Intelligent Transportation Systems Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 5.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Intelligent Transportation Systems Market Analysis

The Intelligent Transportation Systems Market is expected to register a CAGR of over 5.5% during the forecast period.

The term, 'Intelligent Transportation Systems' was coined over two decades ago to designate applications of information and communication technologies to the operational management of transportation networks. The Intelligent Transportation Systems market growth is currently being hindered by the lack of inter-operability and standardization. The rapidly expanding telematics and vehicle infotainment industry, coupled with continued explosive growth of the commercial connected vehicle will see the emergence of new data streams, provided by the auto industry, and openly accessible to the developer community.

The open data streams will facilitate the development of additional applications and services and represents the industry’s first extensive, real-time and anonymized data set, which is sourced from the traditional passenger vehicles. The major objective of the intelligent transport system market is to reduce traffic congestion, pollution level, and to control the number of road accidents. The major reasons behind the increase in traffic congestion are the growth in the number of vehicles on the roads, increase in population, and migration of the rural areas to the metropolitan cities.

Intelligent Transportation Systems Market Trends

This section covers the major market trends shaping the Intelligent Transportation Systems Market according to our research experts:

Increased Adoption of Sensors in Transportation Systems

Technological advances in information technology, coupled with ultramodern/state-of-the-art microchip, improvements in RFID technologies and inexpensive intelligent and advanced sensing technologies, have enhanced the technical capabilities that would facilitate safety benefits for intelligent transportation systems in the global market.

This segment would account to a larger market share of the overall component type of ITS as of 2018. Infrastructure sensors are indestructible devices that are embedded in the road or surrounding the road (e.g., on buildings, posts, and signs), as required, and are manually or automatically operated. Vehicle-sensing systems include deployment of infrastructure-to-vehicle and vehicle-to-infrastructure electronic intelligent sensors for identification communications and may also employ video automatic number plate recognition technologies or vehicle magnetic signature detection technologies at desired intervals to increase monitoring of vehicles operating in critical zones.

Emerging Countries such as Russia, India, Brazil, and South Africa Growing Rapidly

ITS include telematics and all types communication in vehicles, between other vehicles and other connected devices. Intelligent Transportation Systems are not restricted to land transport, but also include all type of navigation and communication system in rail, water and air transport.

Increase in adoption of intelligent transportation system in emerging countries such as Russia, India, Brazil, and South Africa would be a key factor in driving the intelligent transportation system market. The ITS market would grow significantly at a higher rate in Asia-Pacific countries during the forecasted period since ITS helps the consumers significantly in reducing travel time by avoiding overcrowded routes or traffics, which are more relevant with the APAC countries. ITS industry has grown at an average rate of 15% annually over the past 10 years.

With CAFÉ standards and EU regulations becoming increasingly stringent, automobile manufacturers are forced to seek for better ways to increase vehicle safety and driver assistance systems. In addition, consumers are also demanding new innovative features and services that seamlessly integrate into their digitized and mobile lifestyles. To meet these requirements, traditional automotive players are reinventing their business models and are increasingly involved in integrating intelligent transportation systems by adding telematics for various vehicle, driver safety assistance measures, and other in-vehicle infotainment services.

The growth of the Intelligent Transportation Systems market is currently being hindered by the lack of inter-operability and standardization. The rapidly expanding telematics and vehicle infotainment industry, coupled with explosive growth of the commercial connected vehicle across different type of vehicles will see the emergence of improved data streams, and would viciously help to augment the global Intelligent Transportation System market.

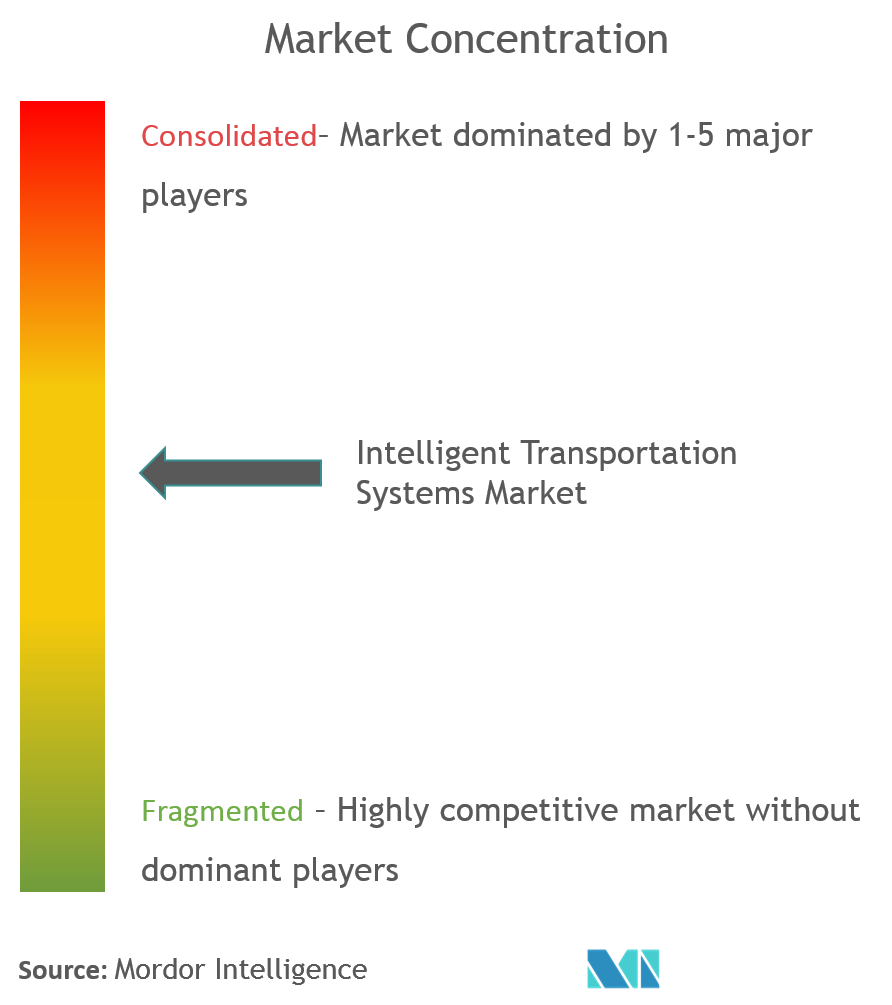

Intelligent Transportation Systems Industry Overview

TransCore, Kapsch TrafficCom AG, Efkon AG,TomTom NV, DENSO Corporation, Thales SA are active players in the market. The high cost of intelligent transportation system makes it difficult for manufacturers to keep the product prices low. Automobile manufacturers have to either keep their profit margins low or shift the pressure onto the customers. However, in the current price-sensitive market, in which customers are looking for products that offer them the maximum value for money, it has become difficult for manufacturers to shift the pricing pressure completely onto customers. Consequently, manufacturers are compelled to keep their margins low. This in turn affects the financial status of the manufacturers and restricts them from spending on other activities, including R&D, which further affects the development of automobile-embedded telematics.

Intelligent Transportation Systems Market Leaders

-

DENSO Corporation

-

TomTom NV

-

TransCore

-

Kapsch TrafficCom AG

-

Thales SA

*Disclaimer: Major Players sorted in no particular order

Intelligent Transportation Systems Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 System

- 5.1.1 Advanced Traffic Management System

- 5.1.2 Advanced Traveler Information System

- 5.1.3 Advanced Public Transportation System

- 5.1.4 Commercial Vehicle Operation

-

5.2 Component

- 5.2.1 Interface Boards

- 5.2.2 Sensors

- 5.2.3 Software

- 5.2.4 Surveillance Camera

- 5.2.5 Tele-Communication Networks

- 5.2.6 Monitoring and Detection System

- 5.2.7 Others

-

5.3 Application

- 5.3.1 Fleet Management and Asset Monitoring

- 5.3.2 Traffic Monitoring System

- 5.3.3 Traffic Signal Control Systems

- 5.3.4 Parking Convenience Systems

- 5.3.5 Traffic Enforcement Cameras

- 5.3.6 Accident Avoidance Systems

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Other Countries

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles

- 6.2.1 Denso Corporation

- 6.2.2 EFKON GmbH

- 6.2.3 Garmin Ltd.

- 6.2.4 Kapsch TrafficCom AG

- 6.2.5 Search Results Finance results Nuance Communications Inc.

- 6.2.6 Savari, Inc.

- 6.2.7 Thales SA

- 6.2.8 TomTom NV

- 6.2.9 TransCore

- 6.2.10 Q-Free ASA

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIntelligent Transportation Systems Industry Segmentation

The Intelligent Transportation Systems Market is segmented by Systems (Advanced Traffic Management System, Advanced Traveler Information System, Advanced Public Transportation System, and Commercial Vehicle Operation), by Components (Interface Boards, Sensors, Software, Surveillance Camera, Tele-Communication Networks, Monitoring & Detection Systems, and Others), by Application (Fleet Management & Asset Monitoring, Traffic Monitoring System, Traffic Signal Control Systems, Parking Convenience Systems, Traffic Enforcement Cameras, and Accident Avoidance Systems), and by Geography (North America, Europe, Asia-Pacific, and Rest of the World)

| System | Advanced Traffic Management System | |

| Advanced Traveler Information System | ||

| Advanced Public Transportation System | ||

| Commercial Vehicle Operation | ||

| Component | Interface Boards | |

| Sensors | ||

| Software | ||

| Surveillance Camera | ||

| Tele-Communication Networks | ||

| Monitoring and Detection System | ||

| Others | ||

| Application | Fleet Management and Asset Monitoring | |

| Traffic Monitoring System | ||

| Traffic Signal Control Systems | ||

| Parking Convenience Systems | ||

| Traffic Enforcement Cameras | ||

| Accident Avoidance Systems | ||

| Geography | North America | United States |

| Canada | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Brazil |

| Argentina | ||

| Other Countries |

Intelligent Transportation Systems Market Research FAQs

What is the current Global Intelligent Transportation Systems Market size?

The Global Intelligent Transportation Systems Market is projected to register a CAGR of greater than 5.5% during the forecast period (2024-2029)

Who are the key players in Global Intelligent Transportation Systems Market?

DENSO Corporation, TomTom NV, TransCore, Kapsch TrafficCom AG and Thales SA are the major companies operating in the Global Intelligent Transportation Systems Market.

Which is the fastest growing region in Global Intelligent Transportation Systems Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Global Intelligent Transportation Systems Market?

In 2024, the North America accounts for the largest market share in Global Intelligent Transportation Systems Market.

What years does this Global Intelligent Transportation Systems Market cover?

The report covers the Global Intelligent Transportation Systems Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Global Intelligent Transportation Systems Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Global Intelligent Transportation Systems Industry Report

Statistics for the 2024 Global Intelligent Transportation Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Global Intelligent Transportation Systems analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.