Food Antioxidants Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.00 % |

| Fastest Growing Market | Europe |

| Largest Market | Asia Pacific |

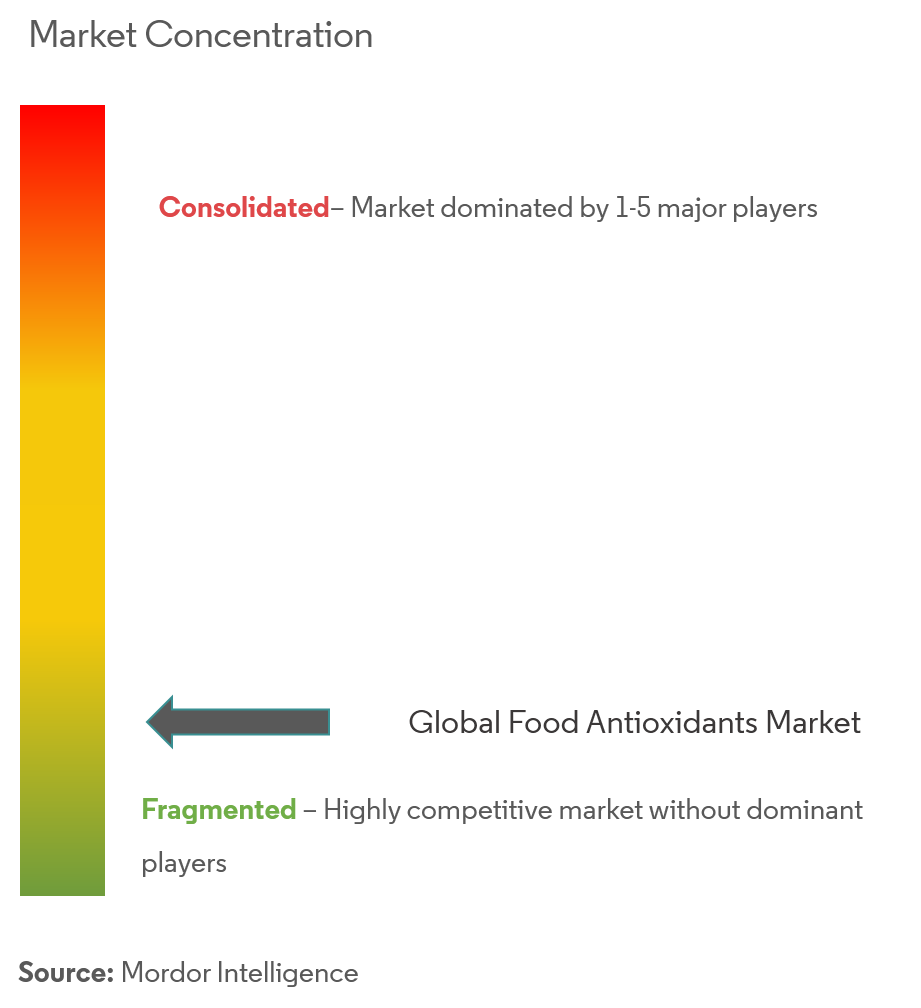

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Food Antioxidants Market Analysis

Global food antioxidants market is growing at a CAGR of 6.0% during the forecast period (2019-2024).

- The growth of the market is attributed to the increasing demand and consumption of processed food, where food antioxidants are highly used, and it also improves the shelf life of products such as bakery, confectionery, and snack products. The presence of antioxidants effectively inhibit oxidation and extend the shelf-life of food products. Additionally, research and development in this field and surveys conducted by the research institutes have fueled the growth of the segment. For instance, The American Heart Association recommends a diet high in fruits, vegetables, and other foods that contain antioxidants to help fight cardiovascular disease. Also, the US Agricultural Research Service suggested that a diet high in antioxidants, especially those found in blueberries, strawberries, and spinach, may also help fight the loss of brain function associated with aging.

- Synthetic antioxidants such as butylated hydroxyanisole (BHA), butylated hydroxytoluene (BHT), propyl gallate (PG) and tert-butylhydroquinone (TBHQ) dominate the market since decades, however, the shift of the consumers mindset towards health consciousness and clean-labeled foods with all-natural ingredients, natural antioxidants segment are on growing pace.

- However, food regulation approved by the regulatory authorities is limiting the use of synthetically derived antioxidants products. Approvals of tests are mandatory for the use of synthetic antioxidants in different food products.

Food Antioxidants Market Trends

This section covers the major market trends shaping the Food Antioxidants Market according to our research experts:

Increased Consumption of Bakery & Confectionery Products

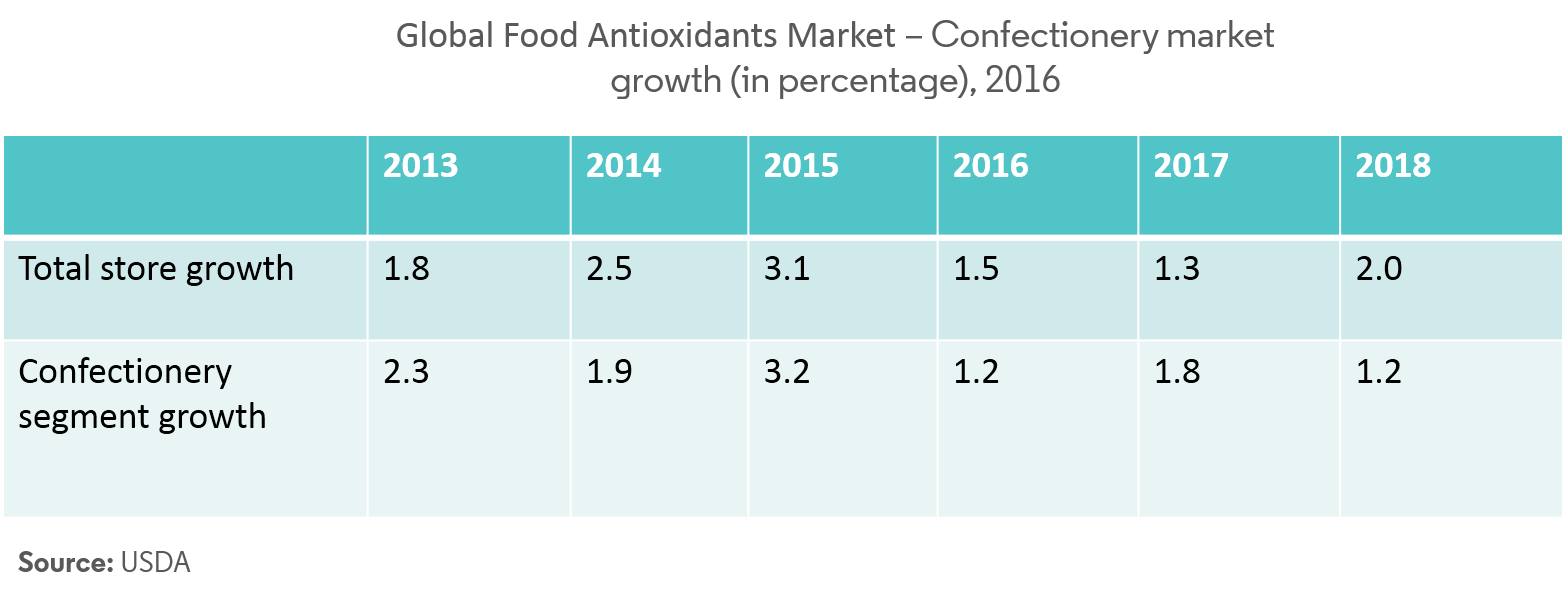

The demand for the use of antioxidants is increasing in recent years, owing to the effect of antioxidants in bakery products that have been reviewed and found to be effective in enhancing shelf life. Natural antioxidants are found to be effective for improving the shelf life of bakery products. Even though baking processes lower the antioxidative activity, but techniques such as encapsulation of antioxidants can retain their activity.

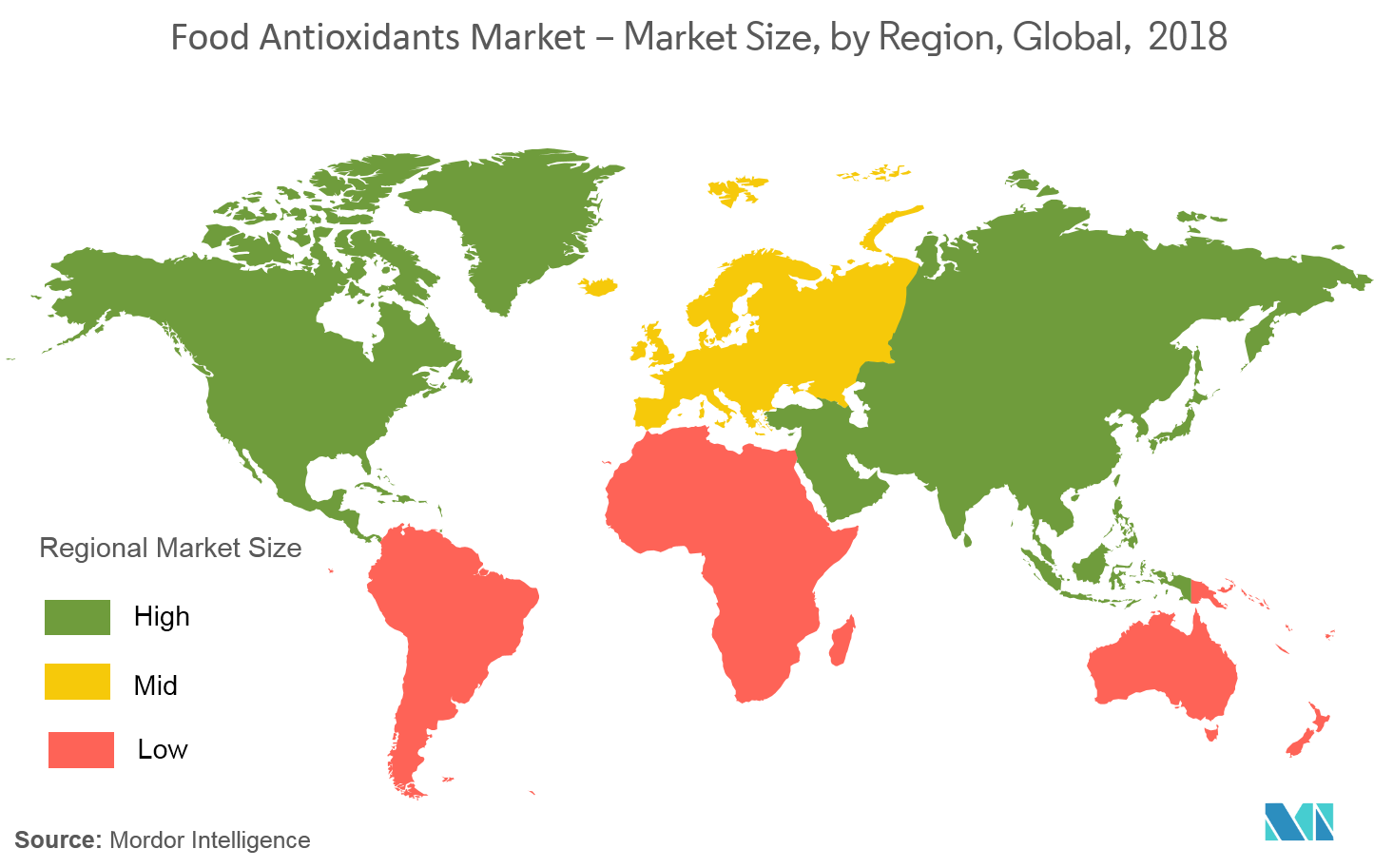

North America & Europe are the fastest growing region

North America & Europe is expected to grow the fastest growing region due to easy availability of food and heavy food subsidization by the government, especially in United States. In Asia-Pacific, the major share of the market is held by the Australia, China, India, and Singapore. Product development by the companies of these region trigger the growth of the market. For instance, NuttZo launched two new vegans Bold BiteZ flavor, packed with antioxidants.

Food Antioxidants Industry Overview

The global market for food antioxidants is fragmented, owing to the presence of large regional and domestic players in different countries. Emphasis is given on the merger, expansion, acquisition, and partnership of the companies along with new product development as strategic approaches adopted by the leading companies to boost their brand presence among consumers. For instance, events of new packaging technologies including increased use of MAP and gases as antioxidants. Also, nanotechnology is expected to play a significant role in the betterment of delivery systems for sensitive oils, such as omega-3 fatty acids in the food antioxidants industry. Similarly, BASF SE will be investing for its Irganox 1010 antioxidant by 40% worldwide through expansion projects at its sites in Jurong, Singapore, and Kaisten, Switzerland, scheduled for completion by 2021.

Food Antioxidants Market Leaders

-

Cargill Incorporated

-

Archer Daniels Midland Company

-

BASF SE

-

DuPont

-

Advanced Organic Materials, S.A.

*Disclaimer: Major Players sorted in no particular order

Food Antioxidants Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Natural

- 5.1.2 Synthetic

-

5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Dry

-

5.3 By Application

- 5.3.1 Processed Foods

- 5.3.1.1 Bakery & Confectionery

- 5.3.1.2 Snack products

- 5.3.1.3 Meat products

- 5.3.2 Beverages

- 5.3.3 Fats & Oils

- 5.3.4 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Cargill Incorporated

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 BASF SE

- 6.4.4 DuPont

- 6.4.5 Advanced Organic Materials, S.A.

- 6.4.6 Eastman Chemical Company

- 6.4.7 Kalsec Inc.

- 6.4.8 DSM

- 6.4.9 International Flavors & Fragrances Inc. IFF

- 6.4.10 Kemin Industries, Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityFood Antioxidants Industry Segmentation

The global food antioxidants market is segmented by types which include natural and synthetic. Based on form, the market is segmented into liquid and dry form. Based on the application, the market is segmented into processed food, beverages, fats & oils, and others. The report further analyses the food antioxidants market based on geography (which includes North America, Europe, Asia-Pacific, South America and the Middle East, and Africa).

| By Type | Natural | |

| Synthetic | ||

| By Form | Liquid | |

| Dry | ||

| By Application | Processed Foods | Bakery & Confectionery |

| Snack products | ||

| Meat products | ||

| By Application | Beverages | |

| Fats & Oils | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| United Arab Emirates | ||

| Rest of Middle East and Africa |

Food Antioxidants Market Research FAQs

What is the current Food Antioxidants Market size?

The Food Antioxidants Market is projected to register a CAGR of 6% during the forecast period (2024-2029)

Who are the key players in Food Antioxidants Market?

Cargill Incorporated, Archer Daniels Midland Company, BASF SE, DuPont and Advanced Organic Materials, S.A. are the major companies operating in the Food Antioxidants Market.

Which is the fastest growing region in Food Antioxidants Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Food Antioxidants Market?

In 2024, the Asia Pacific accounts for the largest market share in Food Antioxidants Market.

What years does this Food Antioxidants Market cover?

The report covers the Food Antioxidants Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Food Antioxidants Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Food Antioxidants Industry Report

The global food antioxidants market is segmented by type, form, application, and geography. Industry reports indicate that the market share and market size are influenced by these segments. The industry analysis highlights the market trends and market growth, with a market forecast providing an industry outlook to the future.

The market analysis reveals that processed food, beverages, fats & oils, and other applications drive the industry. Industry research and market research show that both natural and synthetic antioxidants are significant in the market segmentation.

Market data from the report PDF suggests that the market leaders are focusing on innovation and expansion. The market review and market predictions suggest a positive growth rate, reinforcing the market value and industry size.

Industry statistics and market overview indicate a strong market outlook, supported by industry information and industry trends. The industry sales are expected to rise, as seen in the report example provided.

Overall, the market forecast and market growth are promising, with research companies continuously analyzing the industry to provide updated industry analysis and industry research. The market segmentation and market predictions highlight the importance of food antioxidants in various applications, ensuring a robust market value and market outlook for the future.