Europe Agricultural Tires Market Size

| Study Period | 2019-2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 2.21 Billion |

| Market Size (2029) | USD 4 Billion |

| CAGR (2024 - 2029) | 5.32 % |

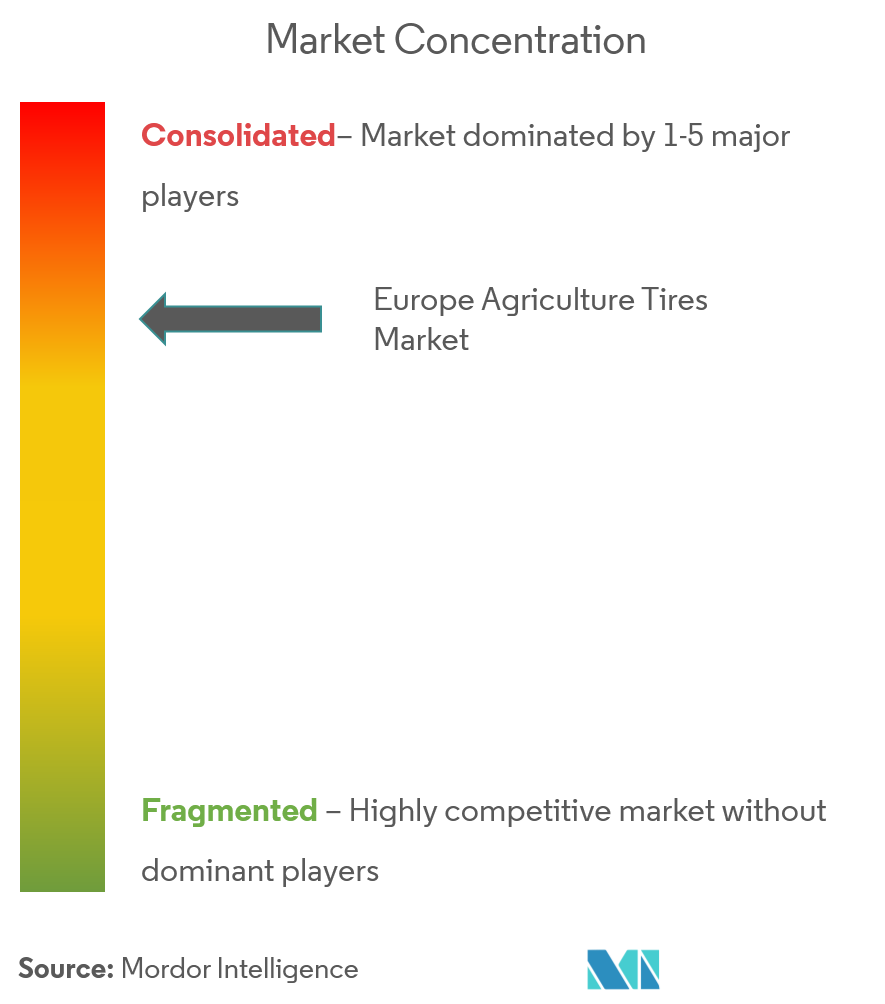

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Europe Agricultural Tires Market Analysis

The Europe Agricultural Tires Market size is estimated at USD 2.21 billion in 2024, and is expected to reach USD 4 billion by 2029, growing at a CAGR of 5.32% during the forecast period (2024-2029).

Over the medium term, the agricultural sector of Europe has been one of the key land users and thus shapes maximum landscapes in several rural areas. In addition, agricultural land plays the most pivotal role in land use patterns across all the countries of the European Union. According to the European Energy Agency, the European Green Deal set the target that, by 2030, 25% of the EU’s agricultural area should be under organic farming.

Furthermore, the European government has been implementing CEMA AgriTech 2030 plans for bringing better advancement in the European agriculture industry. The AgriTech 2030, which was issued by the government in 2019, maps out its focus on witnessing the future of Europe's industry for its advanced agricultural machinery and solutions towards 2030 end. Under the plans, the government shall remain consistent with CEMA's mission in order to bring better-shared expertise and further shape the EU legislation for benefiting sustainable farming and the agricultural machinery sector.

Owing to a number of economic and environmental factors (direct and indirect impact on the environment due to different production methods and subsidies provided by the European Union to the farmers), high farm consolidation activities in the past few years affected the agricultural machinery market to a significant extent, especially in Europe, driving the demand for agricultural tires.

Farm consolidation necessitates the use of fertilizing and planting machinery to obtain sufficient and proper fertilizing of the crops in larger land structures, thereby facilitating the demand for agricultural tires and making companies focus on new launches. In July 2023, Yokohama Off-Highway Tires’ (YOHT) flagship brand Alliance recently released new sizes of the proven Agriflex+ 372 radial tire for tractors and harvesters in Europe. Thus, the above factors contribute to the market demand.

Europe Agricultural Tires Market Trends

Aftermarket Tires Segment to Gain Momentum Over the Forecast Period

The replacement tire segment is expected to constitute a majority of the share in the European tire market due to the inherent demand from the aftermarket segment. The market is characterized by a significant amount of R&D in the tire manufacturing process, driven by the presence of the largest agricultural machinery and equipment research in the region. Also, the increasing adoption of modern farming techniques with agricultural machinery and using suitable tire sizes and patterns for specific crops is expected to drive the growth of the agricultural tire market in the region during the forecast period.

Replacement/aftermarket agricultural tires are cost-effective when compared to OEM tires. Due to their cheaper price, aftermarket agricultural tires are widespread in the market. Despite being less innovative, aftermarket consumers opt for this category due to its ease of availability and customized selection. In the case of OEM tires, after the warranty expiration, it is difficult for farmers to buy them due to the higher price and absence of a wide range of tire portfolios. The tires can be bought both online and through retail stores. Price fluctuation may vary drastically, depending on the quantity ordered/purchased online or in retail stores.

Players are entering into agricultural tires and are offering both OEM and aftermarket to keep a wider horizon of growth owing to consumer preferences. For instance, In May 2022, Maxam Tires Europe got the approval for its Agrixtra range of agricultural tires on newly selected Holland T5, T6, and T7 SWB and LWB tractors. The approval shall fuel the company's potential to grow both OEM and aftermarket replacement segments.

With changing consumer preferences in terms of cost economy and reliability, consumers are shifting toward the adoption of aftermarket as well. These aftermarket tires are readily available and can be customized based on consumer requirements, whereas OEM tires are offered based on specific parameters that are always kept constant. Thus, keeping consumer preferences at the forefront, these aftermarket tires are expected to witness traction during the forecast period.

Germany is Expected to Dominate the Market During the Forecast Period

Germany is the largest exporter of agricultural machinery, the largest manufacturer of agricultural machinery, and the second-largest consumer of agricultural machinery across the world. The high ability and sophisticated design of machinery, coupled with high production efficiency and machining precision, are driving the demand for agricultural machinery in the country. Germany's agricultural machinery manufacturing industry output accounts for 10% of the global output, and the machinery exports from Germany account for more than 70%.

France and Germany continued to portray their dominance over agriculture machinery, occupying the largest agricultural tractor markets in Europe. In addition, these two nations account for nearly four of every ten agricultural tractors which are registered in Europe, and tire companies are also focusing on expanding their product portfolio. In October 2023, Continental announced the expansion of its agricultural tire portfolio in Germany, with new sizes for its TractorMaster and CompactMaster AG/EM product lines now available.

Moreover, manufacturers in Germany are offering different variants of tractors to witness improved sales in the market. For instance, in September 2023, Claas used an exclusive press event in Germany to show its new 650hp Xerion flagship for the first time, along with smaller tractors from 75–103hp, a new mower conditioner and entry-size combined with styling and features like a larger model.

Thus, based on the developments and the recovery of the agricultural sector in the country, the demand for agricultural tires is expected to witness growth in the coming years.

Europe Agricultural Tires Industry Overview

Europe's agricultural tires market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance,

In September 2023, AIS Glass Solutions Limited, a subsidiary of Asahi India Glass Limited (AIS), confirmed the acquisition of certain assets of Balaji Building Technologies, Bengaluru (BBT) in BBT’s business of architectural glass processing.

Some of the major players in the market include Bridgestone Corporation, Continental Tires, Titan International Inc., Michelin, and YOKOHAMA.

Europe Agricultural Tires Market Leaders

-

Bridgestone Corporation

-

Continental Tires

-

Titan International Inc.

-

Michelin

-

YOKOHAMA

*Disclaimer: Major Players sorted in no particular order

Europe Agricultural Tires Market News

- May 2023: Bridgestone introduces its new premium VX-R TRACTOR tire range with wide-tread traction, long wear life, and excellent driver comfort for Europe and Asia Pacific Markets.

- April 2022: Bridgestone's VX-TRACTOR patterned tires have now been approved for selected New Holland T6 and T7 Series tractors in Ireland and the United Kingdom. The company currently offers twenty-eight sizes from 28 to 42 inches.

Europe Agricultural Tires Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Drivers

- 4.1.1 Technological Advances in Agricultural Equipment

-

4.2 Market Restraints

- 4.2.1 Low Quality of Duplicate Tyres

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size in Value and Volume)

-

5.1 By Application Type

- 5.1.1 Tractors

- 5.1.2 Combine Harvester

- 5.1.3 Sprayers

- 5.1.4 Trailers

- 5.1.5 Loaders

- 5.1.6 Other Machinery

-

5.2 By Sales Channel

- 5.2.1 OEM

- 5.2.2 Replacement/Aftermarket

-

5.3 Geography

- 5.3.1 Europe

- 5.3.1.1 Germany

- 5.3.1.2 United Kingdom

- 5.3.1.3 France

- 5.3.1.4 Italy

- 5.3.1.5 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles

- 6.2.1 Bridgestone Corporation

- 6.2.2 Continental AG

- 6.2.3 Yokohama Rubber Co. Ltd.

- 6.2.4 Michelin Group

- 6.2.5 Nokian Tyres Oyji

- 6.2.6 Titan International Inc.

- 6.2.7 Balakrishna Industries Limited

- 6.2.8 Trelleborg AB

- 6.2.9 Prometeon Tyre Group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEurope Agricultural Tires Industry Segmentation

The agricultural tires are the outer covering of tractor wheels, which are in direct contact with land. In addition, these agricultural ties are designed to provide better soil compaction in order to reduce stress.

The European agricultural tire market has been segmented by application type, sales channel type, and Country. By Application Type, the market has been segmented into tractors, combine harvesters, sprayers, trailers, loaders, and other machinery. By sales channel, the market has been segmented into OEM and replacement/aftermarket. By Country, the market has been segmented into Germany, the United Kingdom, France, Italy, and the Rest of Europe.

The report offers a forecast and market size for value (USD) and volume (units).

| By Application Type | Tractors | |

| Combine Harvester | ||

| Sprayers | ||

| Trailers | ||

| Loaders | ||

| Other Machinery | ||

| By Sales Channel | OEM | |

| Replacement/Aftermarket | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Rest of Europe |

Europe Agricultural Tires Market Research FAQs

How big is the Europe Agricultural Tires Market?

The Europe Agricultural Tires Market size is expected to reach USD 2.21 billion in 2024 and grow at a CAGR of 5.32% to reach USD 4 billion by 2029.

What is the current Europe Agricultural Tires Market size?

In 2024, the Europe Agricultural Tires Market size is expected to reach USD 2.21 billion.

Who are the key players in Europe Agricultural Tires Market?

Bridgestone Corporation, Continental Tires, Titan International Inc., Michelin and YOKOHAMA are the major companies operating in the Europe Agricultural Tires Market.

What years does this Europe Agricultural Tires Market cover, and what was the market size in 2023?

In 2023, the Europe Agricultural Tires Market size was estimated at USD 2.09 billion. The report covers the Europe Agricultural Tires Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Europe Agricultural Tires Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Europe Agricultural Tires Industry Report

Statistics for the 2024 Europe Agricultural Tires market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Agricultural Tires analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.