Emollients Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Emollients Market Analysis

The global emollient market is projected to register a CAGR of 5.5% during the forecast period (2019-2024).

- The market is driven by increasing awareness about personal care products. Also, the awareness regarding the harmful effects of chemicals present in skincare, cosmetics and hair care products has led consumers to shift towards naturally derived product ingredients, such as animal and plant-derived emollients that are devoid of chemical modifications thus fueling the market growth. Furthermore, online distribution channels and E-commerce are forecasted to increase the distribution of personal care products in the forecasted period.

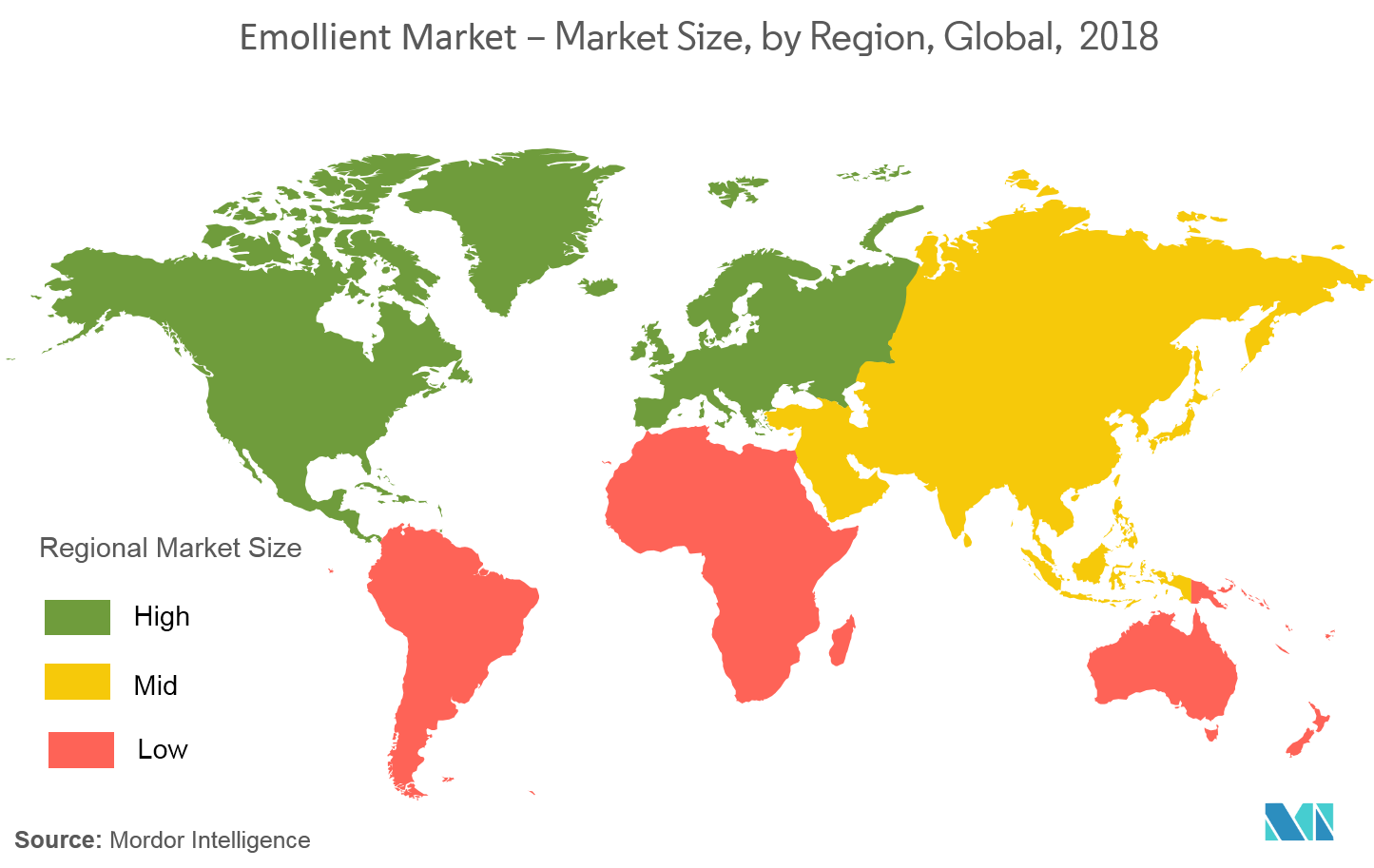

- North America and Europe are dominating the market. Also, developing countries in the Asia-Pacific region such as China, Japan, and Australia are witnessing market growth. For instance, the National Bureau of Statistics of China, the annual growth of cosmetics retail sales value by wholesale and retail companies in China had witnessed significant growth from 8.3% in 2016 to 13.5% in 2017.

- However, the high price of the products is one of the major factors restraining the market primarily in the low income and developing regions.

Emollients Market Trends

This section covers the major market trends shaping the Emollient Market according to our research experts:

Increased retail sales for multifunctional and natural emollients

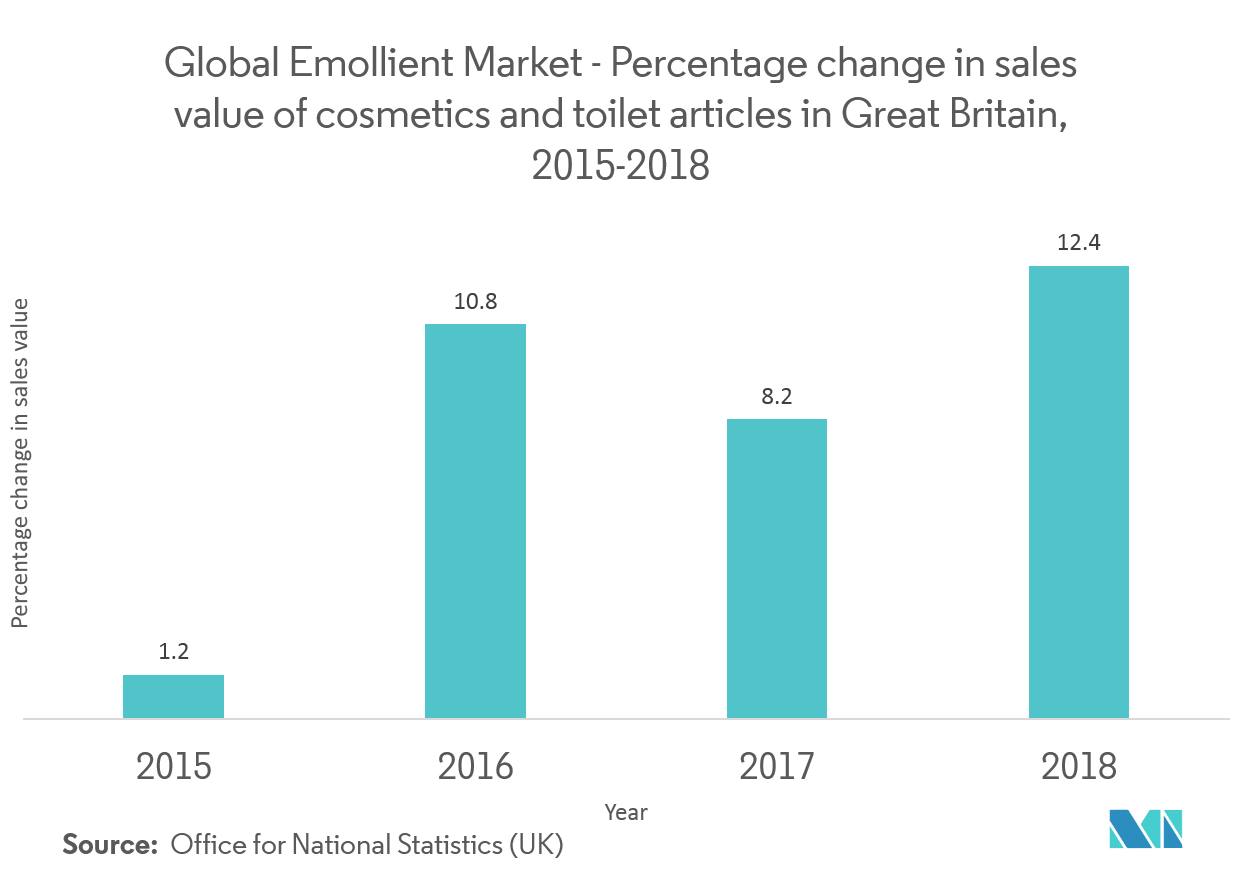

Due to the increased awareness for detrimental effects of the chemical ingredients in the personal care products and development of natural products by the key players in the market, consumers are preferring products having ingredients such as multifunctional and natural emollients. For instance, in Biosynthetic Technologies LLC have launched a new plant-based emollient- BioEstolide. As the emollients are mostly used in personal care products and cosmetic products, these innovations have resulted in an increased trend of retail sales value. For instance, according to the Office for National Statistics (UK) has marked the percentage change in the sales value of cosmetics and toilet articles in Great Britain from 2017 to 2018.

Europe & North America to drive the market

Europe and North America are projected to drive the market owing to the high disposable income of the consumers, especially in the developed countries like United States, Russia, United Kingdom and Germany. Demand for emollients in personal care and cosmetics products have been witnessed to have a rising trend in these countries. Also, factors such as increasing spending more towards cosmetic and personal care, is resulting in the demand to augment the emollients market in Europe and North America.

Emollients Industry Overview

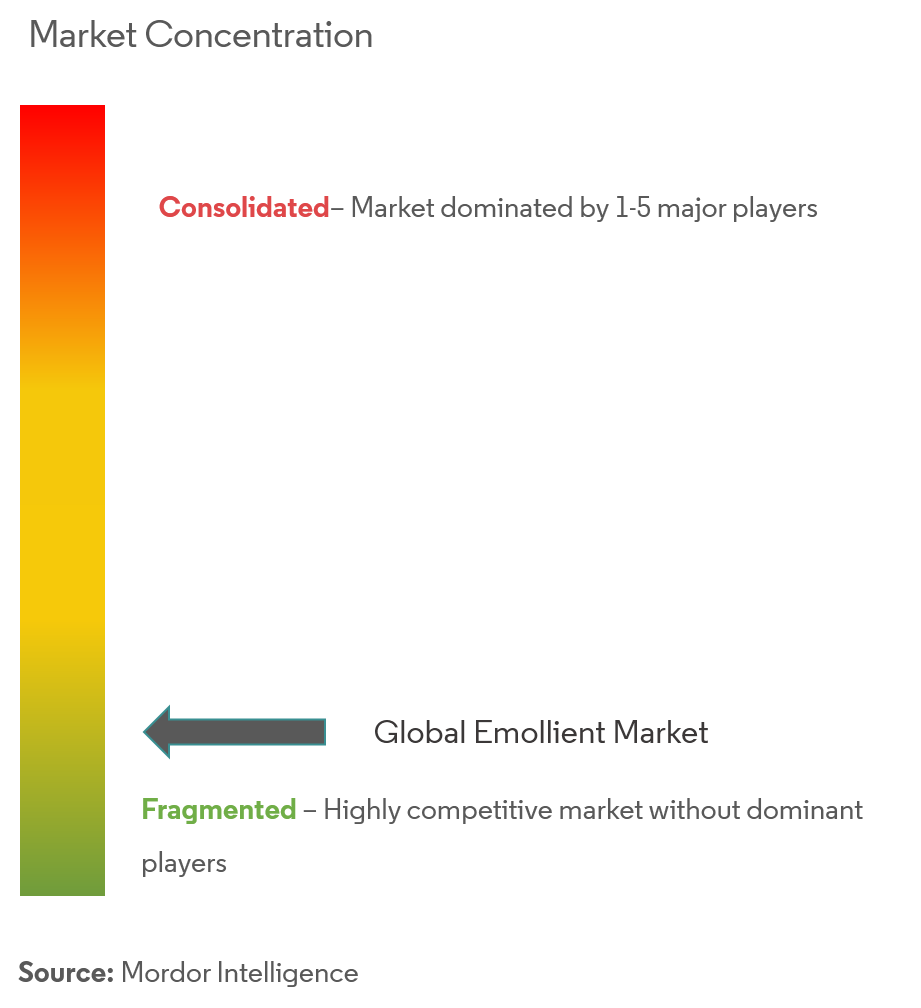

The global emollient market is highly competitive in nature having large number of domestic and multinational player competing for market share and with innovation in products being a major strategic approach adopted by leading players. The key players in the tempeh market includes AAK Sweden AB, BASF SE, Croda International Plc, The Lubrizol Corporation, and Evonik Industries AG to name a few. Additionally, merger, expansion, acquisition and partnership with other companies are the common strategies to enhance the company presence and boost the market. For instance, in 2015, BASF, expanded its production capacity for emollients in China, which is one of the primary player in Asia Pacific to enhance the local production in China.

Emollients Market Leaders

-

AAK Sweden AB

-

BASF SE

-

Croda International Plc

-

The Lubrizol Corporation

-

Evonik Industries AG

*Disclaimer: Major Players sorted in no particular order

Emollients Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Application

- 5.1.1 Skin Care

- 5.1.2 Hair Care

- 5.1.3 Cosmetics

- 5.1.4 Others

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Spain

- 5.2.2.2 United Kingdom

- 5.2.2.3 Germany

- 5.2.2.4 France

- 5.2.2.5 Italy

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 AAK Sweden AB

- 6.3.2 BASF SE

- 6.3.3 Croda International Plc

- 6.3.4 The Lubrizol Corporation

- 6.3.5 Evonik Industries AG

- 6.3.6 Oleon NV

- 6.3.7 Eastman Chemical Company

- 6.3.8 Clariant AG

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEmollients Industry Segmentation

The global emollient market is segmented by application into skin care, hair care, cosmetics and other applications.Also, the study provides an analysis of the emollient market in the emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| Application | Skin Care | |

| Hair Care | ||

| Cosmetics | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East and Africa |

Emollients Market Research FAQs

What is the current Emollient Market size?

The Emollient Market is projected to register a CAGR of 5.5% during the forecast period (2024-2029)

Who are the key players in Emollient Market?

AAK Sweden AB, BASF SE, Croda International Plc, The Lubrizol Corporation and Evonik Industries AG are the major companies operating in the Emollient Market.

Which is the fastest growing region in Emollient Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Emollient Market?

In 2024, the North America accounts for the largest market share in Emollient Market.

What years does this Emollient Market cover?

The report covers the Emollient Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Emollient Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Emollients Industry Report

Statistics for the 2024 Emollients market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Emollients analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.