Handheld Thermal Imaging Equipment Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.34 % |

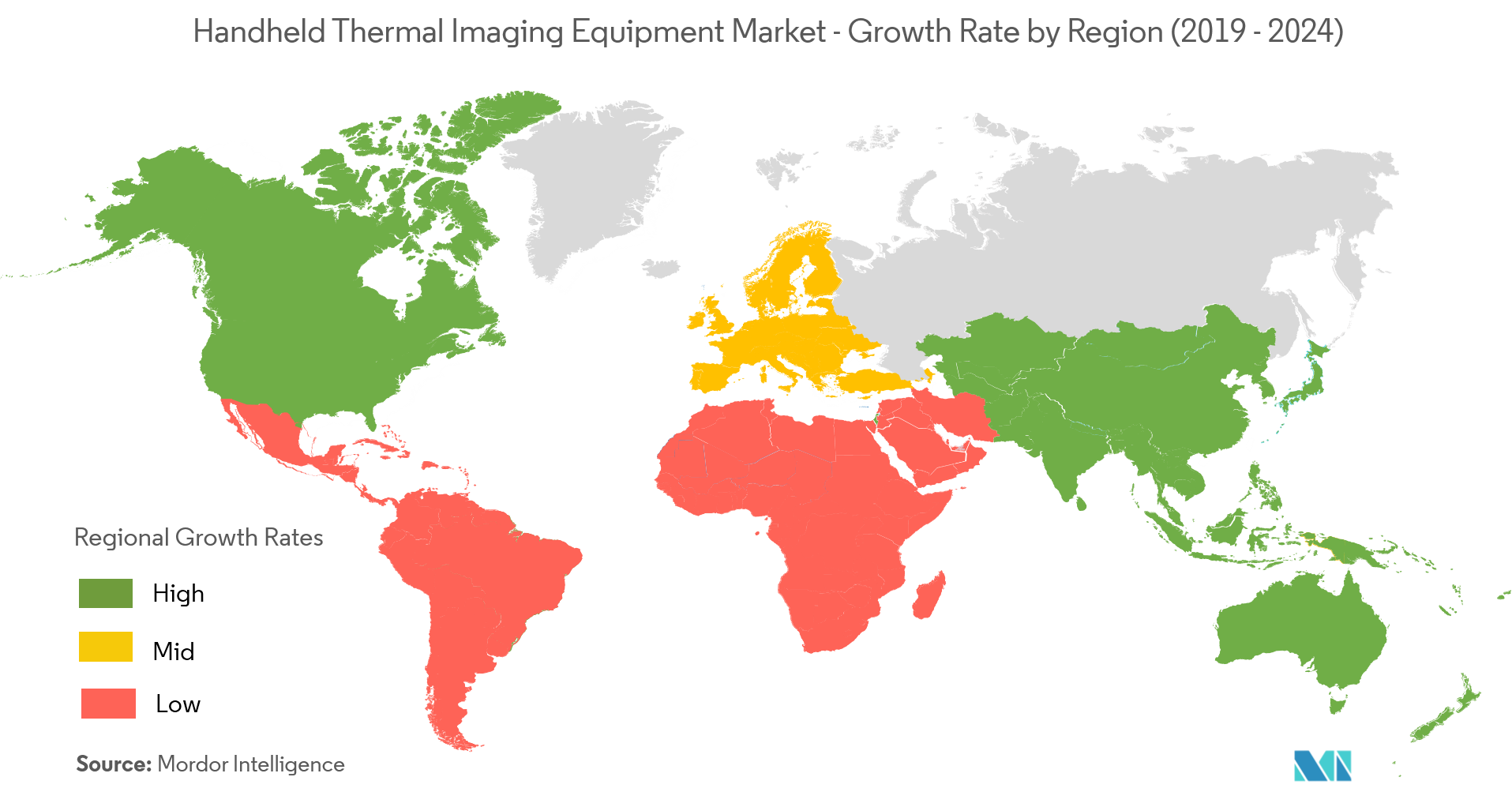

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

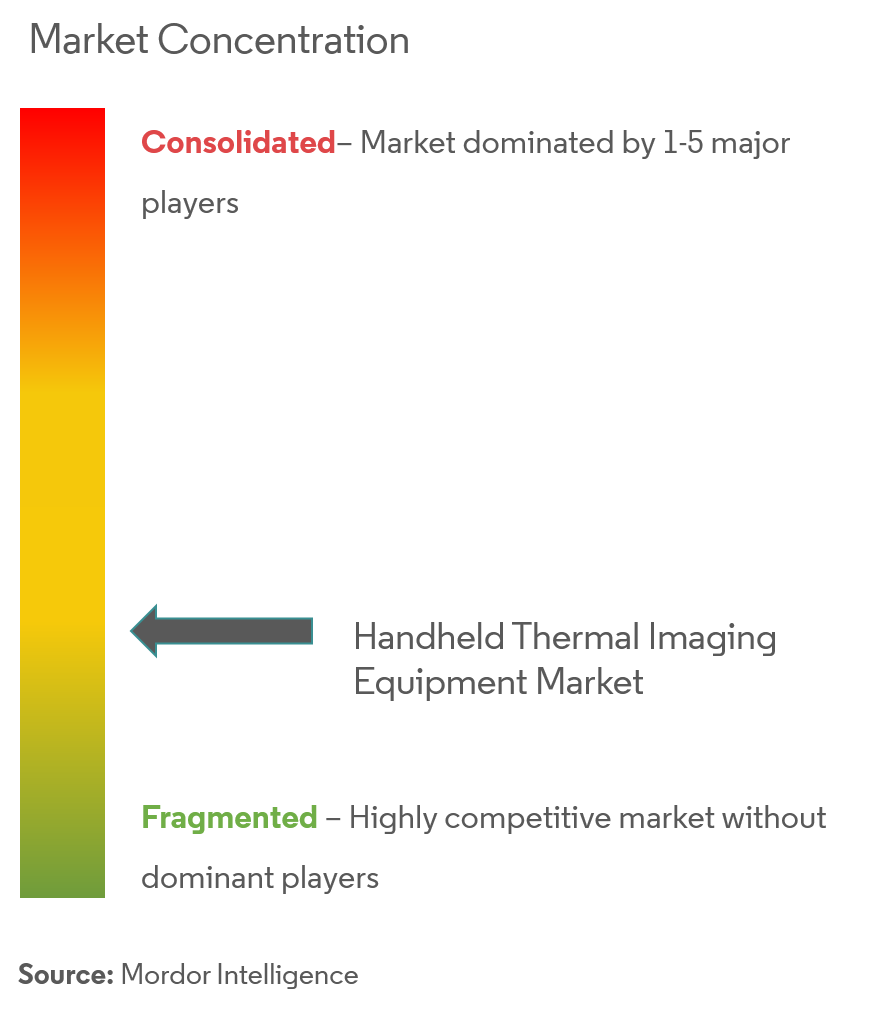

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Handheld Thermal Imaging Equipment Market Analysis

The Handheld Thermal Imaging Equipmen market is expected to grow at a CAGR of 9.34% over the forecast period (2021 - 2026). Handheld thermal imaging equipment gives a tactical advantage in the field, providing clear images in total darkness.

- Further, the advent of smartphones as a cost-effective hand-held/portable thermal imaging devices is expected to increase the adoption of technology. The companies, like Caterpillar(Cat), have integrated FLIR's thermal imaging camera in the Cat S60 and the latest Cat S61 smartphones.

- Moreover, electrical installations in buildings like an office complex, residential complex, or shopping complex like a mall, are mostly located at places with poor air ventilation. Again, it requires an effective maintenance schedule to avoid any mishap. Various surveys in different sectors have shown that predictive maintenance using thermal imaging has saved up to an average of 40% of the maintenance cost and 50% of downtime of the plant process. These factors have a positive outlook on the handheld thermal imaging equipment market.

- However, export restrictions and additional detailing required for longwave infrared cameras restrain the growth of the thermal imaging market.

Handheld Thermal Imaging Equipment Market Trends

This section covers the major market trends shaping the Handheld Thermal Imaging Equipment Market according to our research experts:

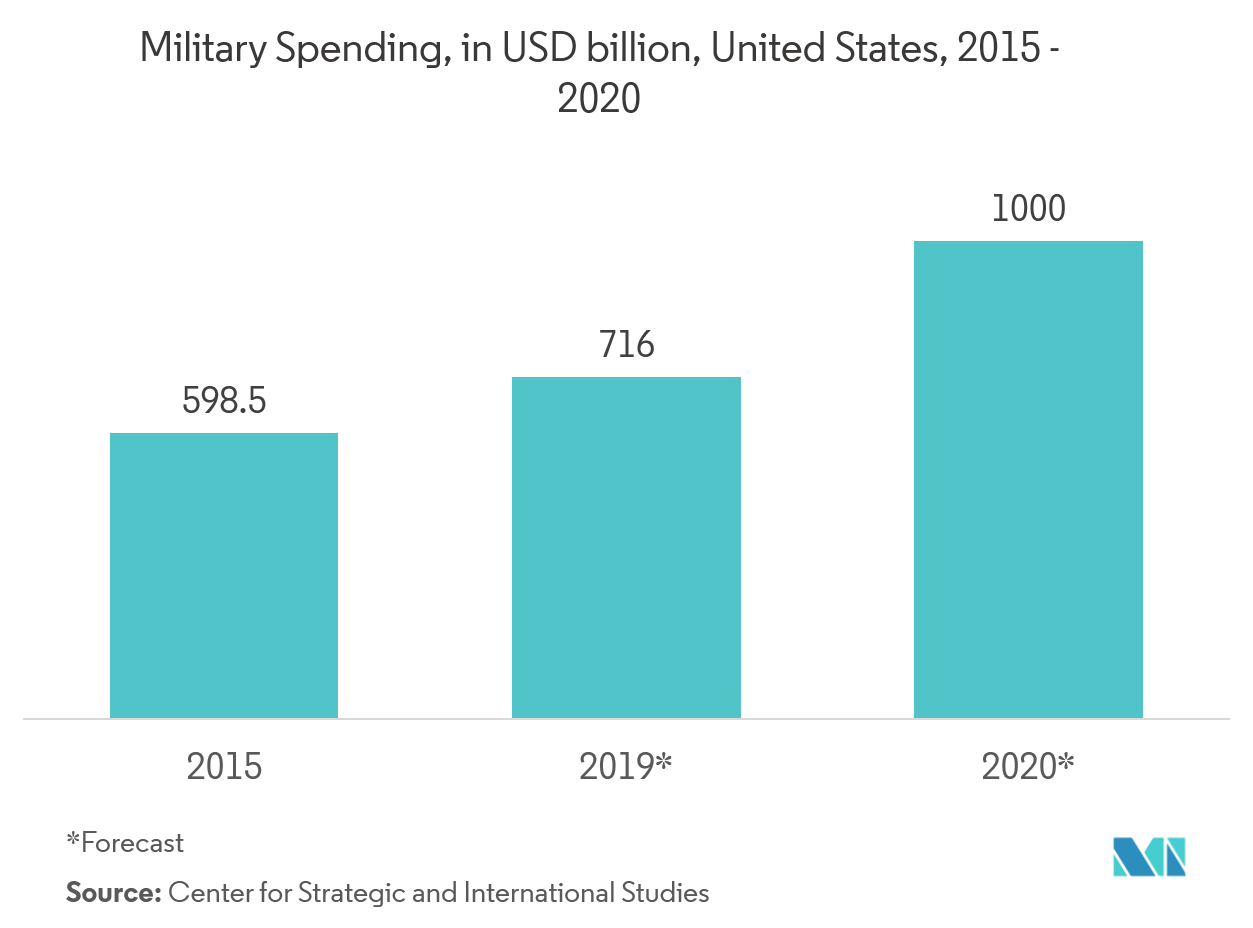

Aerospace and Defense Sector Offers Potential Growth

- Handheld thermal imaging is popularly used by the army and navy for border surveillance and law enforcement. It is also used in ship collision avoidance and guidance systems. In the aviation industry, it has greatly mitigated the risks of flying in low light and night conditions.

- Whether a firefighter, a law enforcement officer or a member of a search and rescue team, handheld thermal imagers give you a tactical advantage in the field, providing clear images in total darkness. Delivering mission-critical information which can save lives, these rugged and portable systems reveal the location of victims and suspects alike.

- Many technological advancements are first tried out by the army. The lack of visual range makes them susceptible to improvised explosive device (IED) attacks and ambushes. So the army and other military activities always look for solutions that can provide them with active, 360° surveillance available solutions, which consist of multi-sensor surveillance systems made up of sub-cameras and thermal imaging cameras for route clearance and reconnaissance missions.

- For instance, in February 2018, FLIR Systems Inc. launched the FLIR M232 marine thermal night vision camera that belongs to the FLIR M100 and M200 series. It is an efficient tilt marine thermal night vision camera that received a Design Award Special Mention ( DAME ) accolade in the ‘Marine Electronics and Marine Related Software’ category.

Asia-Pacific to Witness the Fastest Growth

- The growth in Asia-Pacific is attributed to the military strengthening activities being undertaken in the region, mainly in China and India. China planned to boost its military spending by 8.1% in 2018, as it is aiming to bring in an ambitious modernization drive for its armed forces further.

- Moreover, China has also emerged as a technology hub and has achieved a breakthrough in the technological inventions to make equipment that is useful for military purposes to compete with US technologies. It was even observed that the country is now providing Russia with thermal imaging equipment that is important for Russia.

- Further, India is also witnessing the advent of advanced technology startups in the defense sector. The company, Tonbo Imaging, is developing a lightweight thermal imaging device called ‘Cobra’ and a dual-sensor thermal weapon named ‘Arjun’.These are incorporated with an inbuilt wireless video interface.

- These factors are anticipated to contribute to the growth of the handheld thermal imaging cameras market for the defense sector, owing to their extensive use in border surveillance.

Handheld Thermal Imaging Equipment Industry Overview

The handheld thermal imaging equipment market is fragmented due to the presence of several players, such as Flir Systems Inc.,BAE Systems plc.,American Technologies Network among others. Product launches, high expense on research and development, partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies to sustain the intense competition in this market.

- April 2019 -FLIR announced its new product for public safety applications, the FLIR K1 handheld thermal imaging camera (TIC). The company claimed the equipment to be FLIR’s most affordable(USD 599) TIC for first responder officers and fire investigators, as these are designed to provide visibility through smoke in wildland fire control, searchand rescue missions, structure damage evaluation, and investigative work.

- January 2019 -FLIR, at the SHOT Show 2019, introduced Scion Professional Thermal Monocular(PTM) for public safety professionals. This equipment will replace the FLIR H-Series monocular thermal cameras

Handheld Thermal Imaging Equipment Market Leaders

-

Flir Systems Inc.

-

BAE Systems plc.

-

Leonardo DRS

-

American Technologies Network

-

Raytheon Company

*Disclaimer: Major Players sorted in no particular order

Handheld Thermal Imaging Equipment Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Application Across Various Sectors

-

4.4 Market Restraints

- 4.4.1 Higher Device Cost

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By End-user Industry

- 5.1.1 Defence

- 5.1.2 Public Safety

- 5.1.3 Industrial (Oil and Gas, Utility, etc.)

- 5.1.4 Other End-user Industries

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Flir Systems Inc.

- 6.1.2 BAE Systems PLC

- 6.1.3 Thales Group

- 6.1.4 Safran Electronics and Defense

- 6.1.5 Elbit Systems Ltd

- 6.1.6 Seek Thermal Inc.

- 6.1.7 Fluke Corporation

- 6.1.8 American Technologies Network Corporation

- 6.1.9 Thermoteknix Systems Ltd

- 6.1.10 Raytheon Company

- 6.1.11 Leonardo DRS

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHandheld Thermal Imaging Equipment Industry Segmentation

Unlike the ordinary night vision gadgets, handheld thermal imaging equipment or infrared cameras do not rely on amplification of light and hence, can be used where visual camouflage or any other factor that may hinder the vision, say fog or smoke. The major application of handheld thermal imaging is with the defense and security sector. Moreover, it also made its way into the academic sector for research-related purpose, manufacturing, retail, and other sectors mainly for planned preventive maintenance, quality control, energy conservation, and environmental control.

| By End-user Industry | Defence |

| Public Safety | |

| Industrial (Oil and Gas, Utility, etc.) | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Handheld Thermal Imaging Equipment Market Research FAQs

What is the current Handheld Thermal Imaging Equipment Market size?

The Handheld Thermal Imaging Equipment Market is projected to register a CAGR of 9.34% during the forecast period (2024-2029)

Who are the key players in Handheld Thermal Imaging Equipment Market?

Flir Systems Inc., BAE Systems plc., Leonardo DRS, American Technologies Network and Raytheon Company are the major companies operating in the Handheld Thermal Imaging Equipment Market.

Which is the fastest growing region in Handheld Thermal Imaging Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Handheld Thermal Imaging Equipment Market?

In 2024, the North America accounts for the largest market share in Handheld Thermal Imaging Equipment Market.

What years does this Handheld Thermal Imaging Equipment Market cover?

The report covers the Handheld Thermal Imaging Equipment Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Handheld Thermal Imaging Equipment Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Handheld Thermal Imager Industry Report

Statistics for the 2024 Handheld Thermal Imager market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Handheld Thermal Imager analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.