East Africa Diesel Generator Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2020 - 2022 |

| CAGR | 4.39 % |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

East Africa Diesel Generator Market Analysis

The market for diesel generators in East Africa is expected to grow at a CAGR of 4.39% during the forecast period of 2019 – 2024. Factors such as lack of accessibility to electricity in rural areas, leading to dependency on diesel generators and lack of reliability in the grid due to frequent power outages are the major factors driving the diesel generator market in the region. However, strengthening electricity sector in East Africa under the projects such as East African Power Pool (EAPP) and North-South Power Transmission Corridor (NSPTC) are expected to increase the level of electricity accessibility in the region, in turn, limiting the growth of the diesel generator market in the coming years.

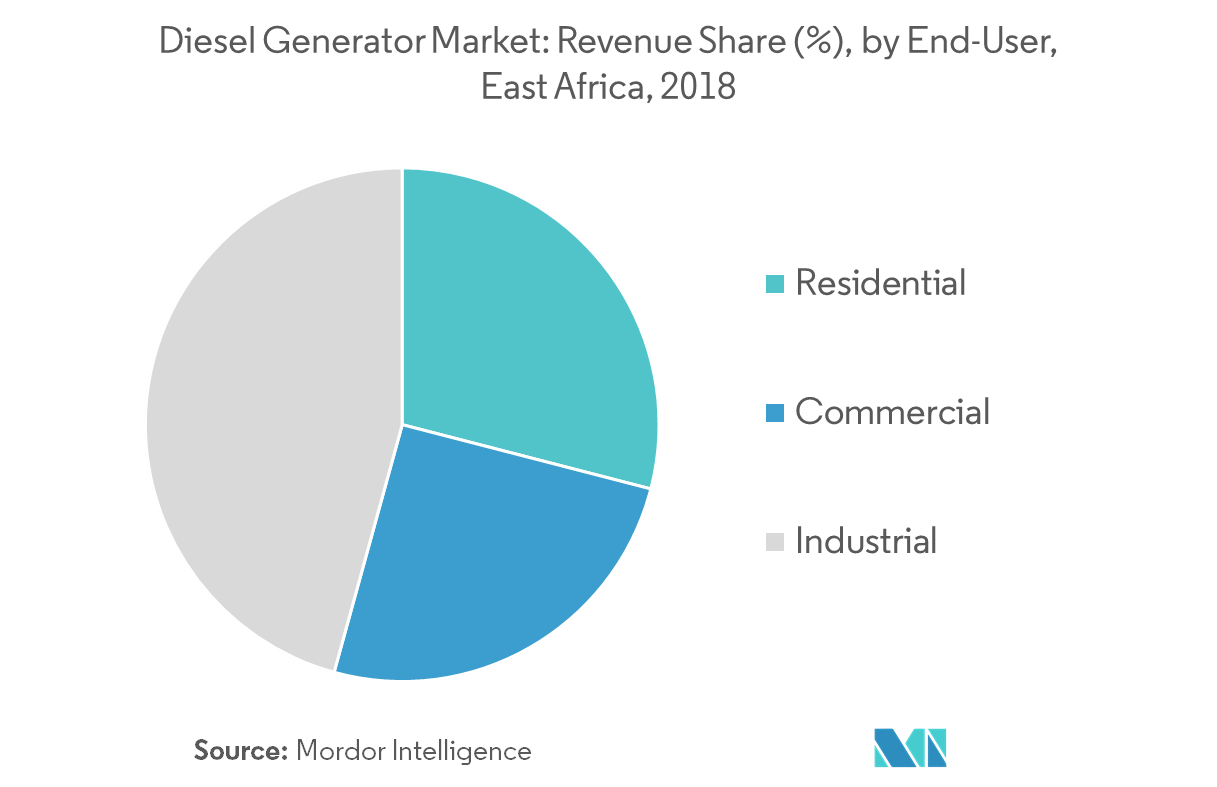

- The industrial sector is expected to account for the largest share in the diesel generator market in East Africa by end-user owing to the increasing demand from small- and medium-scale enterprises which are heavily dependent on diesel generator due to frequent power outages.

- In rural areas hybrid systems powering micro grids are expected to be more viable than the extension of the national electricity grid. Hence, this evolving concept of hybrid mini-grid systems is likely to create opportunities for the companies involved of diesel generator business.

- Ethiopia is expected to dominate the market over the forecast period owing to the rapid industrialization in the country.

East Africa Diesel Generator Market Trends

This section covers the major market trends shaping the East Africa Diesel Generator Market according to our research experts:

Increasing Demand from Industrial Sector

- The industrial sector is expected to dominate the market for diesel generators over the forecast period. The major industries in East Africa consist of mining, manufacturing, agriculture, and construction. These industries (except agriculture) are highly power intensive and require grid connectivity for its operation.

- Majority of the mining companies, farmers and small scale manufacturers completely rely on diesel-fueled generators for a full-time power supply due to inaccessibility of the grid. Supportive government policies to boost industrial activities in the region is expected to give rise to new manufacturing and mining plants and will thus, drive the diesel generator market.

- Another upcoming sector that is expected to emerge as a huge potential market for diesel generator is the oil & gas industry which is very underdeveloped in the region. East Africa is estimated to have more than 10 tcf of proven gas reserves and roughly 11 bpd of proven oil reserves. Although it may take several years for the fields to develop, it still poses as an opportunity for the diesel generators in the long term.

- By offering incentives such as zero ratings of various raw materials, and through various manufacturing incentive schemes, the East African Community (EAC) countries have been trying to promote manufacturing as a way of diversifying their economies. This is further expected to boost the demand for diesel generators, as grid-supplied power may prove to be inadequate due to the underdeveloped grid infrastructure.

Ethiopia to Dominate the Market

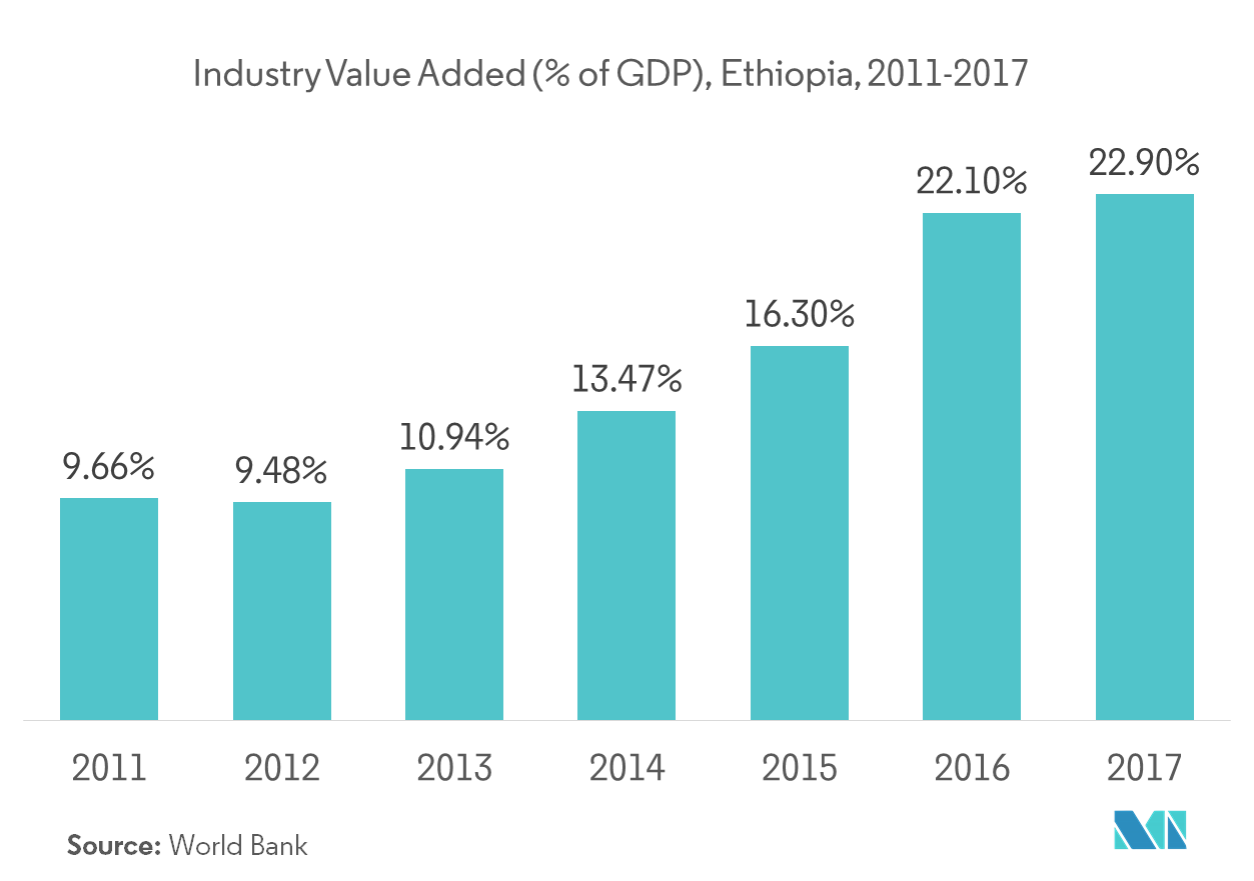

- After being hit by drought in the past few years, Ethiopia is steadily recovering with a continued expansion of services and industry and a rebound in agriculture. The share of industry in national GDP increased from 22.1% in 2016 to 22.9% in 2017, which was driven by the construction, manufacturing, and power sector.

- The government of Ethiopia has prioritized industrialization, especially through the development of industrial parks. It has also started a 656 km Addis Ababa-Djibouti electric railway to ease the cost of doing business.

- The Ethiopian industrial sector is witnessing a high growth rate. Special focus on textile and apparel, as well as leather and leather products, has been a bold move. The construction of industrial parks, one of the priorities of the five-year Growth and Transformation Plan I and II has received due attention.

- While some of the industrial parks, such as Hawassa and Lemi Industrial parks, are built specifically for textile and apparel, others also have a place for textile and garment industries besides others, such as food processing and vehicles assembly. Both inside and outside the industrial park, textile industries have attracted several global companies with renowned international brands.

- Furthermore, the implementation of the export-led industrialization strategy is supporting the growth in the industry. The growth is expected to continue, led by investments in line with the stable public infrastructure spending and the higher foreign direct investment (FDI). The combined effect of all these factors is expected to be a positive sign for high optimism for the increasing demand for diesel generator among the industries in Ethiopia.

East Africa Diesel Generator Industry Overview

The East Africa diesel generator market is largely fragmented, due to the large number of companies operating in the industry. The key players in this market include AKSA Power Generation, General Electric Corporation, Jiangsu Starlight Electricity Equipment Co. Ltd, Kirloskar Oil Engines Limited, and Masterpower Generator Industry and Trading Inc.

East Africa Diesel Generator Market Leaders

-

AKSA Power Generation

-

General Electric Company

-

Jiangsu Starlight Electricity Equipment Co. Ltd

-

Kirloskar Oil Engines Limited

-

Masterpower Generator Industry and Trading Inc.

*Disclaimer: Major Players sorted in no particular order

East Africa Diesel Generator Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

- 1.4 Study Deliverables

- 1.5 Research Phases

2. EXECUTIVE SUMMARY

3. RESEARCH METHODOLOGY

4. MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD million, till 2024

-

4.3 Diesel Generator Trade Statistics, by Major Countries

- 4.3.1 Import, by Power Output

- 4.3.2 Export, by Power Output

- 4.3.3 Trade Balance, Power Output

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

-

4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

-

4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Power Rating

- 5.1.1 Less than or Equal to 75 kVA

- 5.1.2 More than 75 kVA but Less than or Equal to 375 kVA

- 5.1.3 More than 375 kVA

-

5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

-

5.3 Geography

- 5.3.1 Ethiopia

- 5.3.2 Kenya

- 5.3.3 Madagascar

- 5.3.4 Tanzania

- 5.3.5 Zimbabwe

- 5.3.6 Rest of East Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Player Analysis

-

6.4 Company Profiles

- 6.4.1 African Power Machinery (TZ) Ltd

- 6.4.2 AKSA Power Generation

- 6.4.3 Car and General (Kenya) PLC

- 6.4.4 Caterpillar Inc.

- 6.4.5 Deutz Dieselpower

- 6.4.6 Diesel Electric Services (Pty) Ltd

- 6.4.7 Ettes Power Machinery Co. Ltd

- 6.4.8 General Electric Company

- 6.4.9 Jiangsu Starlight Electricity Equipment Co. Ltd

- 6.4.10 Kirloskar Oil Engines Limited

- 6.4.11 Kubota Corporation

- 6.4.12 Mahindra Powerol

- 6.4.13 Mantrac Tanzania

- 6.4.14 Masterpower Generator Industry and Trading Inc.

- 6.4.15 Merrywater Ltd

- 6.4.16 Pai Kane group

- 6.4.17 Phoenix Diesel Power Ltd

- 6.4.18 Power Providers Tanzania

- 6.4.19 Shining Star Power Equipment & Machinery Trading LLC

- 6.4.20 Sincro Sitewatch Ltd

- 6.4.21 Wartsila Corporation

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEast Africa Diesel Generator Industry Segmentation

The East Africa diesel generator market report include:

| Power Rating | Less than or Equal to 75 kVA |

| More than 75 kVA but Less than or Equal to 375 kVA | |

| More than 375 kVA | |

| End-User | Residential |

| Commercial | |

| Industrial | |

| Geography | Ethiopia |

| Kenya | |

| Madagascar | |

| Tanzania | |

| Zimbabwe | |

| Rest of East Africa |

East Africa Diesel Generator Market Research FAQs

What is the current East Africa Diesel Generator Market size?

The East Africa Diesel Generator Market is projected to register a CAGR of 4.39% during the forecast period (2024-2029)

Who are the key players in East Africa Diesel Generator Market?

AKSA Power Generation, General Electric Company, Jiangsu Starlight Electricity Equipment Co. Ltd, Kirloskar Oil Engines Limited and Masterpower Generator Industry and Trading Inc. are the major companies operating in the East Africa Diesel Generator Market.

What years does this East Africa Diesel Generator Market cover?

The report covers the East Africa Diesel Generator Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the East Africa Diesel Generator Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

East Africa Diesel Generators Industry Report

Statistics for the 2024 East Africa Diesel Generators market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. East Africa Diesel Generators analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.