EU Malt Ingredients Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 6.90 % |

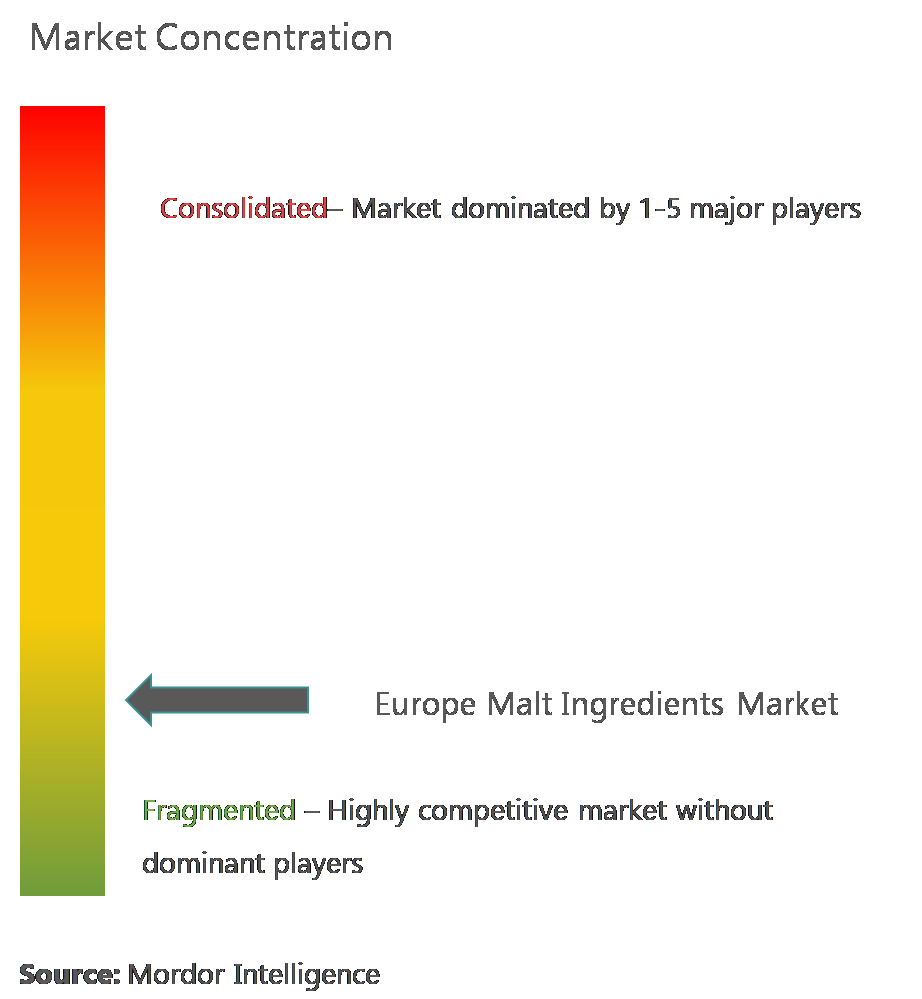

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

EU Malt Ingredients Market Analysis

Europe malt ingredient market is forecasted to grow with a CAGR of 6.9% during the forecast period (2019-2024)

- The European malt ingredients market, led by the United Kingdom, France, Russia, and Germany, is poised to grow owing to increase in bakery and brewery industries.

- Europe is the major producer and consumer owing to increasing consumer trend toward craft beer consumption.

- Malt has been a primary source of brewery for decades. With the growing awareness of malt benefits, the scope of it has tapped the food industry as an additive, flavor, colorant and ingredient. Malt is mainly available as beer, milk powders, snack bars, flakes, syrups, and cookies.

EU Malt Ingredients Market Trends

This section covers the major market trends shaping the Europe Malt Ingredient Market according to our research experts:

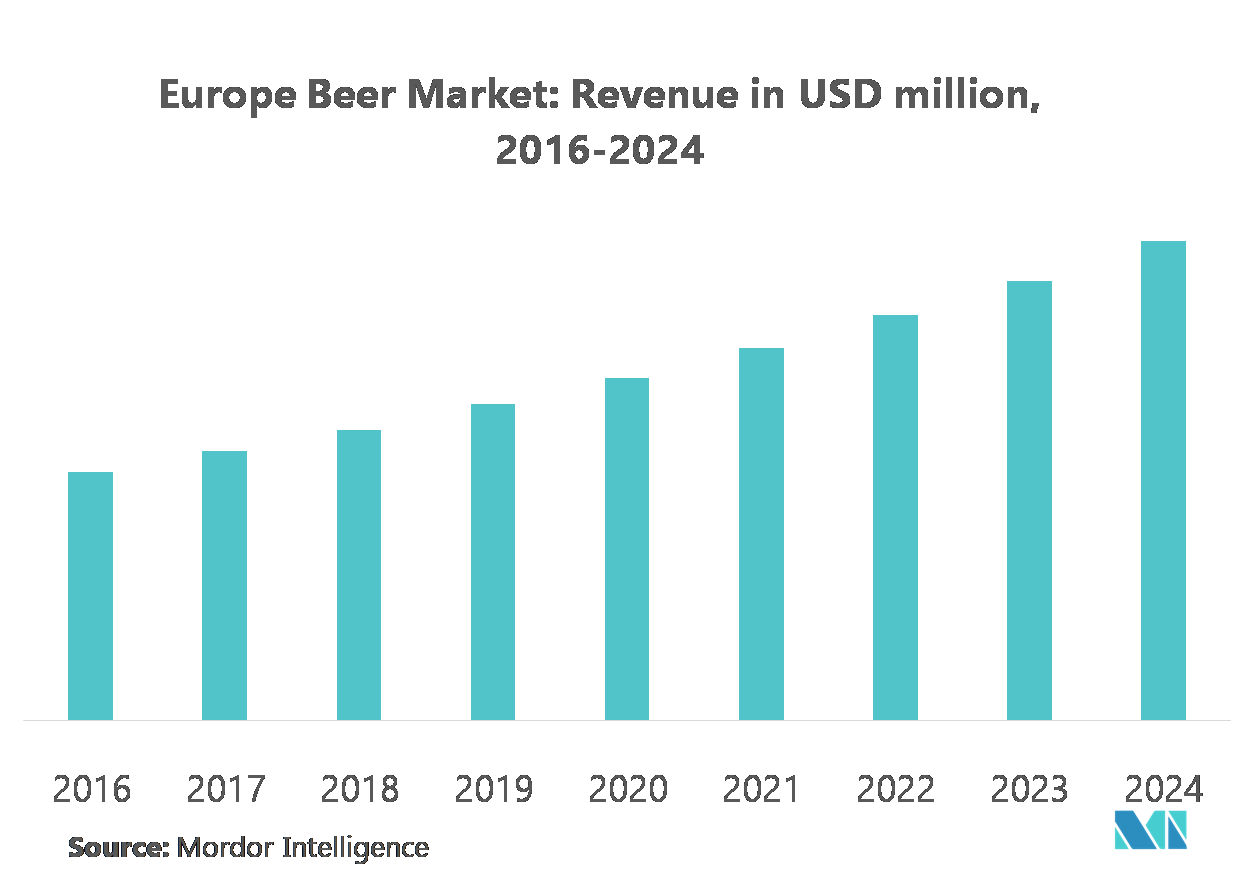

Increasing Beer Consumption In Europe

The key driver for this market is the use of malt in the beer industry, which is growing at a fast rate. Its widespread use in the food industry is another driver for the growth of this market. Opportunities for this market lie in the use of different types of malt extracts in food products. Growing popularity of wine and other beverages acts as a hindrance in the growth of this market, as this would reduce the consumption of beer. Increase in the use of organic malt in making breweries is boosting the growth of the market. The major challenge to this market is the entry of local players in the market. They offer low-quality products, and thus are able to generate a broader customer base.

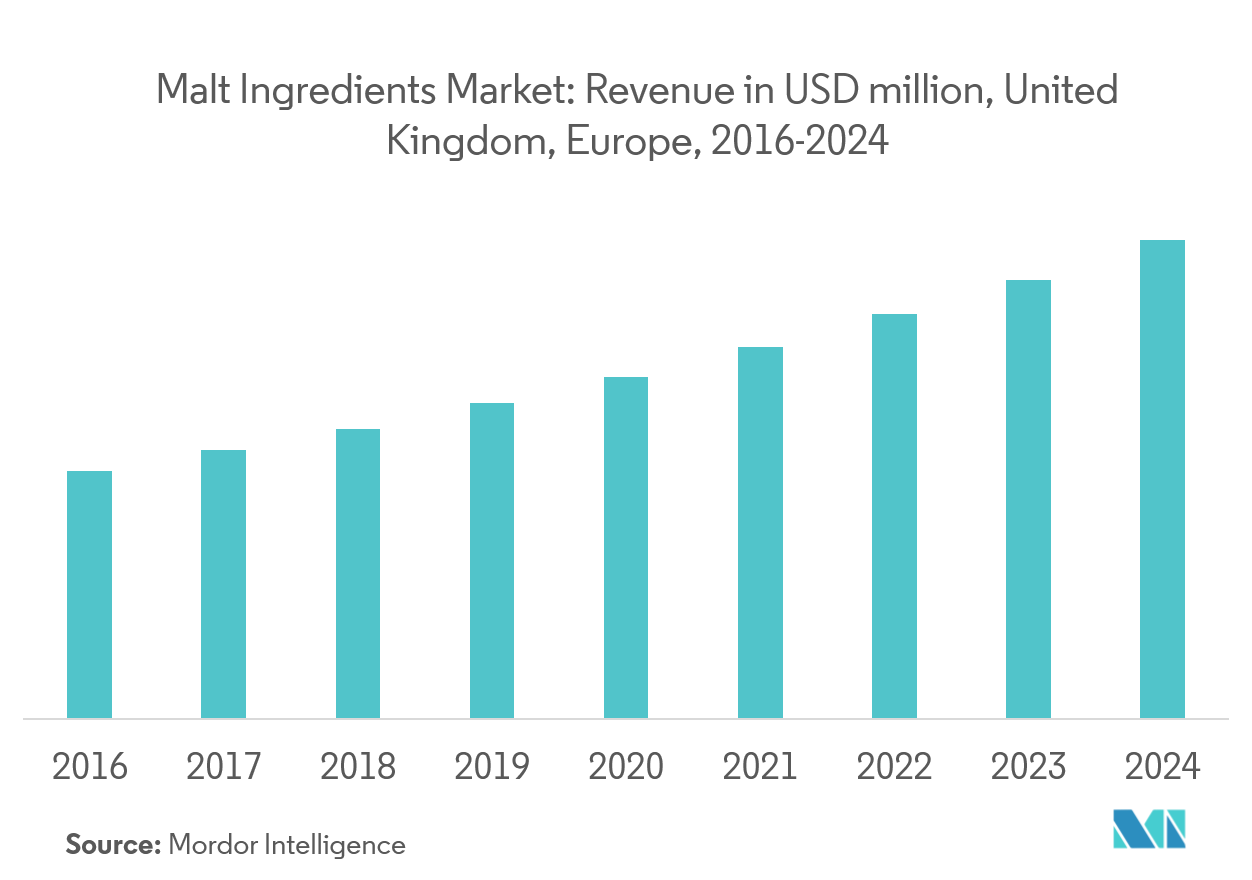

United Kingdom Holds A Major Share

United Kingdom holds the highest share in the market studied, with diversified application areas in beer, traditional alcoholic beverages, and non-alcoholic malt beverage. The increasing consumption of beer and non-alcoholic malt beverages in the United Kingdom is driving the growth of barley use in malt production, owing to the superior flavor profile and varied processing advantages in beer production. Furthermore, there’s a rise in the use of organic malt, in making breweries, which is boosting the growth of the market. Moreover, demand from the industrial sector and increased scope of application in the food and beverage industry are expected to drive the market studied, during the forecast period in the United Kingdom.

EU Malt Ingredients Industry Overview

Europe malt ingredients market is a less consolidated market with the presence of various players in the market. Players come up with ingredients from various sources to expand their portfolio and be in the competition. Various applications of malt ingredients are also opening opportunities for the players.

EU Malt Ingredients Market Leaders

-

Cargill

-

Malteurop Group

-

Boormalt

-

Simpsons Malt

*Disclaimer: Major Players sorted in no particular order

EU Malt Ingredients Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Brewing

- 5.1.2 Distilling

- 5.1.3 Bakery

- 5.1.4 Beverages(Non-Alcoholic)

- 5.1.5 Confectionery

- 5.1.6 Others

-

5.2 Europe

- 5.2.1 Spain

- 5.2.2 United Kingdom

- 5.2.3 Germany

- 5.2.4 France

- 5.2.5 Italy

- 5.2.6 Russia

- 5.2.7 Rest of Europe

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Malteurop Group

- 6.4.2 Boortmalt

- 6.4.3 Cargill

- 6.4.4 Bestmalz

- 6.4.5 Bairds Malt

- 6.4.6 Glen Grant

- 6.4.7 Simpsons Malt

- 6.4.8 The Soufflet Group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEU Malt Ingredients Industry Segmentation

Europe malt ingredient market is segmented by Application into Brewing, Distilling, Bakery, Beverages (Non-Alcoholic), Confectionery and Others; by Geography

| By Application | Brewing |

| Distilling | |

| Bakery | |

| Beverages(Non-Alcoholic) | |

| Confectionery | |

| Others | |

| Europe | Spain |

| United Kingdom | |

| Germany | |

| France | |

| Italy | |

| Russia | |

| Rest of Europe |

EU Malt Ingredients Market Research FAQs

What is the current Europe Malt Ingredient Market size?

The Europe Malt Ingredient Market is projected to register a CAGR of 6.90% during the forecast period (2024-2029)

Who are the key players in Europe Malt Ingredient Market?

Cargill, Malteurop Group, Boormalt and Simpsons Malt are the major companies operating in the Europe Malt Ingredient Market.

What years does this Europe Malt Ingredient Market cover?

The report covers the Europe Malt Ingredient Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Europe Malt Ingredient Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

EU Malt Ingredient Industry Report

Statistics for the 2024 EU Malt Ingredient market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. EU Malt Ingredient analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.