Europe Arachidonic Acid Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 6.00 % |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Europe Arachidonic Acid Market Analysis

Europe Arachidonic Acid Market report is expected to reach USD 56 million by 2025 growing at a CAGR of 6.0% during the forecast period.

- Europe is the second largest consumer of arachidonic acid in the world. The market is growing for arachidonic acid, as the consumers are looking for a healthy dietary supplement.

- The drivers for the ARA market is increased demand for infant nutrition products containing ARA, increased application in sports nutrition, various health benefits of ARA and the government approval for incorporation into infant products. The important function properties of ARA are increasing the consumer demand for arachidonic acid in Europe as a functional food.

- The declining birth rate in the region is the major restraining factor for the market. Europe is expected to grow at a steady growth rate during the forecast period.

Europe Arachidonic Acid Market Trends

This section covers the major market trends shaping the Europe Arachidonic Acid Market according to our research experts:

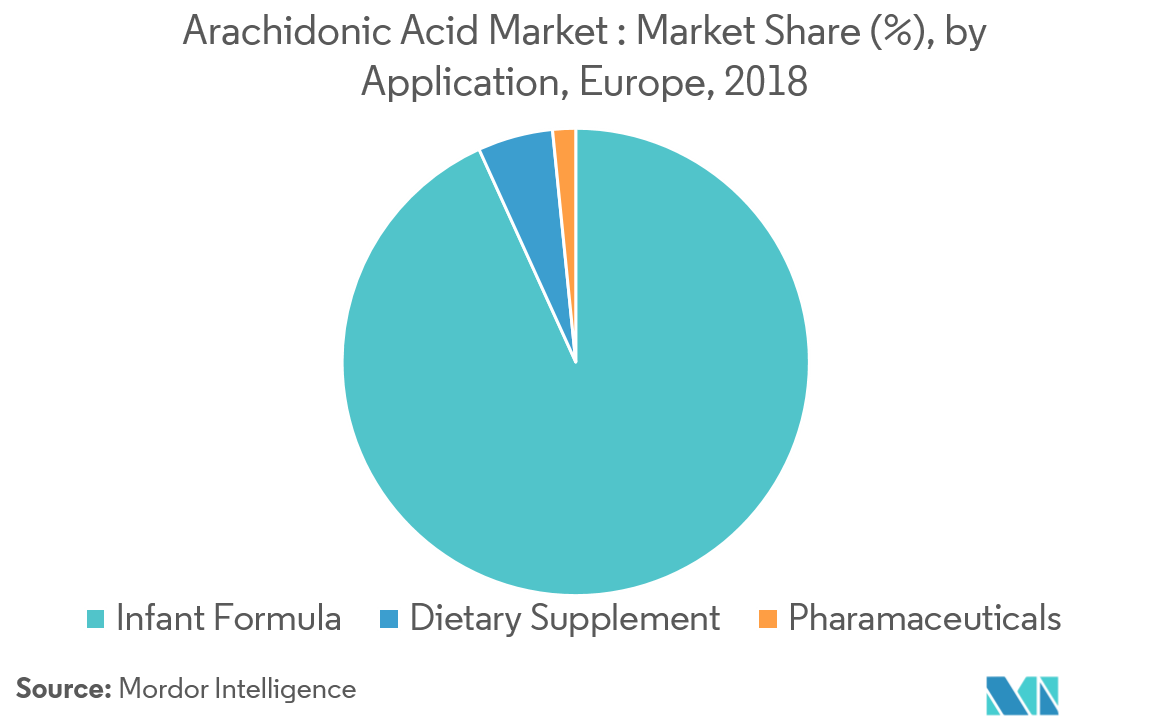

Infant Nutrition Holds The Dominant Share

Infant formula and dietary supplement are the major applications of ARA in the European market. Infant formula accounts for the largest application, while fortified foods and beverages are growing at a faster rate in Europe. The ARA market was first discovered in the European market due to less exposure to technology and R&D activities by the European companies made the intervention of US companies to gain higher market penetration. Europe has tightened regulatory environment related to pharmaceutical and food products especially the when ARA is added in infant formula, the permissible level that is allowed is no more than 0.35% and 0.6% of the total fatty acids as DHA and ARA.

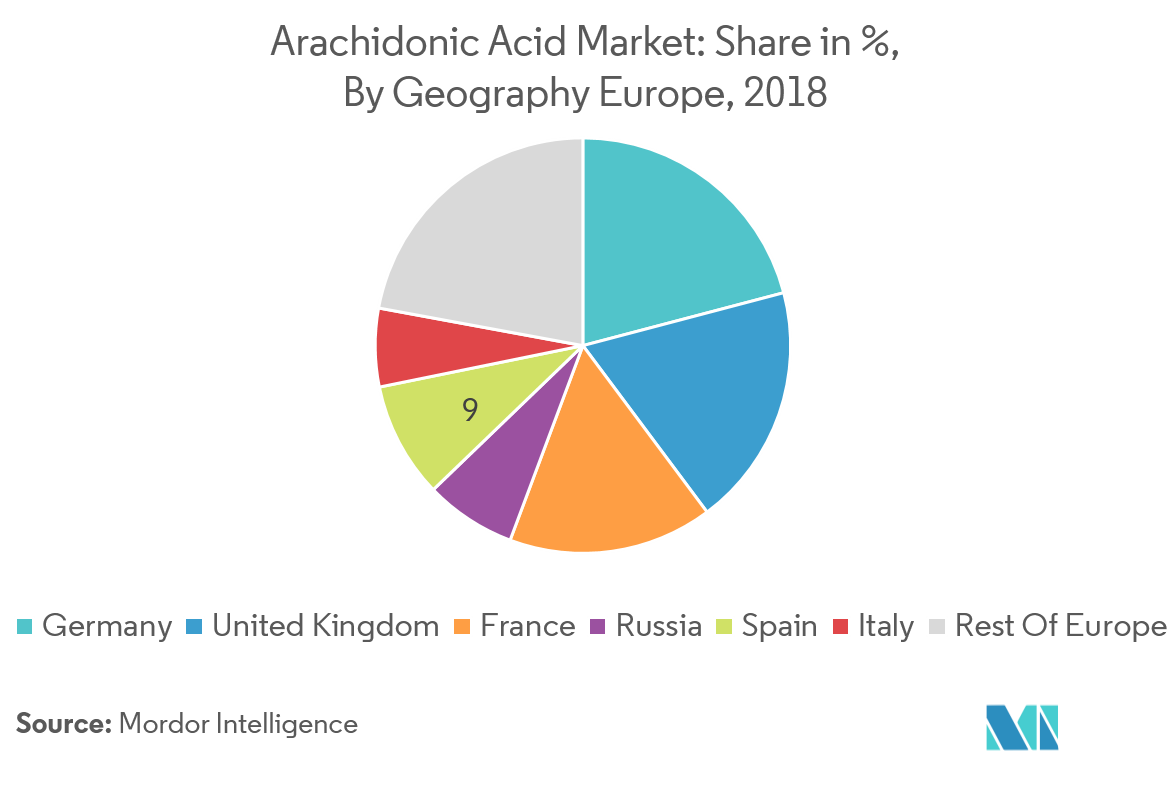

Germany and United Kingdom Dominate The Market

The German ARA market growing at a rate of CAGR of 5.9%. With new innovations in the applications of arachidonic acid, especially in pharma and supplement applications, is driving the market in Germany. Major factors affecting the UK ARA market are increasing applications of Omega 6 fatty acids, such as usage in dietary supplements and supporting regulations of the European Commission for ARA. The consumption pattern of consumers for natural foods, such as fish, egg, beef, etc., containing ARA, enables market players to come up with dietary supplements with ARA as an ingredient. However, Spain also has a significant share of ARA in Europe, with the potential for market growth. Moreover, Russia is one of the most attractive markets for ARA & DHA in Europe due to increased consumption of infant formula and baby food products. Other countries in Europe, with significant markets for ARA are Norway, Finland, Sweden, Iceland, Portugal and Ireland.

Europe Arachidonic Acid Industry Overview

Major Players: DSM, BASF, Cargill, Martek Bioscience, Cabio Bioengineering, Guangdong Runke, Cayman Chemicals, A&Z Food additives Co. Ltd., Zhejiang Weiss (Wecan), and Kingdomway, among others. Advancement in biotechnology has given a good opportunity for the market. The microbiological source of production is giving a new opportunity for the market, as ARA is present in high concentration in microalgae. The production ARA from other sources than fungal is a big challenge for the market, due to its high raw material cost and wastage. The major competitors prefer investment in new product development and marketing strategy, due to volatility in commodity costs to maintain their position.

Europe Arachidonic Acid Market Leaders

-

Cargill Inc.

-

CABIO Biotech Wuhan Co Ltd

-

Cayman Chemical

-

Guangdong Runke Bioengineering Co., Ltd.

-

Royal DSM

*Disclaimer: Major Players sorted in no particular order

Europe Arachidonic Acid Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Technology

- 5.1.1 Solvent Extraction

- 5.1.2 Solid-Phase Extraction

-

5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Infant Formula

- 5.2.1.2 Dietary Supplements

- 5.2.2 Pharmaceuticals

-

5.3 Geography

- 5.3.1 Europe

- 5.3.1.1 Germany

- 5.3.1.2 United Kingdom

- 5.3.1.3 France

- 5.3.1.4 Russia

- 5.3.1.5 Spain

- 5.3.1.6 Italy

- 5.3.1.7 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

-

6.2 Company Profiles

- 6.2.1 Cargill. Inc

- 6.2.2 Cabio Biotech (Wuhan)Co., Ltd

- 6.2.3 Xiamen Kingdomway

- 6.2.4 Cayman Chemicals

- 6.2.5 Martek Bioscience

- 6.2.6 Guangdong Runke Bioengineering Co., Ltd.

- 6.2.7 Royal DSM

- 6.2.8 A & Z Food Additives Co., Ltd

- 6.2.9 Zhejiang Weiss (Wecan)

- 6.2.10 BASF

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEurope Arachidonic Acid Industry Segmentation

The arachidonic acid market is distributed in a different segment on the application type, and by geography. In the application type, the arachidonic acid market is segmented into two major applications, namely, food & beverage and pharmaceutical. The food & beverage segment is further divided into infant formula and dietary supplements. Among food & beverage sub-segments, infant nutrition holds the dominant share of the market and being driven by regulatory support.

| By Technology | Solvent Extraction | |

| Solid-Phase Extraction | ||

| By Application | Food and Beverage | Infant Formula |

| Dietary Supplements | ||

| By Application | Pharmaceuticals | |

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Russia | ||

| Spain | ||

| Italy | ||

| Rest of Europe |

Europe Arachidonic Acid Market Research FAQs

What is the current Europe Arachidonic Acid Market size?

The Europe Arachidonic Acid Market is projected to register a CAGR of 6% during the forecast period (2024-2029)

Who are the key players in Europe Arachidonic Acid Market?

Cargill Inc., CABIO Biotech Wuhan Co Ltd, Cayman Chemical, Guangdong Runke Bioengineering Co., Ltd. and Royal DSM are the major companies operating in the Europe Arachidonic Acid Market.

What years does this Europe Arachidonic Acid Market cover?

The report covers the Europe Arachidonic Acid Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Europe Arachidonic Acid Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Europe Arachidonic Acid Industry Report

Statistics for the 2024 Europe Arachidonic Acid market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Arachidonic Acid analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.