Crop Monitoring Technology in Precision Farming Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 12.60 % |

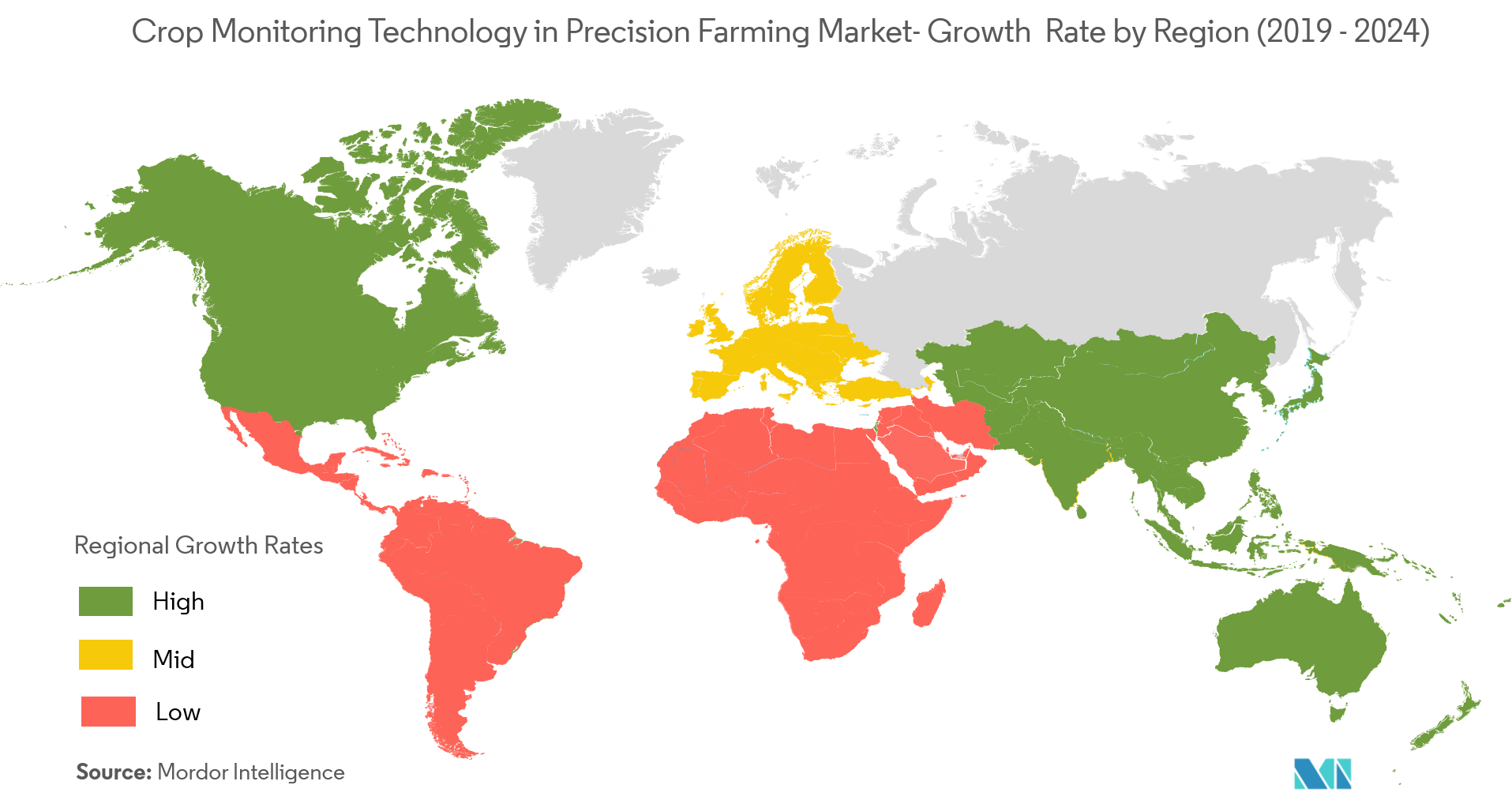

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Crop Monitoring Technology in Precision Farming Market Analysis

The crop monitoring technology in the precision farming market is expected to register a CAGR of 12.6%, during the forecast period (2021 - 2026). As technology has been evolving since its inception, crop monitoring is increasingly becoming critical for making the best use of geospatial technologies and site-specific crop management practices.

- The convergence of IT with agriculture, coupled with government initiatives and decline in sensor prices, is driving the growth of the market.

- A growing number of applications for telematics in agriculture are anticipated to drive the demand for crop monitoring over the forecast period. Telematics services include tracking devices using Global Navigation Satellite System (GNSS) to show the position of the equipment for management purposes.

- The adoption for these solutions is found to be high in areas where labor costs are high and land costs are relatively inexpensive.

- The increasing demand for UAVs and the recent success of precision farming in increasing the productivity of major crops are expected to open up new growth opportunities in the near future.

- Further, measures taken by various governments to meet the increasing food demand is stimulating the market growth. For instance, the US Department of Agriculture, NASA, and NOAA contribute to precision farming, by the development of advanced technologies in GPS navigation. Also, the Indian government provides 100% cost subsidy to Precision Farming Development Centres (PDFCs).

- However, low awareness and high initial costs may hamper the growth of the market. Besides, due to low penetration, presently, the technology is majorly used in developed countries.

Crop Monitoring Technology in Precision Farming Market Trends

This section covers the major market trends shaping the Crop Monitoring Technology in Precision Farming Market according to our research experts:

GPS and GNSS Adoption to Drive the Market Growth

- Miniaturization and improved accuracy of the global navigation satellite system (GNSS) technology (of which, GPS is mostly in use, at present) makes it possible for wide-scale adoption of precision farming technologies for geo-positioning and field mapping.

- The United States is the leading country, in terms of the GNNS/GPS technology used in agriculture. Nearly 70% of the advanced technologies in the US farms are using some level of GPS/GNSS.

- GPS-based applications in precision farming include major areas, such as yield mapping and monitoring, and farm planning, along with field mapping, soil sampling, tractor guidance, crop scouting, variable rate applications.

- Therefore, with increased adoption of GPS and GNSS, coupled with the benefits offered, the demand for crop monitoring is set to increase over the forecast period.

United States to Account for the Largest Share

- As per the estimates of the US Department of Agriculture, nearly 2,029,200 farms in the United States used 950 million acre land, in 2017. With a huge dependency on the agriculture sector, the government in the country is increasingly focusing on implementing precision farming technologies.

- The key agencies responsible for the uprising in large-scale agriculture in the United States include NASA, NOAA, and the US Department of Agriculture. Their goal is to improve farmer’s profitability and reduce the environmental concerns caused due to the application of various chemicals.

- Moreover, although the Federal Aviation Administration (FAA) had laid out restrictions on the flying of drones, as per their new rules passed in 2016. Drones for commercial purposes, weighing up to 55 lb, can be used in the United States during daylight hours. These initiatives have aided the adoption of precision farming in the country.

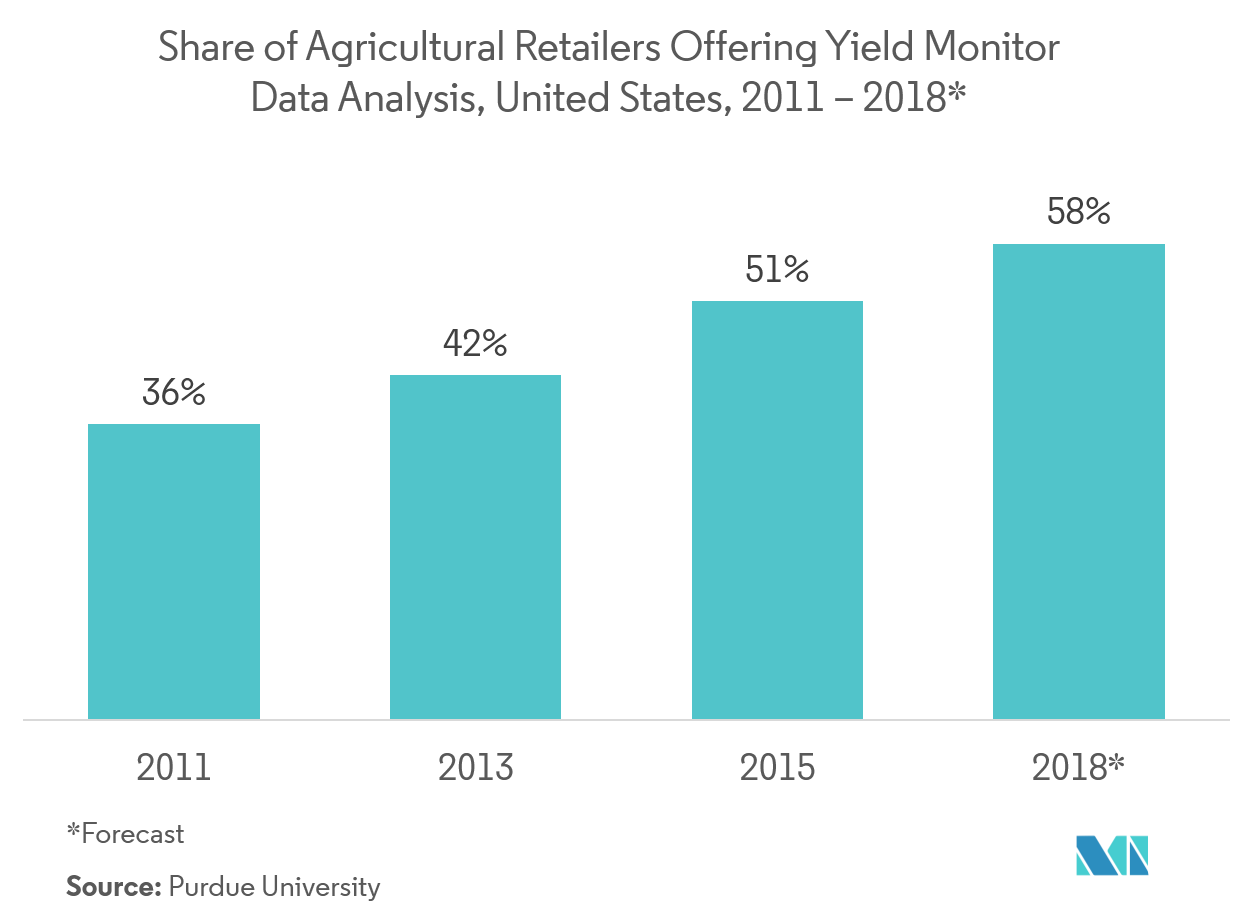

- Further, according to the Farm Profits and Adoption of Precision Agriculture study in 2017, yield mapping is used on about 40% of US corn and soybean acres, GPS soil maps on about 30%, guidance on over 50%, and VRT on 28-34% of acres.

Crop Monitoring Technology in Precision Farming Industry Overview

Market penetration remains fairly moderate and is estimated to grow considerably during the forecast period. A study on the current competitive scenario revealed that more than 50% of the market players relied on strategic acquisitions or R&D collaboration, while other firms focused on expanding product portfolios, to tackle the increasing levels of market penetration. Some key players in the market areAGCO Corporation, AG Junction Inc., John Deere, Dickey-john Corporation, Teejet Technologies Illinois LLC, Raven Industries Inc., Lindsay Corporation, Monsanto Company, Valmont Industries Inc., Yara International ASA, Topcon Precision Agriculture, Trimble Navigation Limited, E.I.Du Pont De Nemours andCompany (Dupont), Land O'lakes Inc., and BASF SE, among others.

- April 2019: Yara International partnered with IBM to combine world-class agronomy and cutting edge technology to develop a digital farming platform which will help farmers worldwide to increase food production.

- June 2018:AGJunction announced the opening of the HandsFreeFarm.com online store, with the aim to bring low-cost, simple-to-use precision agriculture solutions directly to all farmers.

Crop Monitoring Technology in Precision Farming Market Leaders

-

Deere & Company

-

AGCO Corporation

-

AG Junction Inc.

-

Topcon Precision Agriculture

-

Monsanto Company

*Disclaimer: Major Players sorted in no particular order

Crop Monitoring Technology in Precision Farming Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rising Demand for Food Products and Improved Crop Yield

- 4.3.2 Convergence of IT with Agriculture

- 4.3.3 Government Support and Decline in Price of Sensors Aid Adoption

-

4.4 Market Restraints

- 4.4.1 Relatively Low Awareness and Lack af Specialists Remain a Concern

- 4.4.2 High Initial Costs and Sluggish Penetration of Technology

- 4.5 Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Technology

- 5.1.1 Guidance System

- 5.1.2 Remote Sensing

- 5.1.3 Variable Rate Technology

-

5.2 By Solution

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Service

-

5.3 By Application

- 5.3.1 Field Mapping

- 5.3.2 Soil Monitoring

- 5.3.3 Crop Scouting

- 5.3.4 Yield Monitoring

- 5.3.5 Variable Rate Application

- 5.3.6 Other Applications

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 AGCO Corporation

- 6.1.2 AG Junction Inc.

- 6.1.3 Deere & Company

- 6.1.4 Hickey-john Corporation

- 6.1.5 Teejet Technologies Illinois LLC

- 6.1.6 Raven Industries Inc.

- 6.1.7 Lindsay Corporation

- 6.1.8 Monsanto Company

- 6.1.9 Valmont Industries Inc.

- 6.1.10 Yara International ASA

- 6.1.11 Topcon Precision Agriculture

- 6.1.12 Trimble Navigation Limited

- 6.1.13 E. I. Du Pont De Nemours And Company (Dupont)

- 6.1.14 Land O'lakes Inc.

- 6.1.15 BASF SE

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCrop Monitoring Technology in Precision Farming Industry Segmentation

Crop monitoring is the technology that facilitates real-time crop vegetation monitoring via., spectral analysis of high-resolution images for different fields and crops that enables to track positive and negative dynamics of crop development.

| By Technology | Guidance System |

| Remote Sensing | |

| Variable Rate Technology | |

| By Solution | Hardware |

| Software | |

| Service | |

| By Application | Field Mapping |

| Soil Monitoring | |

| Crop Scouting | |

| Yield Monitoring | |

| Variable Rate Application | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Crop Monitoring Technology in Precision Farming Market Research FAQs

What is the current Crop Monitoring Technology in Precision Farming Market size?

The Crop Monitoring Technology in Precision Farming Market is projected to register a CAGR of 12.60% during the forecast period (2024-2029)

Who are the key players in Crop Monitoring Technology in Precision Farming Market?

Deere & Company, AGCO Corporation, AG Junction Inc., Topcon Precision Agriculture and Monsanto Company are the major companies operating in the Crop Monitoring Technology in Precision Farming Market.

Which is the fastest growing region in Crop Monitoring Technology in Precision Farming Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Crop Monitoring Technology in Precision Farming Market?

In 2024, the North America accounts for the largest market share in Crop Monitoring Technology in Precision Farming Market.

What years does this Crop Monitoring Technology in Precision Farming Market cover?

The report covers the Crop Monitoring Technology in Precision Farming Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Crop Monitoring Technology in Precision Farming Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Crop Monitoring Technology in Precision Farming Industry Report

Statistics for the 2024 Crop Monitoring Technology in Precision Farming market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Crop Monitoring Technology in Precision Farming analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.