Electrical Stimulation Devices Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 9.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Electrical Stimulation Devices Market Analysis

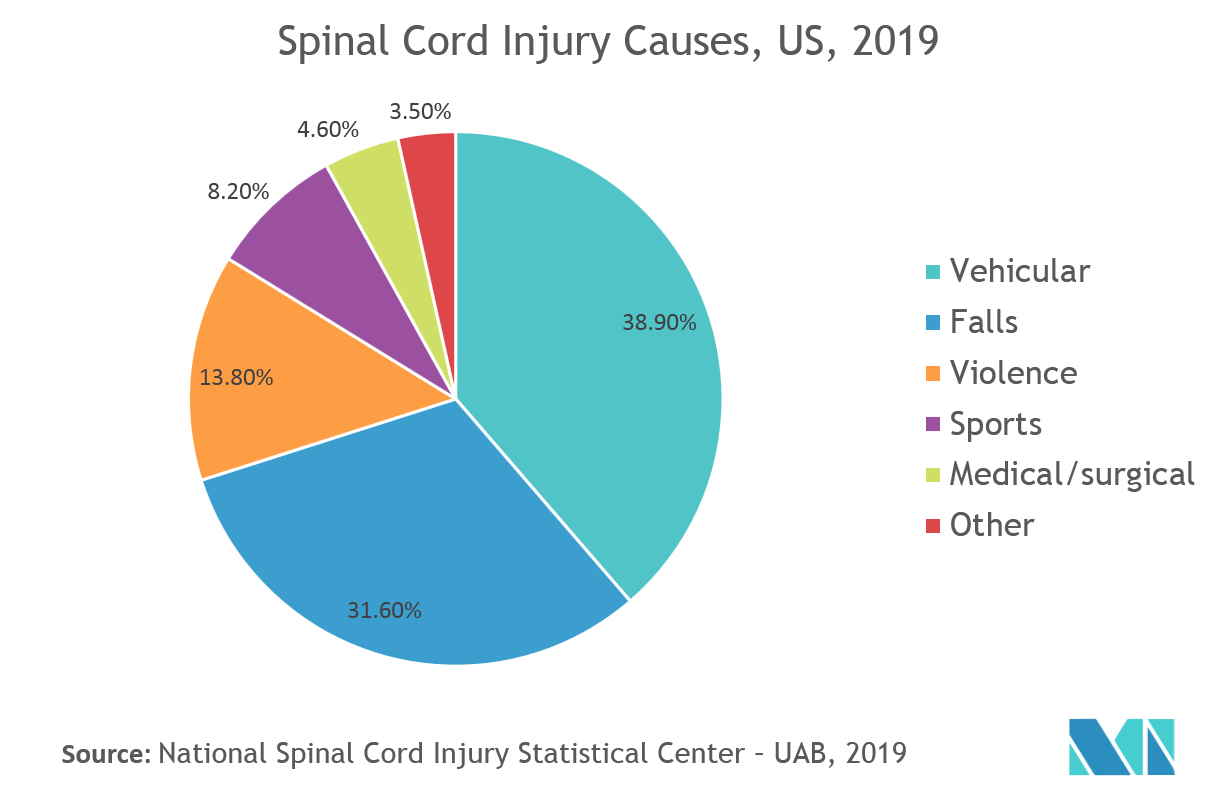

The Electrical Stimulation Devices market studied is anticipated to grow with a CAGR of 9.5%, during the forecast period. The major factors attributing to the growth of the electrical stimulation devices market are the growing incidence of spinal injury triggered by accidents, violence, or falling anticipated to boost the demand for spinal surgery, which is assessed to upsurge the market growth for electrical stimulation devices.

As per the NINDS 2019 Factsheet, there are around 12,000 estimated spinal cord injuries in the United States each year. Falls are the world's second primary cause of unintentional or accidental fatalities from injuries. According to the WHO 2018 data every year there are 37.3 million cases that are serious enough to require medical care and around 646,000 people die globally each year from falls which are expected to further boost the demand for electrical stimulation devices for treatment.

Electrical Stimulation Devices Market Trends

This section covers the major market trends shaping the Electrical Stimulation Devices Market according to our research experts:

Pain Management is Expected to Hold the Largest Market Share in the Electrical Stimulation Devices Market

The dominant share is retained by the pain management segment owing to the attributes such as the strong prevalence of chronic pain ailments and increased use of products to manage pain owing to their high therapeutic benefits.

Chronic pain is among the world's leading causes of suffering and injury, and a prominent indication of both AIDS/HIV and cancer. As per the statistics from the American Academy of Pain Medicine 2018, around 126 million individuals experience pain in the US. It is known that chronic pain affects more than 1.5 billion people worldwide. Therefore the increasing chronic pain among the individuals is found increasing the overall market share.

North America Dominates the Market and Expected to do Same in the Forecast Period

North America is expected to dominate the overall electrical stimulation devices market, throughout the forecast period. This is owing to factors such as the rising prevalence of chronic disorders. An estimated 45 percent or about 33 million Americans were diagnosed with at least one chronic disease, according to the National Center for Biotechnology Information (NCBI), March 2018. Therefore the increase in chronic pain is further expected to upsurge the demand of stimulator devices in the coming years.

Additionally, the presence of key players that manufacture electrical muscle stimulation devices in the region will continue to drive the market’s growth in the United States throughout the projected period.

Electrical Stimulation Devices Industry Overview

The electrical stimulation devices market is moderately competitive and consists of a few major players. In terms of market share, the market is currently dominated by a few of the major players. Some leading players are making intensive investments and launching new products with the other organizations to expand their global market positions. Some of the companies which are currently dominating the market are Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, BTL Corporate, and DJO Global, Inc.

Electrical Stimulation Devices Market Leaders

-

Medtronic plc

-

Abbott

-

Boston Scientific Corporation

-

DJO Global, Inc.

-

BTL Corporate

*Disclaimer: Major Players sorted in no particular order

Electrical Stimulation Devices Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increase in the Incidence of Chronic Diseases, Neurological Disorders and Spinal Injuries

- 4.2.2 Deskbound Ways of life that lead to Chronic Health Issues

-

4.3 Market Restraints

- 4.3.1 Stringent Regulation for Device Approval

- 4.3.2 Availability of Wide Range of Alternatives for Electrical Stimulation Systems

-

4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Device Type

- 5.1.1 Deep Brain Stimulation Devices

- 5.1.2 Spinal Cord Stimulation Devices

- 5.1.3 Sacral Nerve Stimulation Devices

- 5.1.4 Vagus Nerve Stimulation Devices

- 5.1.5 Neuromuscular Electrical Stimulation Devices

- 5.1.6 Other Electrical Stimulation Devices

-

5.2 By Application

- 5.2.1 Musculoskeletal Disorder Management

- 5.2.2 Pain Management

- 5.2.3 Metabolism & GIT Management

- 5.2.4 Neurological and Movement Disorder Management

- 5.2.5 Incontinence Management

- 5.2.6 Others

-

5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Medtronic plc

- 6.1.2 Boston Scientific Corporation

- 6.1.3 Abbott Laboratories

- 6.1.4 DJO Global, Inc.

- 6.1.5 BTL Corporate

- 6.1.6 Nevro Corp.

- 6.1.7 NeuroMetrix, Inc.

- 6.1.8 Zynex Medical

- 6.1.9 Cogentix Medical

- 6.1.10 BioMedical Life Systems

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityElectrical Stimulation Devices Industry Segmentation

As per the scope of the report, electrical stimulation (ES) treatment requires the use of electrodes for the transmission of electrical current to affected areas of the body. ES is used for comforting and contraction in the neuromuscular and wound healing. Basically, electrical stimulators are being used to treat muscle spasms as a result of wounds or neurological ailments.

| By Device Type | Deep Brain Stimulation Devices | |

| Spinal Cord Stimulation Devices | ||

| Sacral Nerve Stimulation Devices | ||

| Vagus Nerve Stimulation Devices | ||

| Neuromuscular Electrical Stimulation Devices | ||

| Other Electrical Stimulation Devices | ||

| By Application | Musculoskeletal Disorder Management | |

| Pain Management | ||

| Metabolism & GIT Management | ||

| Neurological and Movement Disorder Management | ||

| Incontinence Management | ||

| Others | ||

| By End User | Hospitals | |

| Ambulatory Surgical Centers | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Middle-East and Africa | GCC |

| South Africa | ||

| Rest of Middle-East and Africa | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America |

Electrical Stimulation Devices Market Research FAQs

What is the current Electrical Stimulation Devices Market size?

The Electrical Stimulation Devices Market is projected to register a CAGR of 9.5% during the forecast period (2024-2029)

Who are the key players in Electrical Stimulation Devices Market?

Medtronic plc, Abbott, Boston Scientific Corporation, DJO Global, Inc. and BTL Corporate are the major companies operating in the Electrical Stimulation Devices Market.

Which is the fastest growing region in Electrical Stimulation Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Electrical Stimulation Devices Market?

In 2024, the North America accounts for the largest market share in Electrical Stimulation Devices Market.

What years does this Electrical Stimulation Devices Market cover?

The report covers the Electrical Stimulation Devices Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Electrical Stimulation Devices Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Electrical Stimulation Devices Industry Report

Statistics for the 2024 Electrical Stimulation Devices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Electrical Stimulation Devices analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.