Flexible Pipes Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.40 % |

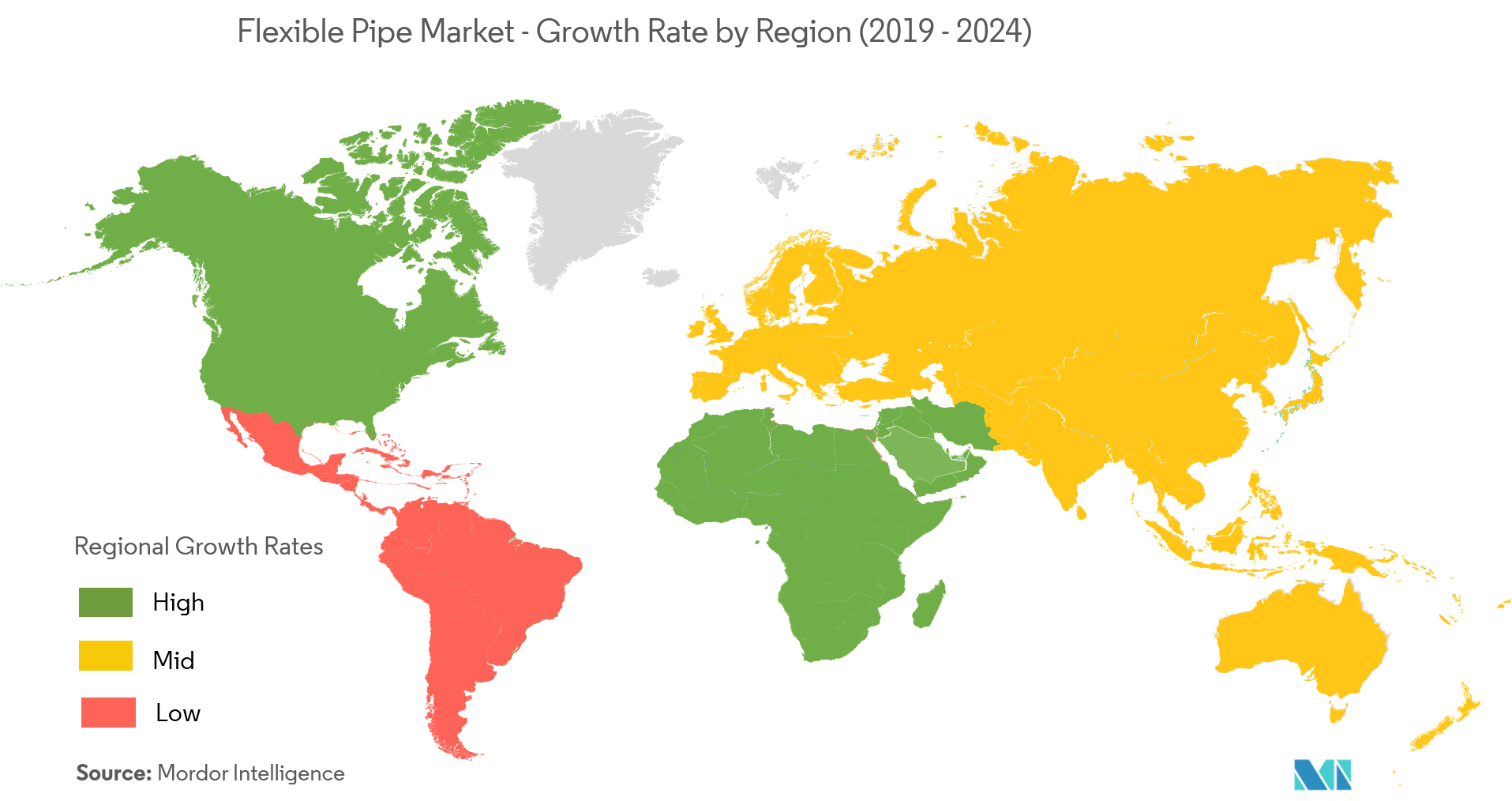

| Fastest Growing Market | Middle East and Africa |

| Largest Market | North America |

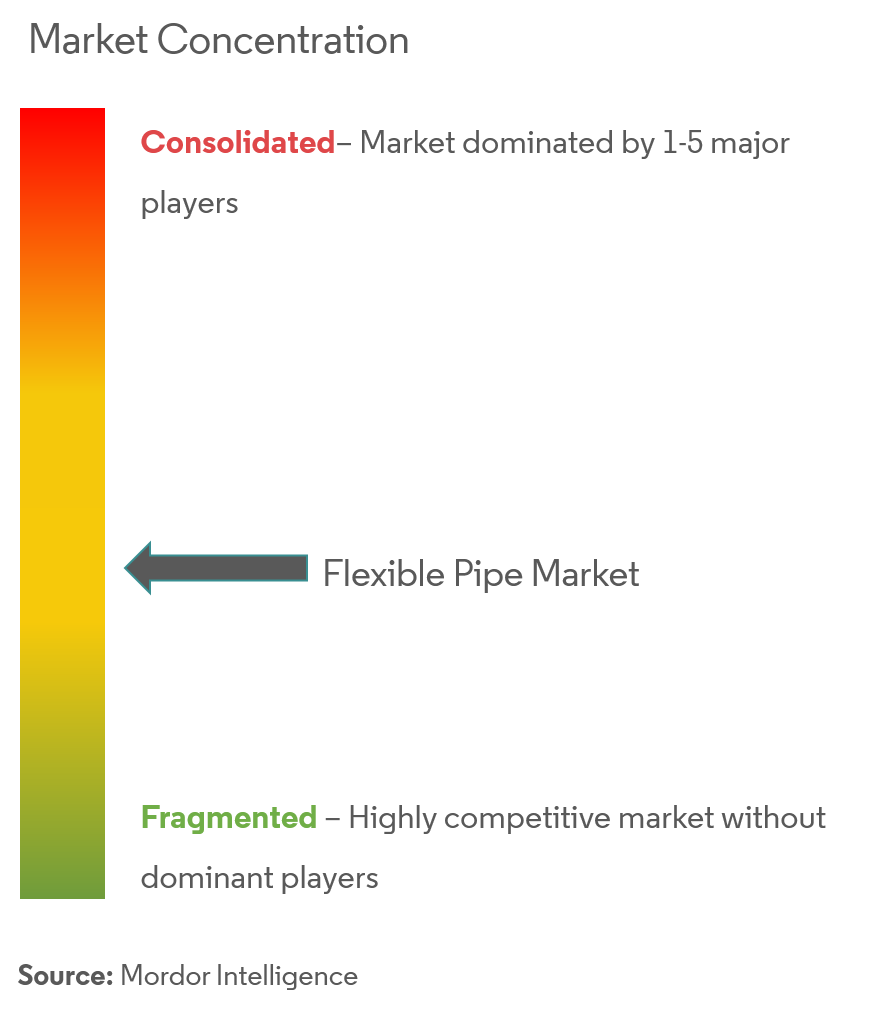

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Flexible Pipes Market Analysis

The flexible pipe market was valued at USD 1,012 million in 2020, and it is expected to reach USD 1,308.44 million by 2026, with a CAGR of 4.44%, over the forecast period (2021-2026).

- Flexible pipes and tubes are widely used to transport oils or other liquids from one location to the other, especially through the seabed, or at construction sites and ores. Due to benefits like high-pressure control, lightweight, leak resistance, and lower price, flexible pipes are being used across industry verticals. The technical and cost advantages these pipes offer, are expected to replace the usage of steel equipment for new exploration activities at a greater pace over the forecast period.

- With the ongoing focus of the oil and gas companies on unconventional sources for oil and gas, along with the offshore and subsea developments, which are moving into deeper waters and more challenging environments, there is a need to minimize inspection to reduce cost. Further, the maintenance and repair costs are high. And thus, flexible pipes are found to be the best fit, as they play a key role in increasing the productivity, life-expectancy, and profitability of onshore and offshore wells.

- However, on the flip side, strict restrictions that are imposed to curb the adverse effects on the environment, along with the rigid regulations imposed on oil and gas drilling activities, restrict the growth of the flexible pipe market.

Flexible Pipes Market Trends

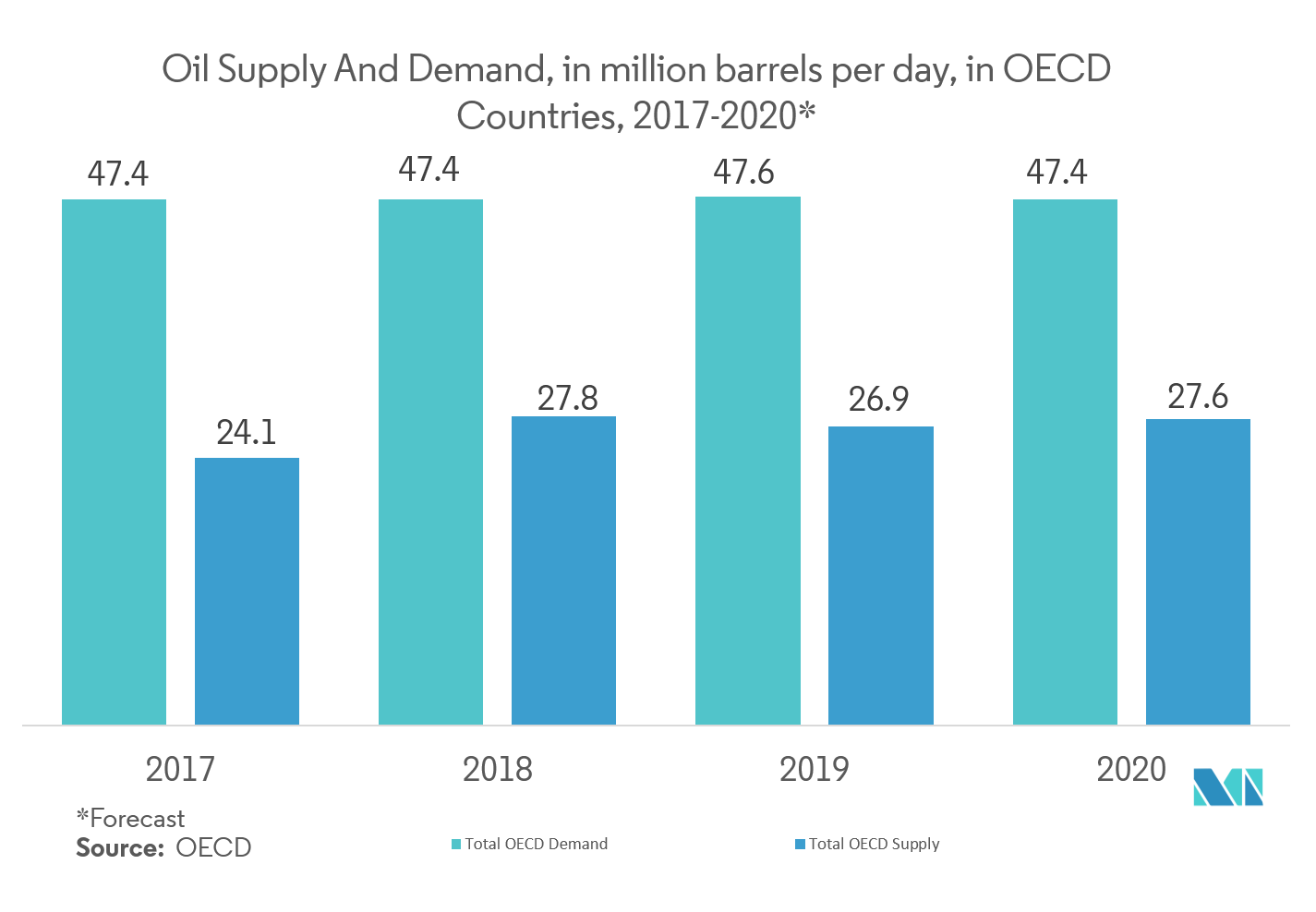

Oil and Gas Industry to Drive the Market

- The downstream product of oil and gas, i.e., petroleum, is widely used in cosmetic products. With the growth of disposable income and the increasing number of working women, the demand for cosmetics is increasing year-on-year.

- This increasing demand for oil and gas requires effective transportation of oil and gas are under enormous physical and chemical stress. Further, the expansion of the transport sector by increasing the number of aviation carriers in the developed region as well as developing regions, along with the increase in the number of owners of passenger cars and vehicles will be driving the market for the oil industry.

- The need for oil and gas does not only restrict to vehicles but it is also widely used in industries for running machines as well.

- The transport sectors are the highest consumption oil and gas and thus, it will fuel the demand for flexible pipe market.

North America Holds the Largest Market Share

- The United States is the largest market for flexible pipes in North America. The country’s newfound shale resources and government policies, which aim at making the country the top oil and gas producer in the next few years, are expected to drive the demand for flexible pipes in the country.

- For instance, with the US Department of Interior (DoI) planning to allow offshore exploratory drilling in about 90% of the outer continental shelf (OCS) acreage, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open up new opportunities to the market.

- Further, according to the US Energy Information Administration, the United States will become a net energy exporter in 2020 and will remain so throughout the forecast period, as a result of large increases in crude oil, natural gas, and natural gas plant liquids (NGPL) production, coupled with slow growth in the US energy consumption.

- The increase in demand for oil and gas will, in turn, boost the flexible pipe market during the forecast period in North America.

Flexible Pipes Industry Overview

The flexible pipe market is competitive and fragmented.Some of the key flexible pipe manufacturers are National Oilwell VarcoInc., GE Oil & Gas Corporation, TechnipFMC PLCInc., Shawcor Ltd, and Prysmian Group, among others. The development of advanced products andmergers andacquisitions are the keystrategies adopted by the major players to remain competitive and to quickly gain market share.

- January 2019:Baker Hughes, a GE company (BHGE),rolled out new technology and underwater development approach, which is set to reduce costs and improve the productivity of offshore oil and natural gas projects. The system includes pumps, flexible pipes, machines to divert oil and gas to pipelines known as manifolds, etc., to control the production. These technologies are modular, structured, compact, and designed to be more responsive to changing conditions across the life of the field, cutting the total cost of ownership by up to 50%.

- August 2018:NOVcompleted a joint industry project to verify and demonstrate installationand performance aspects of a full-scale Seabox subsea water treatment module in a realistic subsea environment.The Seabox system enables water treatment to be done directly at the seabed and water to be pumped straight into the injection well. This will allow the operator to optimize waterflooding and improve oil recovery.

Flexible Pipes Market Leaders

-

National Oilwell Varco (NOV)

-

GE Oil & Gas Corporation

-

TechnipFMC PLC

-

The Prysmian Group

-

Shawcor Ltd

*Disclaimer: Major Players sorted in no particular order

Flexible Pipes Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Demand for Non-corrosive Pipes in Oil and Gas Industry

- 4.3.2 Technological Advances in Drilling Process

-

4.4 Market Restraints

- 4.4.1 Fluctuating Oil Prices

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 TECHNOLOGY SNAPSHOT

5. MARKET SEGMENTATION

-

5.1 By Raw Material

- 5.1.1 High-density Polyethylene

- 5.1.2 Polyamides

- 5.1.3 Polyvinylidene Fluoride

- 5.1.4 Other Raw Materials

-

5.2 By Application

- 5.2.1 Offshore

- 5.2.1.1 Deepwater

- 5.2.1.2 Ultra-deepwater

- 5.2.2 On shore

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Russia

- 5.3.2.3 Norway

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 National Oilwell Varco (NOV)

- 6.1.2 TechnipFMC PLC

- 6.1.3 The Prysmian Group

- 6.1.4 GE Oil & Gas Corporation

- 6.1.5 Shawcor Ltd

- 6.1.6 SoulForce (Pipelife Nederland B.V.)

- 6.1.7 Airborne Oil & Gas BV

- 6.1.8 Magma Global Ltd

- 6.1.9 ContiTech AG

- 6.1.10 Chevron Phillips Chemical Company LLC

- 6.1.11 Flexsteel Pipeline Technologies Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityFlexible Pipes Industry Segmentation

The flexible pipelines have been introduced in the areas of floating production, storage, and offloading (FPSO) ships and semisubmersibles. Moreover, the oil and gas, chemical, power generation, and water treatment industries are the key end-use industries of the flexible pipe market. Further, the development of technologies related to the exploration of reserves and oil production, which are currently in the initial stage, is expected to drive the growth of the flexible pipe market.

| By Raw Material | High-density Polyethylene | |

| Polyamides | ||

| Polyvinylidene Fluoride | ||

| Other Raw Materials | ||

| By Application | Offshore | Deepwater |

| Ultra-deepwater | ||

| By Application | On shore | |

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Russia | ||

| Norway | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Malaysia | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | Saudi Arabia |

| United Arab Emirates | ||

| Rest of Middle East & Africa |

Flexible Pipes Market Research FAQs

What is the current Flexible Pipe Market size?

The Flexible Pipe Market is projected to register a CAGR of 4.40% during the forecast period (2024-2029)

Who are the key players in Flexible Pipe Market?

National Oilwell Varco (NOV), GE Oil & Gas Corporation, TechnipFMC PLC, The Prysmian Group and Shawcor Ltd are the major companies operating in the Flexible Pipe Market.

Which is the fastest growing region in Flexible Pipe Market?

Middle East and Africa is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Flexible Pipe Market?

In 2024, the North America accounts for the largest market share in Flexible Pipe Market.

What years does this Flexible Pipe Market cover?

The report covers the Flexible Pipe Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Flexible Pipe Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Flexible Pipes Industry Report

Statistics for the 2023 Flexible Pipes market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Flexible Pipes analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.