Energy Sector Enterprise Mobility Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 18.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

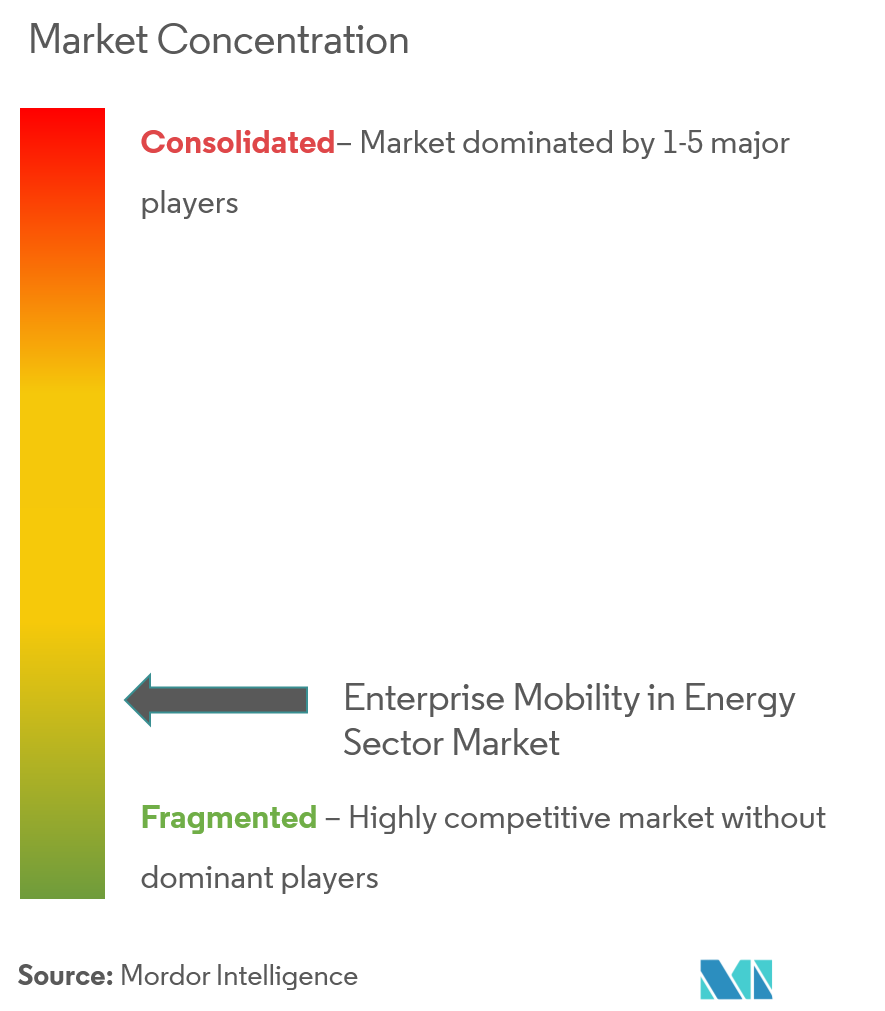

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Energy Sector Enterprise Mobility Market Analysis

The enterprise mobility in energy sector market is expected to grow at a CAGR of 18.5% over the forecast period (2021 - 2026). Due to enterprise mobility, the energy sector is able to keep track of daily processing. It has given companies a new manner to work upon. This helps in computing data of corporate via mobiles while working as a team.

- Advancements in energy revolution is the major driving factor for enterprise mobility growth. For instance, there are many plants generating renewable energy, thus resulting in decentralized energy production. Digital infrastructure is needed where information is transmitted in real time. Mobile devices provide an efficient information exchange and data flow.

- Appropriate authentication needs to be in place within all mobile channels, with access to the corporate network controlled at the correct levels. This will also involve the management of separate user identities in certain cases. Enterprise applications must then be secured to prevent data leakage when being used on personal devices. Thus, security vulnerability is the factor discouraging the market growth.

Energy Sector Enterprise Mobility Market Trends

This section covers the major market trends shaping the Energy Sector Enterprise Mobility Market according to our research experts:

Smartphones to Dominate the Market

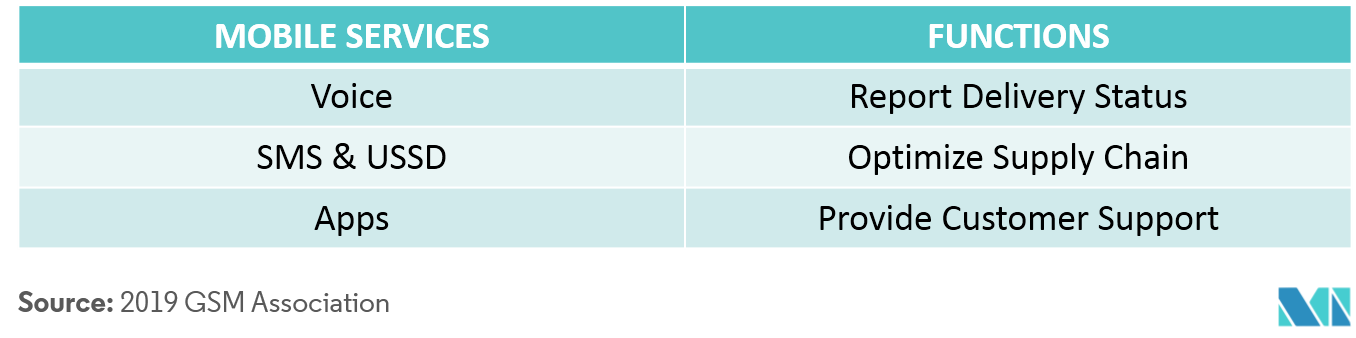

- The Mobile for Development Utilities Programme lead by GSMA tested the used of mobile money in new business models related to water and clean cooking gas in 2017. They also trialled smart metering in on-grid energy in the same year. This was possible only due to migration to smartphones.

- In 2018, mobile operators like Orange and AWCC trialled PAYG solar models. Trialling the use of mobile payments for energy and water in new geographies (Nigeria, Indonesia and Mali) indicates the increased adoption of smartphones in these regions.

- Smartphones enable ways of mobile payments like mobile money, SMS payments and mobile credit, along with remote and secure payment collection.

- Smartphones also enable smart metering and monitoring of utility systems via GSM networks

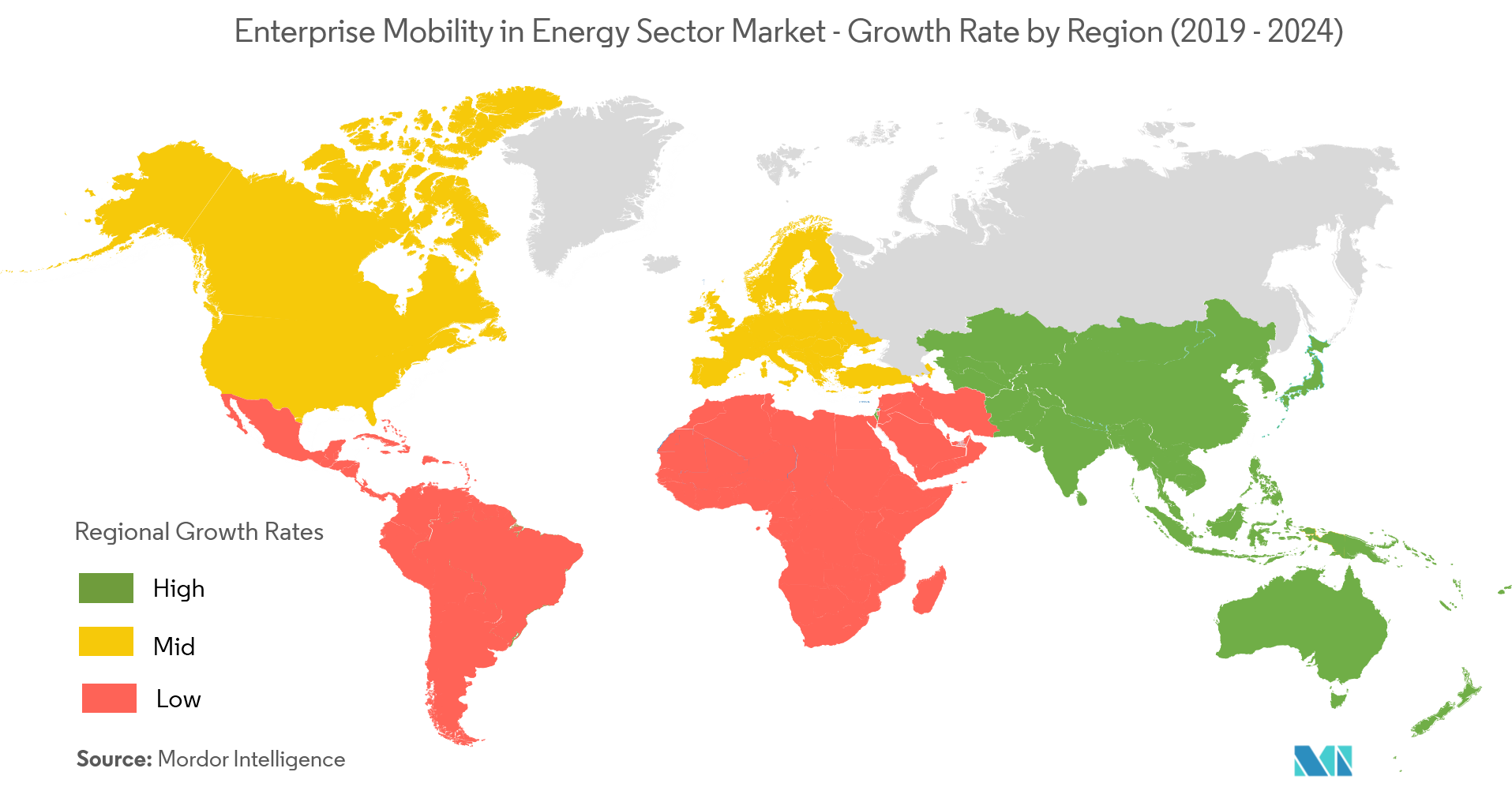

Asia-Pacific to Witness the Highest Growth

- Increased adoption of smartphones in APAC region is making it easier for the energy sector to deploy mobility solutions for the employees.

- Energy and utility companies in Asia-Pacific are embracing BYOD when it comes to increasing employee satisfaction and productivity.

- More than half the world’s mobile subscribers live in Asia-Pacific – mostly in China and India. The growth in high-speed network coverage and smartphone adoption is leading to a surge in the use of mobile data in Asia-Pacific.

- APAC is also rapidly migrating to higher speed mobile networks, with mobile broadband (4G and above) becoming the dominant technology. 5G is expected to gain a strong foothold by the end of 2019, hence supporting the adoption of enterprise mobility solutions.

Energy Sector Enterprise Mobility Industry Overview

The industry is fragmented with most of the players providing enterprise mobility solutions across all sectors, including the energy sector. Vendors are releasing the latest versions of mobility software to keep up with the latest technological developments.

- June 2019 -BlackBerry Limited announced new features and capabilities for its BlackBerry Enterprise Mobility Suite that provides the trust and interoperability organizations need to share and secure data beyond the boundaries of their enterprise.

- February 2018-SAP SEannounced the release of SAP Asset Strategy and Performance Management to enhance asset intelligence across the digital supply chain. It enables criticality assessments and segmentation of assets to help organizations choose a decision framework, such as failure modes and effects analysis (FMEA), for the optimal maintenance strategy for an asset or assets.

Energy Sector Enterprise Mobility Market Leaders

-

Blackberry Ltd.

-

Cisco Systems, Inc.

-

Citrix Systems, Inc.

-

Apteligent

-

McAfee Inc

*Disclaimer: Major Players sorted in no particular order

Energy Sector Enterprise Mobility Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Advancements in Energy Revolution is the Major Driving Factor

-

4.4 Market Restraints

- 4.4.1 Security Vulnerability is the Major Discouraging Factor

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Device

- 5.1.1 Smartphones

- 5.1.2 Laptops

- 5.1.3 Tablets

-

5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Blackberry Ltd.

- 6.1.2 Cisco Systems, Inc.

- 6.1.3 Citrix Systems, Inc.

- 6.1.4 Apteligent

- 6.1.5 McAfee Inc

- 6.1.6 Microsoft Corporation

- 6.1.7 MobileIron, Inc.

- 6.1.8 Oracle Corporation

- 6.1.9 SAP SE

- 6.1.10 Broadcom Inc. (Symantec Corporation)

- 6.1.11 TCS Private Limited

- 6.1.12 Tech Mahindra

- 6.1.13 Tylr Mobile, Inc.

- 6.1.14 VMware Inc.

- 6.1.15 Workspot Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEnergy Sector Enterprise Mobility Industry Segmentation

The energy sector is an industry where the mobile workforces and the globally dispersed stakeholders are the norm. Thus enterprise mobility ranks as a top- technology priority for energy companies. Ongoing developments in mobile technologies, coupled with advances in cloud services, analytics, and mobile application security, are extending its value to ever-more applications and users.

| By Device | Smartphones |

| Laptops | |

| Tablets | |

| By Deployment | On-Premise |

| Cloud | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Energy Sector Enterprise Mobility Market Research FAQs

What is the current Enterprise Mobility in Energy Sector Market size?

The Enterprise Mobility in Energy Sector Market is projected to register a CAGR of 18.5% during the forecast period (2024-2029)

Who are the key players in Enterprise Mobility in Energy Sector Market?

Blackberry Ltd., Cisco Systems, Inc., Citrix Systems, Inc., Apteligent and McAfee Inc are the major companies operating in the Enterprise Mobility in Energy Sector Market.

Which is the fastest growing region in Enterprise Mobility in Energy Sector Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Enterprise Mobility in Energy Sector Market?

In 2024, the North America accounts for the largest market share in Enterprise Mobility in Energy Sector Market.

What years does this Enterprise Mobility in Energy Sector Market cover?

The report covers the Enterprise Mobility in Energy Sector Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Enterprise Mobility in Energy Sector Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Enterprise Mobility in Energy Sector Industry Report

Statistics for the 2024 Enterprise Mobility in Energy Sector market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Enterprise Mobility in Energy Sector analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.