Food Grade Industrial Gasses Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

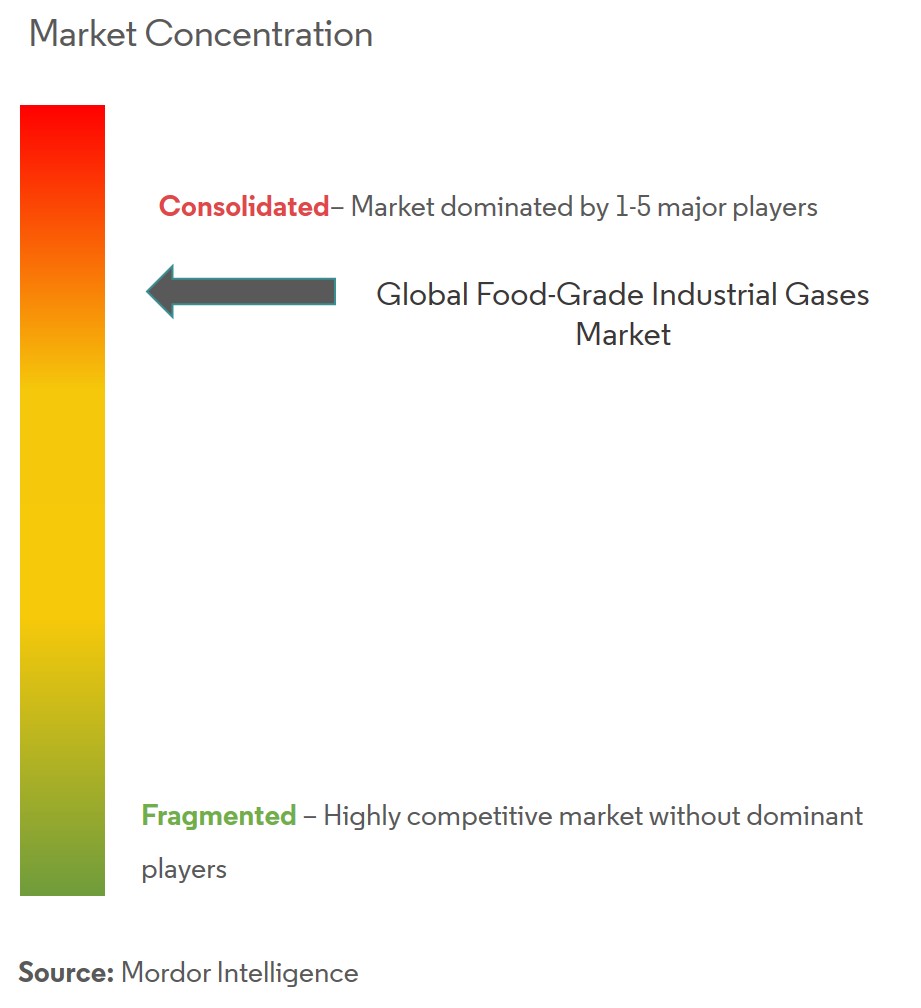

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Food Grade Industrial Gasses Market Analysis

The global food-grade industrial gases market is estimated to register a CAGR of 6.5% during the forecast period (2020-2025).

- The increasing demand for fresh products and packaged food has led to the use of industrial gases in the food and beverage sector. The increasing working hours and changing lifestyles have affected the growth of convenience or packaged food. This has resulted in the growth of packing technologies and frozen foods. Nitrogen, carbon dioxide, and oxygen are the major industrial gases that are used in various food applications, such as freezing, packaging, chilling, and grinding.

- Food-grade industrial gases are classified as processing aids or additives. Nitrogen is an innert gas and is extensively used to delay oxidative and hydrolytic rancidity in fat-rich foods. Carbon dioxide is used in cooling, freezing, modified atmosphere packaging, and carbonization. Higher concentrations of carbon dioxide (above 5%) effectively act as antimicrobial agents, thereby, delaying food spoilage.

- The companies are increasingly investing in packaging technologies that are free from synthetic preservatives, by replacing them with food-grade industrial gases. For example, Deccan Field Agro Industries from India utilized active modified atmosphere packaging (AMAP), in order to extend the shelf life of papaya by over four weeks and to export the fruit to Dubai.

Food Grade Industrial Gasses Market Trends

This section covers the major market trends shaping the Food Grade Industrial Gasses Market according to our research experts:

Increasing Application in Modified Air Packaging (MAP)

The demand for packaged food products is increasing at a faster pace, resulting in the food industries adopting atmospheric modified packaging, because it not only helps in increasing the shelf life of the products, but also maintains their organoleptic properties. As MAP is used to extend the shelf life of various food products, such as cheese, pasta, meat products, and others, without the use of chemicals, it being used in packaging fresh as well as organic food products. The three main gases used in MAP include oxygen, carbon dioxide, and nitrogen, which, in turn, accelerate the growth in the use of industrial food gases across the world. As MAP uses preservatives to retain the freshness of packaged food, primarily organic and fresh fruits and vegetables, meat products, and others, the doses used are in alignment with the ongoing trend of clean-labeled products across the world.

The North American Region Registered a Significant Market Share

The rising demand from various end-use industries, such as processed foods, bakery and confectionery, and breakfast cereals, in the region, are some of the major factors that are expected to boost the North American food-grade industrial gasses market, during the forecast period. Millennials, comprising a major demand group in the region, are largely focusing on consuming food products that are convenient and can be consumed with minimal preparation, owing to their busy work schedules. This has led to an increased demand for packaged food products, as they can be easily reconstituted. There is a rising trend of healthy snacks in the United States, which offers a great opportunity for industrial food-grade gases, in terms of frozen and chilled, packed snack food products. According to the government of Alberto, there has been a significant increase in the demand for ready-to-eat breakfast cereals, among the Canadian consumers, which is yet another factor that is accelerating the market for various food-grade industrial gases. Moreover, the region has the highest per capita consumption of meat products across the world. Thus, the usage of industrial gases in the meat industry is fueling the growth of the market.

Food Grade Industrial Gasses Industry Overview

The global food-grade industrial gases market is a highly competitive one, with major shares being held by the active players, such as Linde PLC, Air Liquide SA, and others. Mergers and acquisitions and product innovations are the most preferred strategies by the companies, to strengthen their market dominance. These strategies help the companies expand their presence across the global market. For instance, Linde PLC acquired Praxair, which is one of America's largest industrial gas companies, to capitalize itself within the American market. The key players are also focusing on expanding their network of innovation centers, enabling them to collaborate with the customers on new product developments and reformulations, and make investments.

Food Grade Industrial Gasses Market Leaders

-

Linde plc

-

Air Products & Chemicals, Inc.

-

Air Liquide S.A.

-

Messer Group

-

Wesfarmers Limited

*Disclaimer: Major Players sorted in no particular order

Food Grade Industrial Gasses Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Carbon Dioxide

- 5.1.2 Nitrogen

- 5.1.3 Oxygen

- 5.1.4 Other Types

-

5.2 By End-use Industry

- 5.2.1 Beverages

- 5.2.2 Meat, Poultry, and Seafood Products

- 5.2.3 Dairy and Frozen Products

- 5.2.4 Bakery and Confectionery Products

- 5.2.5 Fruits and Vegetables

- 5.2.6 Other End-use Industries

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Strategies Adopted by Players

- 6.3 Most Active Companies

-

6.4 Company Profiles

- 6.4.1 Linde plc

- 6.4.2 Air Products & Chemicals Inc.

- 6.4.3 Air Liquide SA

- 6.4.4 Messer Group

- 6.4.5 Wesfarmers Limited

- 6.4.6 Mitsubishi Chemical Holdings Corporation (Taiyo Nippon Sanso)

- 6.4.7 Massy Group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityFood Grade Industrial Gasses Industry Segmentation

The major industrial gases being used in the food and beverage industry include carbon dioxide, nitrogen, oxygen, and other types. Food-grade industrial gases play an important role in different products, such as beverages, meat, poultry, and seafood products, dairy and frozen products, bakery and confectionery products, fruits and vegetables, and others. The market report on industrial food-grade gases provides an outlook on the potential markets in each region.

Food Grade Industrial Gasses Market Research FAQs

What is the current Food-grade Industrial Gases Market size?

The Food-grade Industrial Gases Market is projected to register a CAGR of 6.5% during the forecast period (2024-2029)

Who are the key players in Food-grade Industrial Gases Market?

Linde plc, Air Products & Chemicals, Inc., Air Liquide S.A., Messer Group and Wesfarmers Limited are the major companies operating in the Food-grade Industrial Gases Market.

Which is the fastest growing region in Food-grade Industrial Gases Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Food-grade Industrial Gases Market?

In 2024, the North America accounts for the largest market share in Food-grade Industrial Gases Market.

What years does this Food-grade Industrial Gases Market cover?

The report covers the Food-grade Industrial Gases Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Food-grade Industrial Gases Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Food-grade Industrial Gases Industry Report

Statistics for the 2024 Food-grade Industrial Gases market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Food-grade Industrial Gases analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.