Europe Wall Coverings Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.34 % |

| Fastest Growing Market | Europe |

| Largest Market | Europe |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Europe Wall Coverings Market Analysis

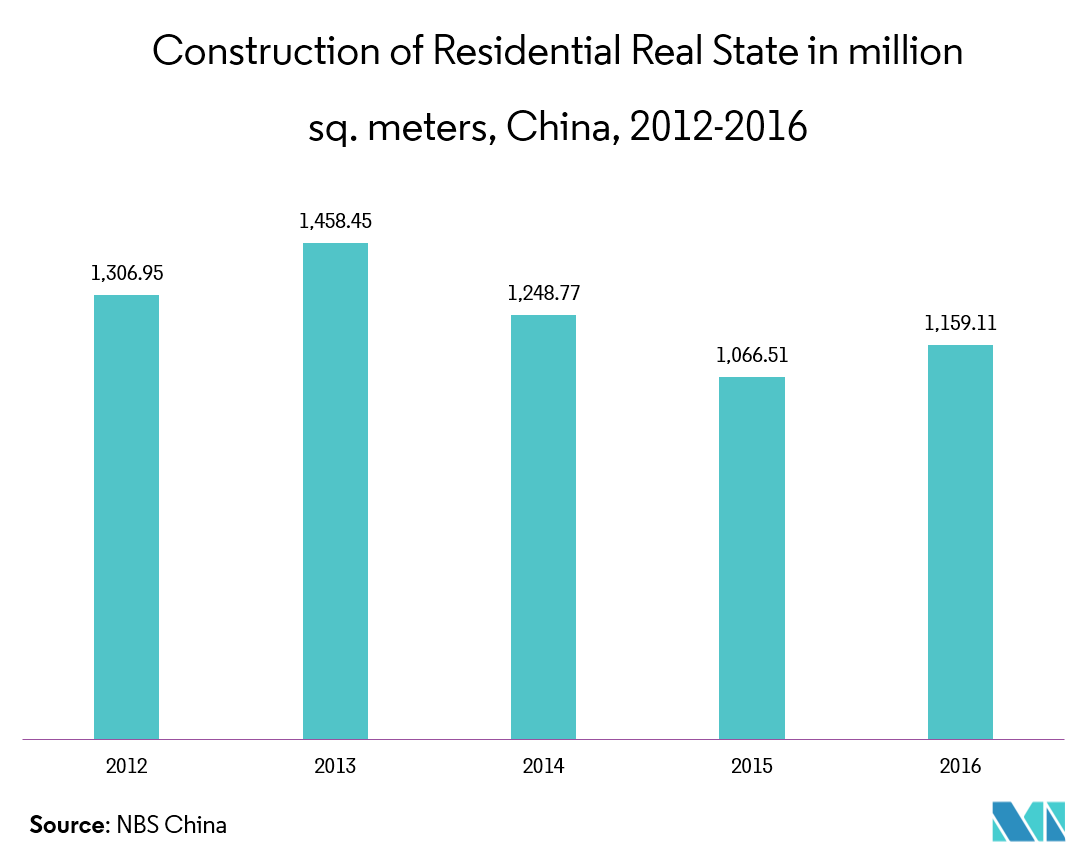

The European wall coverings market was valued at USD 11.195 billion in 2020, and is expected to reach USD 14.43 billion in 2026, registering a CAGR of over 4.34% during the forecast period, 2021-2026. The European market is expected to witness robust growth and is likely to retain its market leadership over the forecast period. The region has witnessed a significant rise in the construction of new buildings, residential as well as commercial, on the back of low-interest rates, good economic growth, and pent-up needs. The aforementioned factors have significantly contributed to the growth of home furnishing.

- The rise in the number of residential houses or complexes, due to an increasing number of nuclear families, caused the residential segment to hold a large share over commercial applications. In the present scenario, wall panels and wallpapers, which are sub-segments of wall coverings, are the dominant products.

- The European population has been concerned about the home furniture and décor systems. Owing to the increasing number of high-income population, the spending on home furnishing has increased over the past few years. Due to this demand, European companies are investing significantly in innovative wall coverings. For instance, Kobe's library offers a wide range of fabrics and wall coverings to create one's own personal statement in interiors.

- High inventory costs have been one of the biggest challenges to the growth of the wall coverings industry. Distributors are needed to stockpile the number of patterns, styles, and raw materials, and store them in controlled environments to protect them from various climatic conditions. Such storage requirements are coupled with very low inventory turnover rates.

Europe Wall Coverings Market Trends

This section covers the major market trends shaping the Europe Wall Coverings Market according to our research experts:

Non-commercial is Expected to Register a Significant Growth

- Consumer trends relating to wallcoverings in Europe are constantly shifting. Wallpaper remained the preferred choice of covering in the last decade, while panels are finding increasing demand in the residential segment.

- Increased consumer awareness is resulting in consumers demanding for specific wall coverings to suit their preference. This is creating a demand for high-end and customized wallcovering solutions in the residential sector in Europe.

- Besides, increasing demand for premium real-estate is one of the important trends, impacting the market. Real-estate companies are focusing on value addition, by providing sophisticated designs and luxury interiors to lure consumers.

- The demand in residential wallcoverings is mainly driven due to the growth in household customization, as nuclear families are growing in the region. Moreover, owing to an increase in residential construction, coupled with the growth of the spending power of people in the region, the market has been handed a boost.

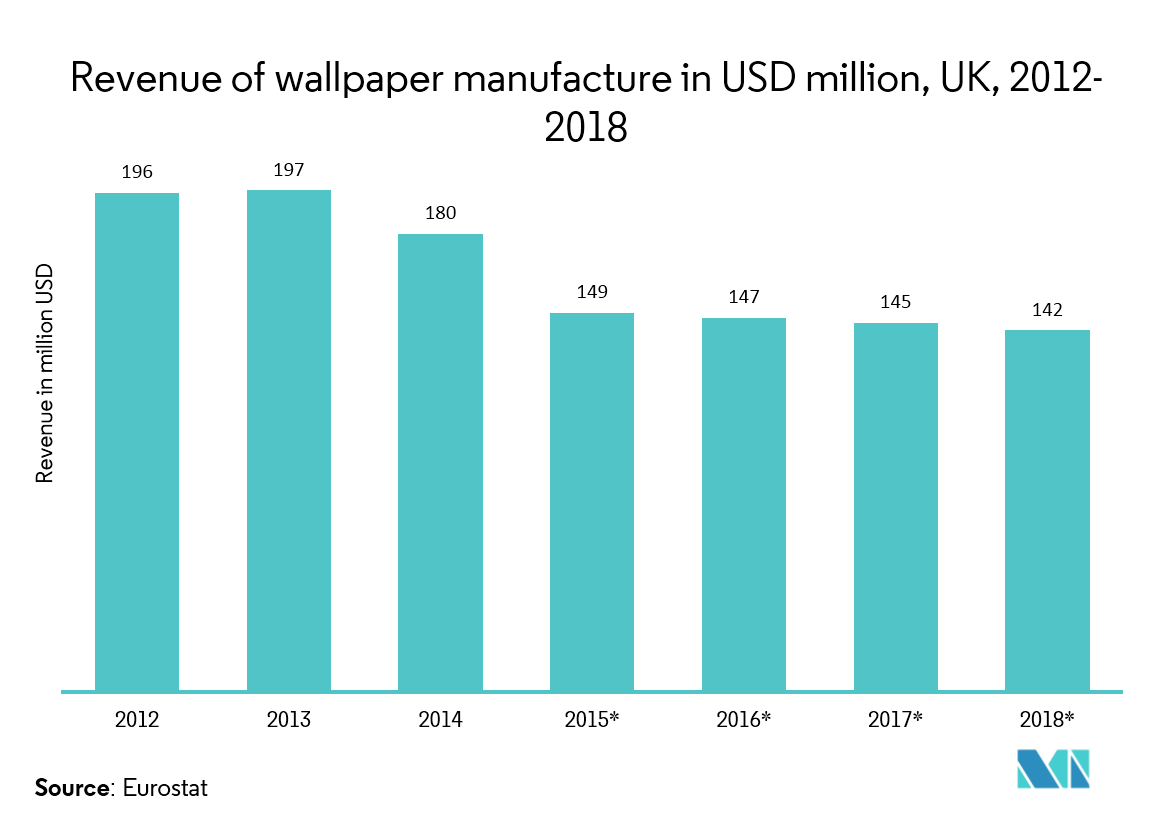

The United Kingdom is Expected to Hold Major Share

- There were 27.2 million households in the United Kingdom, in 2017. The number of households increased by 6%, since 2007, similar to the growth in the UK population, during this period.

- Being the sixth-largest construction sector in the world, the UK construction industry is a major contributor to the domestic economy. It is a highly prioritized industry, with a pledge from the government to build 1,000,000 homes by 2020, and another 500,000 in the subsequent two years.

- The country has also witnessed a trend in off-site construction, particularly in urban areas. The Steel Construction Institute has been able to identify reduced construction time from 76-54 weeks, mainly achievable by using prefabricated and preglazed wall panels, permitting a faster weather-tight building envelope, thereby, allowing other trades to work inside the building.

- According to Hiscox, the number of homeowners, choosing to improve their homes, rather than move, has risen fivefold, since 2013. Also, it is estimated that 53% of owners have carried out some sort of renovation project over the past 10 years.

- Such factors are expected to boost the market studied in this country over the forecast period.

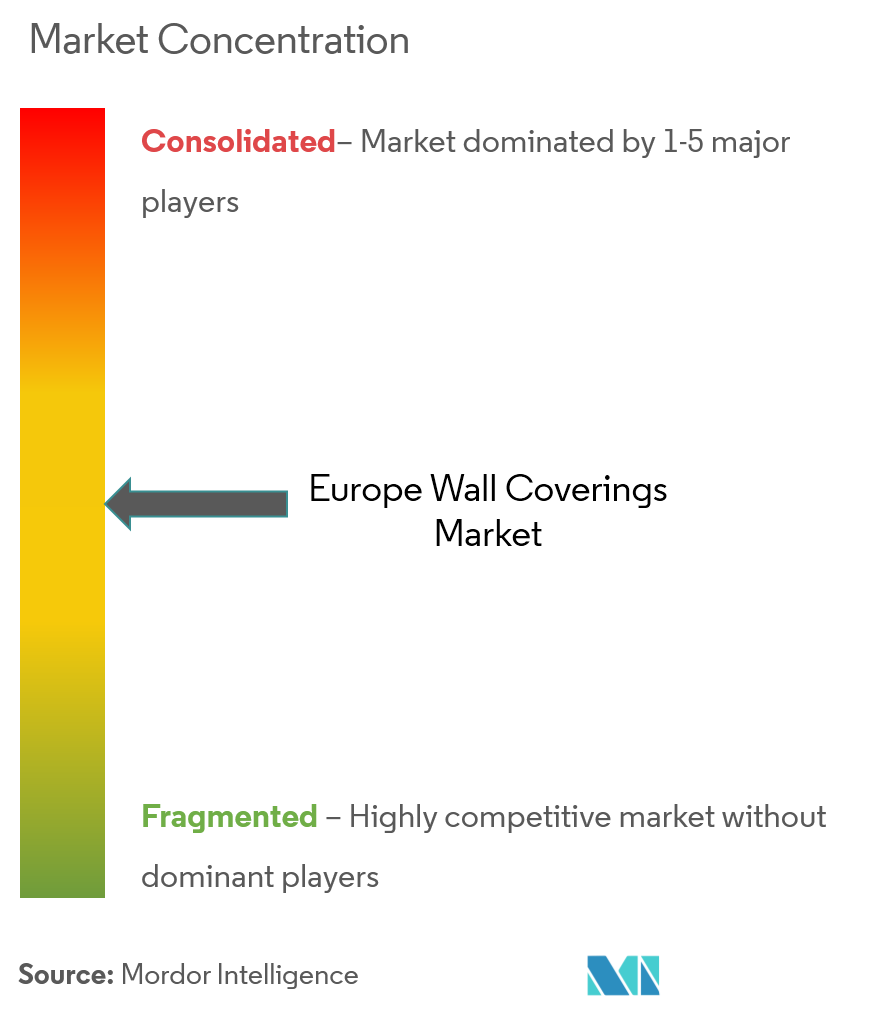

Europe Wall Coverings Industry Overview

The European wall coverings market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring start-ups working on wall coverings to strengthen their product capabilities.

For instance, the merger of Ahlstrom and Munksjo targets product areas, such as wall coverings, décor, filtration and helped Ahlstrom to expand its footprint across Europe. The reachability of the market was increased for Ahlstrom and the company is planning to invest in wall coverings, which depicts the potentiality of the market.

Europe Wall Coverings Market Leaders

-

Grandeco Wallfashion Group

-

Walker Greenbank PLC

-

A.S. Création Tapten AG

-

AkzoNobel NV

*Disclaimer: Major Players sorted in no particular order

Europe Wall Coverings Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Higher Demand for Home Furnishing among the European Countries

- 4.3.2 Availability of Styled Products

-

4.4 Market Restraints

- 4.4.1 High Inventory Costs and Premium Pricing

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. TECHNOLOGY TRENDS

6. MARKET SEGMENTATION

-

6.1 By Product

- 6.1.1 Wallpaper

- 6.1.2 Wall Panel

- 6.1.3 Decorative Tile

- 6.1.4 Metal Panel

- 6.1.5 Other Products

- 6.2 Interior Paints Market

-

6.3 By Application

- 6.3.1 Commercial

- 6.3.2 Non-commercial

-

6.4 Geography

- 6.4.1 Europe

- 6.4.1.1 UK

- 6.4.1.2 France

- 6.4.1.3 Germany

- 6.4.1.4 Spain

- 6.4.1.5 The Netherlands

- 6.4.1.6 Belgium

- 6.4.1.7 Portugal

- 6.4.1.8 Russia

- 6.4.1.9 Poland

- 6.4.1.10 Italy

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Brewster Home Fashions LLC

- 7.1.2 Adfors (Saint Gobain)

- 7.1.3 Ahlstrom-munksjö Oyj

- 7.1.4 Grespania Cerámica

- 7.1.5 AkzoNobel NV

- 7.1.6 A.S. Création Tapten AG

- 7.1.7 Benjamin Moore & Co.

- 7.1.8 Walker Greenbank PLC

- 7.1.9 Grandeco Wallfashion Group

- 7.1.10 Nippon Paint Group

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEurope Wall Coverings Industry Segmentation

Wall coverings protect the wall surface from accidental marks or scratches, besides imparting an air of quality and grandeur to uncovered walls. Wall coverings further help in neutralizing interiors of a building and customizing it with the help of various colors and patterns. These coverings are also cost-effective. The European wallcoverings market report is segmented based on products, applications, and countries. Based on the type of product, the market is divided into wallpaper, wall panel, decorative tile, metal, and other products. Based on application, the market is largely divided into commercial and non-commercial segments. The commercial application segment includes, official, commercial, institutional, industrial, and other non-residential buildings.

| By Product | Wallpaper | |

| Wall Panel | ||

| Decorative Tile | ||

| Metal Panel | ||

| Other Products | ||

| By Application | Commercial | |

| Non-commercial | ||

| Geography | Europe | UK |

| France | ||

| Germany | ||

| Spain | ||

| The Netherlands | ||

| Belgium | ||

| Portugal | ||

| Russia | ||

| Poland | ||

| Italy |

Europe Wall Coverings Market Research FAQs

What is the current Europe Wall Coverings Market size?

The Europe Wall Coverings Market is projected to register a CAGR of 4.34% during the forecast period (2024-2029)

Who are the key players in Europe Wall Coverings Market?

Grandeco Wallfashion Group, Walker Greenbank PLC, A.S. Création Tapten AG and AkzoNobel NV are the major companies operating in the Europe Wall Coverings Market.

Which is the fastest growing region in Europe Wall Coverings Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Europe Wall Coverings Market?

In 2024, the Europe accounts for the largest market share in Europe Wall Coverings Market.

What years does this Europe Wall Coverings Market cover?

The report covers the Europe Wall Coverings Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Europe Wall Coverings Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Europe Wall Coverings Industry Report

Statistics for the 2024 Europe Wall Coverings market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Wall Coverings analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.