Geophysical Equipment and Services Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 2.80 % |

| Fastest Growing Market | North America |

| Largest Market | South America |

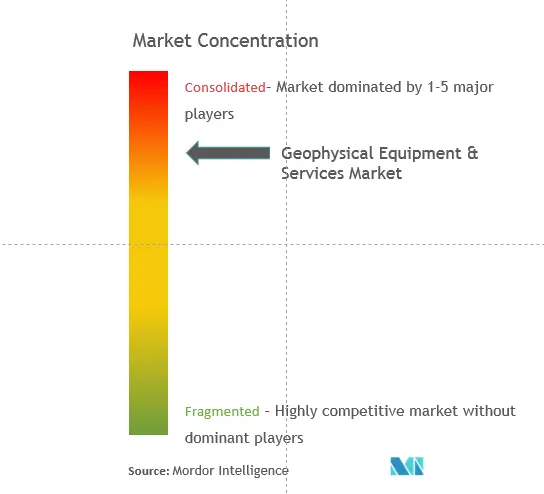

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Geophysical Equipment and Services Market Analysis

The market for geophysical equipment and services is expected to register a CAGR of about 2.8% during 2020-2025. The factors, such as the increasing applications in environmental geophysics and oil and gas exploration activities in the emerging countries (due to the increasing demand from the oil and gas industry), are expected to augment the growth of geophysical equipment and services market. Clean energy transition has driven the demand for metals and minerals, which is expected to boost the need for geophysical equipment and services. The decreasing investments in seismic surveys are expected to restrain the growth of the geophysical equipment and services market during the forecast period.

- The oil and gas sector accounted for the largest share in the geophysical equipment and services market, owing to the demand for seismic surveys that helps to obtain accurate and precise mappings of hydrocarbons.

- Then incorporation of advanced technologies for various geophysical studies is expected to present new avenues for the market studied.

- North America is expected to dominate the market, with majority of the demand from the countries, such as the United States and Mexico.

Geophysical Equipment and Services Market Trends

This section covers the major market trends shaping the Geophysical Equipment & Services Market according to our research experts:

Increasing Demand from Oil and Gas Industry

- The oil and gas industry is expected to maintain its dominance in the market over the forecast period. The geophysical equipment and services market was negatively affected by the downturn in the oil and gas industry in the past few years.

- The oil and gas market started to recover after mid-2016 and gained significant momentum in 2017. In 2018, the price of crude oil was USD 75 per barrel. The investors are expected to invest in the exploration of unconventional reserves, in order to meet the increasing global demand for oil and gas.

- As of 2018, the global consumption of fuel, i.e. oil and gas, accounted for 4662.1 and 3309.4 million ton oil equivalent (MTOE), respectively. The demand for solar and wind energy storage systems and lithium-ion batteries is expected to increase in a carbon-constrained environment. This factor is also expected to result in a huge demand for a wide range of minerals and metals.

- With the increasingly depleting sources of oil and gas, the necessity for finding new sources for hydrocarbons is immense and valuable. With this, the demand for geophysical services is expected to increase in the oil and gas industry.

- Seismic technology is expected to be used extensively in the oil and gas and mining industries. Therefore, the demand for geophysical equipment and services market is expected to increase during the forecast period.

North America to Dominate the Market

- North America is expected to dominate the geophysical equipment and services market during the forecast period. This is primarily on account of the investments in exploration activities.

- The number of geophysical surveys is increasing in the United States, which further boosts the market in this region. Moreover, the geophysical survey budget in the country is estimated to receive USD 1.16 billion, according to a proposed plan for the financial year 2019.

- Mexico’s crude oil production was declining. In order to address this, the government, in 2014, had introduced energy reforms, for ending the monopoly (for 75 years) of PEMEX, a state-owned oil and gas company.

- The Mexican government offered several blocks for exploration in the past few years. The liberalization of the upstream sector led to the entry of 70 oil and gas operators in the country after several biddings for blocks. This factor boosted the demand for geophysical equipment to carry out several operations.

- Therefore, these factors are expected to create opportunities for the growth of the geophysical equipment and services market during the forecast period.

Geophysical Equipment and Services Industry Overview

The global geophysical equipment and services market is consolidated. Some of the major equipment manufacturers and service providers areSchlumberger Limited, Ramboll Group AS, Sercel SA, IRIS Instruments, and DMT GmbH & Co. KG.

Geophysical Equipment and Services Market Leaders

-

Schlumberger Limited

-

Ramboll Group A/S

-

Sercel SA

-

IRIS Instruments

-

DMT GmbH & Co. KG.

*Disclaimer: Major Players sorted in no particular order

Geophysical Equipment and Services Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2025

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

-

4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

-

4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 End User (Qualitative Analysis Only)

- 5.1.1 Minerals and Mining Industry

- 5.1.2 Oil and Gas Industry

- 5.1.3 Groundwater Exploration

- 5.1.4 Other End Users

-

5.2 Type

- 5.2.1 Service Type

- 5.2.1.1 Multi-client Data Acquisition

- 5.2.1.2 Contractual Data Acquisition

- 5.2.1.3 Image Processing

- 5.2.2 Equipment Type (Overview, Market Size and Demand Forecast till 2025 (For Overall Equipment Only and Not for the Sub-segments))

- 5.2.2.1 Electrical Resistivity

- 5.2.2.2 Electromagnetic

- 5.2.2.3 Seismic

- 5.2.2.4 Other Equipment Types (Hyperspectral, Gravity, Gradiometry, Light Detection, and Ranging(LIDAR))

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Equipment Manufacturers

- 6.4.1.1 Phoenix Geophysics

- 6.4.1.2 IRIS Instruments

- 6.4.1.3 Geotech Ltd

- 6.4.1.4 Sercel SA

- 6.4.2 Service Providers

- 6.4.2.1 Ramboll Group AS

- 6.4.2.2 Petroleum Geo-Service

- 6.4.2.3 TGS-NOPEC

- 6.4.2.4 Geoex Ltd

- 6.4.2.5 Schlumberger Limited

- 6.4.2.6 BGP Inc.

- 6.4.2.7 Polarcus Ltd

- 6.4.2.8 CGGVeritas

- 6.4.2.9 Halliburton Company

- 6.4.2.10 IG Seismic Services

- 6.4.2.11 Dolphin Geophysical

- 6.4.2.12 COSL

- 6.4.2.13 Geokinetics Inc.

- 6.4.2.14 SAExploration

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityGeophysical Equipment and Services Industry Segmentation

The report on the geophysical equipment and services market includes:

| End User (Qualitative Analysis Only) | Minerals and Mining Industry | |

| Oil and Gas Industry | ||

| Groundwater Exploration | ||

| Other End Users | ||

| Type | Service Type | Multi-client Data Acquisition |

| Contractual Data Acquisition | ||

| Image Processing | ||

| Type | Equipment Type (Overview, Market Size and Demand Forecast till 2025 (For Overall Equipment Only and Not for the Sub-segments)) | Electrical Resistivity |

| Electromagnetic | ||

| Seismic | ||

| Other Equipment Types (Hyperspectral, Gravity, Gradiometry, Light Detection, and Ranging(LIDAR)) | ||

| Geography | North America | |

| Europe | ||

| Asia-Pacific | ||

| South America | ||

| Middle-East and Africa |

Geophysical Equipment and Services Market Research FAQs

What is the current Geophysical Equipment and Services Market size?

The Geophysical Equipment and Services Market is projected to register a CAGR of 2.80% during the forecast period (2024-2029)

Who are the key players in Geophysical Equipment and Services Market?

Schlumberger Limited, Ramboll Group A/S, Sercel SA, IRIS Instruments and DMT GmbH & Co. KG. are the major companies operating in the Geophysical Equipment and Services Market.

Which is the fastest growing region in Geophysical Equipment and Services Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Geophysical Equipment and Services Market?

In 2024, the South America accounts for the largest market share in Geophysical Equipment and Services Market.

What years does this Geophysical Equipment and Services Market cover?

The report covers the Geophysical Equipment and Services Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Geophysical Equipment and Services Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Geophysical Services Industry Report

Statistics for the 2024 Geophysical Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Geophysical Services analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.