France Property and Casualty Insurance Industry Overview

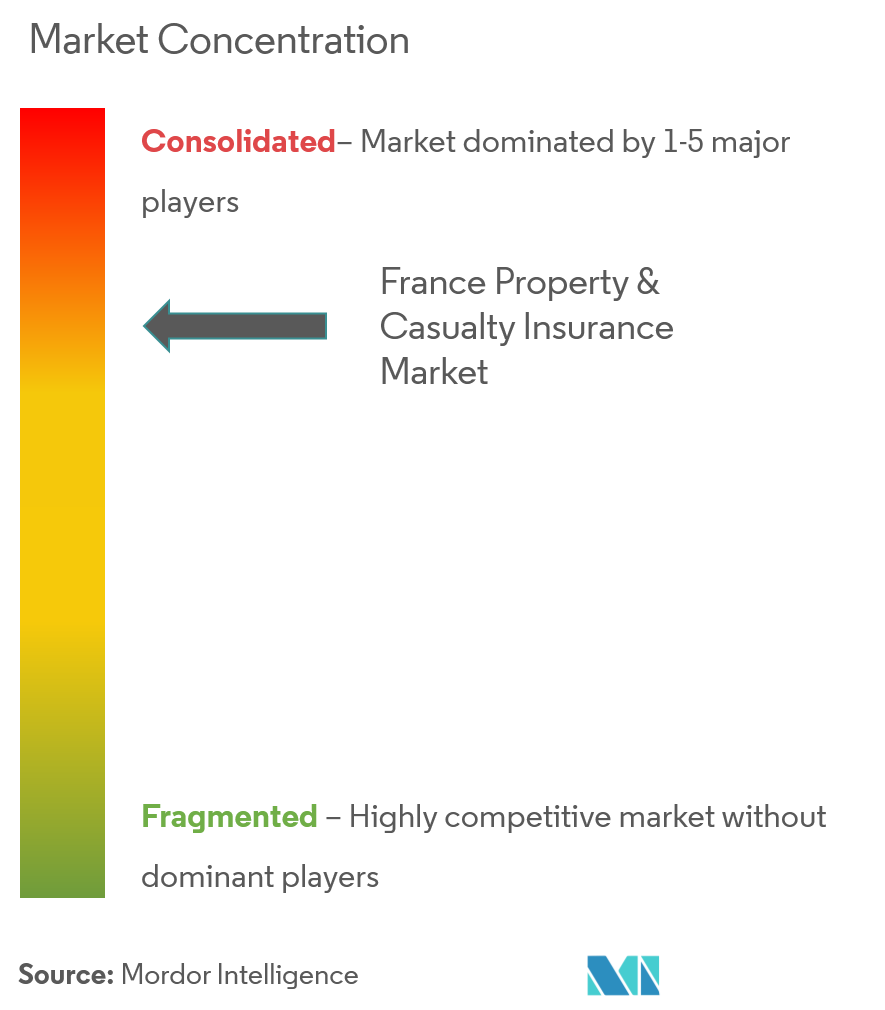

The France Property & Casualty Insurance Market is very competitive and growing Property-nationwide, covering the top portion of the Non-Life Insurance Segment. All property and casualty insurance companies are expected to change their systems and processes so that they can develop and accurately price new products and insurance packages.

Property and casualty insurance companies are developing new attractive, customizable coverage and performance or usage-based insurance products for this. Also, vendors must test large volumes of user data to offer competitive pricing to their end users. For better competition, the insurance companies in France are adapting new technologies for property and casualty Insurance which would offer the potential to create innovative services for consumers.

The key players in France Property & Casualty Insurance Market are Aviva, Allianz, AXA, Groupama, and many more, expected to lead the France Property & Casualty Insurance Market throughout the forecast period.

France Property and Casualty Insurance Market Leaders

-

Aviva PLC

-

Axa

-

Allianz

-

Groupama

-

Covea Insurance

- *Disclaimer: Major Players sorted in no particular order