Energy & Infrastructure Inertial Systems Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 12.90 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Energy & Infrastructure Inertial Systems Market Analysis

The inertial systems market in energy and infrastructure was valued at USD 1.13 billion in 2020, and it is expected to reach USD 2.33 billion by 2026 and grow at a CAGR of 12.9% over the forecast period (2021-2026). The rapid advancement of the global lifestyle has resulted in the need for equipment that can be used with greater ease of use. The use of motion-sensing technology can help achieve this, which extensively uses inertial sensors.

- The emergence of microelectromechanical systems (MEMS) technology resulted in the miniaturization of mechanical and electro-mechanical elements in the field of sensors and semiconductors, with micro-fabrication and micro-machining techniques. Hence, MEMS have become an indisputable part of the future navigation systems, thus, boosting the growth of the high-end inertial systems market.

- The MEMS gyroscopes are emerging to take the market away from traditional FOG (fiber optic gyro) applications and are gaining traction majorly due to improved error characteristics, environmental stability, increased bandwidth, better g-sensitivity, and the increasing availability of embedded computational power that can run advanced fusion and sensor error modeling algorithms.

- The growth of the market studied is majorly driven by the increasing pressure on the contract manufacturers to reduce the size of the inertial systems, to make them suitable for a broad range of applications. MEMS greatly support the rapid increase in portable devices, as they offer enhanced capabilities, within small unit sizes. The inertial MEMS market forecast predicts a dramatic rise in the volume of inertial MEMS devices, over the next five years

- Furthermore, increasing applications based on motion sensing is driving the market. With the current miniaturization of sensors and related components, rising growth toward the advanced function sensors is highly being focused. For instance, Xsens has released improved versions of its MTi 1-series of motion-sensing Inertial Measurement Unit (IMU) modules, offering improved roll, pitch, and yaw measurement accuracy, and higher tolerance of mechanical stress than the first generation of the product in various energy and infrastructure projects.

- However, the large-scale adoption of inertial systems was significantly constrained by the large size and high costs. There has been a paradigm shift in the manufacturing techniques of inertial systems, after the turn of the century. Also, the integration of drift error in the navigation system is expected to pose challenges to the growth of the inertial systems market.

Energy & Infrastructure Inertial Systems Market Trends

This section covers the major market trends shaping the Energy & Infrastructure Inertial Systems Market according to our research experts:

MEMs to Hold Significant Market Growth in the Oil and Gas Sector

- In the oil and gas industry, exploration and survey are one of the most important tasks. Computers, with the help of MEMs and other supplementing equipment, aid the exploration activity in the ocean. In deep oceans, getting real-time measurements of various parameters is critical and important for a company to decide to go ahead or drop the activity.

- In recent years, microelectromechanical system (MEMS) sensors have been extensively used in navigation fields due to their small size, rigidity, and low-cost consumption. Thus, MEMS-based MWD technology has gained much attention and can potentially be applied in very small diameter well drilling activities in the oil and gas sector with satisfactory precision.

- Stand-alone MEMS-based SINS (strap-down inertial navigation system) provides a short-term accurate navigation solution. Therefore, the following aiding information is also used as updates for the MEMS-based SINS in the drilling procedure. This system provides benefits in the growth of the MEMs for intertial system.

- The new GyroSphere MEMS gyro service from Schlumberger, the United States, delivers all three benefits to operators. Unlike any other gyro-surveying-while-drilling offer in the oilfield at present, the service delivers more transparent gyro-surveying data that increases drilling operation efficiency and tool reliability while improving access to small-target reservoirs.

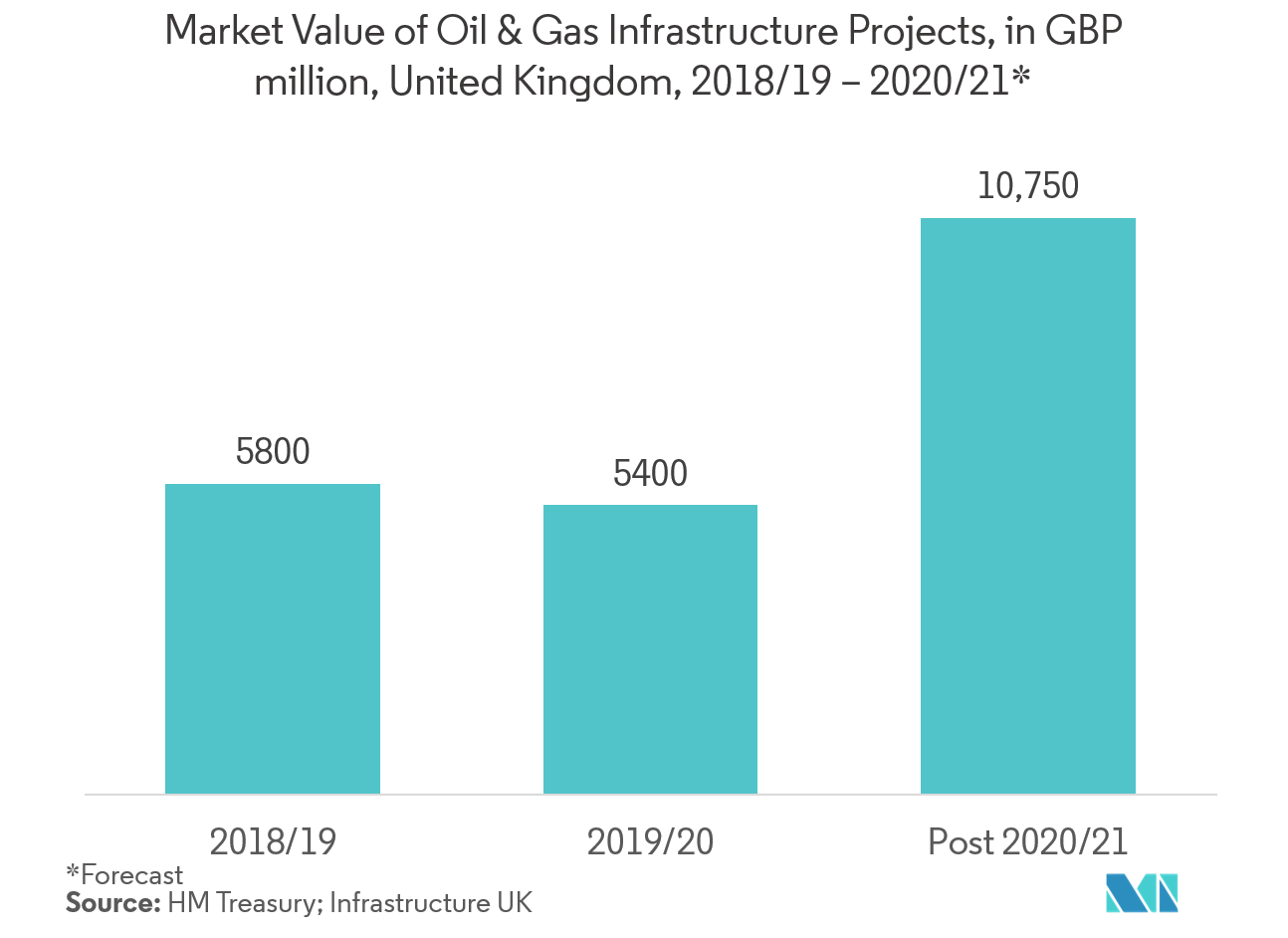

- The oil and gas industry in the United Kingdom make 1.42 million BOE (barrel of oil equivalent) per day. Also, about 98% of production comes from offshore fields and the services industry in Aberdeen has been a leader in developing technology for hydrocarbon extraction offshore. Due to its increasing market value in the future for oil and gas construction, the demand for MMEs will increase highly for inertial system.

- The United States's Department of the Interior (DoI) is planning to allow offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage. Under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open upnew opportunities to the market.

North America Witness Significant Market Share

- North America accounted for the maximum share in the market, with the United States contributing the most significantly. The foremost demand for inertial systems in the region comes from the maritime sector, owing to the renewed emphasis on oil exploration activities. The exploration activities of oil rigs require high-performance gyroscopes, IMUs, and accelerometers to provide a right self-contained sensing system and highly accurate solutions for platform stabilization.

- The region is witnessing a growth in the development of new high-performance accelerometers as companies in this region are investing in introducing advanced and innovative accelerometers. The increased spending by the energy sector is the major factor driving the growth of accelerometers in the region.

- Investment in surface and lease equipment necessary for onshore wells and production platforms in the Gulf of Mexico may lead to the growth of the inertial systems market in this region.

- Increase in the number of applications and technological advancements, across the region, provides lucrative opportunities to the inertial systems. Overall, competitive rivalry among the existing competitors is high. Hence, the vendors are keen on increasing their spending on R&D and product portfolio enhancement, in order to increase their market shares.

Energy & Infrastructure Inertial Systems Industry Overview

The market is fragmented due to the presence of various inertial systems solution provider. However, vendors are consistently focusing on product development to enhance their visibility and global presence. The companies are also undergoing strategic partnerships and acquisitions to gain market traction and increase market share. The key players are Analog Devices Inc., Bosch Sensortec GmbH, and ST Microelectronics, etc. Recent developments in the market are -

- June 2019 - Sensor manufacturer ACEINNA launched its new open-source Inertial Measurement Unit Sensor that is meant for autonomous off-road, construction, energy infrastructure, agricultural vehicle applications. The OpenIMU300RI is a rugged, sealed package, open-source, nine-degree-of-freedom inertial measurement unit (IMU). The precise positioning solutions from ACEINNA are MEMS-based open-source, inertial sensing systems that enable easy-to-use, centimeter-accurate navigation systems.

- June 2019 - At CES in Las Vegas, Nevada, Bosch Sensortec announced the BMI270, an ultra-low-power smart Inertial Measurement Unit (IMU) specifically targeted at wearable applications. It offers a strongly improved accelerometer offset and sensitivity performance, enabled by the newest Bosch MEMS process technology.

Energy & Infrastructure Inertial Systems Market Leaders

-

Analog Devices, Inc

-

Bosch Sensortec GmbH

-

STMicroelectronics

-

Honeywell International Inc.

-

InvenSense Inc.

*Disclaimer: Major Players sorted in no particular order

Energy & Infrastructure Inertial Systems Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

-

4.4 Market Drivers

- 4.4.1 Emergence of MEMS Technology

- 4.4.2 Increasing Applications Based on Motion Sensing

-

4.5 Market Restraints

- 4.5.1 Integration Drift Error

5. MARKET SEGMENTATION

-

5.1 Component

- 5.1.1 Standalone (Accelerometers Gyroscope)

- 5.1.2 Integrated (IMUs and Attitude Heading and Reference Systems)

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle-East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Analog Devices Inc.

- 6.1.2 Bosch Sensortec GmbH

- 6.1.3 ST Microelectronics NV

- 6.1.4 Honeywell International Inc.

- 6.1.5 Invensense Inc.

- 6.1.6 Northrop Grumman Corporation

- 6.1.7 Safran Group (SAGEM)

- 6.1.8 Silicon Sensing Systems Ltd

- 6.1.9 Vector NAV Technologies

- 6.1.10 Thales Group

- *List Not Exhaustive

- 6.2 Investment Analysis

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityEnergy & Infrastructure Inertial Systems Industry Segmentation

- The inertial systems comprise IMUs with high-performance sensors (gyroscopes, magnetometers, and accelerometers), to provide high-accuracy information about the surrounding environment, through relative movement. The powerful combination of IMUs with other onboard sensor data produces reliability and automation breakthroughs for applications in the energy as well as the infrastructure industry. Other major include Gyroscopes for Wind Turbine Control, MEMs in Oil and Gas, and Inertial Systems for Platform Stabilization.

- The reports cover the emerging trends in inertial systems in energy and Infrastructure segmented by components, across different regions studied.

| Component | Standalone (Accelerometers Gyroscope) |

| Integrated (IMUs and Attitude Heading and Reference Systems) | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle-East and Africa |

Energy & Infrastructure Inertial Systems Market Research FAQs

What is the current Inertial Systems Market in Energy and Infrastructure Industry size?

The Inertial Systems Market in Energy and Infrastructure Industry is projected to register a CAGR of 12.90% during the forecast period (2024-2029)

Who are the key players in Inertial Systems Market in Energy and Infrastructure Industry?

Analog Devices, Inc, Bosch Sensortec GmbH, STMicroelectronics, Honeywell International Inc. and InvenSense Inc. are the major companies operating in the Inertial Systems Market in Energy and Infrastructure Industry.

Which is the fastest growing region in Inertial Systems Market in Energy and Infrastructure Industry?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Inertial Systems Market in Energy and Infrastructure Industry?

In 2024, the North America accounts for the largest market share in Inertial Systems Market in Energy and Infrastructure Industry.

What years does this Inertial Systems Market in Energy and Infrastructure Industry cover?

The report covers the Inertial Systems Market in Energy and Infrastructure Industry historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Inertial Systems Market in Energy and Infrastructure Industry size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Inertial Systems in Energy and Infrastructure Industry Report

Statistics for the 2024 Inertial Systems in Energy and Infrastructure market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Inertial Systems in Energy and Infrastructure analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.