Fruit & Vegetable Crop Protection Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 3.90 % |

| Fastest Growing Market | North America |

| Largest Market | Asia Pacific |

| Market Concentration | High |

Major Players*Disclaimer: Major Players sorted in no particular order |

Fruit & Vegetable Crop Protection Market Analysis

The globalcrop protection market for fruit & vegetablesisestimated to register a CAGR of 3.9% during the forecast period, 2020-2025. Growing population, decliningarable land,food security, and the need for augmented agricultural productivityare the significantfactors, which are driving the demand for higher agricultural output, thusaugmenting the growth of the pesticide industry, globally. Increasing R&D cost, low per capita use of crop protection chemicals in several developing economies and ban in pesticides in certain regions are the major factors, which act as restraints to the market. The market is highly consolidated, with a few players dominating the market across different geographical regions. The market players are mostly focusing upon R&D, mergers, and acquisitions, and new product launches to increase their market share.

Fruit & Vegetable Crop Protection Market Trends

Growing Demand for Food Safety and Quality Driving the Market

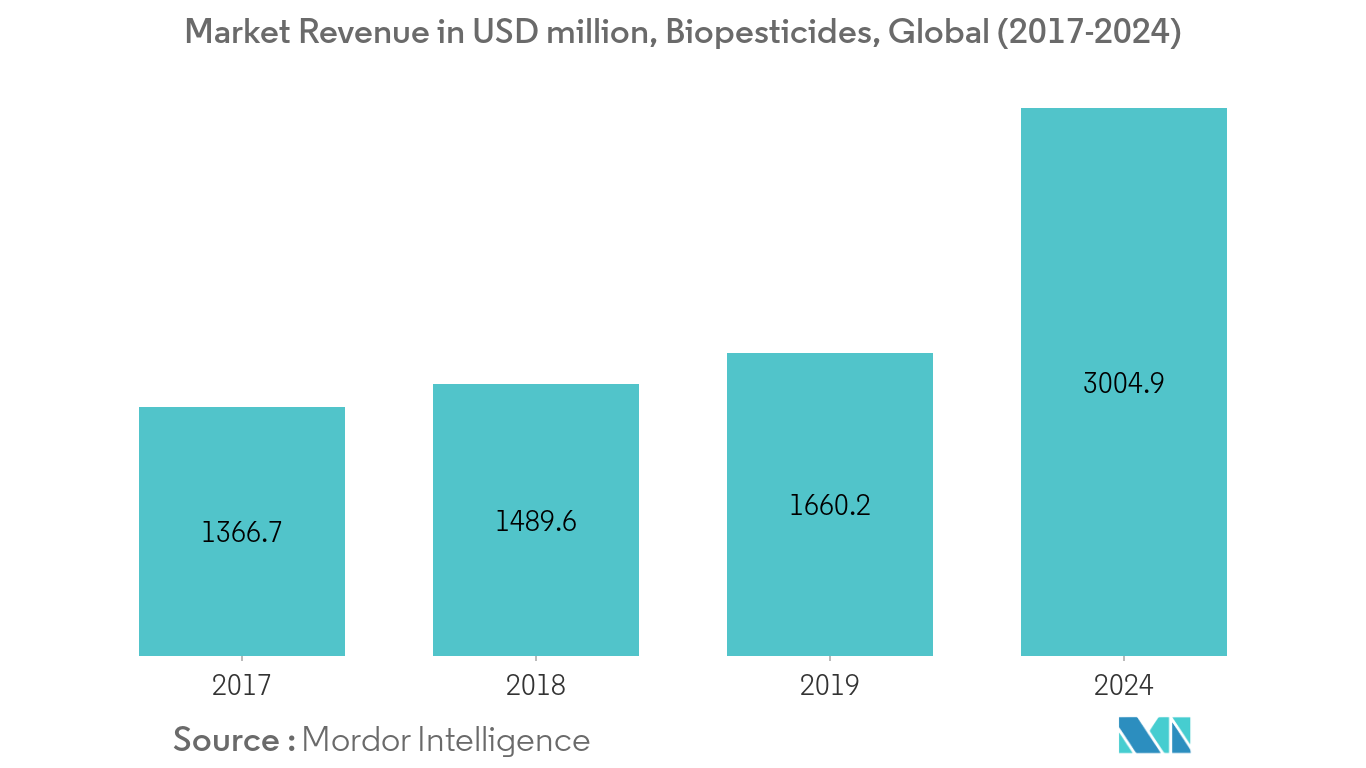

Being essentially less toxic, when compared to regular synthetic crop protection chemicals, biopesticides typically affect only the target pest and other organisms that are closely related to it, as against broad-spectrum conventional pesticides, which can be harmful to other organisms. Greater investment in R&D is likely to be a key factor in the area, now that many major agrochemical companies have an interest in the sector. This factor, coupled with the aforementioned market opportunities, suggest that the biopesticides sector may perform better than the crop-protection sector.

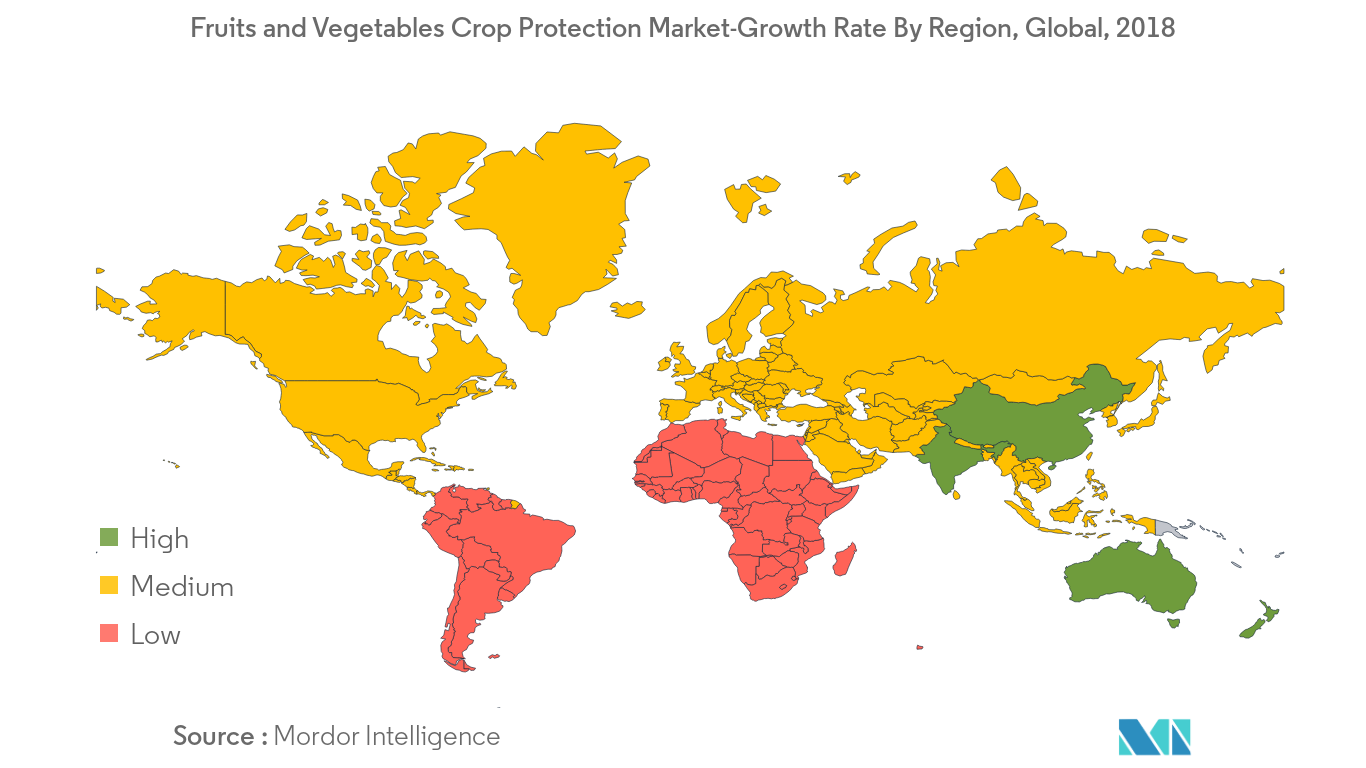

Asia-Pacific dominates the Market

Fruits and vegetables are largely grown in India, China, and Japan, and it involves a very high usage rate of pesticides. Japan is a significant market for crop protection chemicals for fruits and vegetables, occupying a share of more than 15% of the total Asia-Pacific market in 2018. The country has the highest pesticide usage per hectare compared to any other country in the world at approximately 12 kg per hectare. In India, synthetic pesticides have been extensively used for alleviating the estimated 45% gross loss of crops, due to the infestation of pests and diseases. Major factors driving the Indian market include greater demand for food grains, limited availability of arable land, along with increasing exports, growth in horticulture and floriculture, and increasing public awareness regarding synthetic pesticides and biopesticides.

Fruit & Vegetable Crop Protection Industry Overview

The Fruit & Vegetable Crop Protection Market is highly consolidated, with a few players dominating the market across different geographical regions. A large number of merger and acquisitions is a key highlight of the competitive landscape in this market. Heavy investments in research and development are being made by the major players in this industry.

Fruit & Vegetable Crop Protection Market Leaders

-

Adama Agricultural Solutions Ltd.

-

BASF SE

-

Bayer Cropscience AG

-

Corteva Agriscience

-

Syngenta International AG

*Disclaimer: Major Players sorted in no particular order

Fruit & Vegetable Crop Protection Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Origin

- 5.1.1 Synthetic

- 5.1.2 Bio-based

-

5.2 Type

- 5.2.1 Herbicides

- 5.2.2 Fungicides

- 5.2.3 Insecticides

- 5.2.4 Other Types

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Spain

- 5.3.2.3 United Kingdom

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Bayer Cropscience AG

- 6.3.2 Syngenta International AG

- 6.3.3 Corteva Agriscience

- 6.3.4 BASF SE

- 6.3.5 UPL Limted

- 6.3.6 Adama Agricultural Solutions

- 6.3.7 AMVAC Chemical Corporation

- 6.3.8 Certis LLC

- 6.3.9 FMC Corporation

- 6.3.10 Isagro SpA

- 6.3.11 Koppert Biological Systems

- 6.3.12 Marrone Bio innovations

- 6.3.13 Nufarm Limited

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityFruit & Vegetable Crop Protection Industry Segmentation

Fruits are the ripened seed-bearing parts of a plant that are fleshy and edible. Whereas, the herbaceous, edible part of a plant like roots, stems, leaves or flowers are defined as vegetables. Both are sources of nutrients for the consumer. Crop protection chemicals like herbicides, fungicides, insecticides, nematicides, and molluscicides that are used particularly on fruits and vegetables are considered in the scope.

| Origin | Synthetic | |

| Bio-based | ||

| Type | Herbicides | |

| Fungicides | ||

| Insecticides | ||

| Other Types | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| Spain | ||

| United Kingdom | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Australia | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Africa | South Africa |

| Rest of Africa |

Fruit & Vegetable Crop Protection Market Research FAQs

What is the current Fruit & Vegetable Crop Protection Market size?

The Fruit & Vegetable Crop Protection Market is projected to register a CAGR of 3.9% during the forecast period (2024-2029)

Who are the key players in Fruit & Vegetable Crop Protection Market?

Adama Agricultural Solutions Ltd., BASF SE, Bayer Cropscience AG, Corteva Agriscience and Syngenta International AG are the major companies operating in the Fruit & Vegetable Crop Protection Market.

Which is the fastest growing region in Fruit & Vegetable Crop Protection Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Fruit & Vegetable Crop Protection Market?

In 2024, the Asia Pacific accounts for the largest market share in Fruit & Vegetable Crop Protection Market.

What years does this Fruit & Vegetable Crop Protection Market cover?

The report covers the Fruit & Vegetable Crop Protection Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Fruit & Vegetable Crop Protection Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Fruit & Vegetable Crop Protection Industry Report

Statistics for the 2024 Fruit & Vegetable Crop Protection market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Fruit & Vegetable Crop Protection analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.