Chipless RFID Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 28.00 % |

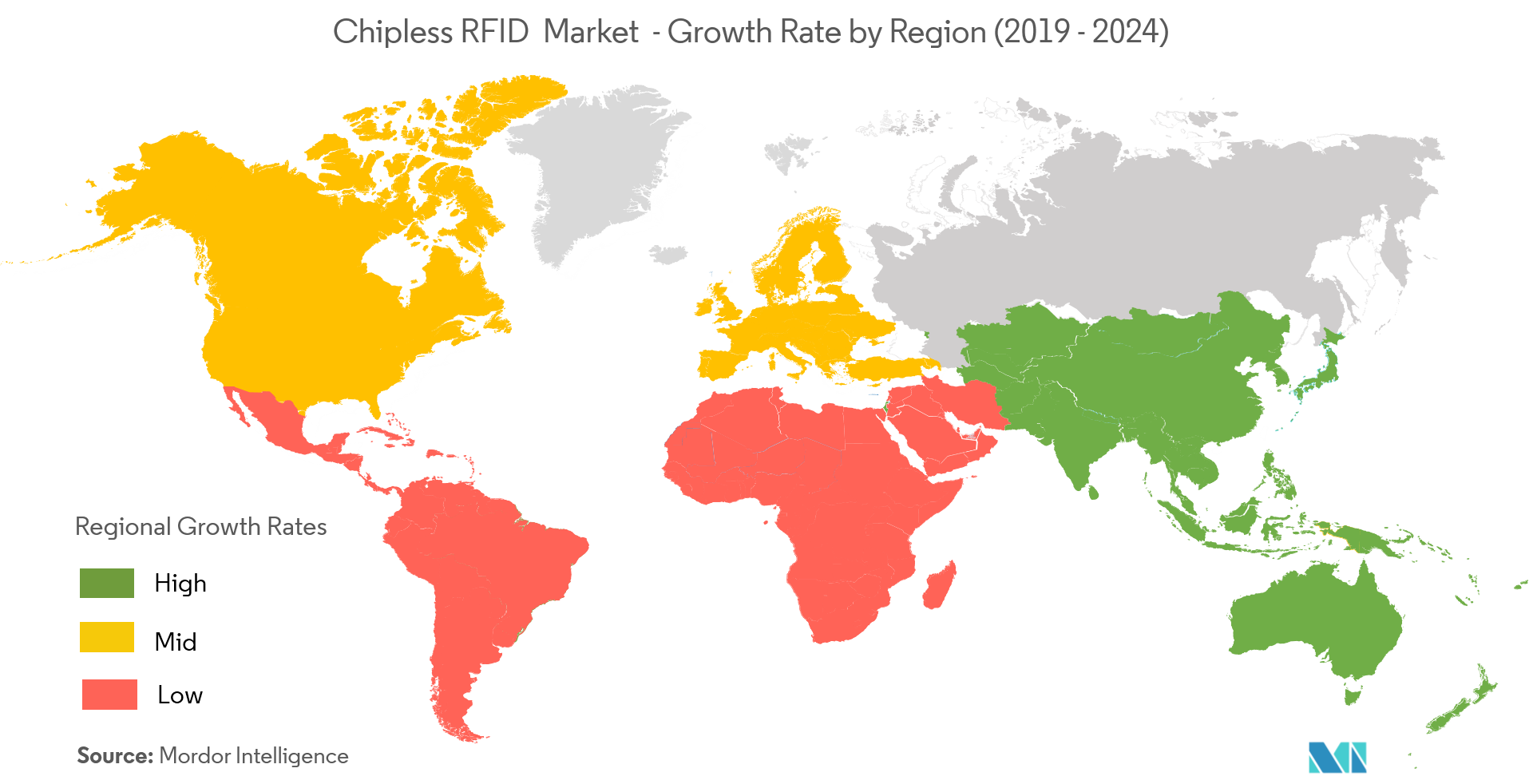

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

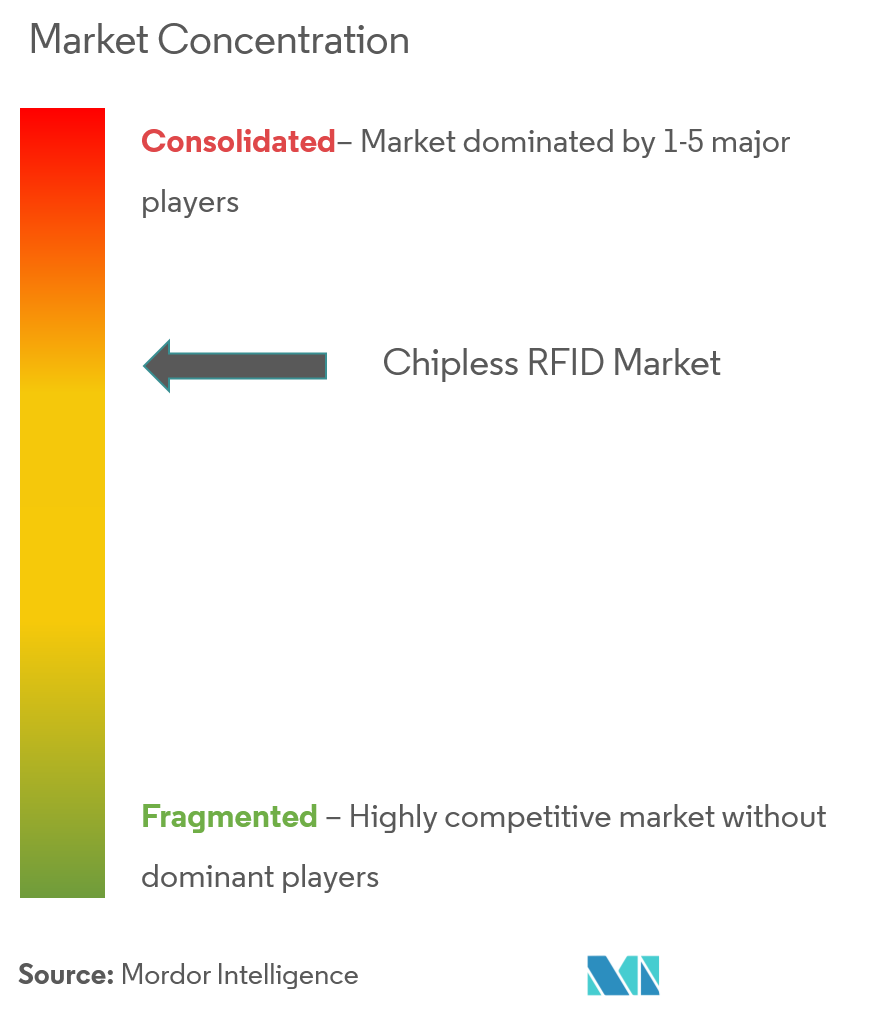

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Chipless RFID Market Analysis

The Chipless RFID Market was valued at USD 0.89 billion in 2020 and is expected to reach USD 3.94 billion by 2026 and work at a CAGR of 28% over the forecast period 2021-2026. Technological advancements have led to new approaches within RFID technology, like microprocessors with 5.8 GHz tags for smart cards and chipless IDs that enable contactless communication even in the absence of a silicon chip.

- The chipless RFID technology has emerged as a lowcost alternative for chipped RFID system and has the potential to penetrate mass markets for lowcost item tagging, considering the high cost of silicon chip RFID transponders compared to optical barcodes. Thus, problems of achieving low-cost chipped RFID are presented with the proposed solution of chipless RFID for lowering the price of the RFID tag.

- For instance, in August 2018, the UC San Diego Jacobs School of Engineering and the Center for Wireless Communications at UC San Diego announced their chipless ID technology that can reflect WiFi signals. The chipless RFID technology released by them is in the form of metal tags made from copper foil printed on thin, flexible substrates, like paper.

- The Institute of Electrical and Electronics Engineers (IEEE) estimated that by 2020, more than 50 billion objects will be networked, of which many will use chipless RFID. With IoT being implemented in the supply chain across the pharmaceutical, manufacturing and other logistics industries, such statistics substantiate the market potential over the forecast period.

Chipless RFID Market Trends

This section covers the major market trends shaping the Chipless RFID Market according to our research experts:

Healthcare Sector to Contribute Significantly to the Market Growth

- For e-healthcare, chipless 2GRFID-Sys integrates diverse wireless networking technologies, such as wireless body area networks and wireless LANs, which use body sensors for monitoring the medical conditions of a patient. This helps in diagnosis assistance and action handling.

- Furthermore, to keep a track on an ambulatory patient who might face a critical situation while traveling to a location outside his/her hometown, chipless 1G-RFID-Sys are being employed in the patient’s ID. These chipless 1G-RFID-Sys tags help to identify the emergence of the situation from the patient’s medical history.

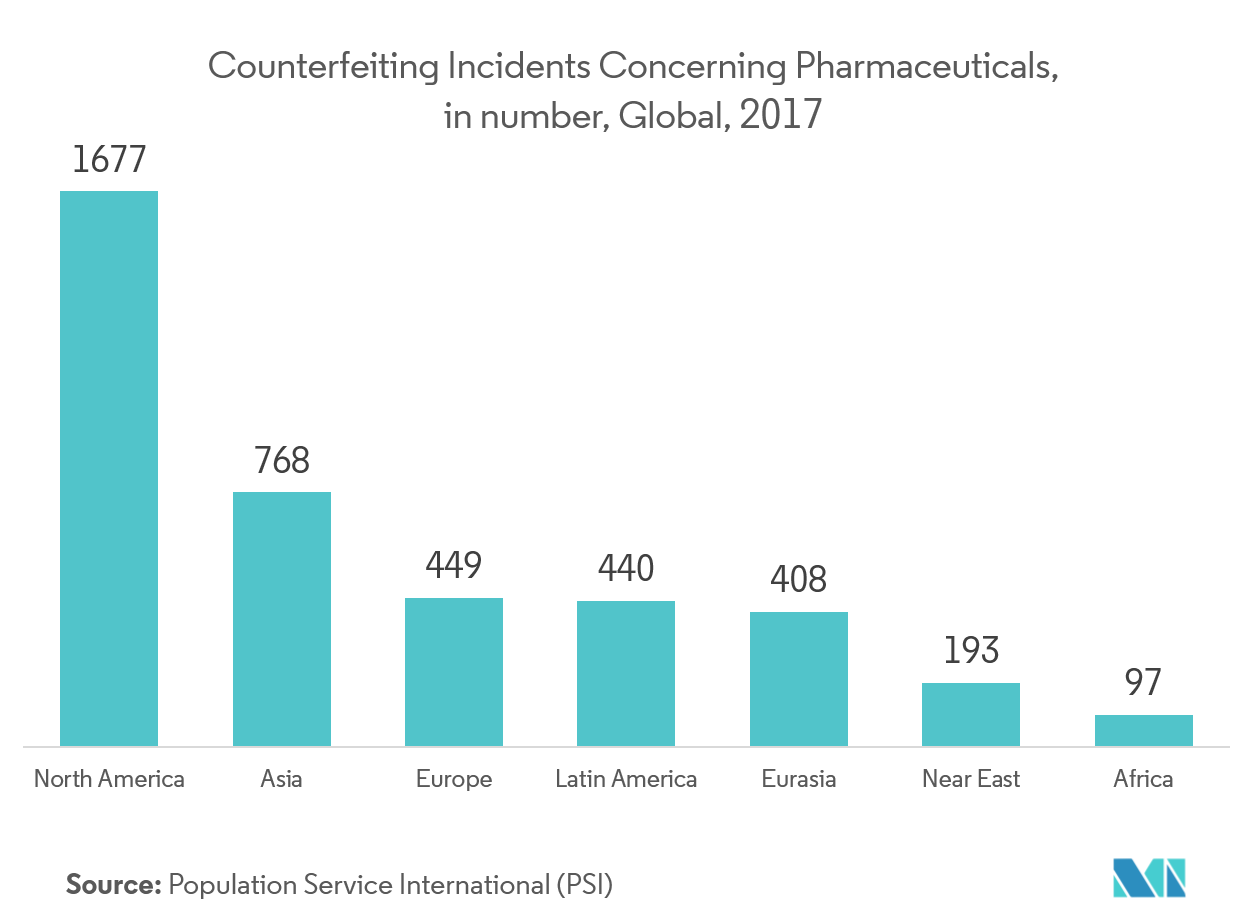

- Moreover, due to the lack of vigilance and advocacy by healthcare providers, lack of legal protection and technology to identify genuine drugs, there is an increase in drug counterfeiting. As traditional RFID with barcode technology cannot prevent counterfeiting drugs, in many healthcare sectors the R&D department is putting efforts to produce chipless RFID devices, which are cheap and could be used to combat this universal burning issue of the healthcare industry.

- As the pharmaceutical sector is moving toward contract packaging, significant efforts are being made by packaging vendors, like BASF, Avery Dennison Group, and Constantia Flexibles Group, in smart packaging levels that would prompt serialization. With such industry focus, the future of chipless RFID is set to be prominent.

Asia-Pacific Expected to Register the Fastest Growth

- In China, many companies are investing to revolutionize the retail industry in the country. For instance, in April 2018, Tencent showcased the working of Unmanned retail wherein if a consumer grabs a product from the shop and walks out of the store, the RFID chip will scan the item and sends the bill to the customer’s WeChat application.

- In addition, Japan is also planning to introduce next-generation in-store experience through the introduction of RFIDs. For instance, in April 2017, Seven-Eleven Japan announced the introduction of next-generation self-checkout.

- Further, in India, the rise in per capita income and the increasing requirements for appliances, such as smartwatches is propelling chipless RFID market. The growing adoption of thin-film battery in India, which needs portable electronic appliances by the application of printed and chipless RFID is penetrating the market growth.

Chipless RFID Industry Overview

The chipless RFIDmarketconsists of a few major players operating in the market. The mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- April 2019:Alien Technology,announcedHiggs-9 IC, the first release of its next-generation of Higgs RFID semiconductor integrated circuits.Higgs-9 enables enterprise-critical applications to run faster, smarter and with quicker ROI in RFID deployments.

- April 2019:Avery Dennison, in a partnership with Kit Check, aimed for implementation ofRFID technology for big pharma. This collaborationwillhelppharmaceutical companies to build into their medication labels, thereby enabling the tracking of each product from the point of manufacture until after it arrives at a hospital.

Chipless RFID Market Leaders

-

Alien Technology Corporation

-

Zebra Technologies Corporation

-

Variuscard GmbH

-

Avery Dennison Corporation

-

NXP Semiconductors NV

*Disclaimer: Major Players sorted in no particular order

Chipless RFID Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

-

5.2 Market Drivers

- 5.2.1 Manufacturing Advantages of Chipless RFIDs

- 5.2.2 Rising Utilization of Access Control and Security Application

-

5.3 Market Restraints

- 5.3.1 High Initial Installation Cost and Device Interoperability

6. TECHNOLOGY OVERVIEW

-

6.1 Printing Technologies

- 6.1.1 Inkjet Printed Technology

- 6.1.2 Screen Printed Technology

- 6.2 Flexible Hybrid Electronics Overview

- 6.3 Printed Electronics Overview

7. MARKET SEGMENTATION

-

7.1 By Product Type

- 7.1.1 Tag

- 7.1.2 Reader

- 7.1.3 Middleware

-

7.2 By Application

- 7.2.1 Smart Cards

- 7.2.2 Smart Tickets

- 7.2.3 Other Applications

-

7.3 By End-user Industry

- 7.3.1 Retail

- 7.3.2 Healthcare

- 7.3.3 Logistics and Transportation

- 7.3.4 BFSI

- 7.3.5 Other End-user Industries

-

7.4 Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia-Pacific

- 7.4.4 Rest of the World

8. COMPETITIVE LANDSCAPE

-

8.1 Company Profiles

- 8.1.1 Alien Technology Corporation

- 8.1.2 IDTRONIC GmbH

- 8.1.3 Zebra Technologies

- 8.1.4 Variuscard GmbH

- 8.1.5 Avery Dennison

- 8.1.6 NXP Semi Conductors

- *List Not Exhaustive

9. INVESTMENT ANALYSIS

10. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityChipless RFID Industry Segmentation

Chipless RFID (Radio Frequency Identification) is an emerging disruptive wireless technology for identification, tracking, and sensing. A chipless RFID tag does not contain an application specific integrated circuit (ASIC), hence the reader does all signal processing to read the tag. Chipless RFID tags are low-cost passive microwave/millimeter wave circuits where the information is stored in printable resonators and delay lines and typically implemented in flexible substrates such as polymers and papers, like optical barcodes.

| By Product Type | Tag |

| Reader | |

| Middleware | |

| By Application | Smart Cards |

| Smart Tickets | |

| Other Applications | |

| By End-user Industry | Retail |

| Healthcare | |

| Logistics and Transportation | |

| BFSI | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Chipless RFID Market Research FAQs

What is the current Chipless RFID Market size?

The Chipless RFID Market is projected to register a CAGR of 28% during the forecast period (2024-2029)

Who are the key players in Chipless RFID Market?

Alien Technology Corporation, Zebra Technologies Corporation, Variuscard GmbH, Avery Dennison Corporation and NXP Semiconductors NV are the major companies operating in the Chipless RFID Market.

Which is the fastest growing region in Chipless RFID Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Chipless RFID Market?

In 2024, the North America accounts for the largest market share in Chipless RFID Market.

What years does this Chipless RFID Market cover?

The report covers the Chipless RFID Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Chipless RFID Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Chipless RFID Industry Report

Statistics for the 2024 Chipless RFID market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Chipless RFID analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.