EU Food Colorant Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 3.80 % |

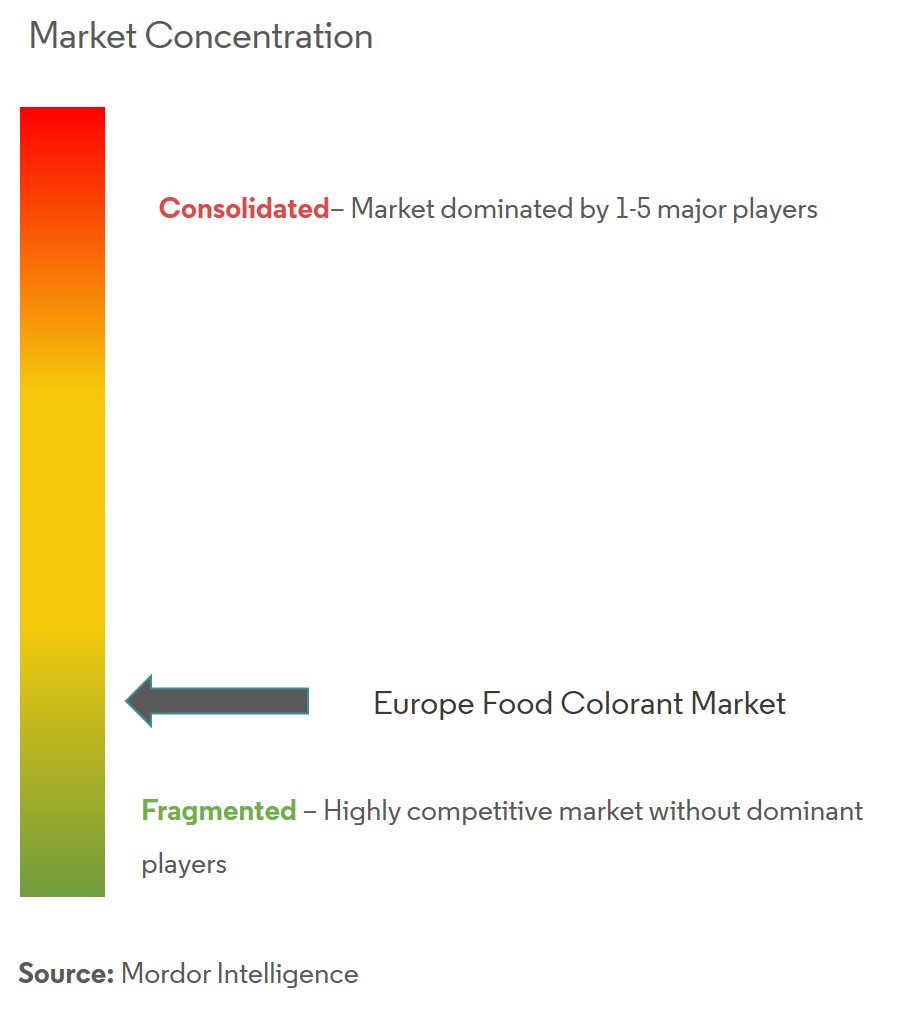

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

EU Food Colorant Market Analysis

Europe food colorant market is projected to grow at a CAGR of 3.8% during the forecast period (2020 - 2025).

- In the European Union, food colors are regulated as food additives, under a comprehensive set of regulations, for food improvement agents. Presently, in the European Union, 39 colors are authorized as color additives, for usage in foods. The European food colorants market continues to capture the largest market share, due to the growing demand for clean label foods and health awareness

- Anthocyanin and betalain pigments are mostly used for producing red, purple, pink, and blue colors, and the demand for anthocyanin in Europe is expected to stimulate the demand over next five years.

EU Food Colorant Market Trends

This section covers the major market trends shaping the Europe Food Colorants Market according to our research experts:

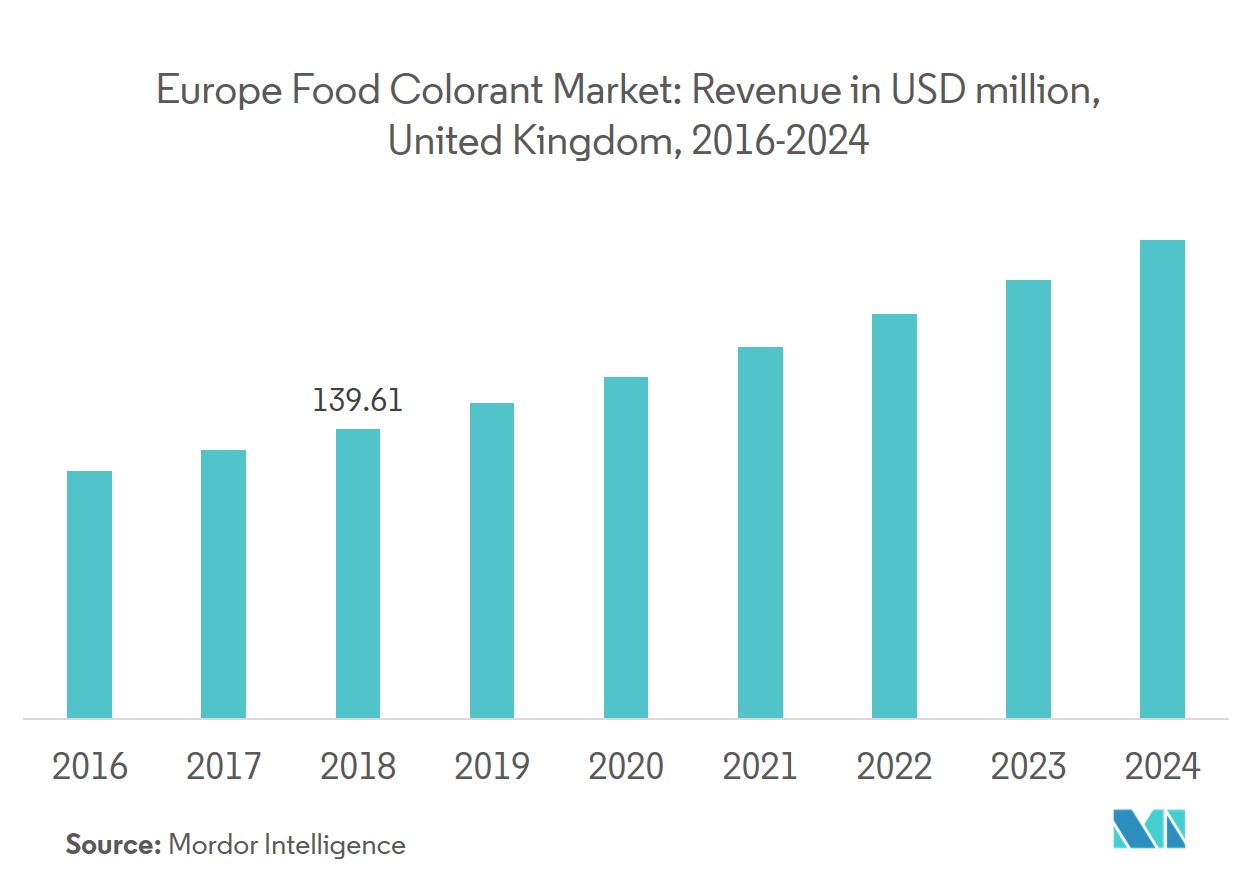

United Kingdom Held the Largest Market Share

The Food colorant market in the United Kingdom is driven by easily-available raw materials, which includes fruits and vegetables and increased consumption of packaged food, including beverages, ready to eat foods, and other products. Consumers in the United Kingdom alligns natural products with superior quality. For instance: colors derived from well-known sources, such as beetroot, grapes, cabbage, and paprika, are more readily-recognized and accepted by consumers. In the United Kingdom, rising food safety concerns are pressurizing manufacturing to adopt clean labels, which is triggering the demand for natural colors.

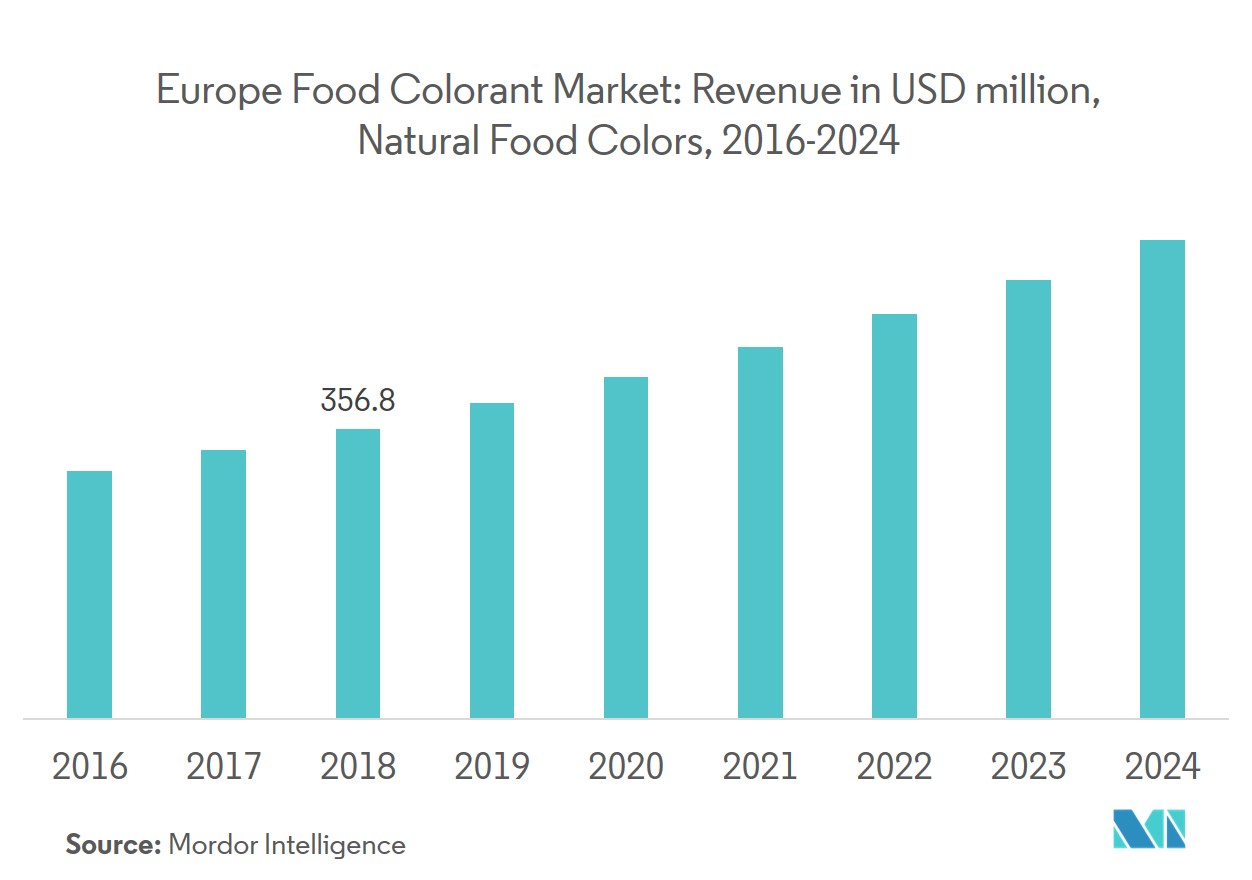

Natural Food Colorants Dominates the Overall Market

The growing health concerns among the consumers have given a boost to the demand for natural products in their everyday diet. This, in turn, increased the application of natural food colorants such as Allura red, carmoisine, ponceau 4R, quinoline yellow and others in the food and beverage industry. Natural Food Coloring in the food & beverages industry Is gaining popularity with an increasing number of natural food colors and dyes being produced commercially. Innovation in natural food colors to mitigate the application challenges faced by the food industry is one of the key approach adopted by the companies so as to meet the propelling consumer's demand.

EU Food Colorant Industry Overview

The Europe food colorant market is a highly fragmented market due to the presence of various global and local players in the region. The active companies in the Europe food colorant market include Royal DSM, BASF SE, Chr. Hansen A/S and others. The product innovation and expansion are the two most adopted by the companies operating in the region. The global companies are also acquiring small local players so as to increase their dominance in Europe. They also use strategies, like forming new agreements and partnerships with local players to increase their footprint in the foreign country and release new products according to consumers changing preferences.

EU Food Colorant Market Leaders

-

Royal DSM

-

BASF SE

-

Chr. Hansen A/S

-

Sensient Technologies

-

Dohler Group Se

*Disclaimer: Major Players sorted in no particular order

EU Food Colorant Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Natural Color

- 5.1.2 Synthetic Color

-

5.2 By Application

- 5.2.1 Beverage

- 5.2.2 Dairy & Frozen Product

- 5.2.3 Bakery

- 5.2.4 Meat, Poultry & Seafood

- 5.2.5 Confectionery

- 5.2.6 Others

-

5.3 Geography

- 5.3.1 Spain

- 5.3.2 United Kingdom

- 5.3.3 Germany

- 5.3.4 France

- 5.3.5 Italy

- 5.3.6 Russia

- 5.3.7 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Koninklijke DSM N.V.

- 6.4.2 BASF SE

- 6.4.3 Chr. Hansen A/S

- 6.4.4 Sensient Technologies

- 6.4.5 Dohler Group

- 6.4.6 D.D. Williamson & Co

- 6.4.7 Riken Vitamin

- 6.4.8 Givaudan (Naturex)

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEU Food Colorant Industry Segmentation

Europe Food Colorants Market is segmented By Type into Natural Color and Synthetic Color; By Application into Beverage, Dairy & Frozen Product, Bakery, Meat, Poultry & Seafood, Confectionery,and Others & Geography

| By Product Type | Natural Color |

| Synthetic Color | |

| By Application | Beverage |

| Dairy & Frozen Product | |

| Bakery | |

| Meat, Poultry & Seafood | |

| Confectionery | |

| Others | |

| Geography | Spain |

| United Kingdom | |

| Germany | |

| France | |

| Italy | |

| Russia | |

| Rest of Europe |

EU Food Colorant Market Research FAQs

What is the current Europe Food Colorants Market size?

The Europe Food Colorants Market is projected to register a CAGR of 3.80% during the forecast period (2024-2029)

Who are the key players in Europe Food Colorants Market?

Royal DSM, BASF SE, Chr. Hansen A/S, Sensient Technologies and Dohler Group Se are the major companies operating in the Europe Food Colorants Market.

What years does this Europe Food Colorants Market cover?

The report covers the Europe Food Colorants Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Europe Food Colorants Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

EU Food Colorant Industry Report

Statistics for the 2024 EU Food Colorant market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. EU Food Colorant analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.