Europe Automotive Parts Die Casting Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 12.02 Billion |

| Market Size (2029) | USD 18.32 Billion |

| CAGR (2024 - 2029) | 7.28 % |

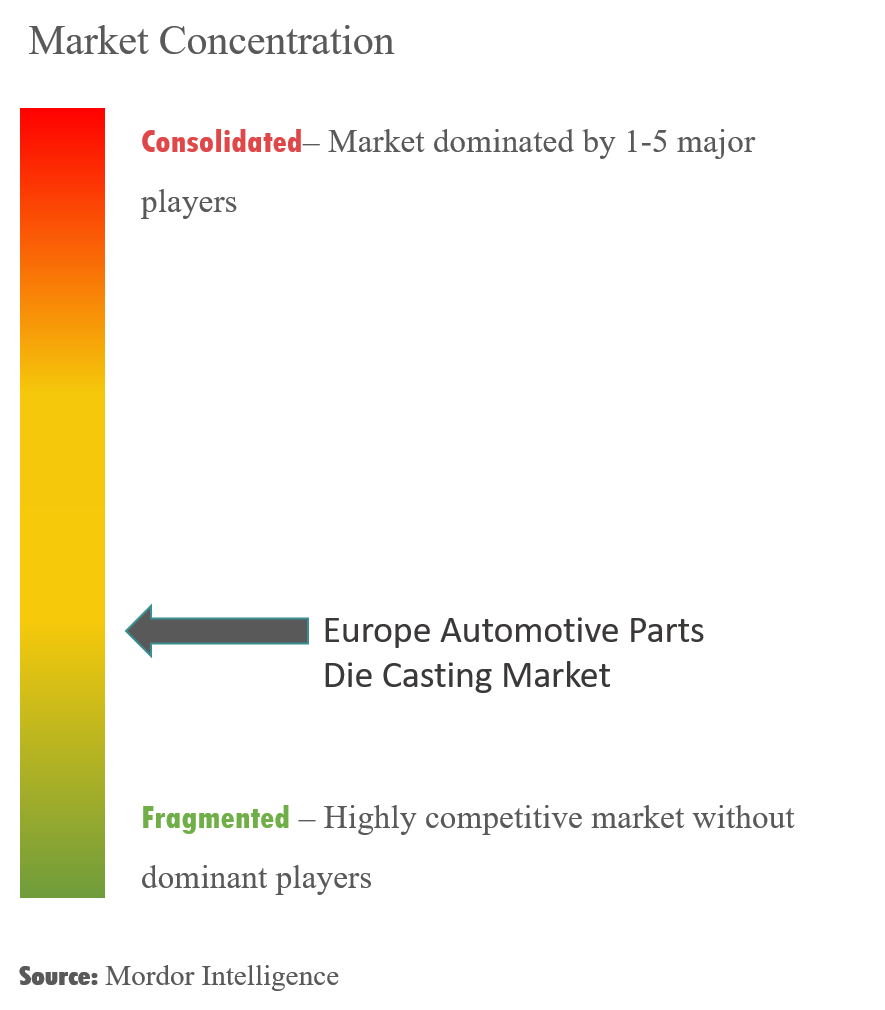

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Europe Automotive Parts Die Casting Market Analysis

The Europe Automotive Parts Die Casting Market size is estimated at USD 12.02 billion in 2024, and is expected to reach USD 18.32 billion by 2029, growing at a CAGR of 7.28% during the forecast period (2024-2029).

- The COVID-19 pandemic severely impacted the automotive industry across the world. The disruptions in supply chain activities, the interruption in large-scale manufacturing, restrictions on travel, and the declining sales of vehicles during 2020 were responsible for the declining growth of the market. However, after the pandemic, a surge in the manufacturing volume of passenger cars and hybrid electric vehicles was observed in the country due to the easing of restrictions. The automotive parts die-casting market in Europe coped with all the losses that happened during the period and grew at a certain pace.

- Over the long term, the market studied is largely driven by supply chain complexities in the die-casting industry, expanding the automotive market, increasing penetration of die-casting parts in industrial machinery, growing commercial vehicle sector, and employing aluminum casts in electrical and electronics.

- The European industry, as a whole, has more than doubled the average amount of die-cast parts that have been used in passenger cars for the past 20 years. From just 50 kg of aluminum parts per passenger vehicle in 1990 to over 500 kg of it in the AUDI A8 model, the market for automotive parts die casting is evolving in the region and is expected to maintain moderate growth for the coming five years.

- Non-ferrous castings in Europe registered an average performance of 37 metric tons per employee in 2021, according to the latest statistics from the European Foundry Association (EFA). Over 80% of the castings produced in Europe are consumed by the automotive industry.

- The Corporate Average Fuel Economy (CAFÉ) standards and Environmental Protection Agency (EPA) policies to cut down automobile emissions and increase fuel efficiency are driving the automakers to reduce the weight of the automobile by employing lightweight non-ferrous metals. Demand from the commercial vehicle segment is one other factor that is driving the market. On the flip side, the shift toward electric vehicles is expected to act as a major restraint on the casting industry. A combustion engine contains approximately 220 casted parts, but only about 25 are needed for an electrical drive. Also, the number of people employed in European non-ferrous casting foundries has been volatile for the past five years.

Europe Automotive Parts Die Casting Market Trends

Increasing Demand from the Commercial Vehicle Segment

- The underlying factor driving the growth of the light commercial vehicle market in Europe is the increased preference for pickup trucks and small vans over heavy-duty trucks and railways for logistics. The demand for lightweight vehicle components to integrate into light commercial vehicles is expected to increase significantly during the forecast period.

- The market is recovering from its period of slump during the economic recession of 2010 and is expected to improve further over the forecast period because of the cost-effective benefits associated with using light commercial vehicles (LCVs) over other modes of transport, especially in countries like Italy. In Italy, most of the farms are organic and family-owned. These family-owned businesses lease commercial vehicles to transport their produce to nearby retail outlets, thus, driving the market.

- Also, with new regulations mandating that LCVs stay within the stipulated weight limit, it has become critical for original equipment manufacturers (OEMs) to focus on making LCVs with lighter materials. The fast-growing e-commerce market in the region is also creating a huge demand for commercial vehicles to transport goods to different nations.

- Therefore, due to the aforementioned factors, commercial vehicles are expected to drive the growth of the market.

Germany, Italy, and Russia Expected to be the Three Largest Markets in Europe

- The European automotive industry is known to be the most technically advanced and innovative industry in the world. Due to economic crises and political pressures, the reduction of fuel consumption and CO2 emission has become a major agenda for automobile manufacturers, and reducing the weight of the automobile through better design and construction, seemed to be the most favorable solution. Solutions based on the intensive use of non-ferrous metals as modified or new alloys are being developed specifically for the automotive industry's needs.

- Country-wise, Germany and the United Kingdom are expected to occupy the top spots, accounting for nearly 60% of the total market. Although France is the second-largest ferrous casting country within the European region, when it comes to non-ferrous castings and die casting in particular, the country lags behind Germany and Italy. The Czech Republic and Poland are the other important markets in the European region.

- Owing to the high demand for vehicles in the country, Germany is one of the largest markets for automobiles in the world. The presence of leading automobile manufacturers, as well as component manufacturers, is driving growth in the region.

- Even though the coronavirus pandemic is widely acknowledged to be the primary cause of the decline between 2019 and 2020, buying a new car has always been more expensive. However, it is expected that in 2023, there will be around 48.76 million registered cars in Germany itself.

- Germany is one of the world's leading car producers and is well-known for its excellence in the automotive industry. Today, Germany's automotive industry is one of the most innovative and competitive industries, having the third-highest car production in the world and fourth-highest vehicle production. Germany ranks 1st in car production in Europe, with a 52% market share among the Western European countries and 31% in the European Union.

- Germany invests in R&D growth in the automotive sector. Over the last few years, the country accounted for 60% of the R&D growth in Europe. Germany invested over EUR 20 billion (USD 23.6 billion) in R&D in the automotive industry, which is the highest among other sectors. There are several premium car manufacturers, like Mercedes, Audi, BMW, etc., in the country, which are spending heavily on enhancing their product line.

- Hence, many die-casting companies are investing in expanding their production capabilities in the country. For instance, in September 2022, DGS Druckguss Systeme s.r.o. announced that it had begun operations at the Frdlant plant and produces die castings made of aluminum and magnesium alloy for the automotive industry.

- Owing to the above factors, the market is expected to grow in the coming years.

Europe Automotive Parts Die Casting Industry Overview

The European market for the automotive parts die-casting industry is fragmented. Major players, such as Rheinmetall AG, GF Automotive, Martinrea, Nemak, DGS Druckguss Systeme Handtmann Group, and others, have together accounted for a major share of the market in the region. These companies have focused their investments on R&D to come up with better production processes and alloys. This strategy will assist in the production of premium quality die-cast parts for the European automotive and industrial sectors.

For instance, in June 2022, Handtmann, a German manufacturer of light metal components, purchased an A Carat 610 extended die-casting solution for its production facility in Biberach a. d. Riss, Germany. The acquisition was made with the aim of enhancing the production of body-in-white and structural parts.

Europe Automotive Parts Die Casting Market Leaders

-

Martinrea Honsel

-

Ryobi Die Casting

-

Georg Fischer

-

Rheinmetall Automotive

-

Buhler Group

*Disclaimer: Major Players sorted in no particular order

Europe Automotive Parts Die Casting Market News

- September 2022: Rheinmetall AG (Rheinmetall) secured a new EUR 20 million (USD 23.6 million) order for its cutting-edge air-divert valve, the Turbo Bypass Valve (TBV) Gen 6, further solidifying its position as a key player in the industry. This order adds to the series of recent successful orders received by the Group subsidiary. Production of the TBV Gen 6 will be carried out at Pierburg's Neuss, Germany, plant.

- May 2022: GF Casting Solutions, a division of Georg Fischer, announced its commitment to enhance the development of electric vehicle (EV) products and services. Leveraging its expertise and artificial intelligence (AI), the company aims to facilitate customers' transition to electric drive engines and e-mobility. By utilizing AI, GF Casting Solutions can deliver high-quality products that contribute positively to the environment.

Europe Automotive Parts Die Casting Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Drivers

- 4.1.1 Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

-

4.2 Market Restraints

- 4.2.1 Fluctuations in Raw Material Prices

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION ( Value in USD Billion)

-

5.1 By Production Process Type

- 5.1.1 Vacuum Die Casting

- 5.1.2 Pressure Die Casting

- 5.1.3 Other Production Process Types

-

5.2 By Metal Type

- 5.2.1 Aluminum

- 5.2.2 Zinc

- 5.2.3 Other Metal Types

-

5.3 By Application Type

- 5.3.1 Engine Parts

- 5.3.2 Transmission Components

- 5.3.3 Structural Parts

- 5.3.4 Other Application Types

-

5.4 Geography

- 5.4.1 Europe

- 5.4.1.1 Germany

- 5.4.1.2 United Kingdom

- 5.4.1.3 France

- 5.4.1.4 Italy

- 5.4.1.5 Russia

- 5.4.1.6 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

-

6.2 Company Profiles

- 6.2.1 Martinrea Honsel

- 6.2.2 Ryobi Die Casting

- 6.2.3 Rheinmetall Automotive

- 6.2.4 Georg Fischer Limited

- 6.2.5 Buhler Group

- 6.2.6 Nemak

- 6.2.7 Dynacast

- 6.2.8 Brabant Alucast

- 6.2.9 DGS Druckguss Systeme

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEurope Automotive Parts Die Casting Industry Segmentation

Automotive die casting uses a metal molding process to produce parts from molten metal (die). They then cool the metal and solidify it into machined items such as engine blocks or gearboxes. This approach eliminates waste while saving manufacturers and customers time and money.

The Europe automotive parts die casting market has been segmented by production process type (vacuum die casting, pressure die casting, and other production process types), application type (engine parts, transmission components, structural parts, and other application types), metal type (aluminum, zinc, and other metal types), and country (Germany, United Kingdom, France, Italy, Rest of Europe).

The report offers the market size in value (USD) and forecasts for all the above segments.

| By Production Process Type | Vacuum Die Casting | |

| Pressure Die Casting | ||

| Other Production Process Types | ||

| By Metal Type | Aluminum | |

| Zinc | ||

| Other Metal Types | ||

| By Application Type | Engine Parts | |

| Transmission Components | ||

| Structural Parts | ||

| Other Application Types | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe |

Europe Automotive Parts Die Casting Market Research FAQs

How big is the Europe Automotive Parts Die Casting Market?

The Europe Automotive Parts Die Casting Market size is expected to reach USD 12.02 billion in 2024 and grow at a CAGR of 7.28% to reach USD 18.32 billion by 2029.

What is the current Europe Automotive Parts Die Casting Market size?

In 2024, the Europe Automotive Parts Die Casting Market size is expected to reach USD 12.02 billion.

Who are the key players in Europe Automotive Parts Die Casting Market?

Martinrea Honsel, Ryobi Die Casting, Georg Fischer, Rheinmetall Automotive and Buhler Group are the major companies operating in the Europe Automotive Parts Die Casting Market.

What years does this Europe Automotive Parts Die Casting Market cover, and what was the market size in 2023?

In 2023, the Europe Automotive Parts Die Casting Market size was estimated at USD 11.14 billion. The report covers the Europe Automotive Parts Die Casting Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Europe Automotive Parts Die Casting Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Europe Automotive Parts Die Casting Industry Report

Statistics for the 2024 Europe Automotive Parts Die Casting market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Automotive Parts Die Casting analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.