Automotive Logistics Market Size

| Study Period | 2020 - 2029 |

| Market Size (2024) | USD 317.29 Billion |

| Market Size (2029) | USD 437.80 Billion |

| CAGR (2024 - 2029) | 6.65 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia-Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Automotive Logistics Market Analysis

The Global Automotive Logistics Market size is estimated at USD 317.29 billion in 2024, and is expected to reach USD 437.80 billion by 2029, growing at a CAGR of 6.65% during the forecast period (2024-2029).

The COVID-19 problem has significantly impacted numerous industries, including tourism, healthcare, and retail. Due to the pandemic's extensive disruption of its supply chain, the automotive industry has also been severely impacted. The health issue continues to significantly influence the automotive industry despite a gradual lifting of government restrictions. With the automotive industry continually evolving, logistics are getting complex. Automotive companies are looking toward supply chain strategies to exploit new market opportunities, reduce costs, and maintain competitive advantage.

- Additionally, the introduction of electric vehicles is projected to offer a key uplift to the global automotive logistics market. The players operating in the logistics industry also offer warehousing and inventory management services to OEMs and Tier I and Tier II component manufacturers. The demand for these services depends on vehicle production.

- Hence, the regions with more vehicle production are likely to have a significant share in the automotive warehousing sector. In addition to warehousing and distribution, logistics service providers (LSPs) also offer assembly services for OEMs.

- Global car makers are disrupting the traditional supply chain with innovative transport solutions. For instance, in January 2019, Renault announced plans to start a home delivery service in Russia for vehicles sold via its online showroom. Promoting the online showroom is part of Renault's sales development strategy in Russia. It has already sold 27,000 finished vehicles via the site, primarily Renault Kaptur and Renault Duster units.

- While roll-on/roll-off (ro-ro) is the traditional method of shipping finished vehicles, containerization is becoming increasingly viable as the automotive industry decentralizes and introduces more EVs. Growth in China and Southeast Asia offers shipping and logistics companies good opportunities.

- Furthermore, the use of containers on developing routes out of China is also being adopted, especially by rail between China and Europe. Southeast Asia is considered one of the favorable regions to make containerization feasible, as the region witnesses growth in vehicle sales and demand for logistics services.

- Following the free trade agreement signed in the ASEAN markets, including the Philippines, Malaysia, Thailand, Vietnam, and Cambodia, trade-in finished vehicles has grown. CFR Rinkens, a vehicle transportation service provider, won a contract to ship BMWs from Europe to Vietnam in containers.

Automotive Logistics Market Trends

Positive Outlook for the Automotive Sales and Production Demands Efficient Logistics Services

Despite some headwinds, the automotive industry looks bright globally. According to industry sources, global light vehicle production unit sales have been remarkable and continue to grow. APAC is expected to register the highest growth rate in terms of production volumes, followed by North America. Furthermore, electric vehicle production and sales are increasing at a record pace, which needs specialized logistics.

The COVID-19 pandemic and automotive semiconductor shortages have resulted in lower demand and production halts for the worldwide automobile sector since 2020. Around 11.3 million vehicles were removed from production globally in 2021 due to the chip shortage, and predictions predict that seven more vehicles will be removed from production in 2022 due to supply chain disruptions in the automotive industry. After experiencing a decline during the pandemic, global auto sales began to rebound, reaching 66.7 million units sold in 2021. It was anticipated that this sales volume would drop in 2022, and the 2023 sales volume is expected to still be below the 2019 levels.

China's economy started to slow down after years of double-digit growth. Based on sales, China had the largest vehicle market, with about 19.8 million units in 2020. However, the coronavirus outbreak in the nation and worries about an impending recession caused monthly auto sales in China to plunge in 2021. Because of effective containment measures, the market began to show indications of recovery in April, giving key manufacturers a lifeline.

Asia-Pacific dominates the Market

As per the industry analysis, the Asia-pacific region is estimated to hold the major market share in the market. This is primarily because of emerging economies such as China and India. Numerous factors, like easy availability of raw materials, increased demand for vehicles in the region, rising population, and availability of low-wage workers, are anticipated to drive the automotive logistics market in the region.

APAC is home to some of the major automotive OEM companies, like Toyota, Maruti Suzuki, Hyundai, and SAIC Motor Corporation Limited, among others. With the increasing production and trading activities, there is a demand for logistics companies to manage the procurement, transport, and storage activities of the OEMs to optimize the latter's supply chain more efficiently.

Global logistics companies are increasingly entering the APAC region to tap the growth associated with the market. For instance, in June 2019, French logistics provider GEFCO set up a dedicated subsidiary in Chongqing (China) to specialize in importing and exporting vehicles by rail between Europe, Russia, and China. Additionally, it is developing the group's other logistics activities in Central China.

Beyond current inbound and aftermarket services in the Chinese automotive sector, GEFCO plans to boost OEM supply chains in China with activity in the finished vehicle sector. These include door-to-door services for complete built-up units, pre-carriage, car transport, storage, compound design, operation management, and domestic distribution to dealers. Furthermore, the group anticipates increasing demand for new-generation automotive logistics and other development opportunities resulting from China's Belt and Road infrastructure-led initiative.

OBOR extends to most of the countries in the region with major development plans. Electric Vehicle sales will witness significant growth in the region, owing to several nation's environmental and sustainability goals. Logistics companies with capabilities to handle EVs and their parts can benefit from this scenario.

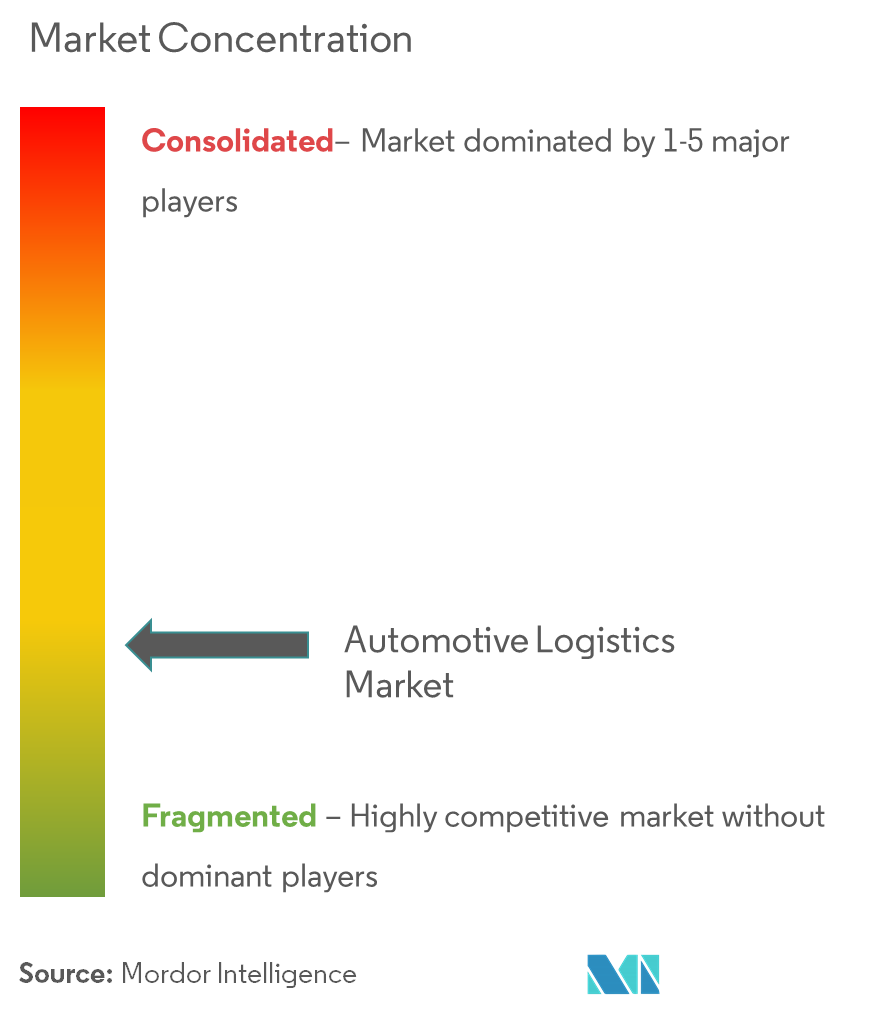

Automotive Logistics Industry Overview

The automotive logistics market is fragmented in nature, with large global players, small- and medium-sized local players, and few players who occupy the market share. Most global logistics players have an automotive logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of inventory handling, service offerings, products handled, and technology.

The third-party logistics (3PL) service providers in the market compete intensely based on reliability and supply chain capacity. By offering value-added services, companies would differentiate their service offerings. The growing e-commerce sales are creating opportunities and challenges for logistics firms in terms of speed, delivery, etc.

Global companies with high assets and capital can invest in advanced technology and distribution centers and benefit from the scenario mentioned above. On the other hand, regional and local players are coming up with better sector solutions to support the needs of manufacturers, retailers, as well as dealers. This industry's major players include Hellmann Worldwide Logistics, APL Logistics, BLG Logistics Group, CEVA Logistics, and DB Schenker.

Automotive Logistics Market Leaders

-

Hellmann Worldwide Logistics SE & Co. KG

-

APL Logistics Ltd

-

BLG Logistics Group AG & Co. KG

-

CEVA Logistics

-

DB Schenker

*Disclaimer: Major Players sorted in no particular order

Automotive Logistics Market News

- December 2022: Delhivery, a provider of logistics services, announced the acquisition of Algorhythm Tech Pvt Ltd of Pune for INR 14.9 crores (USD 17.99 Million) in an all-cash purchase to expand its integrated supply chain solutions portfolio. By the end of January 2023, Delhivery anticipates the acquisition to be completed. At this point, Algorhythm Tech will function as a fully-owned subsidiary of the logistics company based in Gurugram.

- August 2022: Bolloré Logistics, a global provider of transportation and logistics services, increased its presence in Australia by purchasing the South Australian firm Lynair Logistics. According to Thibault Janssens, CEO of Bolloré Logistics, Pacific Region, the purchase of Lynair Logistics further enhances their footprint in Australia, and they are glad to welcome their new, experienced, and highly skilled team members into the Bolloré Logistics Australia team.

Automotive Logistics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Industry Value Chain Analysis

- 4.3 Government Regulations and Initiatives

- 4.4 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, etc.)

- 4.5 Focus on the Global Automotive Industry (Overview, Development and Trends, Statistics, etc.)

- 4.6 Spotlight - Effect of E-commerce on Traditional Automotive Logistics Supply Chain

- 4.7 Review and Commentary on Reverse Logistics (Overview, Challenges in Comparison with Forwards Logistics, etc.)

- 4.8 Insights on Automotive Aftermarket and its Logistics Activities

- 4.9 Spotlight on the Demand for Contract Logistics and Integrated Logistics

- 4.10 Impact of COVID 19 on Automotive Logistics Market

5. MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

- 5.3 Market Opportunities

-

5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Powers of Buyers/Consumers

- 5.4.2 Bargaining Power of Suppliers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6. MARKET SEGMENTATION

-

6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution, and Inventory Management

- 6.1.3 Other Services

-

6.2 By Type

- 6.2.1 Finished Vehicle

- 6.2.2 Auto Components

- 6.2.3 Other Types

-

6.3 Geography

- 6.3.1 Asia-Pacific

- 6.3.1.1 China

- 6.3.1.2 Japan

- 6.3.1.3 India

- 6.3.1.4 South Korea

- 6.3.1.5 Rest of Asia-Pacific

- 6.3.2 North America

- 6.3.2.1 United States

- 6.3.2.2 Canada

- 6.3.2.3 Mexico

- 6.3.3 Europe

- 6.3.3.1 United Kingdom

- 6.3.3.2 Germany

- 6.3.3.3 Italy

- 6.3.3.4 Russia

- 6.3.3.5 France

- 6.3.3.6 Rest of Europe

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 South Africa

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Rest of Middle East & Africa

7. COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

-

7.2 Company Profiles

- 7.2.1 Hellmann Worldwide Logistics SE & Co. KG

- 7.2.2 APL Logistics Ltd

- 7.2.3 BLG Logistics Group AG & Co. KG

- 7.2.4 CEVA Logistics

- 7.2.5 DB Schenker

- 7.2.6 DHL Group

- 7.2.7 GEFCO SA

- 7.2.8 Kerry Logistics Network Ltd

- 7.2.9 Kuehne + Nagel International AG

- 7.2.10 Penske Logistics Inc.

- 7.2.11 Ryder System Inc.

- 7.2.12 DSV Panalpina AS

- 7.2.13 Expeditors

- 7.2.14 Panalpina

- 7.2.15 XPO Logistics Inc.

- 7.2.16 Tiba Group

- 7.2.17 Bollore Logistics

- 7.2.18 CFR Rinkens*

- *List Not Exhaustive

8. FUTURE OF THE MARKET

9. APPENDIX

- 9.1 GDP Distribution (by Activity - Key Countries)

- 9.2 Insights on Capital Flows - Key Countries

- 9.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy (Key Countries)

- 9.4 Global Automotive Industry Statistics

Automotive Logistics Industry Segmentation

The thorough planning and execution of a challenging vehicle transportation operation are known as automotive logistics. It includes all forms of transportation, including trucking, rail, and maritime.

A complete background analysis of the global automotive logistics market, which includes an assessment and contribution of the sector in the economy, market overview, market size estimation for key segments, key countries and emerging trends in the market segments, market dynamics, and key component flow statistics are covered in the report.

The global automotive logistics market is segmented by service (transportation, warehousing, distribution, inventory management, and other services), by type (finished vehicle, auto components, and other types), and by geography (Asia-Pacific, North America, Europe, Latin America, and the Middle East and Africa). The report offers market size and forecasts in values (USD billion) for all the above segments.

| By Service | Transportation | |

| Warehousing, Distribution, and Inventory Management | ||

| Other Services | ||

| By Type | Finished Vehicle | |

| Auto Components | ||

| Other Types | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| Italy | ||

| Russia | ||

| France | ||

| Rest of Europe | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | South Africa |

| United Arab Emirates | ||

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Automotive Logistics Market Research FAQs

How big is the Global Automotive Logistics Market?

The Global Automotive Logistics Market size is expected to reach USD 317.29 billion in 2024 and grow at a CAGR of 6.65% to reach USD 437.80 billion by 2029.

What is the current Global Automotive Logistics Market size?

In 2024, the Global Automotive Logistics Market size is expected to reach USD 317.29 billion.

Who are the key players in Global Automotive Logistics Market?

Hellmann Worldwide Logistics SE & Co. KG, APL Logistics Ltd, BLG Logistics Group AG & Co. KG, CEVA Logistics and DB Schenker are the major companies operating in the Global Automotive Logistics Market.

Which is the fastest growing region in Global Automotive Logistics Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Global Automotive Logistics Market?

In 2024, the Asia-Pacific accounts for the largest market share in Global Automotive Logistics Market.

What years does this Global Automotive Logistics Market cover, and what was the market size in 2023?

In 2023, the Global Automotive Logistics Market size was estimated at USD 297.51 billion. The report covers the Global Automotive Logistics Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Global Automotive Logistics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Automotive Logistics Industry Report

Statistics for the 2024 Automotive Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive Logistics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.