Fixed Satellite Services Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.48 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

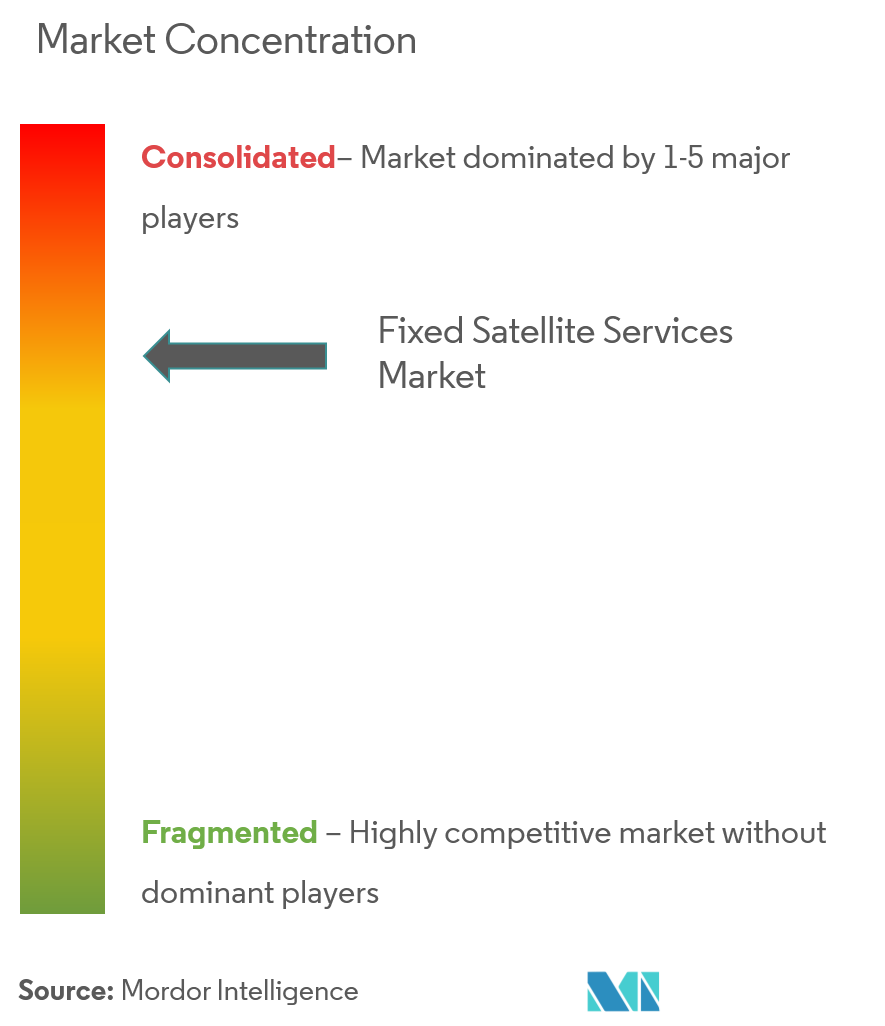

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Fixed Satellite Services Market Analysis

The fixed satellite services market was valued at USD 22.46 billion in 2020 and is projected to reach USD 27.15 billion by the end of 2026, registering a CAGR of 5.48% during the forecast period (2021 - 2026).

- Fixed satellite services (FSS) use ground equipment at set locations to receive and transmit satellite signals. Fixed satellite services generally have a low power output and larger dish-style antennas are required for reception. Also, the satellites used for fixed service require less power than direct broadcasting satellites (DBS).

- The fixed satellite service market is expected to grow significantly over the forecast period, owing to the rise in the extensive use of data communications and increasing demand for high-speed internet.

- High capital investment and increasing use of fiber optic transmission cables are some of the major factors restraining the adoption of the fixed satellite services. Also, the stringent government regulation related to the market and limited orbital locations can also effect the entrance of new players into the studied market.

- The demand for fixed satellite services is also rising from the enterprise segment. In July 2018, Gilat Telecom announced that it was chosen as a service provider for Iridium Certus for land-mobile applications and can now offer customers a wider variety of fixed connectivity solutions.

Fixed Satellite Services Market Trends

This section covers the major market trends shaping the Fixed Satellite Services Market according to our research experts:

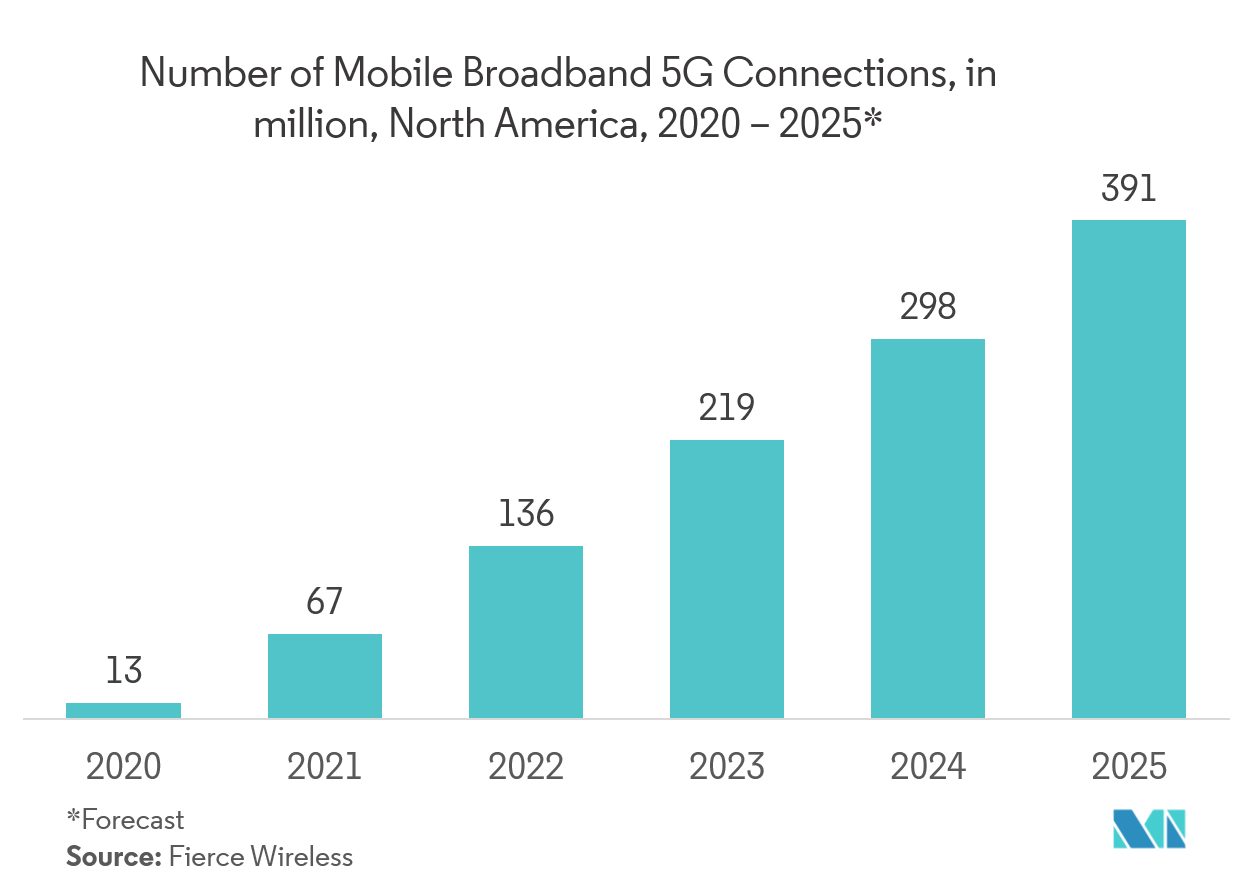

Increasing 5G Penetration to Stimulate the Market Growth

- Increasing 5G penetration is expected to further increase the market growth over the forecast period. This is because with the increased usage of 5G connection among users, the market is likely to grow even bigger as the 5G connection uses the fixed satellites to establish connections.

- Research has been undertaken regarding 28 GHz band sharing between 5G new radio cellular systems and fixed satellite services (FSS).

- This method focuses on modelling a sharing scenario between the uplink of the FSS system and the uplink of the 5G NR enhanced mobile broadband (eMBB) cellular system. It can help in developing an interference from the FSS terminals toward the 5G base station, known as next-generation Node-B.

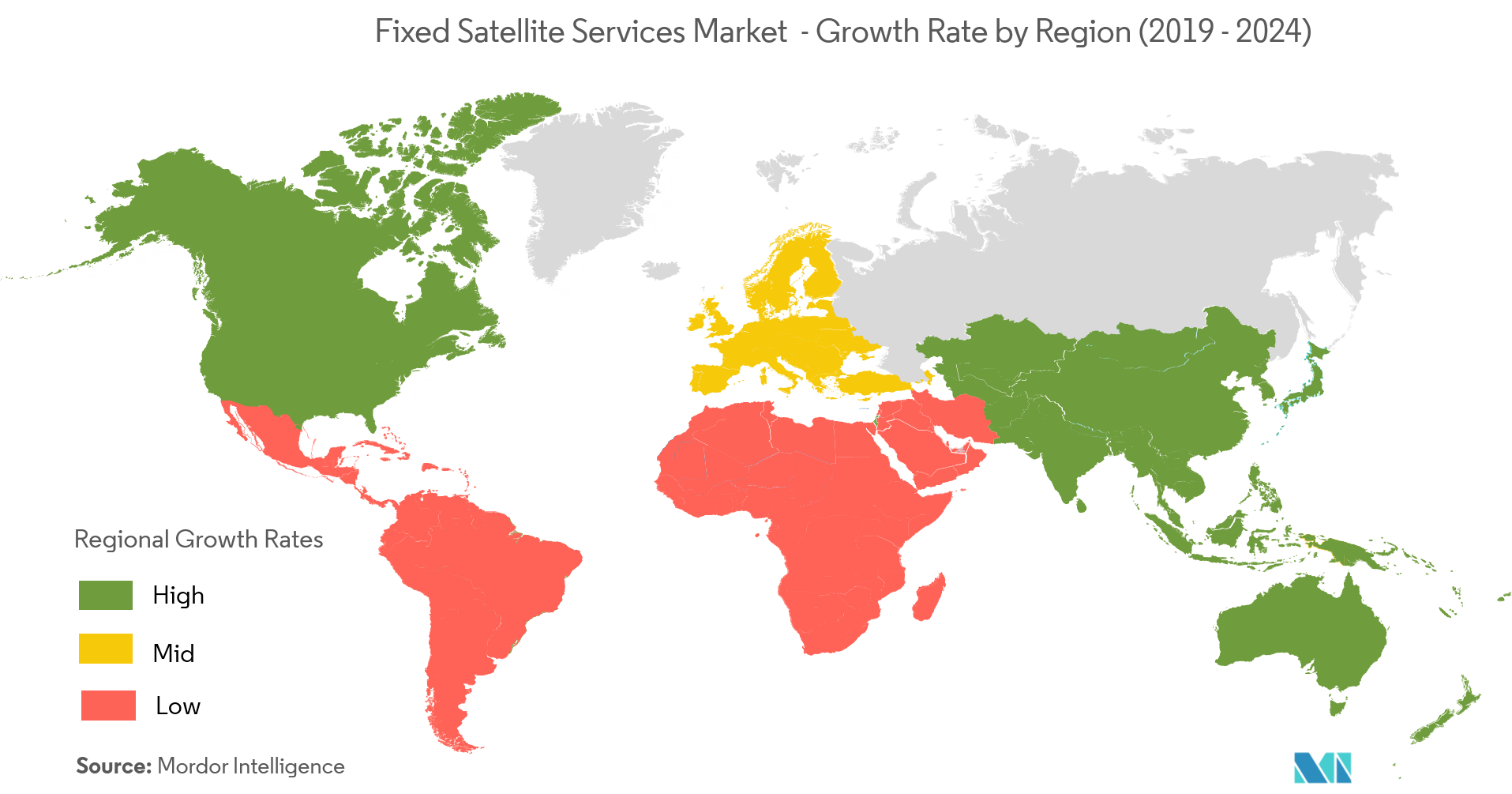

Asia-Pacific is Expected to be the Fastest Growing Market

- The region is estimated to be the fastest growing market over the forecast period, owing to the booming telecom sector in the region and increasing investment in the satellite services market.

- In December 2018, China launched its first communication satellite to provide space-based internet services worldwide, in an apparent bid to rival other international firms. Moreover, in February 2019, India launched its communication satellite GSAT-31 by a European launch services provider. It is a “high power” communication satellite with Ku-band, and it is going to serve and replace some of the satellites that are going to expire soon.

- The continued efforts by the government of the countries and their efforts are driving the fixed satellites and therefore the related services market in the region.

Fixed Satellite Services Industry Overview

The fixed satelliteservicesmarket is highly competitive and consists of a fewmajor players. In terms of market share, a few of the major players currently dominate the market. Theseplayers with high market shares in the market are focusing on expanding their customer base across foreign countries. These companies are constantly seekingstrategic collaborative initiatives to increase their market share and increase their profitability.The companies operating in the market are also collaborating/acquiring firmsworking on fixed satellite services to strengthen their product capabilities. Some of the major firms in the market are Intelsat SA, Eutelsat Communications,Singapore Telecommunications Ltd (Singtel), among others.

- July 2018: Intelsat and Eutelsat announced that they are aligned on a market-based proposal for the future use of the lower C-band spectrum in the United States.

- June 2018: Intelsat announced that the Ministry of Transport and Communications (MOTC) of Myanmar broadened its relationship with Intelsat to accelerate the deployment of the country’s wireless communications infrastructure in Myanmar.

Fixed Satellite Services Market Leaders

-

Eutelsat Communications

-

Telesat Holdings

-

Singapore Telecommunications Ltd (Singtel)

-

SES SA

-

Intelsat SA

*Disclaimer: Major Players sorted in no particular order

Fixed Satellite Services Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing DTH Subscriptions

- 4.3.2 Increasing Demand from Corporate Enterprise and Growing use of Transponders in the Media and Entertainment Industry

-

4.4 Market Restraints

- 4.4.1 High Capital Investment and Increasing Use of Fiber Optic Transmission Cables

- 4.4.2 Regulatory Constraints and Limited Orbital Locations

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type of Services

- 5.1.1 Transponder Agreements

- 5.1.2 Managed Services

-

5.2 By End-user Vertical

- 5.2.1 Government

- 5.2.2 Commercial

- 5.2.3 Aerospace and Defense

- 5.2.4 Media

- 5.2.5 Other End-users Verticals

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Embratel Star One

- 6.1.2 Eutelsat Communications

- 6.1.3 Telesat Holdings

- 6.1.4 Thaicom Public Company Ltd

- 6.1.5 Nigerian Communications Satellites Ltd

- 6.1.6 Telenor Satellite Broadcasting

- 6.1.7 Singapore Telecommunications Ltd (Singtel)

- 6.1.8 SES SA

- 6.1.9 Arab Satellite Communications Organization

- 6.1.10 Hispasat SA

- 6.1.11 Intelsat SA

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityFixed Satellite Services Industry Segmentation

Fixed satellite services (FSS) provides a high-speed connection to the end users by making use of very small aperture terminal (VSAT) technology. FSS systems are positioned in a fixed strategic location and the coverage area extends up to several square miles. FSS systems are used in various sectors like commercial, aerospace and defense, media but the telecom industry is the prime user among all.

| By Type of Services | Transponder Agreements |

| Managed Services | |

| By End-user Vertical | Government |

| Commercial | |

| Aerospace and Defense | |

| Media | |

| Other End-users Verticals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Fixed Satellite Services Market Research FAQs

What is the current Fixed Satellite Services Market size?

The Fixed Satellite Services Market is projected to register a CAGR of 5.48% during the forecast period (2024-2029)

Who are the key players in Fixed Satellite Services Market?

Eutelsat Communications, Telesat Holdings, Singapore Telecommunications Ltd (Singtel), SES SA and Intelsat SA are the major companies operating in the Fixed Satellite Services Market.

Which is the fastest growing region in Fixed Satellite Services Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Fixed Satellite Services Market?

In 2024, the North America accounts for the largest market share in Fixed Satellite Services Market.

What years does this Fixed Satellite Services Market cover?

The report covers the Fixed Satellite Services Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Fixed Satellite Services Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Fixed Satellite Services Industry Report

Statistics for the 2024 Fixed Satellite Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Fixed Satellite Services analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.