Beauty Drinks Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 11.92 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | North America |

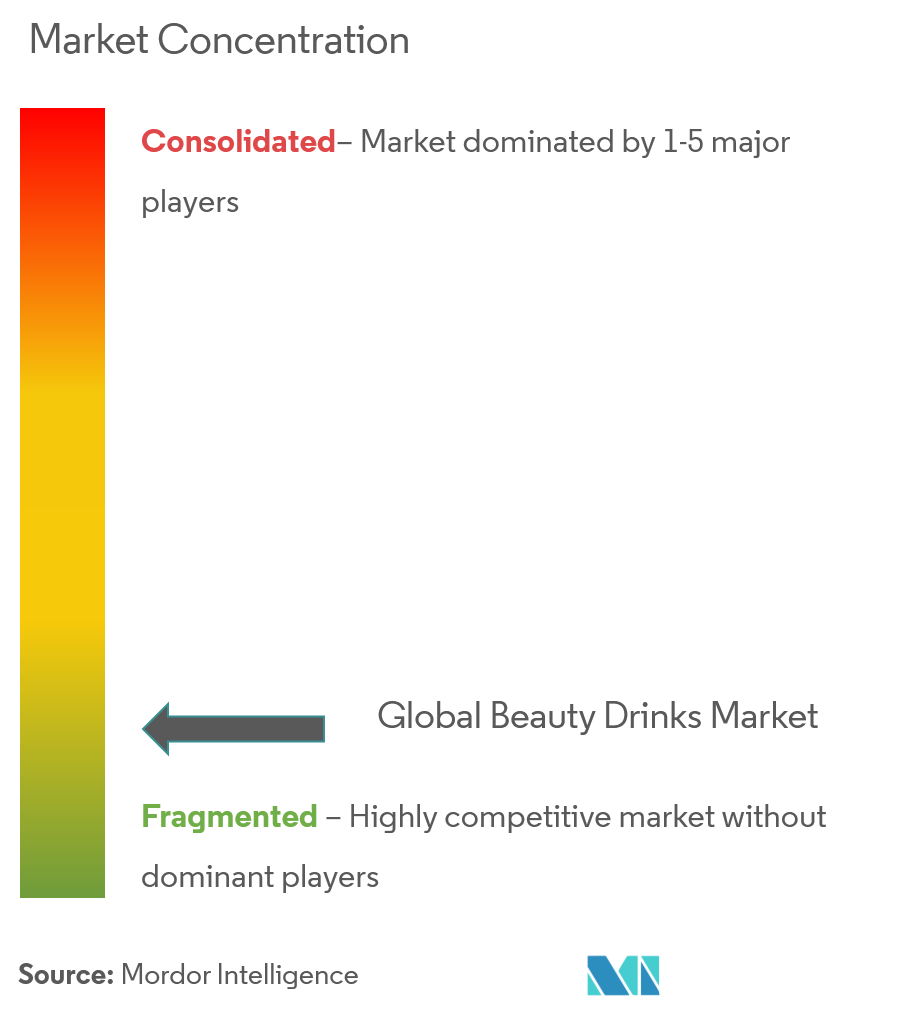

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Beauty Drinks Market Analysis

The global beauty drinks market is projected to register a CAGR of 11.92% during the upcoming five years.

The beauty drinks market was less impacted by the COVID-19 pandemic as more consumers stayed home, paying more attention to their health, including their beauty health. Staying at home also led consumers to shift their focus from makeup routines to nutricosmetics or toward low-maintenance and natural looks, which boosted the demand for beauty drinks during the COVID-19 pandemic. In addition, beauty drinks that were trending well before the pandemic have suddenly become more popular as more consumers seek out the latest information on what products can help in their beauty routine.

Among all the ingestible and topical combination products within the industry, beauty drinks are proving to be a highly palatable option in line with consumers growing preference for these products as well. The major reasons for the increased demand for beauty drinks include the increasing prevalence of lifestyle-related diseases and people consciously taking preventive healthcare measures. In addition, the market for beauty drinks is predominantly driven by consumers shifting toward preventive skincare as the aging population increases in developed countries. For instance, According to Cera Ve, 63 percent of millennial consumers in the United States took their skin care routine seriously, a slightly higher number compared to the 57 percent of Generation Z who claimed the same thing.

Beauty drinks have been witnessing robust demand, particularly from women, in order to eliminate the appearance of wrinkles and enhance beauty. Moreover, celebrities have been promoting the consumption of these drinks and their benefits, which is expected to drive market growth.

Beauty Drinks Market Trends

Growing Female Population and Increasing Consumer Awareness of Collagen-infused Nutri-cosmetics

With the growing female population globally, there is a significant increase in awareness of beauty drinks, which help in anti-aging, making the skin more radiant, and minimizing the appearance of acne, scars, and pigmentation. Acne is the most common problem, especially in women. For instance, according to NHS, about 95% of people aged 11- 30 are affected by acne to some extent. Acne is most common in girls from the ages of 14 to 17. Owing to increasing awareness of beauty drinks that deliver healthy aging benefits with an emphasis on skin, hair, and nail beauty, there has been a growing demand for beauty drinks such as collagen-based drinks. This trend is due to the increased consumer awareness of the benefits of collagen peptides and tripeptides infused in human nutrition, which has gained traction in the nutrition and cosmetic markets and is contributing to the growth of nutri-cosmetic solutions across the world. With consumers' growing desire to prevent premature aging and a growing preference for natural, safe, and effective beauty solutions, protein- and amino acid-derived nutri-cosmetics such as collagen drinks held a significant share in the nutri-cosmetics market. This trend has led key players in the nutraceutical market to expand their product portfolios to place themselves strongly in the beauty drinks market.

Constantly changing health trends and large amounts of easily available information on health and nutrition are blurring the lines of what products consumers use to maintain their health. For example, consumers who previously relied on traditional beauty products to maintain their appearance now look at vitamins and supplements to enhance their overall well-being.

North America May Become the Largest Market

Health is taking a backseat among the US population due to increasingly hectic work-life schedules. According to the American Academy of Dermatologists Association,84.5 million Americans - one in four - were impacted by skin disease. Skin disease costs the US healthcare system USD 75 billion in medical, preventative, and prescription and non-prescription drug costs. Acne is the most common skin condition in the United States, affecting up to 50 million Americans annually, leading to a need for nutri-cosmetic products, like beauty drinks. The major companies in the region are more focused on targeting consumers who appear to be more concerned regarding health and aging. The sales of beauty drinks in North America, especially the United States, are expected to increase tremendously due to increasing incidences of skin problems, hair fall issues, and the fashion industry's influence. To capture this opportunity, the beauty drink companies dominating the region are working toward growing their number of brands and increasing assortments. The rising trend of beauty shots aimed to improve the external appearance of consumers is leading to increased demand for beauty shots.

Beauty Drinks Industry Overview

Global players, including SAPPE Public Company Limited, Shiseido Co. Ltd, Lacka Foods Limited, and Nestle SA (Vital Proteins Ltd), hold a minor portion of the market. New product launches, market expansions, and partnerships are the preferred strategic approaches most companies adopt in the beauty drinks business. Owing to product expansions and growing consumption of nutri-cosmectics, the global players in the beauty drinks market are adopting new product launches as their key strategy. The market studied is gaining high traction among consumers and manufacturers, which has led to expansions, and various companies are trying to gain a sustainable competitive advantage through innovation. Companies are focusing on R&D activities to enhance the shelf-life of their supplement products.

Beauty Drinks Market Leaders

-

Shiseido Co. Ltd

-

Kinohimitsu

-

Sappe Public Company Limited

-

Nestle SA

-

Lacka Foods Limited

*Disclaimer: Major Players sorted in no particular order

Beauty Drinks Market News

- In February 2022, Nestle Health Science, a business unit of Nestle SA, completed its acquisition of Vital Proteins, a Chicago-based manufacturer of collagen-based foods, beverages, and supplements.

- In October 2021, SAPPE introduced a new, less sweet Sappe Beauti Drink line to offer consumers a choice of innovative products while adding maximum value to the commodity.

- In May 2021, Aquilini Beverage Group launched the Beautiful Drinks Co. (BDC), a selection of sparkling, spirit-based, ready-to-drink (RTD) cocktails inspired by Beauty In Nature. These premium cocktails are vegan, gluten-free, and preservative-free, flavored with selected distillates and botanical extracts.

- In February 2020, Rejuvenated Ltd unveiled its first compostable packaging, 'bio-pouch,' for its Collagen Shots, a powder skincare supplement drink. The eco-friendly packaging suits home composting as the pouch meets Vinçotte OK Compost's certification requirements.

Beauty Drinks Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Vitamins and Minerals

- 5.1.2 Collagen

- 5.1.3 Carotenoids

- 5.1.4 Other Types

-

5.2 By Distribution Channel

- 5.2.1 Grocery Retailers

- 5.2.2 Beauty Specialty Stores

- 5.2.3 Drug Stores and Pharmacies

- 5.2.4 Other Distribution Channels

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 Australia

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Sappe Public Company Limited

- 6.3.2 Shiseido Co. Ltd

- 6.3.3 Nestle SA

- 6.3.4 Hangzhou Nutrition Biotechnology Co. Ltd

- 6.3.5 Kinohimitsu

- 6.3.6 Big Quark

- 6.3.7 Lacka Foods Limited

- 6.3.8 Rejuvenated Ltd

- 6.3.9 On-Group Ltd

- 6.3.10 Molecule Beverages

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBeauty Drinks Industry Segmentation

Beauty drinks are a new concept among a growing trend of 'nutri-cosmetics,' which include foods, drinks, and supplements that provide beauty benefits from within.

The beauty drinks market is segmented by type (vitamins and minerals, collagen, carotenoids, and other types), distribution channel (grocery retailers, beauty specialty stores, drug stores and pharmacies, and other distribution channels), and geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The report offers market size and forecasts in value (USD million) for the above segments.

| By Type | Vitamins and Minerals | |

| Collagen | ||

| Carotenoids | ||

| Other Types | ||

| By Distribution Channel | Grocery Retailers | |

| Beauty Specialty Stores | ||

| Drug Stores and Pharmacies | ||

| Other Distribution Channels | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Russia | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | Australia |

| China | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| United Arab Emirates | ||

| Rest of Middle East and Africa |

Beauty Drinks Market Research FAQs

What is the current Beauty Drinks Market size?

The Beauty Drinks Market is projected to register a CAGR of 11.92% during the forecast period (2024-2029)

Who are the key players in Beauty Drinks Market?

Shiseido Co. Ltd, Kinohimitsu, Sappe Public Company Limited, Nestle SA and Lacka Foods Limited are the major companies operating in the Beauty Drinks Market.

Which is the fastest growing region in Beauty Drinks Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Beauty Drinks Market?

In 2024, the North America accounts for the largest market share in Beauty Drinks Market.

What years does this Beauty Drinks Market cover?

The report covers the Beauty Drinks Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Beauty Drinks Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Beauty Drinks Industry Report

Statistics for the 2024 Beauty Drinks market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Beauty Drinks analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.