Hazardous Location Motor Starters Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.25 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

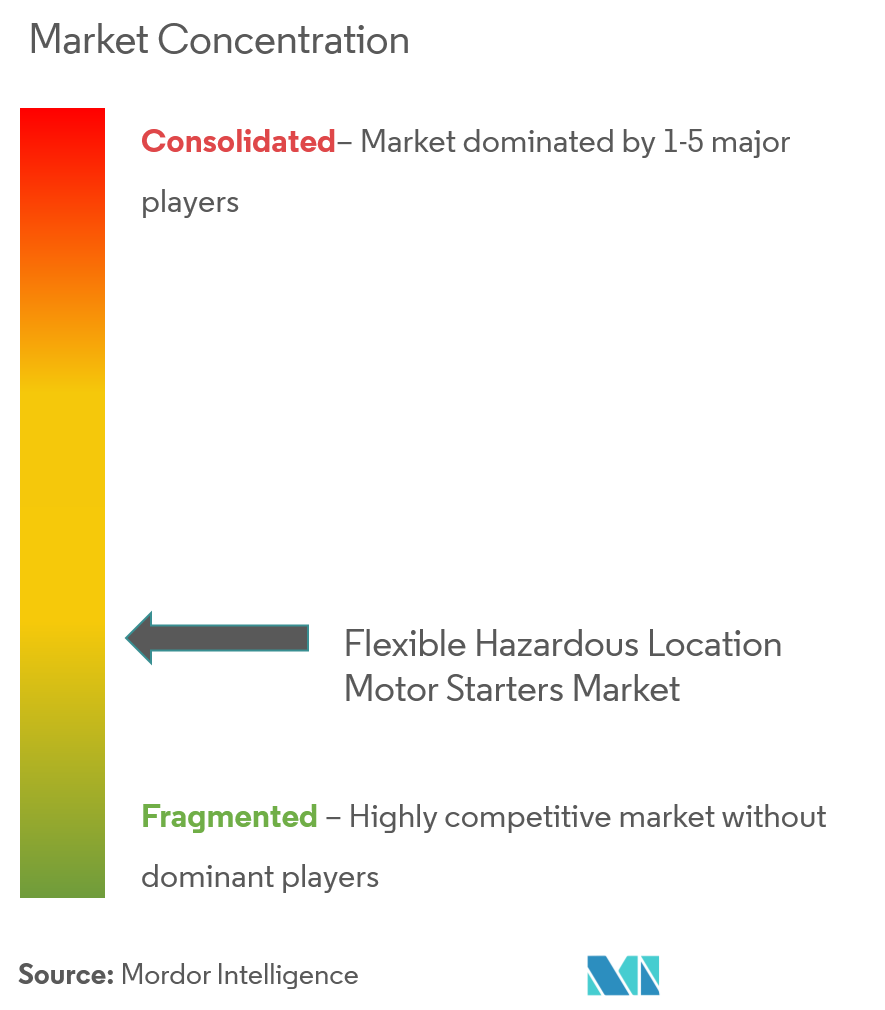

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Hazardous Location Motor Starters Market Analysis

The hazardous location motor starters market is expected to register a CAGR of 5.25% over the forecast period (2021-2026). Major offshore oil and gas developments, new oil discoveries, coupled with an increasing focus on deepwater drilling activities and rising expenditures in the water and wastewater industry, are the major opportunities for the market to grow in the future.

- Due to technological advancements, the need for integrated servo and brushless explosion-proof motors has increased, due to the growing robotic and automation technologies in industries. Majority of these robotics and automation activities are carried out in potentially explosive atmospheres, which are driving the market.

- Growing demand for instruments used for protection against thermal overload is driving the market as instantaneous over-current is usually the result of fault conditions. Bimetallic overload relay and time overcurrent relay are the motor protection relay used in high voltage area and provide various features, such as short circuit protection, locked rotor protection, etc.

- The major restraints faced by the market are related to the manufacturing of starters as they cannot withstand the most unlikely of weather conditions and corrosive environments, which is a challenge in the market.

Hazardous Location Motor Starters Market Trends

This section covers the major market trends shaping the Hazardous Location Motor Starters market according to our research experts:

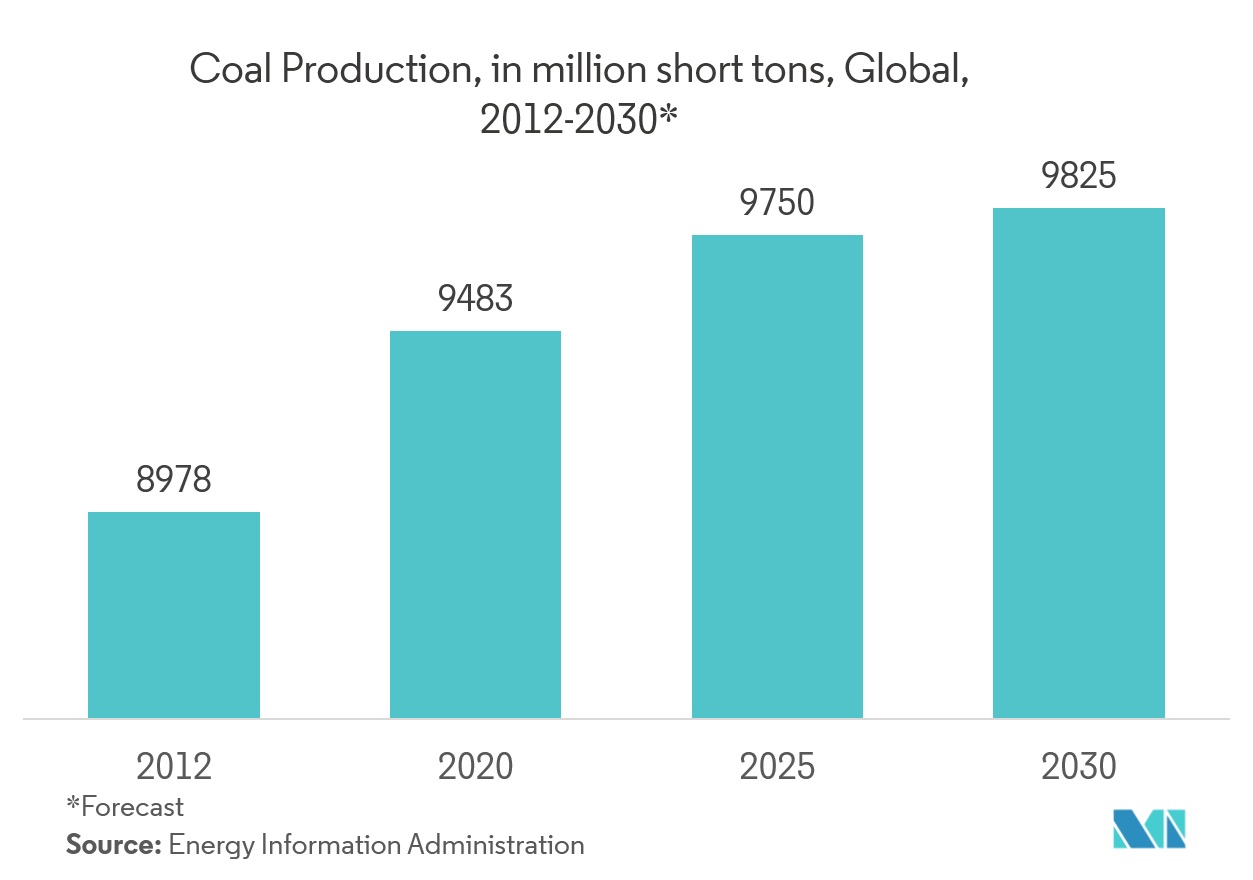

Explosion Proof Motor in Coal Production to Drive the Market Growth

- Growing dependency on coal production is triggering the growth of several coal plants in the world, which is driving the market. Eliminating the presence of potential sources of ignition, and providing appropriate equipment, all machinery and electrical equipment inside the enclosed coal storage area or structure are approved for use in hazardous locations. These are provided with spark-proof motors or explosion proof motors, which are assigned a temperature code (T code).

- Flameproof motors, which are a part of explosion-proof motors, are designed for operation in coal mines that are endangered by the explosion of methane and coal dust in spaces (zones one and two) where explosive mixtures of combustible gases and steams of liquid with air occurs.

- Dust ignition-proof motor is designed to exclude hazardous materials and prevent dust explosions. ABB offers a wide range of dust ignition proof motors and with Ex t motors, any explosion transmission of dust is prevented in the coal preparation.

- The explosion-proof enclosure used in the US coal mines complies with the applicable design requirements of 30 CFR 18, subpart B. It is able to contain internal explosions of methane-air mixtures without undergoing damage or excessive distortion of its walls or covers, without causing an ignition of a surrounding methane-air mixture.

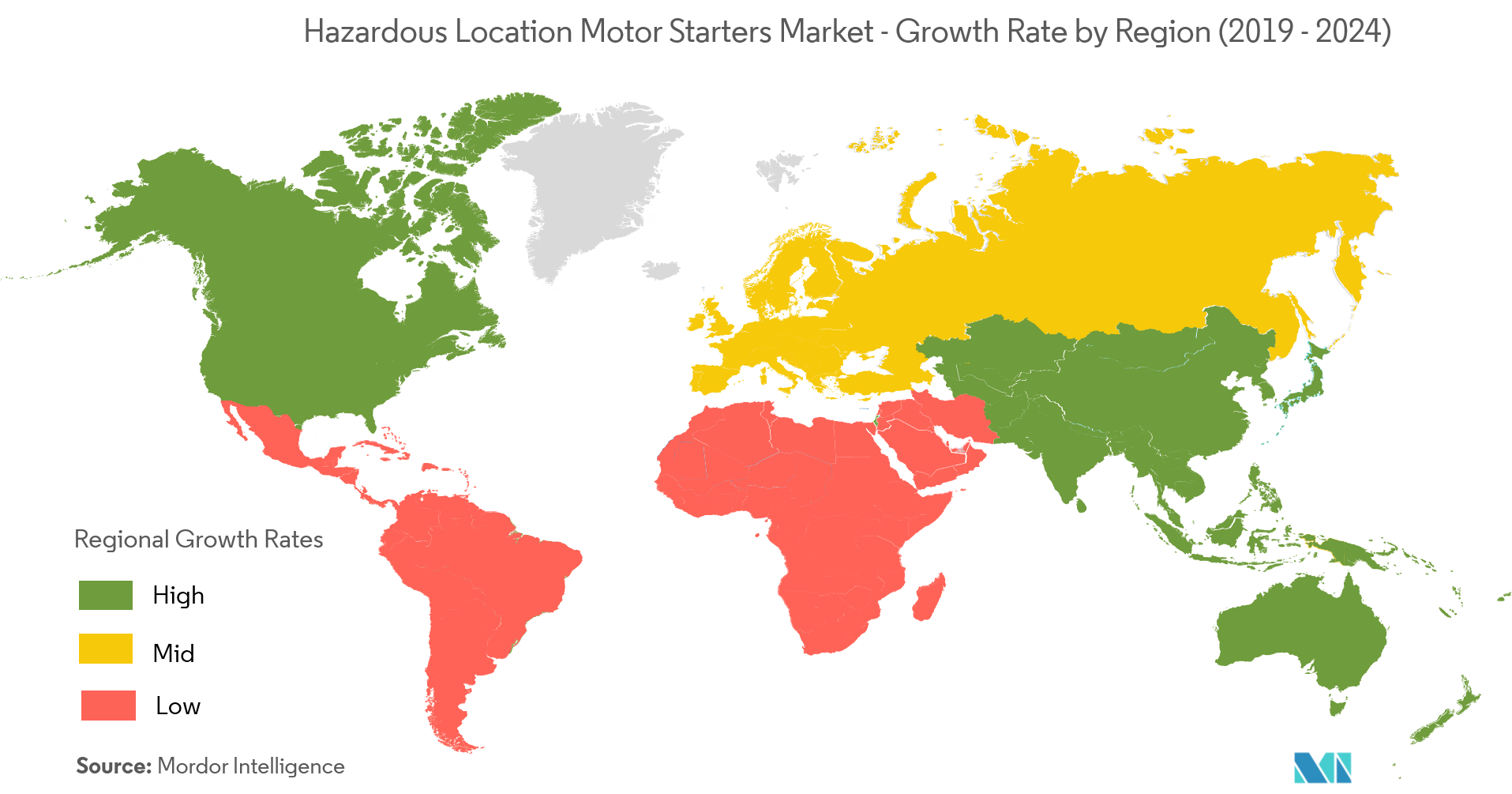

Asia-Pacific to Witness the Fastest Growth in Future

- The Asia-Pacific motor starters market is expected to observe a substantial growth in the near future, determined by the discovery of new oil and gas reserves in this region.

- A significant number of mergers and acquisitions, in the region, have led to an enormous amount of drilling and exploration activities in hazardous locations. This has further boosted the demand for motors and motor starters in this region.

- Asia-Pacific is likely to emerge as a demand center for soft starters, which are used in the motor for protection. Due to the increasing industrialization, in the region’s emerging economies, such as India and China, it is expected that motor starters will experience high growth of the motor starter in various applications.

- India has one of the world’s largest refinery complexes in Jamnagar, owned by Reliance group. The need for safety and explosion-proof motors at this refinery is driving market growth.

Hazardous Location Motor Starters Industry Overview

The hazardous location motor starters market is fragmented in nature due to the presence of a large number of regional and international players of various sizes.The market competition is predicted to grow higher with the increase in technological innovation and M&A activities in the future. Moreover, many local and regional vendors are offering specific application products for diverse end-users. Key players areRockwell Automation,Schneider Electric,ABB Group, etc. Recent developments in the market are -

- February 2019: Danfoss company demonstratedhow its VLT Automation Drive can be used to perform condition monitoring using technologies such as external vibration sensors and load-envelope monitoring. These functions convert the drive into an “intelligent sensor” that detects problems at an early stage and identifies them before they cause downtime.

Hazardous Location Motor Starters Market Leaders

-

Rockwell Automation

-

Schneider Electric

-

ABB Group

-

Eaton Corporation

-

WEG Industries

*Disclaimer: Major Players sorted in no particular order

Hazardous Location Motor Starters Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Demand for Explosion-proof Devices

-

4.4 Market Restraints

- 4.4.1 Manufacturing of Starters Withstanding Weather Conditions

- 4.5 Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. TECHNOLOGY SNAPSHOT

6. MARKET SEGMENTATION

-

6.1 By Type of Motor Starter

- 6.1.1 Low Voltage

- 6.1.2 Full Voltage

- 6.1.3 Manual Motor Starter

- 6.1.4 Magnetic Motor Starter

- 6.1.5 Other Types of Motor Starters

-

6.2 By Class

- 6.2.1 Class I

- 6.2.2 Class II

- 6.2.3 Class III

-

6.3 By Division

- 6.3.1 Division 1

- 6.3.2 Division 2

-

6.4 By Zone

- 6.4.1 Zone 0

- 6.4.2 Zone 1

- 6.4.3 Zone 21

- 6.4.4 Zone 2

- 6.4.5 Zone 22

-

6.5 By Application

- 6.5.1 Paint Storage Areas

- 6.5.2 Coal Preparation Plants

- 6.5.3 Sewage Treatment Plants

- 6.5.4 Oil Refineries

- 6.5.5 Chemical Storage and Handling Facilities

- 6.5.6 Grain Elevators

- 6.5.7 Petrochemical Facilities/Oil Rigs

- 6.5.8 Other Applications

-

6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East & Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Eaton Corporation

- 7.1.2 Emerson Industrial Automation

- 7.1.3 WEG Industries

- 7.1.4 Rockwell Automation

- 7.1.5 R. Stahl Inc.

- 7.1.6 Heatrex Inc

- 7.1.7 Schneider Electric

- 7.1.8 Siemens

- 7.1.9 ABB Group

- 7.1.10 GE Industrial Solutions (ABB Group)

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHazardous Location Motor Starters Industry Segmentation

The hazardous location motor starters market is growing due to technological advancements in the industry, which have led to growth in the manufacturing of explosion proof motor starters. They are used in hazardous locations where the concentration of flammable gas vapors and dust is high, with applications such as coal preparation plants, oil refineries, and chemical storages.

| By Type of Motor Starter | Low Voltage |

| Full Voltage | |

| Manual Motor Starter | |

| Magnetic Motor Starter | |

| Other Types of Motor Starters | |

| By Class | Class I |

| Class II | |

| Class III | |

| By Division | Division 1 |

| Division 2 | |

| By Zone | Zone 0 |

| Zone 1 | |

| Zone 21 | |

| Zone 2 | |

| Zone 22 | |

| By Application | Paint Storage Areas |

| Coal Preparation Plants | |

| Sewage Treatment Plants | |

| Oil Refineries | |

| Chemical Storage and Handling Facilities | |

| Grain Elevators | |

| Petrochemical Facilities/Oil Rigs | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Hazardous Location Motor Starters Market Research FAQs

What is the current Hazardous Location Motor Starters Market size?

The Hazardous Location Motor Starters Market is projected to register a CAGR of 5.25% during the forecast period (2024-2029)

Who are the key players in Hazardous Location Motor Starters Market?

Rockwell Automation, Schneider Electric, ABB Group, Eaton Corporation and WEG Industries are the major companies operating in the Hazardous Location Motor Starters Market.

Which is the fastest growing region in Hazardous Location Motor Starters Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Hazardous Location Motor Starters Market?

In 2024, the North America accounts for the largest market share in Hazardous Location Motor Starters Market.

What years does this Hazardous Location Motor Starters Market cover?

The report covers the Hazardous Location Motor Starters Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Hazardous Location Motor Starters Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Hazardous Location Motor Starters Industry Report

Statistics for the 2024 Hazardous Location Motor Starters market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hazardous Location Motor Starters analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.