shift in consumer purchasing behavior from physical to online retailers. Because of this, prominent players in the worldwide duty-free retailing industry, including Dufry AG, Delhi Duty-Free, and Dubai Duty-Free, have developed websites that offer their customers a hassle-free shopping experience along with a variety of promo codes and discounts that will aid in drawing in a sizable user base. Additionally, the tracking of human behavior online and offline with more complex analytics and customization was made easier by technological integration. In the e-commerce travel retail sector, a rise in contactless purchasing experiences with an emphasis on zero-waste production and sustainable consumption practices is predicted to create significant chances in the market.

Duty-Free And Travel Retail Market Trends

Increase in the Demand for Premium Brands and Fashion Accessories

The travel retail & duty-free market is growing because of the widespread desire for luxury cosmetics from a few well-known companies like Estee Lauder, MAC Cosmetics, and L'Oreal Paris. In addition, Europe enjoys a solid reputation in the markets for luxury products and fashion. Duty-free stores enable tourists to buy high-end items at tax-free prices, such as the highly sought-after Italian fashion labels Versace, Gucci, Prada, and Armani. The expansion of Italy's travel retail & duty-free industry is attributed to the appeal of Italian luxury products and fashion. All of these factors drive the growth of the market in this region.

The duty-free and travel retail markets are expanding due in part to the rising demand for retail chains that carry luxury and premium brands of a variety of goods. Distribution channels provide travelers with value, improve their travel experiences, and boost economic activity. Due to factors like a lack of marketing campaigns and expensive merchandise, it is anticipated that the low consumer interest in shopping at airports will likely limit the market's growth. The market is expanding as a result of numerous businesses collaborating with duty-free retailers to introduce their unique or limited-edition goods. Throughout the projection period, the wines and spirits segment is anticipated to significantly increase in market share.

Asia-Pacific is Anticipated to Dominate the Market

Over one-third of the market share was held by Asia-Pacific in the current year. The growth of the Asia-Pacific duty-free and travel retail sector is primarily driven by the opening of low-cost carriers and the expansion of new air routes. The increasing consumption and purchasing power in China and India has a positive impact on this region's market. Asia-Pacific duty-free customers are using digital platforms more and more to make their purchases easier. Usually, smartphone apps like Alipay, Paytm, etc. are used for this. One of the biggest areas for the duty-free shopping business to expand globally is India. The factors behind the expansion of the Indian market are the country's expanding population, improved air connectivity, incoming tourism, and the middle class's inclination to go abroad.

The growing preference for distinctive and value-added items in the region is encouraging people to travel, which is expected to raise demand for duty-free goods. The acceptance of new lifestyles and the launch of low-cost destination travel packages by businesses like GoIbibo, MakeMyTrip, and Cleartrip could lead to an expansion of the worldwide duty-free and retail travel markets. Additionally, vendors operating in the Asia-Pacific market are anticipated to find profitable prospects as a result of the economy's growing digitalization and social media penetration during the forecast period.

Duty-Free And Travel Retail Industry Overview

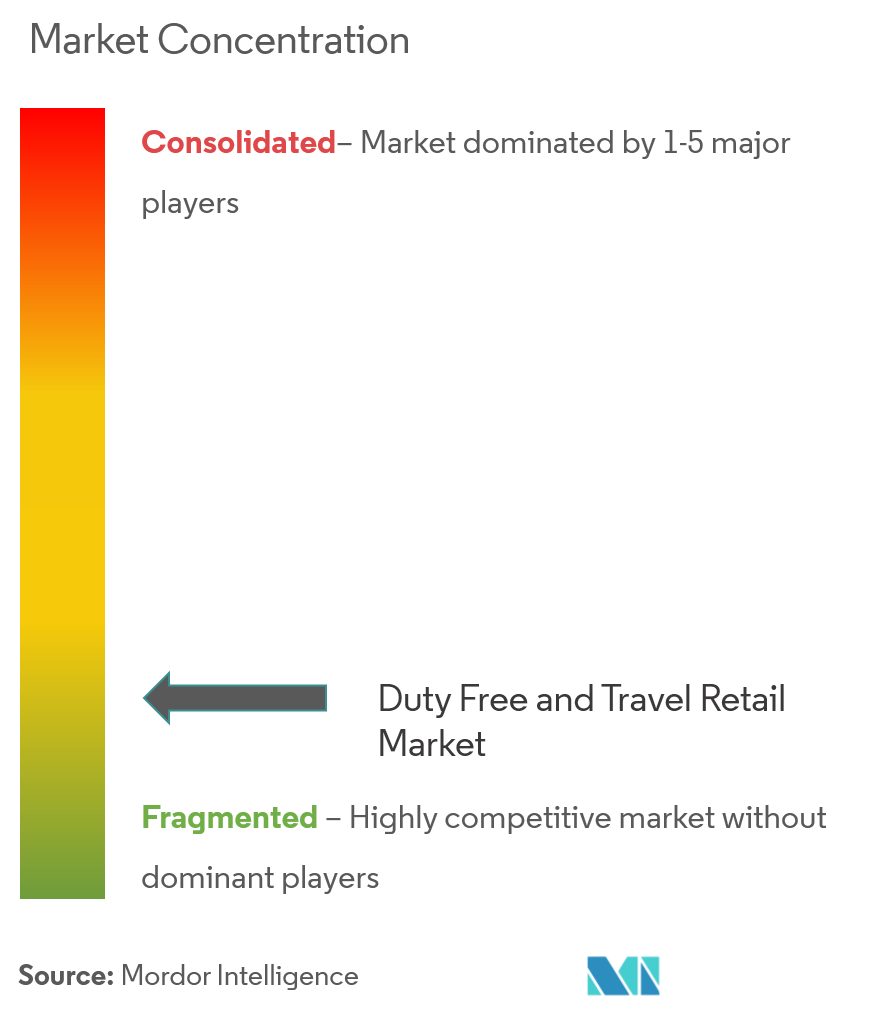

The duty-free & travel retail market is fragmented. Customers are being encouraged to create new stores and chains in the duty-free and travel retail market by the expansion of the travel and tourism industry. The suppliers may be able to draw in a sizable customer base and increase their market shares as a result of the growing emphasis on providing a broad and varied selection of items. Competitors in the duty-free and travel retail industry may be able to maintain their competitiveness by implementing creative promotional strategies and alluring price offers. Major worldwide companies involved in this industry are covered in the research. At the moment, a small number of the main competitors control the majority of the market share.

Duty-Free And Travel Retail Market Leaders

-

Dufry

-

Lagardère Travel Retail

-

DFS Group

-

Lotte Duty Free

-

Flemingo International Ltd

*Disclaimer: Major Players sorted in no particular order

Duty-Free And Travel Retail Market News

- October 2023: Lagardère Travel Retail stated that it reached a master concession agreement with Société des Aéroports du Benin, a state-owned enterprise, to run duty-free travel essentials and food service activities at Cotonou International Airport, Benin.

- September 2023: Lagardère Paradies acquired Fly. The deal was due for closure in the fourth quarter of 2023, subject to several circumstances, including regulatory approval and consent from third parties. With this acquisition, Paradies Lagardère's dining footprint in North America is expanding, and its standing as a leader in this industry is further cemented.

- July 2023: Lagardère Travel Retail partnered with Inflyter to digitalize the duty-free shopping experience for more travelers and provide them with enhanced opportunities to browse and buy items ahead of traveling. This extended partnership supports Lagardère Travel Retail’s overall digital strategy to diversify digital sales channels and multiply touchpoints to engage customers throughout their journey.

Duty-Free And Travel Retail Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Drivers

- 4.1.1 Rise in Duty-Free Retailing Stores with Technology Integration will accelerate market growth

- 4.1.2 Rise in Foreign Tourists to Boost the Market Growth

-

4.2 Market Restraints

- 4.2.1 Convenience and Variety of Online Shopping as more and more Customers Purchase Online

- 4.2.2 Usage of Unsustainable Goods for Storage Affecting Market Growth

-

4.3 Market Opportunities

- 4.3.1 Increased Digitalization To Boost the Demand for Duty Free Products

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the market

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Fashion and Accessories

- 5.1.2 Jewellery and Watches

- 5.1.3 Wine and Spirits

- 5.1.4 Food and Confectionery

- 5.1.5 Fragrances and Cosmetics

- 5.1.6 Tobacco

- 5.1.7 Other Product Types

-

5.2 By Distribution Channel

- 5.2.1 Airports

- 5.2.2 Airlines

- 5.2.3 Ferries

- 5.2.4 Other Distribution Channels

-

5.3 By Geography

- 5.3.1 North America

- 5.3.2 South America

- 5.3.3 Europe

- 5.3.4 Asia-Pacific

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 Dufry

- 6.2.2 Lotte Duty Free

- 6.2.3 Lagardere Travel Retail

- 6.2.4 DFS Group

- 6.2.5 The Shilla Duty Free

- 6.2.6 King Power International Group

- 6.2.7 China Duty Free Group

- 6.2.8 Dubai Duty Free

- 6.2.9 Duty Free Americas

- 6.2.10 Sinsegae Duty Free

- 6.2.11 WH Smith*

- *List Not Exhaustive

7. FUTURE MARKET TRENDS

8. DISCLAIMER AND ABOUT US

** Subject To AvailablityDuty-Free And Travel Retail Industry Segmentation

Duty-free shops (or stores) are retail outlets whose goods are exempt from the payment of certain local or national taxes and duties on the requirement that the goods sold will be sold to travelers who will take them out of the country.

The duty-free and travel retail market is segmented by product type, distribution channel, and by region. By product type, the market is segmented into fashion and accessories, jewelry and watches, wine & spirits, food & confectionery, fragrances and cosmetics, tobacco, and others (stationery, electronics, etc.). By distribution channel, the market is segmented into airports, airlines, ferries, and others (railway stations, border, downtown), and by region, the market is segmented into North America, South America, Europe, Asia-Pacific, and Middle East & Africa.

The report offers market size and forecasts for the duty-free and travel retail market in value (USD) for all the above segments.

| By Product Type | Fashion and Accessories |

| Jewellery and Watches | |

| Wine and Spirits | |

| Food and Confectionery | |

| Fragrances and Cosmetics | |

| Tobacco | |

| Other Product Types | |

| By Distribution Channel | Airports |

| Airlines | |

| Ferries | |

| Other Distribution Channels | |

| By Geography | North America |

| South America | |

| Europe | |

| Asia-Pacific | |

| Middle East & Africa |

Duty-Free And Travel Retail Market Research FAQs

How big is the Duty Free And Travel Retail Market?

The Duty Free And Travel Retail Market size is expected to reach USD 76.20 billion in 2024 and grow at a CAGR of 7.23% to reach USD 108.02 billion by 2029.

What is the current Duty Free And Travel Retail Market size?

In 2024, the Duty Free And Travel Retail Market size is expected to reach USD 76.20 billion.

Who are the key players in Duty Free And Travel Retail Market?

Dufry, Lagardère Travel Retail, DFS Group, Lotte Duty Free and Flemingo International Ltd are the major companies operating in the Duty Free And Travel Retail Market.

Which is the fastest growing region in Duty Free And Travel Retail Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Duty Free And Travel Retail Market?

In 2024, the Asia Pacific accounts for the largest market share in Duty Free And Travel Retail Market.

What years does this Duty Free And Travel Retail Market cover, and what was the market size in 2023?

In 2023, the Duty Free And Travel Retail Market size was estimated at USD 70.69 billion. The report covers the Duty Free And Travel Retail Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Duty Free And Travel Retail Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the technology drivers impacting the growth of the Duty-Free & Travel Retail Market?

The technology drivers impacting the growth of the Duty-Free & Travel Retail Market are a) Integration of omnichannel experiences combining physical and digital touchpoints b) Adoption of contactless payment options and use of digital kiosks

Duty-Free And Travel Retail Industry Report

The Global Duty Free & Travel Retail Market Report is segmented by product type and distribution channel, offering a comprehensive industry analysis. The market is a significant revenue generator for aviation, tourism, and other travel-related industries. Airports, in particular, derive a considerable portion of their income from duty-free and travel retailing. Despite challenges such as trade tensions and protectionism between countries, the market is seeing an increased demand for duty-free alcohol, spurred by diversifying consumer buying habits and rising spending among the middle-class population.

The market's growth is fueled by the rapidly expanding international tourism market and the increasing number of new air routes in Asian countries. However, global currency fluctuations could potentially hamper product demand. The market is segmented by type, with perfumes expected to dominate the global duty-free retail market share. The rising popularity of premium beauty products is also fueling demand in the cosmetics space. In terms of sales channels, airports dominate product sales worldwide.

The Asia Pacific market is anticipated to witness significant growth over the forecast period, with Europe and North America also expected to see growth. The South America and Middle East and Africa markets are likely to experience an upward trend due to rising consumer demand for premium/luxury perfumes. Duty-Free & Travel Retail market share, size, and revenue growth rate statistics provide a comprehensive market overview, including market forecast and market trends. A sample of this industry report is available as a free report PDF download.

The industry outlook remains positive, with market leaders driving the market growth. Market segmentation by product type and distribution channel offers detailed market data. The market value is projected to rise, supported by industry statistics and market predictions. Research companies provide valuable industry information and industry research, contributing to market review and market analysis. The report example highlights the importance of understanding market dynamics to capitalize on growth opportunities.