GigE Camera Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 13.60 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

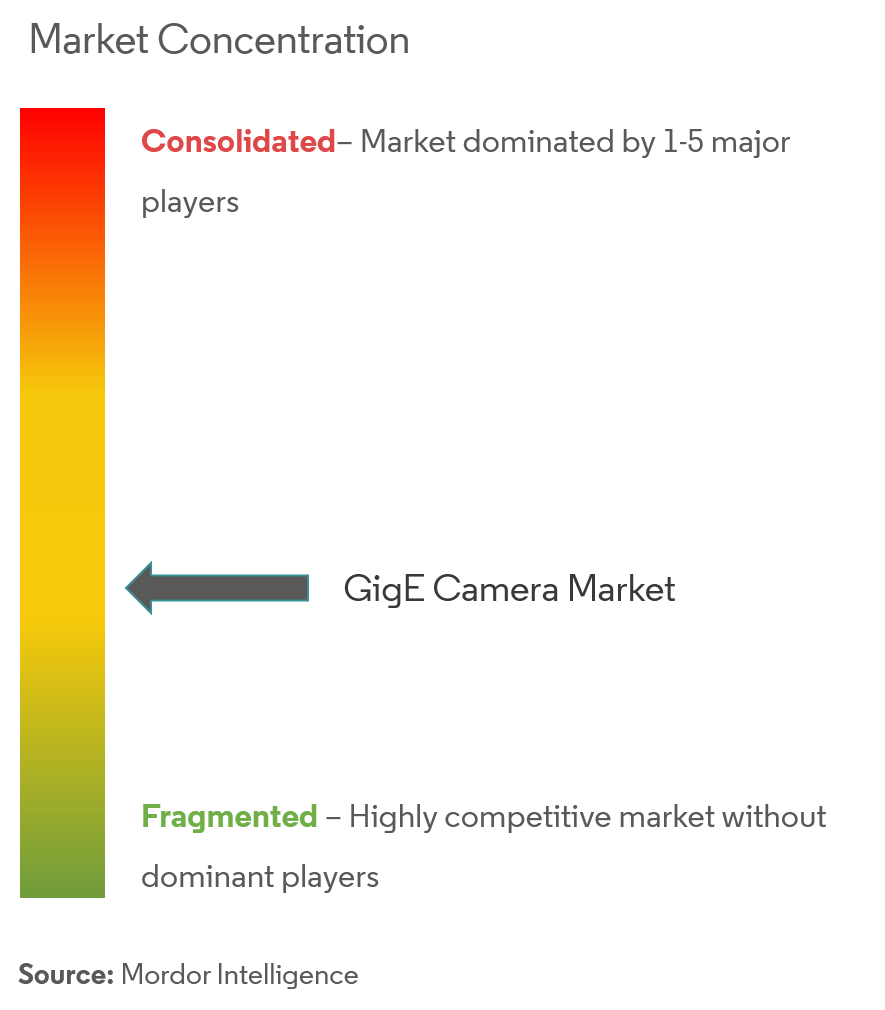

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

GigE Camera Market Analysis

The market for GigE camera is expected to register a CAGR of 13.60% over the forecast period (2021 - 2026). GigE cameras have applications in tasks that need multiple cameras; quick data transfer rates, or long cable lengths. It is designed to interface with computer systems using GigE ports.

- The gigE camera allows for seamless integration between machine vision hardware and software products. Hence, GigE reduces the tedious, time-consuming multi-vendor integration issues that slow down the machine vision industry. The high-speed data transfer rate up to 1000 Mb/s capability by offering RAW images is driving the applications of the GigE cameras.

- In this technology, the cap on the number of interfaced devices is eliminated. Therefore, allowing a large number of networked imaging cameras to function in any setting effectively. Also, GigE cameras offer high data rates and long cable lengths on a standard connection found on all modern computers.

- Moreover, these cameras eliminate the need for frame grabbers, which is a necessary component when used with analogue technology or conventional cameras. Hence, the installation cost of a GigE camera setup is relatively low, which is further fueling its adoption rate.

- However, the application of GigE cameras need universal drivers for interoperability, and also, the high speed and high-resolution capability increases the load on the system CPU, limiting market growth to an extent.

GigE Camera Market Trends

This section covers the major market trends shaping the GigE Camera Market according to our research experts:

Traffic, Security & Surveillance Segment to Grow Significantly

- The growing population, along with the improving lifestyles of the people across the world, is bringing challenges for the respective governments to manage the developing transportation infrastructure and security. This cannot be optimally resolved by additional staffing because it will be over the budget.

- The trend towards the adoption of Intelligent Transport System (ITS) offers the most promising safer, greener and more connected roads to the future. This enables the demand for industrial cameras like GigE so that speed, toll and red light enforcement can be done effectively. Also, the Power Over Ethernet (PoE) provides easy installation as a result of multiple cameras in a system that can be accessed easily for the transportation system.

- Unlike traffic monitoring, toll and red light enforcement have demanding requirements to capture usable images in lighting conditions that range from full daylight to night-time with only a corner lamp post for illumination. The camera also needs to include colour operation and must have a wide enough field of view to capture the entire vehicle’s image and need high enough resolution that automatic license plate recognition is reliable.

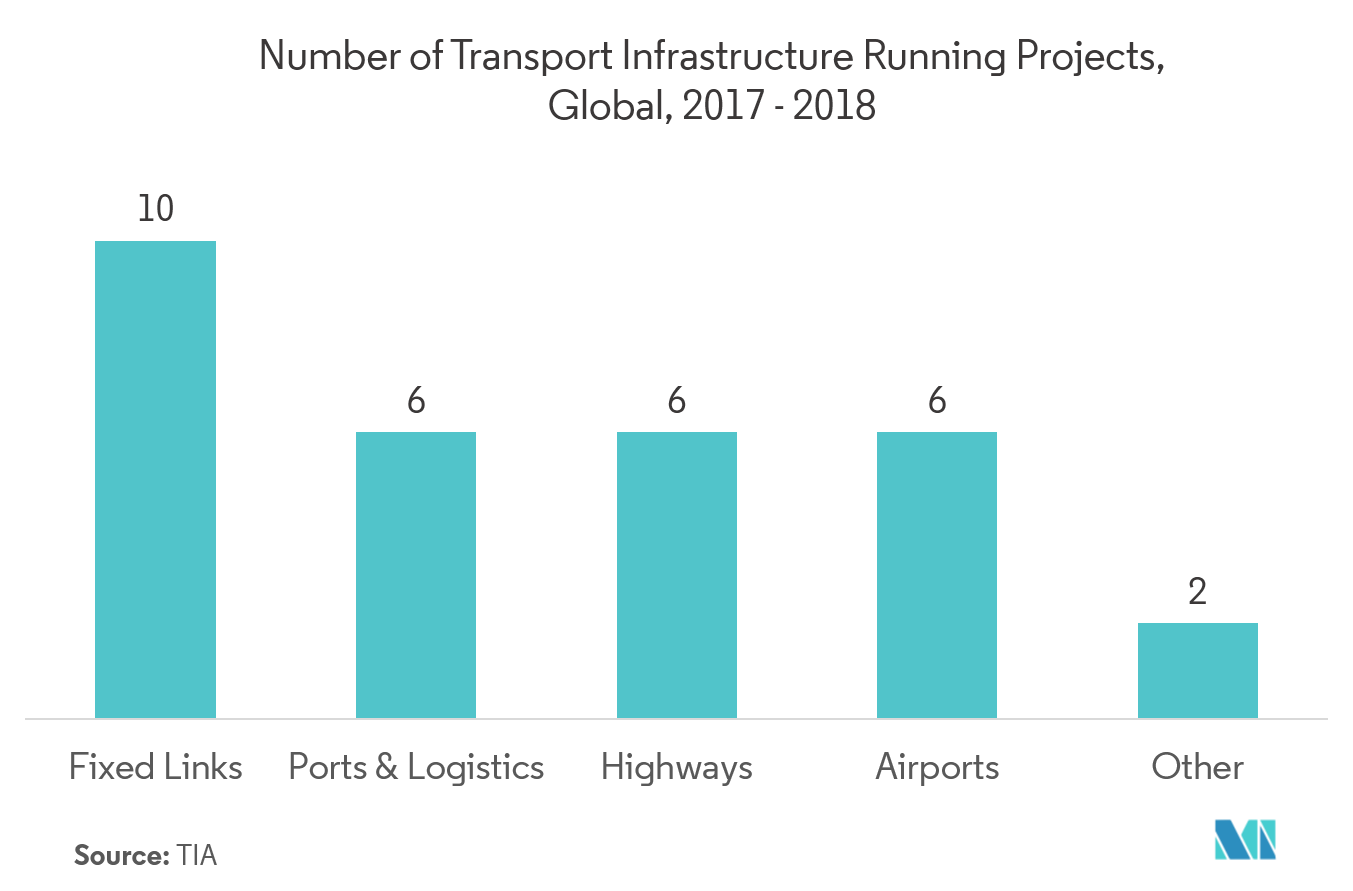

- Many countries, including China, are highly investing in developing connected transport infrastructure. According to the 2018 global infrastructure report, there are 30 transport infrastructure projects running in the year 2017-2018. Also, TIA estimated the United States to invest USD 39 billion for ITS.

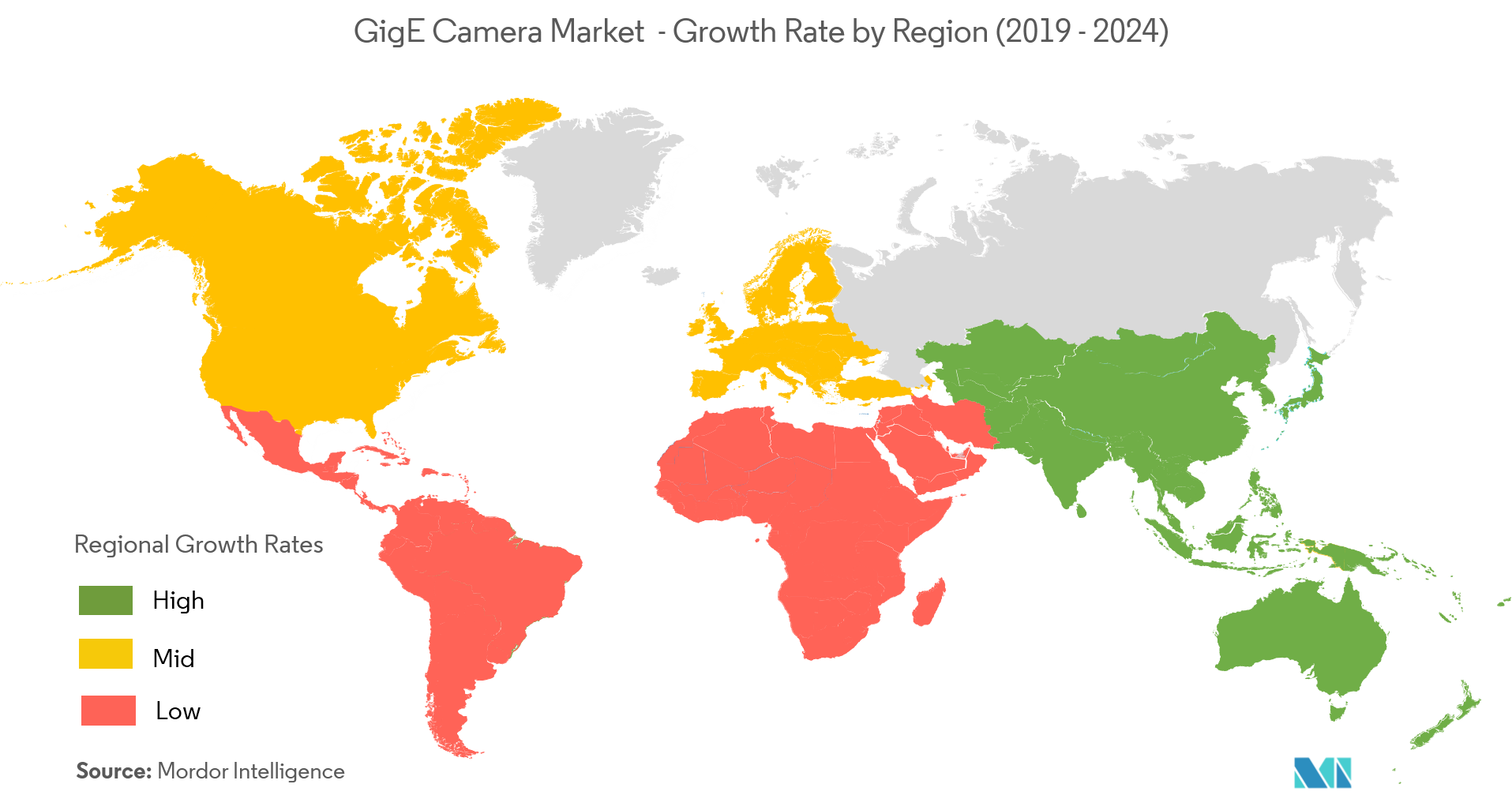

Asia-Pacific Region to Witness Fastest Growth

- The demand for GigE cameras is expected to see a steady growth rate in the region owing to the growing end-user industries. In the automotive sector specifically, the increasing investments in the region coupled with the growth in investments related to e-vehicles are further expected to propel the gigE camera market. For instance, General Motors has invested USD 2.8 billion as fresh investment in South Korea in 2018 over the next ten years as part of its plan to restructure its embattled unit in the country.

- The GigE camera is the most common and preferred interface for machine vision cameras as the networking infrastructure already present. Lab automation for the pharmaceutical is one of the most significant application of GigE cameras. For barcode reading and flow control processes, monochromatic cameras are used where the colour is not essential.

- According to the vissiononline.org., 95% of the cameras used in life sciences are greyscaled, and only about 5% are colour. The Indian pharmaceutical industry which provides 40% of the generic drugs to the United States are developing towards the adoption of industry 4.0, driving the demand for GigE cameras in the region.

- Moreover, the region is investing in connected infrastructure projects which represent 10% of the total global projects are currently running towards energy, transportation, water and rail. These developments in the region are driving the demand for GigE camera market growth.

GigE Camera Industry Overview

The market trend for GigE camera market is fragmentedwith the presence of many players offering the products in the market. Also, because of the less product differentiation in the offerings, vendors are adopting improved product launch strategies with competitive pricing, which is driving the competition in the market.

- April 2019 - The Image Source, a manufacturer of imaging products for industrial, scientific and medical applications announced its entry to the GigE camera market by introducingGigE zoom camera rangefeaturing 20x optical zoom, autofocus, auto-iris, and with Power over Ethernet (PoE). The cameras are available as colour and monochrome variants and feature the Sony Pregius 3.1 MP IMX265 sensor.

- February 2019 - Teledyne Marine launched GigE subsea underwatercamera range. The company claimedthat this whole range also suite for its Versatile and Lightweight Observation ROV (VALOR) launched in 2018. The company is also leveraging the CMOS technology from Teledyne Dalsa. These cameras are capable oftransmission of sharp, high-speed video images and related control data over ethernet networks with almost zero latency with frame rates of up to 862 frames per second.

GigE Camera Market Leaders

-

Allied Vision Technologies GmbH

-

Basler AG

-

Baumer Holding AG

-

FLIR Integrated Imaging Solutions, Inc.

-

JAI A/S

*Disclaimer: Major Players sorted in no particular order

GigE Camera Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Efficient Data Transfer Coupled with Faster Transfer Rate

- 4.2.2 Ability to Connect with Numerous Devices

-

4.3 Market Restraints

- 4.3.1 Universal Drivers needed for Interoperability

- 4.3.2 Excessive Load on the CPU

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Technology

- 5.1.1 Charge Coupled Device (CCD)

- 5.1.2 Complementary Metal- Oxide - Semiconductor (CMOS)

-

5.2 By Type

- 5.2.1 Area Scan

- 5.2.2 Line Scan

-

5.3 By Colour Sensor Type

- 5.3.1 Monochrome

- 5.3.2 Colour

-

5.4 By End-user Vertical

- 5.4.1 Industrial

- 5.4.2 Medical / Life Sciences

- 5.4.3 Traffic, Security & Surveillance

- 5.4.4 Pharmaceutical

- 5.4.5 Military and Defense

- 5.4.6 Other End-user Verticals

-

5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Allied Vision Technologies GmbH

- 6.1.2 Basler AG

- 6.1.3 Baumer Holding AG

- 6.1.4 FLIR Integrated Imaging Solutions, Inc.

- 6.1.5 JAI A/S

- 6.1.6 Matrox Graphics Inc.

- 6.1.7 Pleora Technologies Inc.

- 6.1.8 Sony Corporation

- 6.1.9 Teledyne DALSA Inc.

- 6.1.10 Toshiba Teli Corporation, Ltd.

- 6.1.11 Imperx Incorporated

- 6.1.12 Sensor Technologies America, Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityGigE Camera Industry Segmentation

The scope of the study for GigE camera market is limited to the hardware product offerings by the vendors in combinations of the technology, resolutions and type of products and their application in a wide range of end-user verticals globally. The after sales services are not considered for market estimation.

| By Technology | Charge Coupled Device (CCD) |

| Complementary Metal- Oxide - Semiconductor (CMOS) | |

| By Type | Area Scan |

| Line Scan | |

| By Colour Sensor Type | Monochrome |

| Colour | |

| By End-user Vertical | Industrial |

| Medical / Life Sciences | |

| Traffic, Security & Surveillance | |

| Pharmaceutical | |

| Military and Defense | |

| Other End-user Verticals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

GigE Camera Market Research FAQs

What is the current GigE Camera Market size?

The GigE Camera Market is projected to register a CAGR of 13.60% during the forecast period (2024-2029)

Who are the key players in GigE Camera Market?

Allied Vision Technologies GmbH, Basler AG, Baumer Holding AG, FLIR Integrated Imaging Solutions, Inc. and JAI A/S are the major companies operating in the GigE Camera Market.

Which is the fastest growing region in GigE Camera Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in GigE Camera Market?

In 2024, the North America accounts for the largest market share in GigE Camera Market.

What years does this GigE Camera Market cover?

The report covers the GigE Camera Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the GigE Camera Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

GigE Camera Industry Report

Statistics for the 2024 GigE Camera market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. GigE Camera analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.