Europe Energy Bar Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 4.80 % |

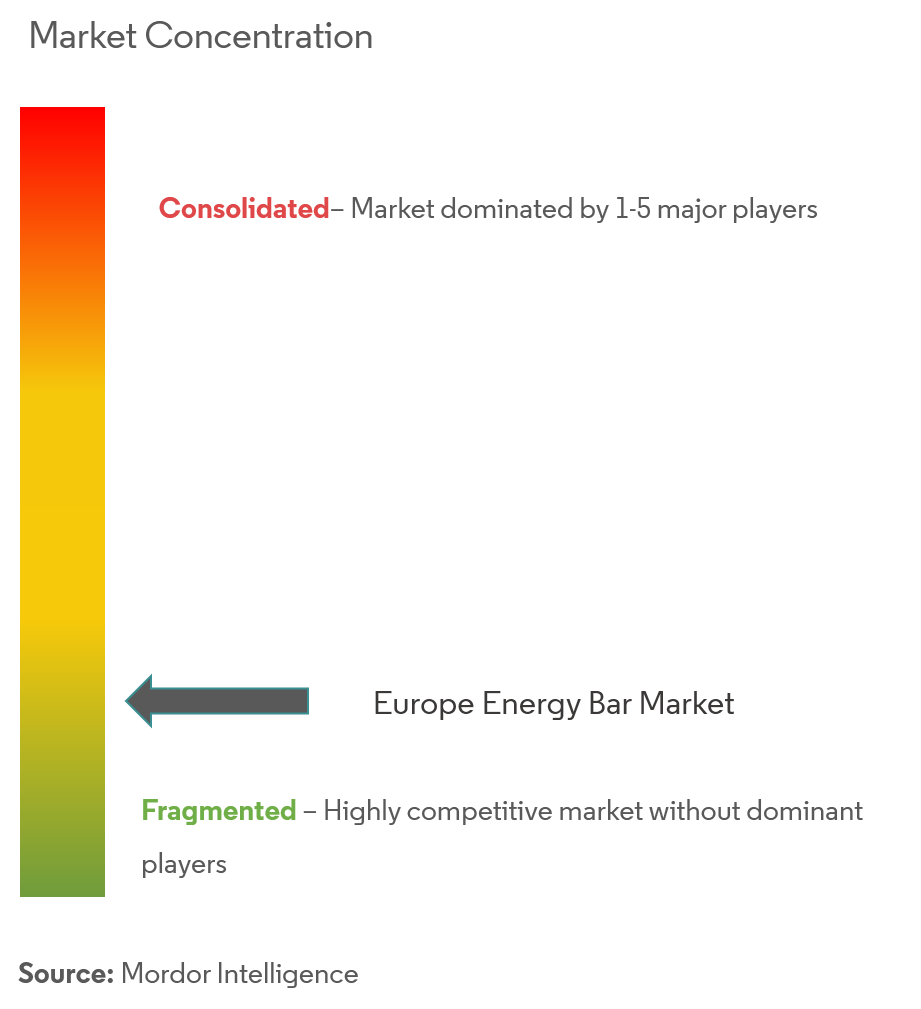

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Europe Energy Bar Market Analysis

Europe Energy Bar Market is projected to grow ata CAGR of 4.8% during the forecast period (2020-2025).

- Growing demand for organic snacking, indulgence, meal replacement, on-the-go snacking are various factors that fueled the energy bar market growth.Consumers are increasingly going health conscious when it comes to bite in between meals.

- Featuring healthbenefit with convenience and nutritional component while on-the-go snacking fueled the nutrition bar market. Consumers are looking for clean label and free-from products with the number of companies releasing new products keeping consumer growing interest towards Clean-label products.

Europe Energy Bar Market Trends

This section covers the major market trends shaping the Europe Energy Bar Market according to our research experts:

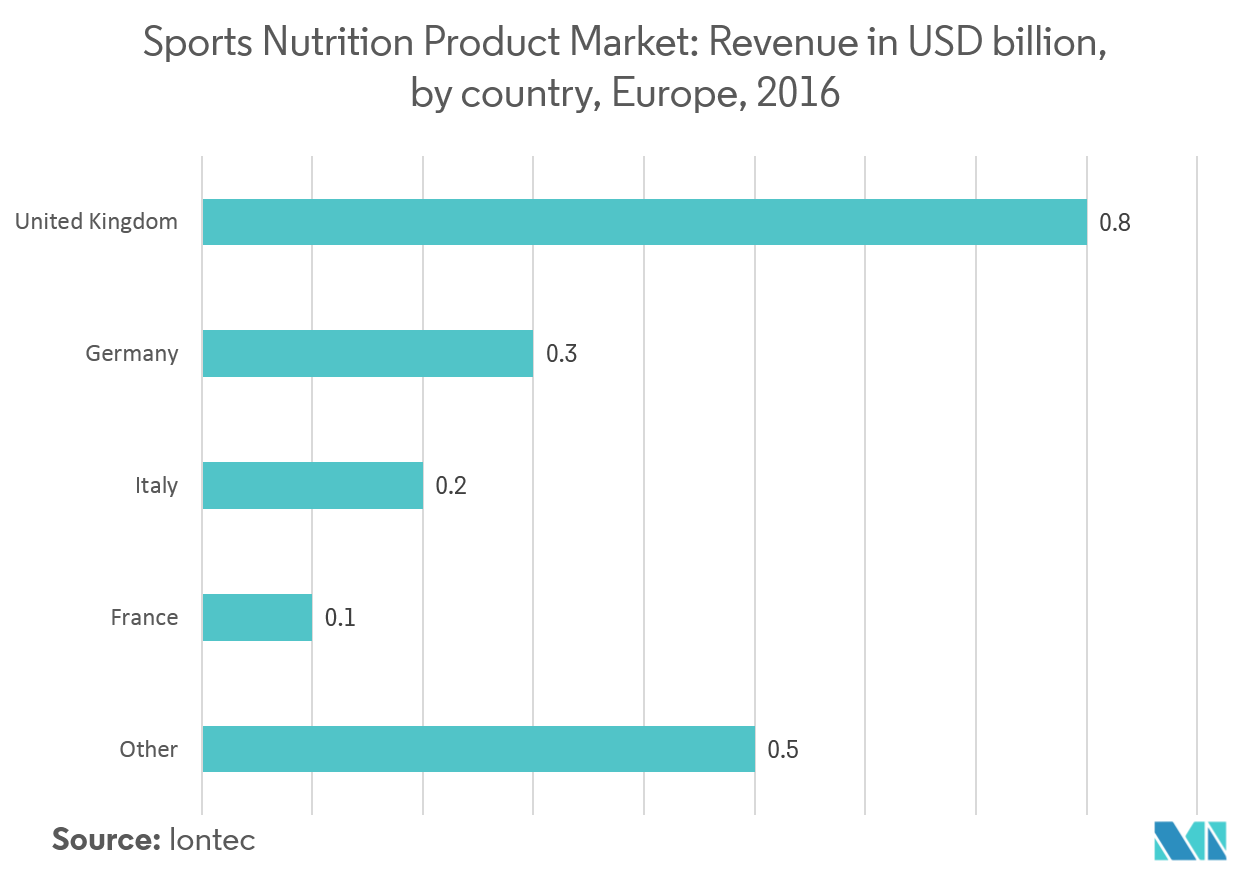

United Kingdom Dominating the Market

There is an increase in demand for energy bars in the United Kingdom with people becoming more health conscious and hitting the fitness centers and gyms. Bodybuilders and athletes are the primary consumers of sports nutrition products. The demand for the market is fuelled by the growing usage of sports nutrition products by sports enthusiasts, which are likely to create new market opportunities for snack bar manufacturers.

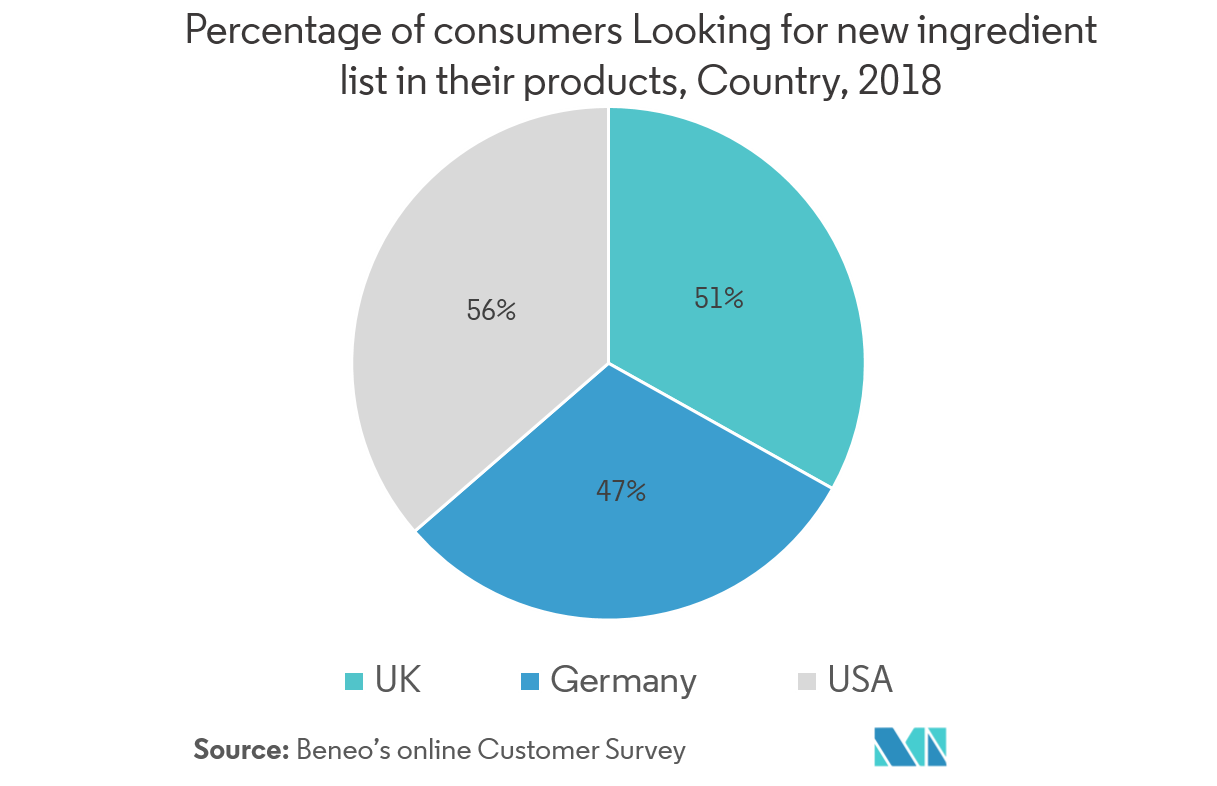

Growing Trend for Clean-Label Bars

Clean label and free-from products are leading the way in Europe, which is growing at a faster pace in the energy bar market. To meet the consumer demand for transparency, healthy-positioned products, and labels, many companies in Europe are reconstructing their bars with clean label requirements putting many of the go-to ingredients out of reach. Further companies are coming with innovative products by using alternative protein sources, changing flavor profiles and relying on forward-thinking ingredient suppliers to meet the trend. Keeping in line with this clean label trend, Mule bar, a UK based company describes its nutrition bars as "real, identifiable and natural", while Natural Balance Foods company highlights that its energy bar contains five ingredients compared to typical 30 of conventional bars.

Europe Energy Bar Industry Overview

Europe energy bar market is fragmented with the presence of numerous players. The major players are General Mills Inc, The Kellogg Company, QuestNutrition LLC, Probar LLC, Clif Bar and Company and others. Companies are launching new products to meet the demand of consumers. For Instance, In 2016, MioBio Company launched Superheraw Energy bar in the European market which is a high quality ecological product with no artificial flavor, added sugar or additives. The product has performed well across Europe with increased demand. The innovative packaging design of the product received prestigious design award Red Dot Communication Design in 2017.

Europe Energy Bar Market Leaders

-

General Mills Inc

-

The Kellogg Company

-

QuestNutrition LLC

-

Probar LLC

-

Clif Bar & Company

*Disclaimer: Major Players sorted in no particular order

Europe Energy Bar Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Distribution Channel

- 5.1.1 Supermarkets/Hypermarkets

- 5.1.2 Convenience Stores

- 5.1.3 Specialist stores

- 5.1.4 Online Retail Stores

- 5.1.5 Other Distribution Channels

-

5.2 Geography

- 5.2.1 Europe

- 5.2.1.1 Spain

- 5.2.1.2 United Kingdom

- 5.2.1.3 Germany

- 5.2.1.4 France

- 5.2.1.5 Italy

- 5.2.1.6 Russia

- 5.2.1.7 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 General Mills Inc

- 6.4.2 The Kellogg Company

- 6.4.3 QuestNutrition LLC

- 6.4.4 Probar LLC

- 6.4.5 Oatein

- 6.4.6 Clif Bar & Company

- 6.4.7 Pepsico Inc

- 6.4.8 PowerBar, Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEurope Energy Bar Industry Segmentation

The Europe Energy Bar Market is segmented by distribution channels that includes supermarkets/hypermarkets, convenience stores, specialist stores, online retail stores, and other distribution channels. The study also involves the analysis of regions such as Spain, United Kingdom, Germany, France, Italy, Russia and rest of Europe.

| By Distribution Channel | Supermarkets/Hypermarkets | |

| Convenience Stores | ||

| Specialist stores | ||

| Online Retail Stores | ||

| Other Distribution Channels | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe |

Europe Energy Bar Market Research FAQs

What is the current Europe Energy Bar Market size?

The Europe Energy Bar Market is projected to register a CAGR of 4.80% during the forecast period (2024-2029)

Who are the key players in Europe Energy Bar Market?

General Mills Inc, The Kellogg Company, QuestNutrition LLC, Probar LLC and Clif Bar & Company are the major companies operating in the Europe Energy Bar Market.

What years does this Europe Energy Bar Market cover?

The report covers the Europe Energy Bar Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Europe Energy Bar Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Europe Energy Bar Industry Report

Statistics for the 2024 Europe Energy Bar market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Energy Bar analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.