Business Productivity Software Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 59.27 Billion |

| Market Size (2029) | USD 120.52 Billion |

| CAGR (2024 - 2029) | 15.25 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Business Productivity Software Market Analysis

The Business Productivity Software Market size is estimated at USD 59.27 billion in 2024, and is expected to reach USD 120.52 billion by 2029, growing at a CAGR of 15.25% during the forecast period (2024-2029).

Business can be conducted from anywhere, across the world, in real-time. Collaboration tools are economically and environmentally helpful, as their benefits include reduced travel costs and increased productivity.

- While AI and IoT propagate the wave of incoming technology advances, business productivity is one area of business that is currently emerging. Business productivity can be traced to an organization's ability to execute an overall strategy successfully. Moreover, business productivity is directly proportional to employee productivity. Businesses are widely adopting various tools to aid employees in enhancing their productivity.

- The increased adoption of smartphones and bring-your-own devices (BYOD), which have expanded the mobile workforce, are strong drivers in the market.

- Implementing cloud computing or AI in business processes stimulates the market. Moreover, vast data being generated across businesses propels the need for adopting better data management techniques, driving the market's growth.

- Business Productivity Software supports and integrates data and processes in every aspect of the business. It also aids in optimizing cloud computing and helps in better collaboration with clients, vendors, suppliers, employees, and customers.

- Organizations adopted the work-from-home policy during the pandemic to ensure their employees' safety. Thus, the demand for business productivity software, such as scheduling software, collaboration tools, and other solutions, increased.

Business Productivity Software Market Trends

This section covers the major market trends shaping the Business Productivity Software Market according to our research experts:

Content Management and Collaboration to have the Highest Adoption Rate

- Traditionally, enterprise content management (ECM) was confined to the back office and remained unstructured. However, over the past few years, ECM shifted toward a more interactive role in businesses. Machine learning, cloud technology, and mobile capability presented new opportunities for businesses. New types of content, including video, audio, and social, blur the lines of a traditional ECM.

- Microsoft SharePoint offers many tools to build an ECMS with solid document management and other SharePoint facilities. Customers look for strong internal integration with systems and document management, and as per various players, SharePoint offers a strong toolkit for customizing an ECMS.

- The cloud-based services exhibit the potential to provide cost-effective, flexible, easy-to-manage, and authoritative resource facilities over the internet. Cloud-based ECM services upsurge the capabilities of hardware resources through optimal and shared utilization. These features encourage organizations and individual users to shift their services and applications to the cloud.

- Cloud is essential for document collaboration tools, and tools like Office 365 provide features such as cloud collaboration. Employees in the modern workplace no longer accept adequate pay and perks as sufficient. They seek out working places where they may advance their careers and learn. Over 3/4 of workers, according to a study by Capital One, a bank holding company, perform better in collaborative work environments. The penetration rate is also increasing with automation trends, which has become increasingly important for enterprises looking for solutions offering services.

- Further, Compliant Office is an easy-to-use and regulatory-compliant service for both public and private sector organizations, which features high-security standards while still providing opportunities for digital innovation. Across the EU, politicians, the public sector, and industry organizations have been very vocal about their need for cloud services. There has been much debate and discussion about the legality of their usage. Some public organizations even conducted their risk assessments and actively decided not to comply with current legislation.

North America is Expected to Hold a Majority Share

- North America is expected to dominate the business productivity software market. The early adoption of technological advancements has majorly driven the growth in this market. North America is the most mature market in terms of cloud computing services adoption or AI and IoT adoption due to several factors, such as the presence of many enterprises with advanced IT infrastructure and the availability of technical expertise.

- The major productivity software vendors, like Amazon Web Services Inc. (US), Microsoft (Office 365), Google, etc., are based in this region, so there is strong competition. Also, North America's strong financial position enables it to invest heavily in advanced solutions and technologies. These advantages have provided regional organizations with a competitive edge in the market.

- The market for productivity management software is anticipated to develop due to the rise in cloud-based technology use. Through connected devices, cloud-based technology offers access to stored files. By decreasing employee downtime and increasing productivity, cloud-based technology aids in the management of productivity.

- For instance, 94% of businesses will use cloud-based technology for productivity management in 2021, according to Flexera, a US-based company that makes productivity management software. As a result, the market for productivity management software is driven by the growth in the usage of cloud-based technologies.

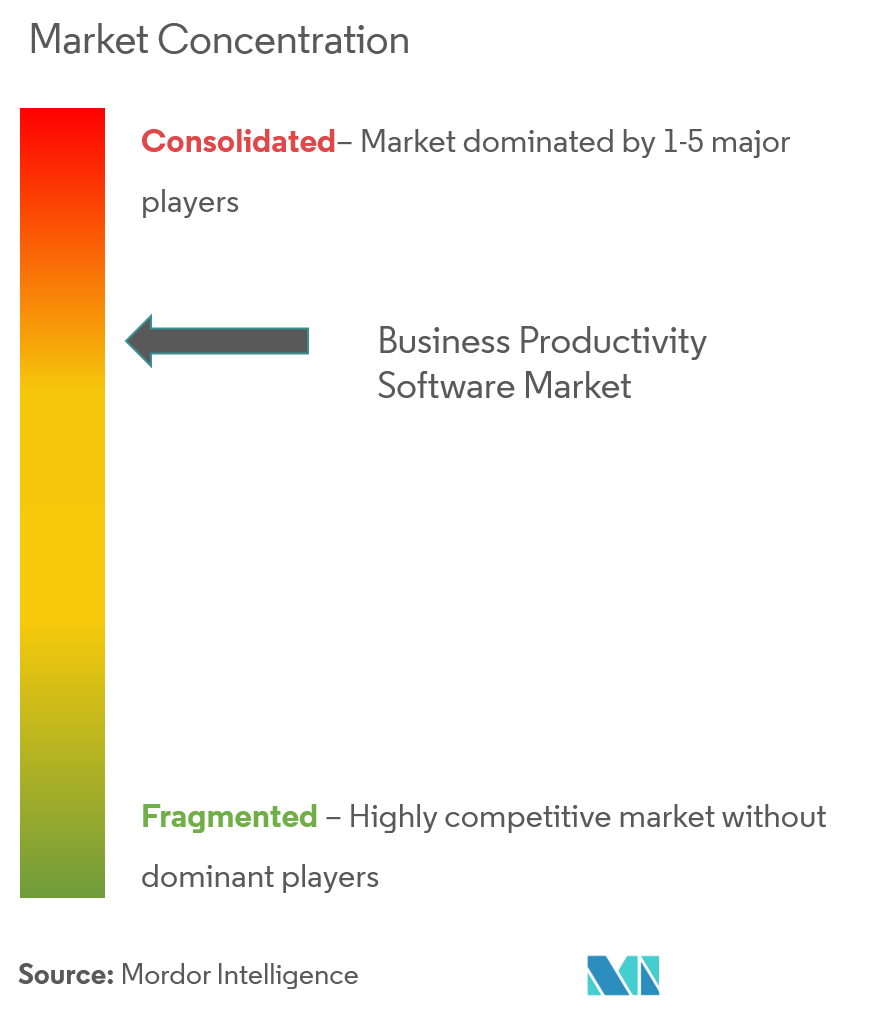

Business Productivity Software Industry Overview

The business productivity software market is highly competitive and consists of several major players. Few of the major players currently dominate the market share. These major players with a prominent market share focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In February 2022, a US-based software startup called Pendo introduced Pendo Adopt, a productivity management program. This program aids an organization's staff to improve their performance, which raises productivity.

Business Productivity Software Market Leaders

-

Microsoft Corporation

-

Google LLC

-

Oracle Corporation

-

Broadcom Inc. (Symantec Corporation)

-

SAP SE

*Disclaimer: Major Players sorted in no particular order

Business Productivity Software Market News

- May 2022 - Microsoft released Designer, a straightforward visual design app, for free and as a component of subscriptions to its Office productivity suite. The program is a substitute for Canva, a creative tool with more than 100 million active monthly users.

- September 2022 - Canva, an online platform for visual design and publishing, announced plans to add a new Office software suite to its product lineup. Canva Visual Worksuite is promoted as an all-in-one visual communication platform with a built-in website builder, web apps for making documents and presentations, tools for editing videos, and tools for swiftly creating social network postings. Canva Docs' goal is to provide customers and organizations with a complete document editor focusing on design features. Like Google Docs, it can be accessed online from a computer or mobile device and offers collaborative tools like comments and task assignments.

Business Productivity Software Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increase in Smartphone Penetration and Increased Adoption of BYOD

- 4.2.2 Growing Demand for Cloud Computing, Business Intelligence, and AI

- 4.2.3 Growing Need for Data Management

-

4.3 Market Restraints

- 4.3.1 High Installation and Training Costs

-

4.4 Industry Attractiveness - Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 Deployment

- 5.1.1 On-premise

- 5.1.2 On-cloud

-

5.2 Organization Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

-

5.3 End User Industry

- 5.3.1 BFSI

- 5.3.2 Telecommunication

- 5.3.3 Manufacturing

- 5.3.4 Media and Entertainment

- 5.3.5 Transportation

- 5.3.6 Retail

- 5.3.7 Other End User Industries

-

5.4 Solutions

- 5.4.1 Content Management and Collaboration

- 5.4.2 Asset Creation

- 5.4.3 AI and Predictive Analytics

- 5.4.4 Structured Work Management

- 5.4.5 Other Solutions

-

5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles*

- 6.1.1 Microsoft Corporation

- 6.1.2 Google LLC

- 6.1.3 Oracle Corporation

- 6.1.4 Broadcom Inc. (Symantec Corporation)

- 6.1.5 SAP SE

- 6.1.6 Salesforce.com Inc.

- 6.1.7 VMware Inc.

- 6.1.8 IBM Corporation

- 6.1.9 Amazon.com Inc.

- 6.1.10 AppScale Systems Inc.

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBusiness Productivity Software Industry Segmentation

Business productivity software maximizes productivity by enhancing employee productivity, by optimizing time and expenditure on the task or business process. Business productivity software helps employees optimize their workflow using various employee-friendly, reliable, and compatible analytical tools and generates reports with advanced management features.

The Business Productivity Software Market is segmented by Deployment (On-premise, Cloud), Organization Size (Small and Medium Enterprises, Large Enterprises), Solutions (Content Management and Collaboration, Asset Creation, AI, Predictive Analytics, Structured Work Management), End User Industry (BFSI, Telecommunications, Manufacturing, Media and Entertainment, Transportation, Retail), and Geography.

The market sizes and forecasts are provided regarding value (USD million) for all the above segments.

| Deployment | On-premise |

| On-cloud | |

| Organization Size | Small and Medium Enterprises |

| Large Enterprises | |

| End User Industry | BFSI |

| Telecommunication | |

| Manufacturing | |

| Media and Entertainment | |

| Transportation | |

| Retail | |

| Other End User Industries | |

| Solutions | Content Management and Collaboration |

| Asset Creation | |

| AI and Predictive Analytics | |

| Structured Work Management | |

| Other Solutions | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World |

Business Productivity Software Market Research FAQs

How big is the Business Productivity Software Market?

The Business Productivity Software Market size is expected to reach USD 59.27 billion in 2024 and grow at a CAGR of 15.25% to reach USD 120.52 billion by 2029.

What is the current Business Productivity Software Market size?

In 2024, the Business Productivity Software Market size is expected to reach USD 59.27 billion.

Who are the key players in Business Productivity Software Market?

Microsoft Corporation, Google LLC, Oracle Corporation, Broadcom Inc. (Symantec Corporation) and SAP SE are the major companies operating in the Business Productivity Software Market.

Which is the fastest growing region in Business Productivity Software Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Business Productivity Software Market?

In 2024, the North America accounts for the largest market share in Business Productivity Software Market.

What years does this Business Productivity Software Market cover, and what was the market size in 2023?

In 2023, the Business Productivity Software Market size was estimated at USD 51.43 billion. The report covers the Business Productivity Software Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Business Productivity Software Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the major challenges faced by the Productivity Management Software Market?

Key challenges faced by the Productivity Management Software Market include: a) Data security concerns b) High implementation costs c) Resistance to change from traditional practices

Business Productivity Software Industry Report

The global productivity management software market is on a remarkable growth trajectory, fueled by the adoption of cutting-edge technologies like cloud computing, Artificial Intelligence (AI), and Internet of Things (IoT). This burgeoning market, detailed in Mordor Intelligence™ Industry Reports, spans various segments including solutions, deployment types, and organization sizes across diverse industries such as Banking, Financial Services and Insurance (BFSI), IT & Telecom, healthcare, and retail. Key solutions like content management, AI-driven predictive analytics, and structured work management are gaining traction, especially cloud-based deployments, to boost business efficiency. The integration of cognitive collaboration, leveraging AI and machine learning, is revolutionizing communication processes, complemented by the rise of smart virtual assistants and chatbots for task automation and enhanced service delivery. North America leads in market share due to its technological prowess, while the Asia Pacific region emerges as the fastest-growing market, spurred by digital transformation efforts. The market's expansion is also supported by the increasing use of smart devices and the BYOD trend, underscoring a robust growth outlook. For a comprehensive analysis, including market share, size, revenue growth rate, and a forecast outlook, access a free report PDF download from Mordor Intelligence™ Industry Reports, offering valuable insights into the global productivity management software market's future.