Frozen Food Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.18 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Frozen Food Packaging Market Analysis

The frozen food packaging market was valued at USD 41.53 million in 2020 and is expected to reach a value of USD 56.2 million by 2026, at a CAGR of 5.18% over the forecast period (2021 - 2026). Recently, according to consumers convenience, frozen food packaging provides features like the packings are lightweight, unbreakable, and resealable, lower fossil fuel usage, and is also capable of greenhouse gas emissions, water usage for creating an eco-friendly environment.

- Majority consumers of frozen food products prefer large retail stores, supermarkets, and hypermarkets. Organized retail stores are a significant part of large retail chains, that have a huge presence in the global market. The growth in the organized retail chain is translating directly into the demand for food packaging solutions in the frozen food industry.

- For instance, Walmart is expected to host more than 11,000 stores, worldwide, and Amazon Go. Amazon is expected to open more than 3,000 cashier-less stores by 2021. Hence, the frozen food packaging market is expected to flourish.

- Consumers are also switching to frozen food to reduce the amount of waste they create, as a study in the British Food Journal showed that families reduced their food waste by over 47% by switching to frozen food.

- As packaging for frozen specialties like meat, poultry, and seafood are the fastest gains among major frozen food applications. Many large food packaging companies in North America and Asia-Pacific are investing hugely for creative and decorative packaging.

- However, the government packaging laws regulations in most of the developing and developed countries stand as a challenging factor for the market.

Frozen Food Packaging Market Trends

This section covers the major market trends shaping the Frozen Food Packaging Market according to our research experts:

Bags Packaging Type to Account for a Major Share in the Market

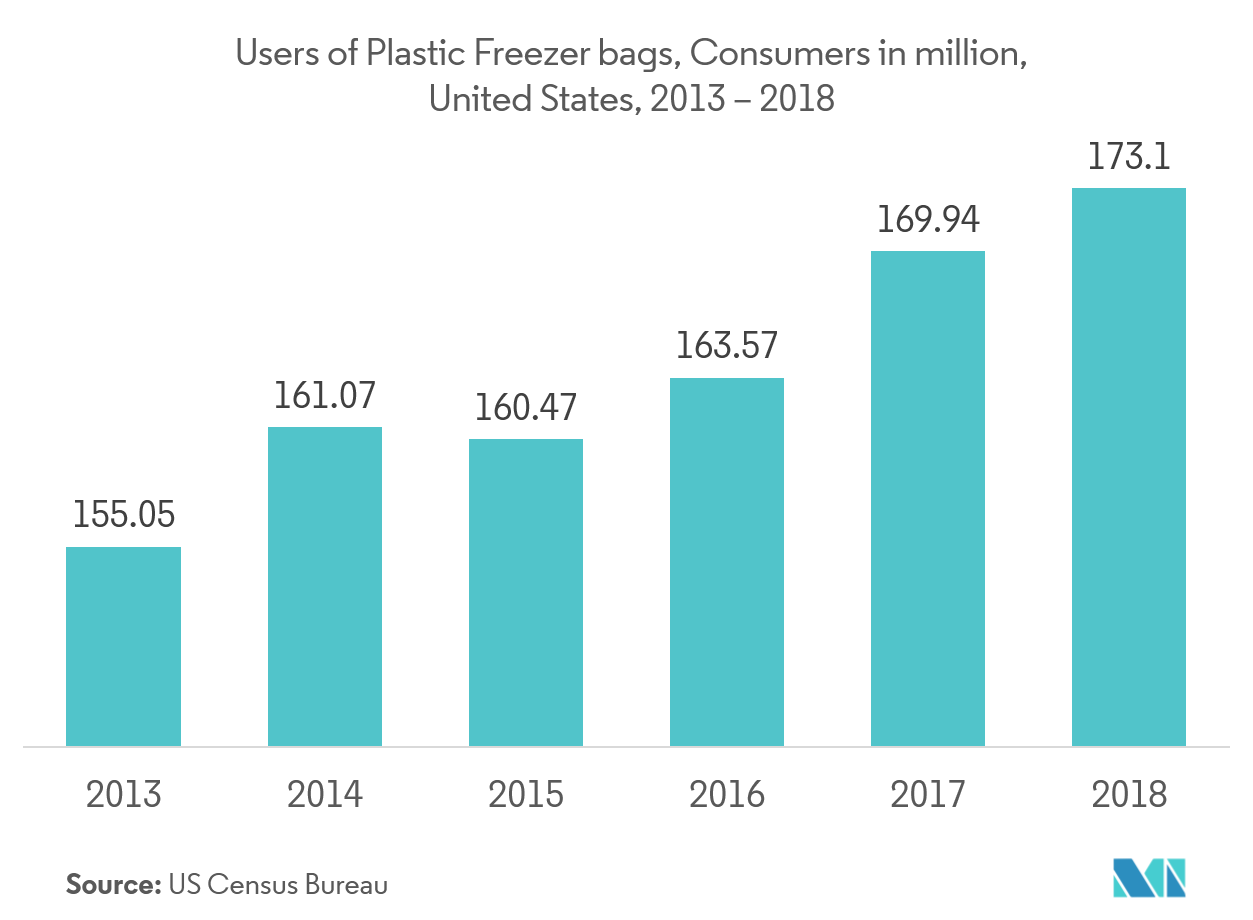

- Various factors, such as changing lifestyle, increasing disposable income, and rapid urbanization in developing countries, especially the growing middle-income population, are increasing the demand for bags for frozen food. In the United States, the growing adoption of freezer bag has increased the growth of the frozen food packaging market.

- Plastic bags are available in different sizes and shapes. It offers several benefits, such as the ability to tolerate temperatures, and technical advantages, which is further fuelling the demand for bags in frozen food packaging.

- Ziploc bag is an important example of bag packaging. This type of bag is available in various sizes and can be used for storing meat and dairy food. For instance, dairy products can be frozen in freezer bags, as these are ideal for short-term usage and saving space. Another major trend being followed is customizing the product based on client requirements.

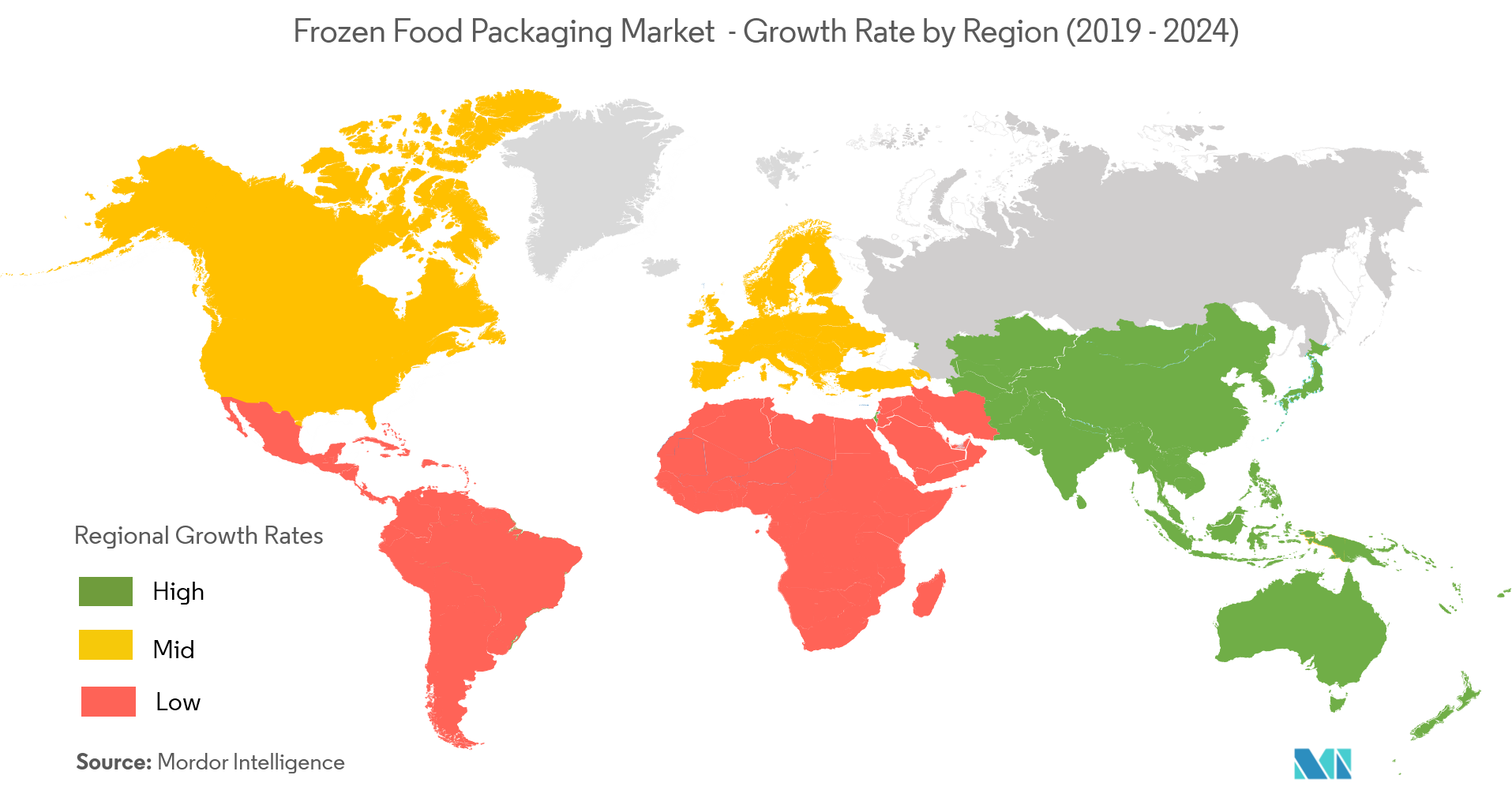

Asia-Pacific to Witness the Fastest CAGR

- In the Asia-Pacific region, the demand for food products is expected to grow with increasing population, and quality products are expected to be on demand, with urbanization and expanding awareness about foodborne illnesses, food wastage, and food spoilage.

- China has the largest share in the Asia-Pacific frozen food packaging market. Large population and urbanization in this country have led to an increased demand for frozen food products. Chinese consumers are now looking for easy-to-use and quality food products. The demand for frozen meat and other regularly consumed products in the frozen food market has been constant in the region, because of their availability.

- According to the National Bureau of Statistics of China, the growth of food packaging in China had increased by 32% by 2018, since 2013. Furthermore, the market also provides an opportunity for vendors of frozen food packaging solutions, as it is still in the nascent stage in terms of adoption of the latest packaging products.

Frozen Food Packaging Industry Overview

The frozen food packagingmarket is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with creative and decorative packaging patterns, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- May 2019 -Cascades Sonoco, a joint venture of Cascades Inc.and Sonoco Products Company, inaugurated the expansion of packaging facility in Birmingham, Alabama, by its new production line of innovative, eco-friendly packaging. They have investedUSD 17 million to produce a water-based functional coating solution which cancreate recyclable, repulpable and compostable containers.

- Apr2019 -WestRock Company has got the "Innovator Award" for the company’s work in improving the recyclability of foodservice packaging.

Frozen Food Packaging Market Leaders

-

Berry Plastics Group, Inc.

-

Sonoco Products Company

-

ProAmpac LLC

-

Cascades Inc.

-

American Packaging Corporation

*Disclaimer: Major Players sorted in no particular order

Frozen Food Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growing Frozen Food Demand in Emerging Countries

- 4.3.2 Rising Investments for Creative Packaging

- 4.3.3 Growing Number of Organized Retail Stores

-

4.4 Market Restraints

- 4.4.1 Government Regulations and Interventions

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type of Food Product

- 5.1.1 Fruits and Vegetables

- 5.1.2 Meat and Sea Food

- 5.1.3 Frozen Desserts and Ice Creams

- 5.1.4 Baked Goods

-

5.2 By Type of Packaging

- 5.2.1 Bags

- 5.2.2 Boxes

- 5.2.3 Tubs and Cups

- 5.2.4 Trays

- 5.2.5 Wrappers

- 5.2.6 Pouches

- 5.2.7 Other Types of Packaging

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 ProAmpac LLC

- 6.1.2 Sonoco Products Company

- 6.1.3 American Packaging Corporation

- 6.1.4 Amcor PLC (Bemis Company Inc.)

- 6.1.5 Berry Plastics Group Inc.

- 6.1.6 Carter Holt Harvey Packaging S.A.

- 6.1.7 Cascades Inc.

- 6.1.8 Reynolds Presto Products Inc.

- 6.1.9 WestRock Company

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityFrozen Food Packaging Industry Segmentation

Frozen food packaging helps to preserve food from the time it is prepared to the time it is eaten. The frozen food packaging helps to maintain original color, flavor, and texture and generally more of their nutrients than foods preserved by other methods. Mostly, fruits and vegetables, meat, and seafood, frozen desserts, and ice creams, baked goods that are packaged in bags, boxes, tubs and cups, trays, wrappers, and pouches.

| By Type of Food Product | Fruits and Vegetables | |

| Meat and Sea Food | ||

| Frozen Desserts and Ice Creams | ||

| Baked Goods | ||

| By Type of Packaging | Bags | |

| Boxes | ||

| Tubs and Cups | ||

| Trays | ||

| Wrappers | ||

| Pouches | ||

| Other Types of Packaging | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | |

| Middle East & Africa |

Frozen Food Packaging Market Research FAQs

What is the current Frozen Food Packaging Market size?

The Frozen Food Packaging Market is projected to register a CAGR of 5.18% during the forecast period (2024-2029)

Who are the key players in Frozen Food Packaging Market?

Berry Plastics Group, Inc., Sonoco Products Company, ProAmpac LLC, Cascades Inc. and American Packaging Corporation are the major companies operating in the Frozen Food Packaging Market.

Which is the fastest growing region in Frozen Food Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Frozen Food Packaging Market?

In 2024, the North America accounts for the largest market share in Frozen Food Packaging Market.

What years does this Frozen Food Packaging Market cover?

The report covers the Frozen Food Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Frozen Food Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Frozen Food Packaging Industry Report

Statistics for the 2024 Frozen Food Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Frozen Food Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.