Environmental Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

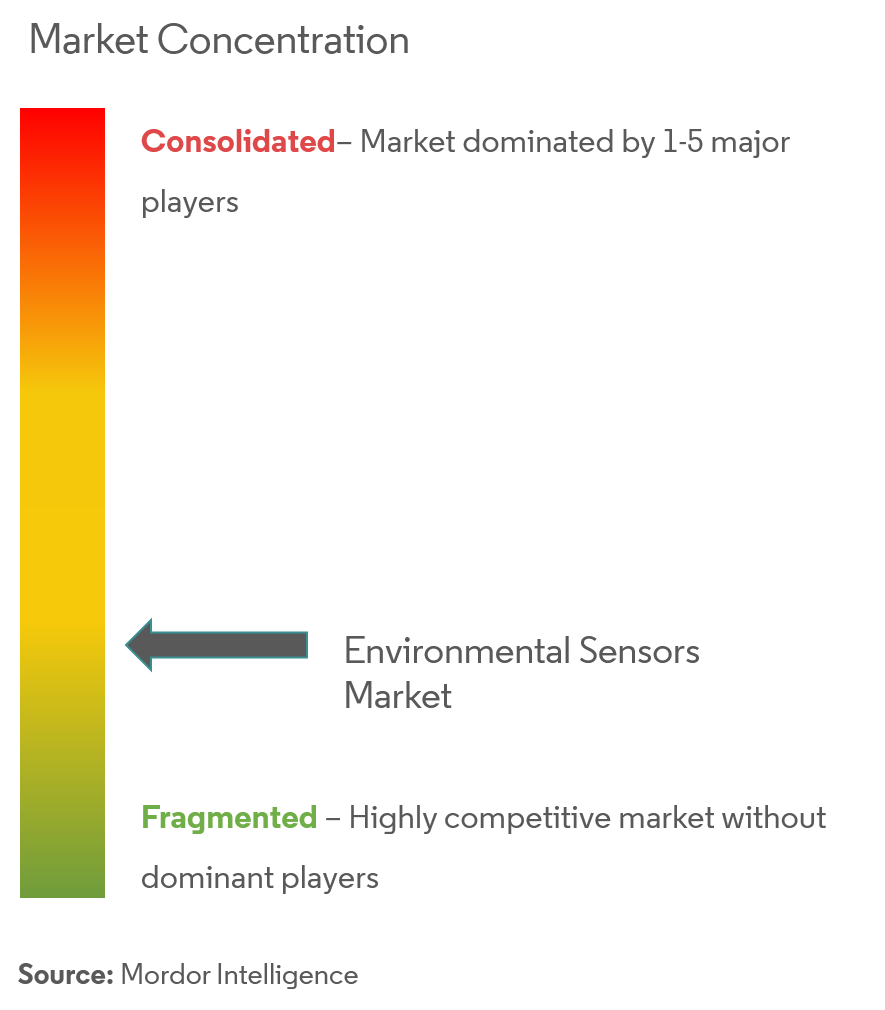

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Environmental Sensors Market Analysis

The environmental sensors market is expected to grow by registering a CAGR of 9.25% during the forecast period. The market for environmental sensors is anticipated to experience considerable growth potential due to the rise in pollution yearly brought on by increased air travel, autos, and other factors. The development of Industry 4.0, which develops a market for environmental sensors, adds to this.

- The growth of the global population has led to increased industrial development and activity simultaneously. The unsustainable practices across industries have resulted in rapid degradation of soil, air, and water quality worldwide, which has, in turn, led to an increase in the demand for devices that can help detect environmental changes.

- The environmental sensor market is supported by the growing number of government initiatives for curbing environmental pollution. For instance, the government's increasing focus worldwide on monitoring ecological pollution and reducing the number of deaths due to gaseous pollution is anticipated to increase environmental sensors' demand.

- Further, with the Industry 4.0 developments, environmental sensors are expected to collectively reap the benefits of multiple innovative and brilliant city initiatives. For instance, machine-to-machine (M2M) is scheduled to include interaction between technologies (such as factory floor sensors) to enhance manufacturing processes and safety.

- Companies are focused on providing industrial sensors dedicated to the chemical industry to cater to various needs. For instance, Sensortech Systems offers RF Series moisture sensor that includes moisture measurement for powdered chemical products. The company also gives IR Series moisture analyzers that provide a non-contact continuous online moisture measurement. This line of sensors further automation in chemical industries.

- However, lack of awareness, budgetary constraints to adopting new technology, and regularity models are the restraints to the growth of environmental sensing.

- Though the pandemic has increased concerns in the industrial sector, it has decreased pollution across the globe. One of the most tangible and immediate environmental manifestations of the coronavirus pandemic has been ameliorated air quality due to reduced air pollutant emissions. This is because lockdowns and closures worldwide led to reduced energy consumption, transportation use, and oil demand. In China, for instance, the emission of NO2 (nitrogen dioxide) dropped by 70% between January and February, according to a study published in May in the multidisciplinary journal Air Quality, Atmosphere, and Health. In India, a reduction of 20-30% was noted.

Environmental Sensors Market Trends

This section covers the major market trends shaping the Environmental Sensors Market according to our research experts:

Temperature Sensors to Drive the Environmental Sensors Market

- A smart temperature sensor is an integrated system consisting of a temperature sensor, bias circuitry, and an analog-to-digital converter (ADC). A temperature sensor measures heat to ensure a process stays within a specific range, providing safe application usage or meeting a necessary condition when dealing with extreme heat, hazards, or inaccessible measuring points.

- The demand for reliable, high-performance, and low-cost sensors is increasing, leading to the development of new technologies, such as microtechnology and nanotechnology. The low cost, small size, and ease of use led the sensors to widespread use in various industries, such as automobile, residential, medical, environmental, food processing, and chemical.

- Integrating temperature sensors into smart homes help homeowners enhance their energy efficiency, as the heating inside the property is adjusted based on the occupancy. Sensor-equipped devices, such as remote thermostat controllers, get real-time temperature data from inside every house room.

- Temperature sensors are being incorporated into intelligent camera systems designed to offer accurate and non-contact temperature monitoring across various disciplines. The applications include manufacturing process control, product development, waste management, facilities maintenance, emissions monitoring, and environmental, health, and safety (EHS) improvements.

- Additionally, temperature sensors enable accurate non-contact temperature measurement in healthcare. Physicians use IoT-based temperature trackers to measure ear, forehead, or skin temperature. Moreover, Multiple companies are launching IIoT sensors to drive the automation of the chemical industry. For instance, in January 2021, Asystom announced the launch of AsystomSentinel EX, a combination of triaxial vibration, sound, and ultrasound sensors to cater to the chemical industry.

Asia-Pacific is Expected to Register the Highest Growth Rate

- The Asia-Pacific is the fastest-growing economic region in the world. The region is witnessing the rapid proliferation of smart technologies, such as smart cities, autonomous vehicles, IoT applications, home automation, industrial automation, intelligent processing technologies, and others. Such factors are expected to drive market growth.

- In recent years, the APAC region witnessed a notable surge in the usage of connected devices, including connected cars, smart home devices, wearables, and autonomous machines. Demand for connected devices is expected to drive the Environmental Sensors Market during the forecast period.

- India is one of the fastest developing countries in the world, with the government investing significantly in advanced technologies and more innovative infrastructures. With such rapid developments, sensors in the country are finding widespread applications in smartphones, automobiles, and healthcare. Some of the most common consumer electronics sensors include motion, temperature, and pressure sensors.

- Further, according to Schneider, "The smart homes market is fast evolving in the Indian context.' Initially, smart homes were marketed primarily as homes with advanced security features. The market is now changing into newer areas, like lighting systems, gas leakage detectors, fire detection systems, entertainment systems, and energy efficiency systems. Therefore, the growth of smart homes will lead to a positive outlook in the environmental sensors market.

- Moreover, increasing government initiatives to control environmental pollution levels, increasing government funding for pollution control and monitoring, ongoing installations of environment monitoring stations, and growing initiatives for the development of environment-friendly industries are some key factors driving the growth of the global market.

- For instance, in July 2021, a proposal from the Indian government's Ministry of Earth Sciences to pursue a Deep Ocean Mission to explore the ocean for resources and develop deep-sea technologies for sustainable use of ocean resources was cleared by the Cabinet Committee on Economic Affairs. The project has an estimated cost of about INR 4,077 crore (~USD 492.5 million) for five years.

Environmental Sensors Industry Overview

The environmental sensors market is moderately competitive because of many significant players in the market. The leading companies operating in the environmental sensors market are AMS AG, Powelectrics Limited, Texas Instruments Inc., Omron Corporation, Honeywell International, Bosch Sensortec, and Texas Instruments. Key players in the environmental sensor market are catering to the demand by collaborating, innovating, acquiring small players, and investing in a technologically-advanced product portfolio worldwide.

- September 2022 - Sensirion announces the STS4xA, a highly reliable digital temperature sensor series specifically designed for automotive applications. The sensor platform supports automated optical inspection and comes with an advanced onboard diagnosis system.

- April 2022 - AMS, a global company in optical solutions, has introduced a green laser diode which is a brighter, easier to use, more reliable, and cost-competitive replacement for red lasers in applications such as leveling, scanning, biosciences, and dot projection.

Environmental Sensors Market Leaders

-

AMS AG

-

Powelectrics Limited

-

Texas Instruments Inc.

-

Raritan Inc.

-

Sensirion Holding AG

*Disclaimer: Major Players sorted in no particular order

Environmental Sensors Market News

- September 2022 - Eurotech S.p.A., a global provider of Edge Computing solutions for mission-critical applications, announced that it has successfully finalized today, concurrently with the signing of the related binding agreement, the acquisition from InoNet GmbH of the entire share capital of InoNet Computer GmbH ('InoNet'), a German company based in Taufkirchen (south of Munich), operating in the sectors of Industrial PCs (IPCs) and embedded systems for special applications.

- June 2022 - AMS, one of the global leaders in optical solutions, teamed up with leading imaging technology and machine vision solutions provider Teknique to enable customers to quickly take to market 2D/3D camera systems based on ams OSRAM's advanced sensor and emitter components combined with Teknique's SoM product range.

Environmental Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Increasing Government Initiatives for Pollution Monitoring and Control

- 5.1.2 Development of Environment-friendly Industries

-

5.2 Market Restraints

- 5.2.1 Weak Pollution Control Reforms

6. Industry Attractiveness - Porter's Five Forces Analysis

- 6.1 Bargaining Power of Suppliers

- 6.2 Bargaining Power of Consumers

- 6.3 Threat of New Entrants

- 6.4 Threat of Substitute Products

- 6.5 Intensity of Competitive Rivalry

7. Impact of COVID-19 on the Market

8. MARKET SEGMENTATION

-

8.1 By Product Type

- 8.1.1 Fixed

- 8.1.2 Portable

-

8.2 By Sensing Type

- 8.2.1 Humidity

- 8.2.2 Temperature

- 8.2.3 Gas

- 8.2.4 Pressure

-

8.3 By End-user

- 8.3.1 Medical

- 8.3.2 Consumer Electronics

- 8.3.3 Industrial

- 8.3.4 Automotive

- 8.3.5 Other End-users

-

8.4 Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 Germany

- 8.4.2.2 United Kingdom

- 8.4.2.3 France

- 8.4.2.4 Rest of Europe

- 8.4.3 Asia Pacific

- 8.4.3.1 China

- 8.4.3.2 Japan

- 8.4.3.3 India

- 8.4.3.4 Rest of Asia-Pacific

- 8.4.4 Rest of the World

9. COMPETITIVE LANDSCAPE

-

9.1 Company Profiles

- 9.1.1 AMS AG

- 9.1.2 Powelectrics Limited

- 9.1.3 Raritan Inc.

- 9.1.4 Texas Instruments Inc.

- 9.1.5 Sensirion Holding AG

- 9.1.6 Eurotech SpA

- 9.1.7 Omega Engineering Inc.

- 9.1.8 Nesa SRL

- 9.1.9 Eko Instruments BV

- *List Not Exhaustive

10. INVESTMENT ANALYSIS

11. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEnvironmental Sensors Industry Segmentation

Environmental sensors are critical for making a more connected world possible. From providing information on the immediate surroundings to help tackle global climate change, sensors and sensor networks have been fundamentally changing awareness of the detrimental factors that affect the environment. The market study categorizes the analysis of the environmental sensors manufactured and provided by various vendors in different regions. The study categorizes environmental sensors by product type, sensing type, end-user vertical, and geography.

The Environmental Sensors Market is Segmented by Product Type (Fixed, Portable), Sensing Type (Humidity, Temperature, Gas, Pressure), End-user (Medical, Consumer Electronics, Industrial, and Automotive), and Geography. The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| By Product Type | Fixed | |

| Portable | ||

| By Sensing Type | Humidity | |

| Temperature | ||

| Gas | ||

| Pressure | ||

| By End-user | Medical | |

| Consumer Electronics | ||

| Industrial | ||

| Automotive | ||

| Other End-users | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World |

Environmental Sensors Market Research FAQs

What is the current Environmental Sensors Market size?

The Environmental Sensors Market is projected to register a CAGR of 9.20% during the forecast period (2024-2029)

Who are the key players in Environmental Sensors Market?

AMS AG, Powelectrics Limited, Texas Instruments Inc., Raritan Inc. and Sensirion Holding AG are the major companies operating in the Environmental Sensors Market.

Which is the fastest growing region in Environmental Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Environmental Sensors Market?

In 2024, the North America accounts for the largest market share in Environmental Sensors Market.

What years does this Environmental Sensors Market cover?

The report covers the Environmental Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Environmental Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Environmental Sensors Industry Report

Statistics for the 2024 Environmental Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Environmental Sensors analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.