France Food Sweetener Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 1.53 % |

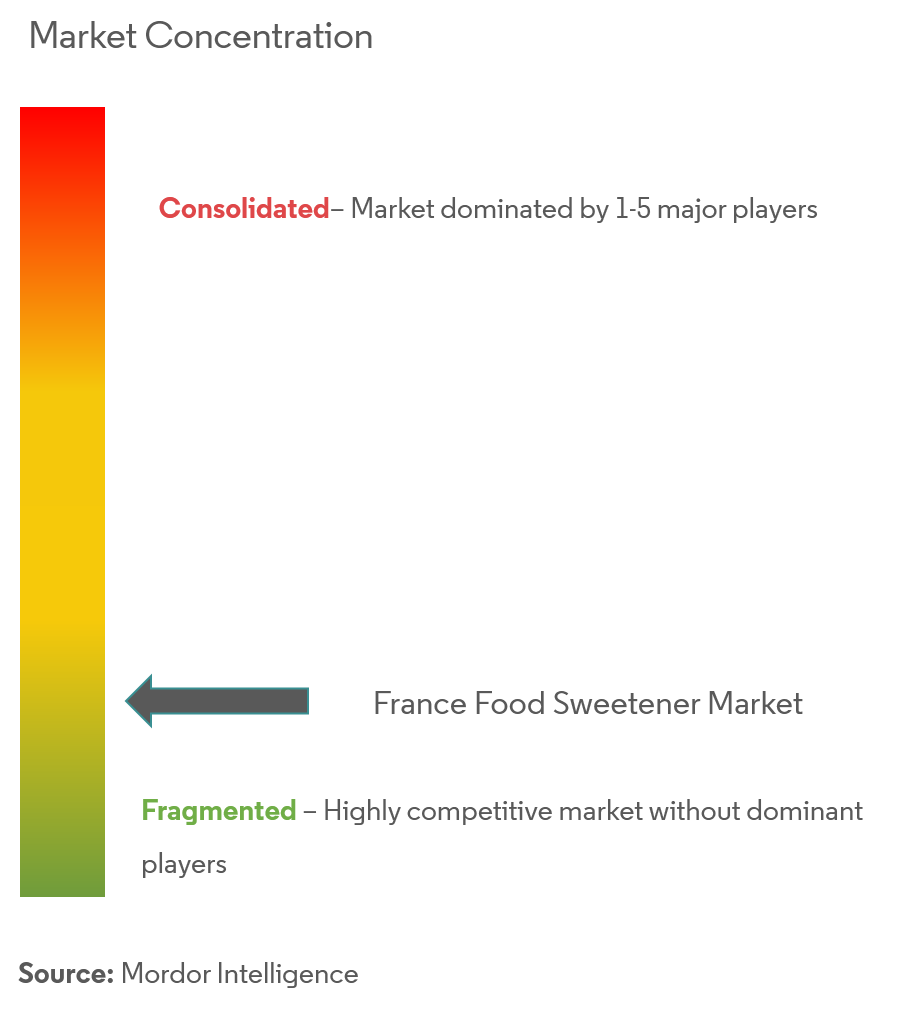

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

France Food Sweetener Market Analysis

France Food Sweetener Market is growing by registering a CAGR of 1.53% during the forecast period.

- France is among the largest markets for food sweetener in Europe, owing to the high alcoholic beverage consumption. The approval for use of stevia in food products by EFSA (European Food Safety Authority) augmented the French food sweeteners market’s growth.

- Non-calorie sweeteners primarily contain synthetic ingredients, and are extensively used in soft drinks and other food segments.

- In France, the increasing demand for natural ingredients, especially from the food industry, is expected to aid the growth of the market studied. The rising health problems, such as obesity and diabetes, are driving the adoption of healthier lifestyles, including alternatives to sugar.

France Food Sweetener Market Trends

This section covers the major market trends shaping the France Food Sweetener Market according to our research experts:

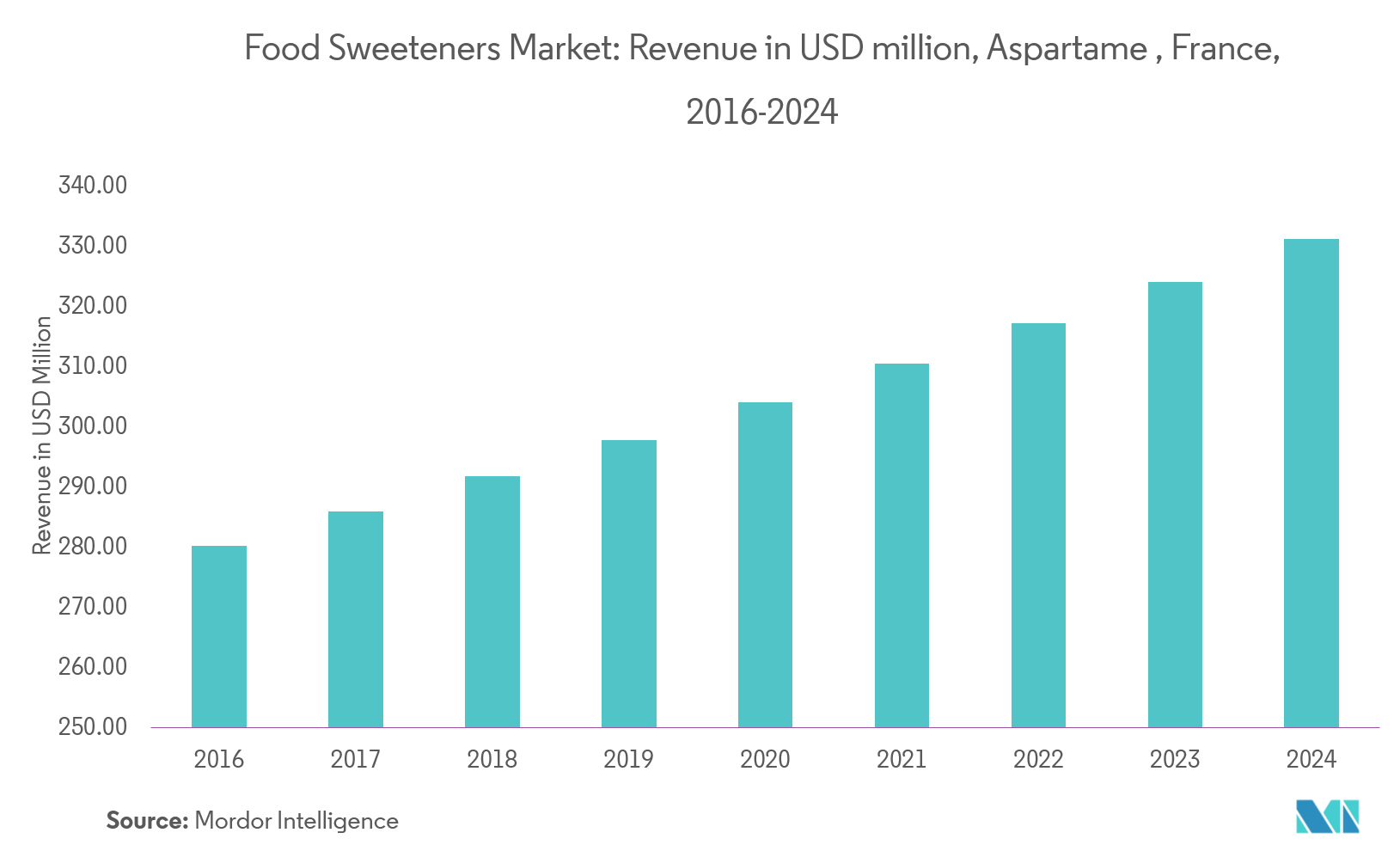

Aspartame Is A Major Sweetener In France

The growing use of blends of aspartame with other sweeteners in Europe and elsewhere has allowed customers to reduce sweetening costs without any appreciable loss of quality. Most diet soft drink bottlers, certainly those in the EU, Canada, and increasingly those in the United States have now switched from 100% aspartame to blends of aspartame and acesulfame K for their second ranking brands, and some top line brands. In the future, we can expect to see increased quantities of aspartame destined for the confectionery and dairy industries, and we may even see lower priced aspartame making gains from saccharin in certain pharmaceutical applications.

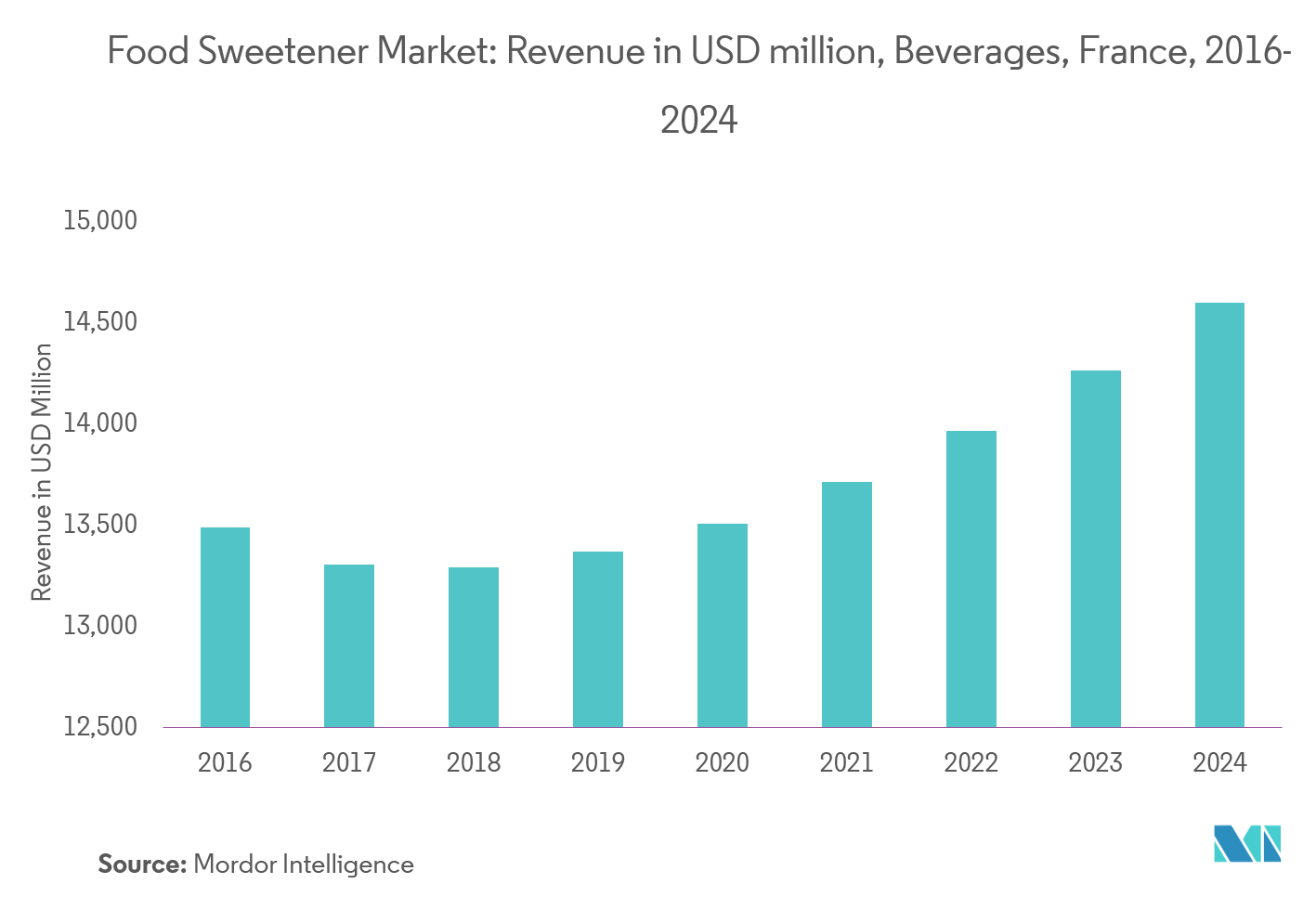

Beverage Industry Is The Major Area Of Application In The Country

The intake of beverages has changed dramatically over the past few decades, coinciding with an increased prevalence of obesity. Intakes of soft drinks, colas, other sweetened carbonated beverages, and fruit drinks with added sugar have increased dramatically, especially among youth, whereas the intake of milk has declined. Detrimental effect linked with consumption of excess sugar or artificial sweeteners, have led consumers to shift interests toward functional beverages. Incorporating botanical herbs, along with therapeutic properties has laid down a better roadmap for manufacturers to target the “desire for natural products” among consumers.

France Food Sweetener Industry Overview

The France Food Sweetener Market is a fragmented market with the presence of various players. Major players are bringing innovatoions in their products and are expanding their product portfolio to maintain the position in the market. Players are also focusing on natural and clean label products since consumers are becoming more health conscious.

France Food Sweetener Market Leaders

-

Cargill

-

Tate & Lyle

-

DuPont

-

Ingredion

*Disclaimer: Major Players sorted in no particular order

France Food Sweetener Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Key Deliverables of the Study

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Drivers

- 4.2 Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Sucrose (Common Sugar)

- 5.1.2 Starch Sweeteners and Sugar Alcohols

- 5.1.2.1 Dextrose

- 5.1.2.2 High Fructose Corn Syrup (HFCS)

- 5.1.2.3 Maltodextrin

- 5.1.2.4 Sorbitol

- 5.1.2.5 Xylitol

- 5.1.2.6 Others

- 5.1.3 High Intensity Sweeteners (HIS)

- 5.1.3.1 Sucralose

- 5.1.3.2 Aspartame

- 5.1.3.3 Saccharin

- 5.1.3.4 Cyclamate

- 5.1.3.5 Ace-K

- 5.1.3.6 Neotame

- 5.1.3.7 Stevia

- 5.1.3.8 Others

-

5.2 By Application

- 5.2.1 Dairy

- 5.2.2 Bakery

- 5.2.3 Soups, Sauces and Dressings

- 5.2.4 Confectionery

- 5.2.5 Beverages

- 5.2.6 Others

6. Competitive Landscape

- 6.1 Most Adopted Strategies

- 6.2 Most Active Companies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Tate & Lyle PLC

- 6.4.2 Cargill Incorporated

- 6.4.3 DuPont

- 6.4.4 Ingredion Incorporated

- 6.4.5 PureCircle Limited

- 6.4.6 NutraSweet Company

- 6.4.7 GLG Life Tech Corporation

- 6.4.8 Tereos S.A.

- *List Not Exhaustive

7. MARKET TRENDS AND OPPORTUNITIES

** Subject To AvailablityFrance Food Sweetener Industry Segmentation

France Food Sweetener Market is segmented by Type into Sucrose, Starch Sweeteners and Sugar Alcohols and High Intensity Sweeteners. The market is segmented by Application into Dairy, Bakery, Beverages, Confectionery, Soups, Sauces and Dressings and Others.

| By Product Type | Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Xylitol | ||

| Others | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Saccharin | ||

| Cyclamate | ||

| Ace-K | ||

| Neotame | ||

| Stevia | ||

| Others | ||

| By Application | Dairy | |

| Bakery | ||

| Soups, Sauces and Dressings | ||

| Confectionery | ||

| Beverages | ||

| Others |

France Food Sweetener Market Research FAQs

What is the current France Food Sweetener Market size?

The France Food Sweetener Market is projected to register a CAGR of 1.53% during the forecast period (2024-2029)

Who are the key players in France Food Sweetener Market?

Cargill, Tate & Lyle, DuPont and Ingredion are the major companies operating in the France Food Sweetener Market.

What years does this France Food Sweetener Market cover?

The report covers the France Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the France Food Sweetener Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

France Food Sweetener Industry Report

Statistics for the 2024 France Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. France Food Sweetener analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.