Insoluble Dietary Fibers Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 7.80 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

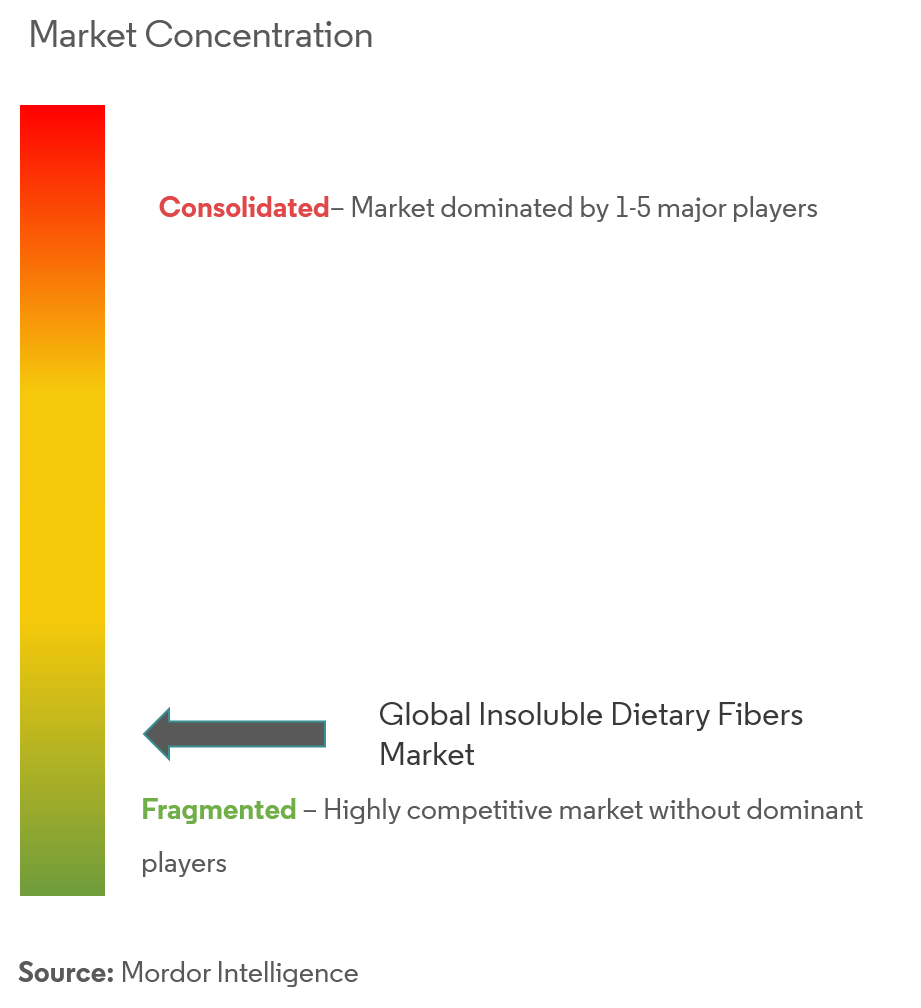

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Insoluble Dietary Fibers Market Analysis

The global insoluble dietary fibers market is growing at a CAGR of 7.8% during the forecast period (2020 -2025).

- The market is driven by the rising demand for functional foods due to health-consciousness. Also, stimulating government health programs and prolonged researches to spread consumer awareness regarding the benefits of functional food and its potential to reduce the risk of major disorders such as cardiovascular disease (CVC), cancer and osteoporosis have further boosted the market growth.

- Also, new launches with formulations and the enhanced product have fueled the market growth. For instance, Ingredion Incorporated, in 2017 launched a new range of insoluble dietary fiber 'Novelose' for fiber fortification & calorie reduction in pastas, baked goods, noodles, and extruded products with lower impact on product texture, color and flavor and in 2018 launched 'Potex and Potex Crown' insoluble dietary fibers which find application in bakery, meat, and savory products, and can absorb water up to 12 times their own weight which helps it to increase juiciness of meats or add moisture to baked goods.

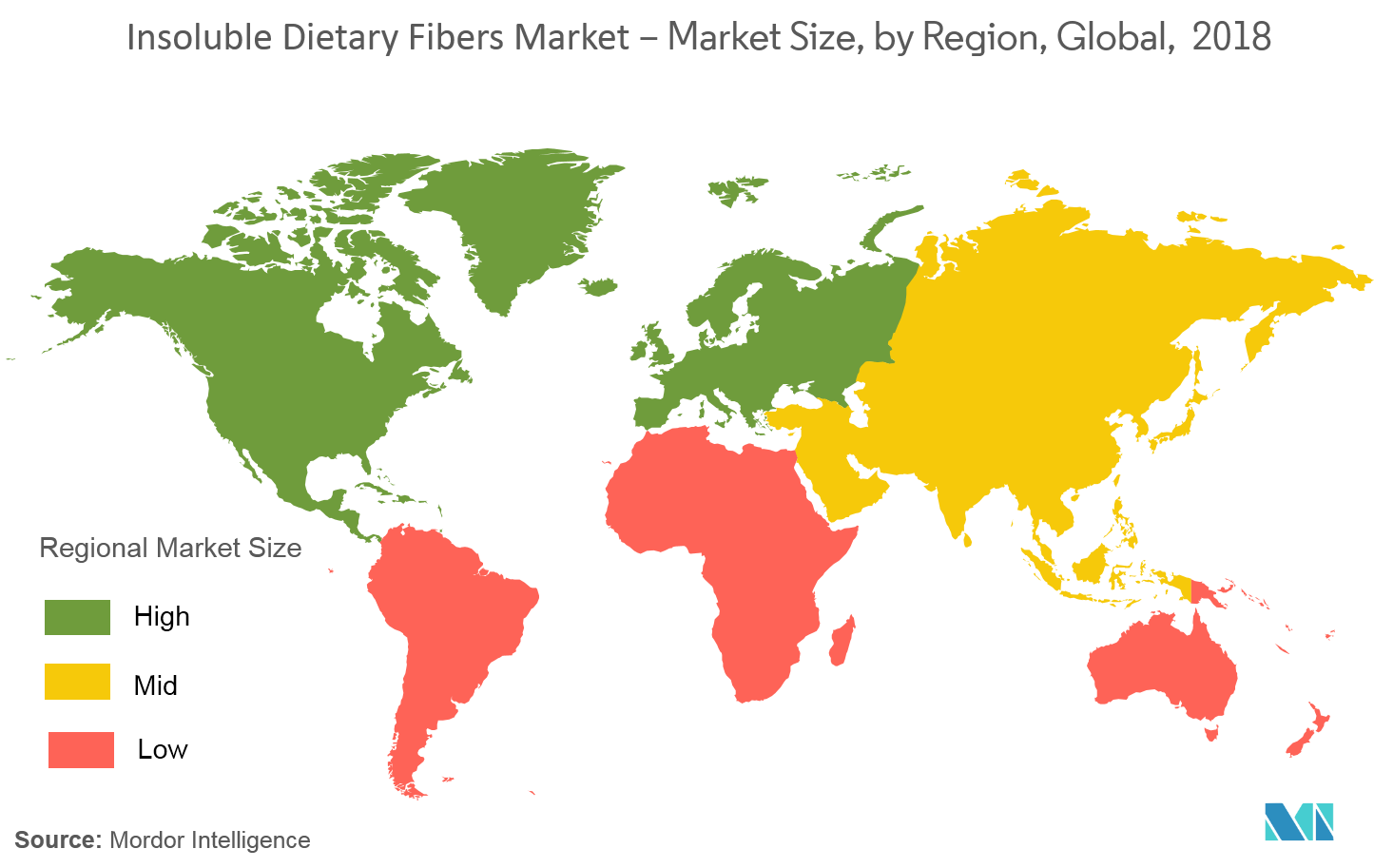

- Geographically, United States in North American region accounts for the largest share in the market, followed by Canada, owing to the increasing demand and health awareness of insoluble fiber supplements. In Europe, Germany and France collectively accounts for a considerable share in the market, which is followed by the Asia Pacific region where China and Japan are leading the market.

Insoluble Dietary Fibers Market Trends

This section covers the major market trends shaping the Insoluble Dietary Fibers Market according to our research experts:

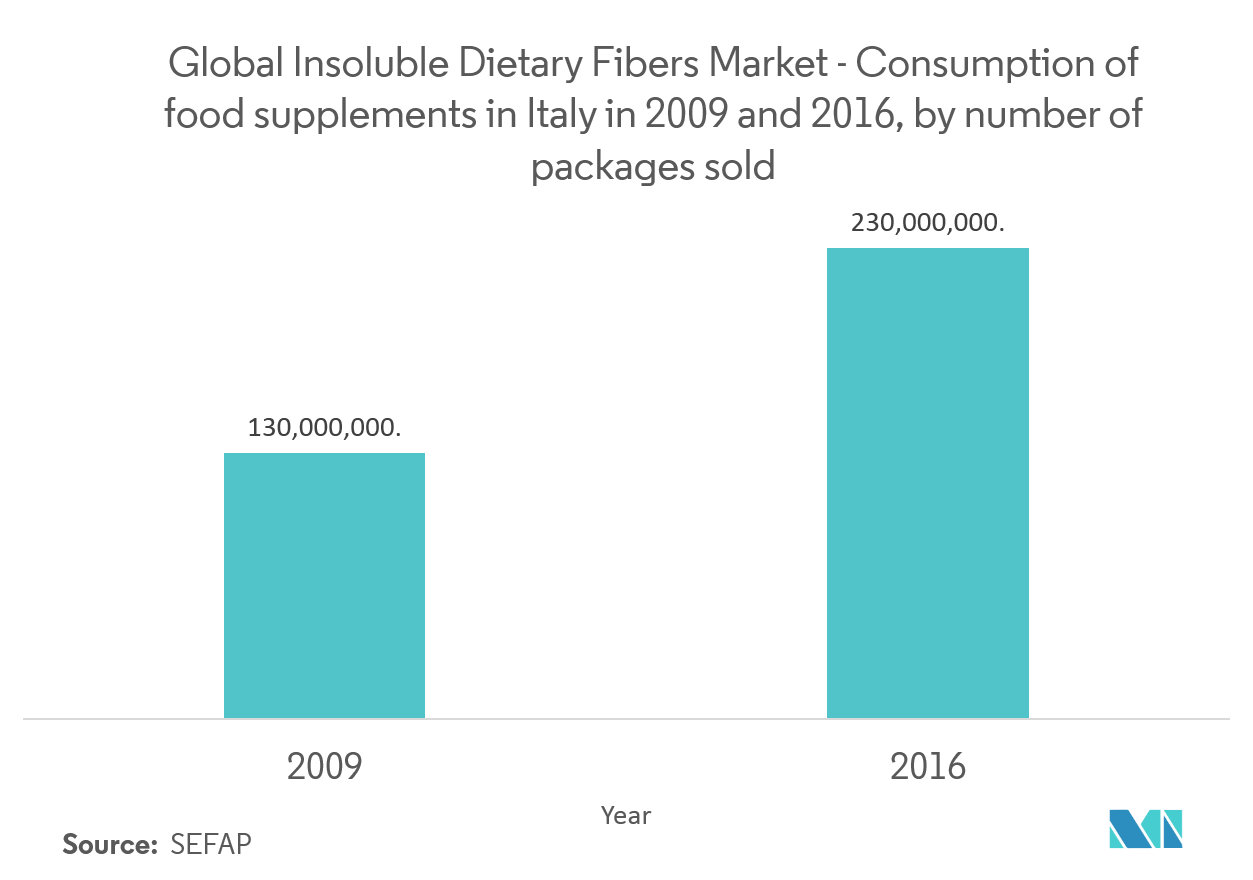

Increased demand for insoluble dietary fiber supplements

Trends in population demographics are in the surge of dietary supplements of insoluble fiber due to the increase in the number of elderly and the desire for an improved quality of life, as well as increasing health disorders such as obesity, cholesterol, diabetes, diverticular diseases across the globe which can be cured by the increased usage of dietary fibers, thus drive the market growth globally. Also, government initiatives have paired with the researches to spread awareness among people regarding its consumption quantity and its benefits. For instance, the Food and Nutrition Board (FNB) has given adequate limits on intake based on age and gender to keep the nutrient levels inside the body. Other regulatory bodies supporting the market progress include the Food & Drug Administration (FDA), the United States Department of Agriculture (USDA), and the Canadian Food Inspection Agency (CFIA).

North America to Drive the Market

Countries in the North American region, mainly the United States and Canada dominate the market share owing to the increase in intake of supplements based on insoluble dietary fibers and its use as an ingredient in most of the functional food and beverages. Besides all these beneficial factors it provides, government initiatives have fueled the market growth. For instance, FDA under U.S. Nutritional facts label in 2016 have mandated to prove the physiological benefits of the products mentioned under 'dietary fiber' by the manufacturers, which influences them to evaluate and purify their products that leads to enhanced product development.

Insoluble Dietary Fibers Industry Overview

The insoluble dietary fibers market is highly competitive in nature having a large number of domestic and multinational players competing for market share and with innovation in products being a major strategic approach adopted by leading players. Additionally, merger, expansion, acquisition, and partnership with other companies are the common strategies to enhance the company presence and boost the market. The key players in the market include Cargill, Incorporated, Grain Processing Corporation, Ingredion Incorporated, and InterFiber to name a few.

Insoluble Dietary Fibers Market Leaders

-

Cargill, Incorporated

-

Grain Processing Corporation

-

Ingredion Incorporated

-

InterFiber

-

J. Rettenmaier & Söhne GmbH + Co KG

*Disclaimer: Major Players sorted in no particular order

Insoluble Dietary Fibers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By source

- 5.1.1 Fruits & Vegetables

- 5.1.2 Cereals & Grains

- 5.1.3 Others

-

5.2 By application

- 5.2.1 Functional food and beverages

- 5.2.2 Pharmaceuticals

- 5.2.3 Animal feed

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Position Analysis

-

6.4 Company Profiles

- 6.4.1 Cargill, Incorporated

- 6.4.2 Grain Processing Corporation

- 6.4.3 Ingredion Incorporated

- 6.4.4 InterFiber

- 6.4.5 J. Rettenmaier & Sohne GmbH + Co KG

- 6.4.6 CFF GmbH & Co. KG

- 6.4.7 DuPont

- 6.4.8 SunOpta Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityInsoluble Dietary Fibers Industry Segmentation

Global insoluble dietary fibers market has been segmented by the source which includes fruits & vegetables, cereals & grains, and others. On the basis of application, the market is segmented as functional food and beverages, pharmaceuticals, and animal feed. The report further analyses the global scenario of the market in the regions of North America, Europe, Asia-Pacific, South America and, the Middle East and Africa.

| By source | Fruits & Vegetables | |

| Cereals & Grains | ||

| Others | ||

| By application | Functional food and beverages | |

| Pharmaceuticals | ||

| Animal feed | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| United Arab Emirates | ||

| Rest of Middle East and Africa |

Insoluble Dietary Fibers Market Research FAQs

What is the current Insoluble Dietary Fibers Market size?

The Insoluble Dietary Fibers Market is projected to register a CAGR of 7.80% during the forecast period (2024-2029)

Who are the key players in Insoluble Dietary Fibers Market?

Cargill, Incorporated, Grain Processing Corporation, Ingredion Incorporated, InterFiber and J. Rettenmaier & Söhne GmbH + Co KG are the major companies operating in the Insoluble Dietary Fibers Market.

Which is the fastest growing region in Insoluble Dietary Fibers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Insoluble Dietary Fibers Market?

In 2024, the North America accounts for the largest market share in Insoluble Dietary Fibers Market.

What years does this Insoluble Dietary Fibers Market cover?

The report covers the Insoluble Dietary Fibers Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Insoluble Dietary Fibers Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Insoluble Dietary Fibers Industry Report

Statistics for the 2024 Insoluble Dietary Fibers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Insoluble Dietary Fibers analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.