Food Texturizers Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.10 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

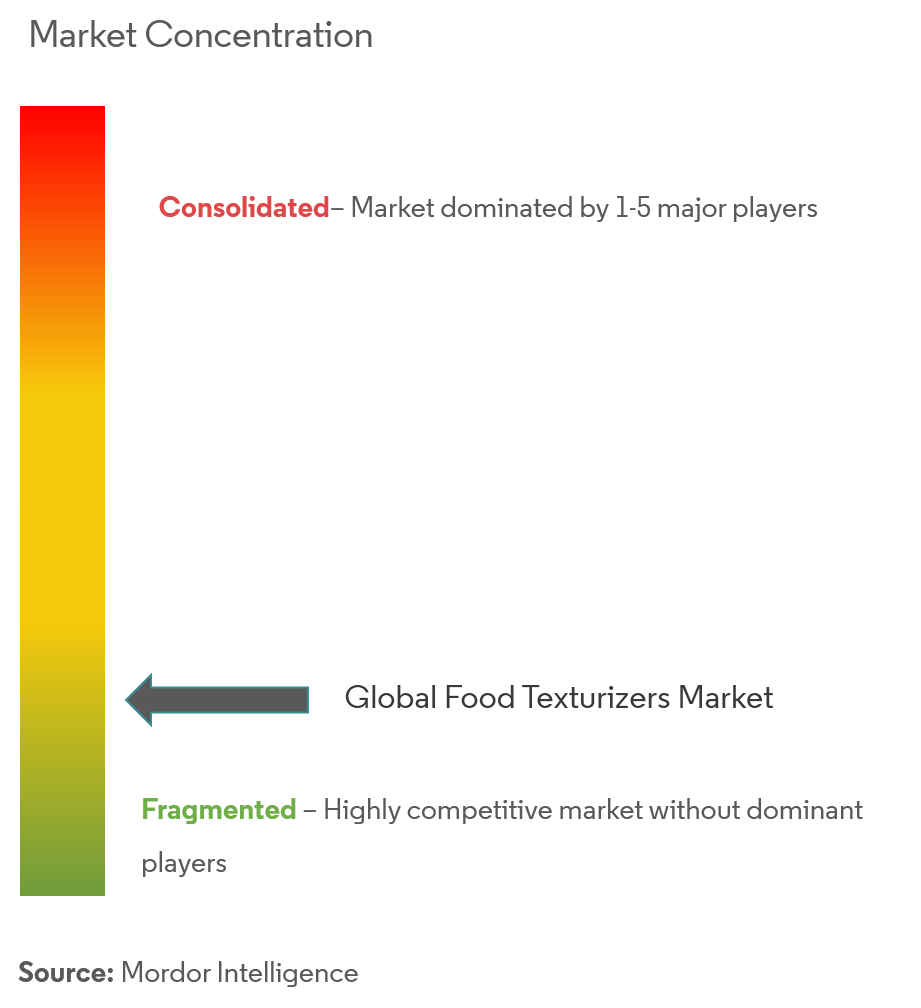

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Food Texturizers Market Analysis

The global food texturizers market is projected to register a CAGR of 5.1% over the next five years.

- Globally, most food and beverage companies are utilizing food texturizing agents as food stabilizers and emulsifiers, owing to their qualities of restricting microorganism growth, enhancing shelf-life, and above all, a distinct mouth feel of the food products.

- The improving palatability and taste appeal enhancement are reflecting the rapid growth of food texturizers in the food and beverage industry. The growth of the food texturizers market is largely driven by global food and beverage growth, which will continue in the future as well.

- Due to technological advancements in the food processing sector and increased consumer demand for ingredients that can enhance the basic characteristics of food products, the global market for food texturizing agents is anticipated to expand at a substantial rate over the forecasted years.

- The use of food texturizing agents by food manufacturers to extend food products' shelf lives, prevent microbial growth inside of them, and improve the flavor is anticipated to have a substantial impact on the market for food texturizing agents. To stay competitive, major players in the market for food texturizing agents are emphasizing the introduction of improved and novel products as well as increasing their involvement in merger and acquisition operations.

Food Texturizers Market Trends

Growing Demand for Low Calorie Food Products

- Fast-evolving consumer lifestyles have led to many innovations in the food and beverage industry. Consumers look for alternative food products and focus on the ingredient content of the product. Moreover, increasing obesity and cardiovascular disease cases over the last few years have triggered the demand for low-fat content food. Food texturizing agents have the ability to replace calorie-dense fats and oils, thus allowing the formulation of more healthy food. Inproved formulations of food products have also utilized food texturizing agents as "fat mimetics."

- For instance, cellulose derivatives such as microcrystalline cellulose, a type of texturizing agent, are used to prepare low-fat ice creams and dressings. Additionally, in 2022, the National Heart, Lung, and Blood Institute articles stated that over time, when people consume more calories than they burn, they may become overweight or obese.

- When the energy in (calories) does not equal the energy out, this is often referred to as an energy imbalance (calories the body uses for things such as breathing, digesting food, and being physically active). Therefore, demand for naturally derived ingredients in products is rising as the prevalence of diabetes, obesity, high blood pressure, and other chronic conditions rises.

- According to the 2021 Global Health Monitor study, Mexico had 52% of obese people, while 13% of the population in the world was diabetic. Similarly, according to the Health Survey for England report from 2021.25% of men and 26% of women in England were obese. Therefore, the need for low-calorie food additives has significantly high potential in the market globally. Also, during the forecasted period, the market is anticipated to grow as consumers' food preferences will continue to be dominated by health and nutrition considerations.

North America Dominates the Market

- North America holds the largest market share in the food texture market. It is poised to grow at a steady CAGR over the forecast period. Owing to the increase in innovations in food solutions, demand for ingredients providing textures to food has increased. Texturants while primarily functioning as texturing agents, provide multiple benefits in food processing and improve the appeal of food and palatability. Also, increasing demand for processed foods in bakery, confectionery, convenience foods, and dairy industries drive the food texture market globally.

- Rising demand from various end-user industries in the country, such as processed food, nutraceutical, and consumer goods, is a major factor that is expected to boost the United States food texture ingredients market over the forecast period. In addition, the growing demand for retail foods due to the increasing retail chains in the country may drive the market's growth in the future.

- For instance, in April 2021, according to an Institute of Food Technologists article, the dynamics of the food texturizer industry in the United States have been significantly impacted by consumers' growing preference for organic, vegan, and clean-label food ingredients. Key players are also encouraged by this factor. The article also lists an ingredient's purpose on the label, such as "citric acid for colour retention," "sodium sorbate for shelf stability," or "guar gum for texture," is another approach to create a clearer or healthier label.

- Therefore, factors such as health conciousness, increased consumption of convenience/processed foods and inclination towards clean-label are majorly driving the food texurizers market in this region and encouraging manufacturers to innovate.

Food Texturizers Industry Overview

The market players offering innovative and customized food texturizers are rapidly increasing their market share. This market needs an application-specific approach and composition, which are key factors for further market growth. Some of the major key players in the food texturizers market include Archer Daniels Midland Co., Cargill, Incorporated., Estelle Chemicals Pvt. Ltd., Ingredion Inc., and Tate & Lyle Plc, among others.

Food Texturizers Market Leaders

-

Cargill, Incorporated.

-

DuPont

-

Fiberstar Inc.

-

Ingredion Inc.

-

Kerry Inc.

*Disclaimer: Major Players sorted in no particular order

Food Texturizers Market News

- April 2022: Cargill Salt announced it will invest USD 68 billion in expanding ST. Clair Plant. Investments being made by Cargill will enhance the plant's production capacity through increased automation, new technology, and efficiency improvements. The multi-year improvement project also includes constructing a new 50,000-square-foot evaporation facility to house a state-of-the-art dry processing line expected to reduce waste and increase capacity by up to 40%.

- October 2021: Cargill Incorporated launched SimPure rice flour, a clean-label bulking agent with a taste, texture, and functionality similar to maltodextrin. The company officially unveiled the new ingredient at the SupplySide West trade show. The primary strategy behind this innovation was to expand the company's product portfolio.

Food Texturizers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Cellulose Derivatives

- 5.1.2 Gums

- 5.1.3 Pectins

- 5.1.4 Gelatins

- 5.1.5 Starch

- 5.1.6 Inulin

- 5.1.7 Dextrins

- 5.1.8 Other Types

-

5.2 Application

- 5.2.1 Dairy Products & Ice Creams

- 5.2.2 Confectionery

- 5.2.3 Jams

- 5.2.4 Layers

- 5.2.5 Fillings

- 5.2.6 Bakery

- 5.2.7 Meat Products

- 5.2.8 Ready Meals

- 5.2.9 Sauces

- 5.2.10 Beverages

- 5.2.11 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Co.

- 6.3.2 Cargill, Incorporated.

- 6.3.3 DuPont

- 6.3.4 Estelle Chemicals Pvt. Ltd.

- 6.3.5 Ingredion Inc.

- 6.3.6 Kerry Inc.

- 6.3.7 Tate & Lyle Plc

- 6.3.8 Royal DSM N.V.

- 6.3.9 Palsgaard A/S

- 6.3.10 Fiberstar Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. ABOUT US

** Subject To AvailablityFood Texturizers Industry Segmentation

Food texturizing agents are food additives that are incorporated into food products to enhance both their texture and stability. Food texturizing additives can be derived from a range of sources, including seaweeds, animals, and plants.

The global food texturizer market is segmented by type, application, and geography. Based on type, the market is segmented into Cellulose derivatives, gums, pectins, gelatins, starch, inulin, dextrins, and other types. Based on application, the market is segmented into dairy products & ice creams, confectionery, jams, layers, fillings, bakery, meat products, ready meals, sauces, beverages, and others. Based on geography, the study provides an analysis of the food texturizers market in emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

For each segment, the market sizing and forecast have been done based on value (USD million).

| Type | Cellulose Derivatives | |

| Gums | ||

| Pectins | ||

| Gelatins | ||

| Starch | ||

| Inulin | ||

| Dextrins | ||

| Other Types | ||

| Application | Dairy Products & Ice Creams | |

| Confectionery | ||

| Jams | ||

| Layers | ||

| Fillings | ||

| Bakery | ||

| Meat Products | ||

| Ready Meals | ||

| Sauces | ||

| Beverages | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Russia | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia Pacific | India |

| China | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Food Texturizers Market Research FAQs

What is the current Food Texturizers Market size?

The Food Texturizers Market is projected to register a CAGR of 5.10% during the forecast period (2024-2029)

Who are the key players in Food Texturizers Market?

Cargill, Incorporated., DuPont, Fiberstar Inc., Ingredion Inc. and Kerry Inc. are the major companies operating in the Food Texturizers Market.

Which is the fastest growing region in Food Texturizers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Food Texturizers Market?

In 2024, the North America accounts for the largest market share in Food Texturizers Market.

What years does this Food Texturizers Market cover?

The report covers the Food Texturizers Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Food Texturizers Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Food Texturants Industry Report

Statistics for the 2024 Food Texturants market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Food Texturants analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.