Nano Biosensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 10.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

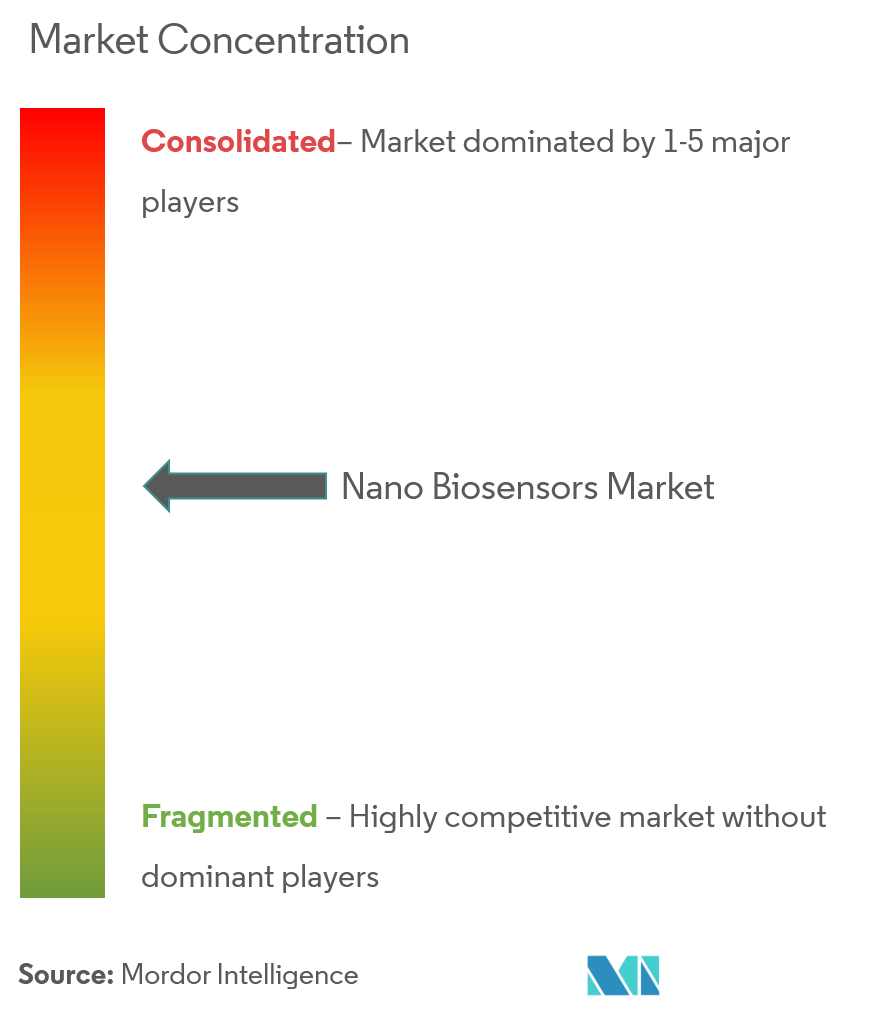

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Nano Biosensors Market Analysis

The nano-biosensors market is expected to register a CAGR of 10%, during the forecast period 2021-2026. Continuous development in nanotechnology tools and gaining insights into nanoscale phenomena are expected to be crucial for improving the performance of existing nanosensors and support researchers in the development of nanosensors based on innovative mechanisms.

- The market studied has witnessed important innovations and developments in the field of nanotechnology, recently. Major factors influencing the market studied are the quality of research that companies can access, the availability of sources of finance, and supportive policy frameworks, particularly in the healthcare, and food & beverage sector.

- The healthcare segment is expected to account for a significant share of the market studied, over the forecast period. Expansion in these segments can be attributed to the use of nanosensors in medical diagnostics to detect cancers or as blood-borne sensors.

- Also, with the increasing significance of intelligent packaging, the adoption of nanosensors is expected to witness a considerable growth. The use of nanotechnology, nano minerals, and nanosensors in the agri-food sector, including feed and nutrient components, intelligent packaging, and quick detection systems, may create opportunities of improvements in the agricultural sector.

- Nano biosensors are emerging as promising tools for the applications in the agriculture and food production. They offer significant improvements in selectivity, speed, and sensitivity, compared to traditional chemical and biological methods. Nano biosensors can be used for determination of microbes, contaminants, pollutants, and food freshness. The nano biosensors used in food analyses combine knowledge of biology, chemistry, and nanotechnology and may also be called nano biosensors.

- With the outbreak of COVID-19, the nanosensors market will witness a significant increase in demand due to the increasing requirement of testing, tracing, and tracking the virus. The fact that the diagnostic lab needs many capabilities to test up to thousands of samples per day. For instance, in July 2020, MIT engineers had developed a nanoparticle sensor system, which can detect and monitor lung diseases by measuring compounds exhaled in the breath.

Nano Biosensors Market Trends

This section covers the major market trends shaping the Nano Biosensors Market according to our research experts:

Healthcare Industry Holds the Significant Share in the Market

- The healthcare and the biomedical sectors are the largest initial market for nano biosensors due to the increasing requirement for rapid, compact, accurate, and portable diagnostic sensing systems. Urgent care centers (UCC) and retail clinics centers (RC) have become popular, as the need for convenient care continues to grow because of the long waits seen by the Emergency Departments.

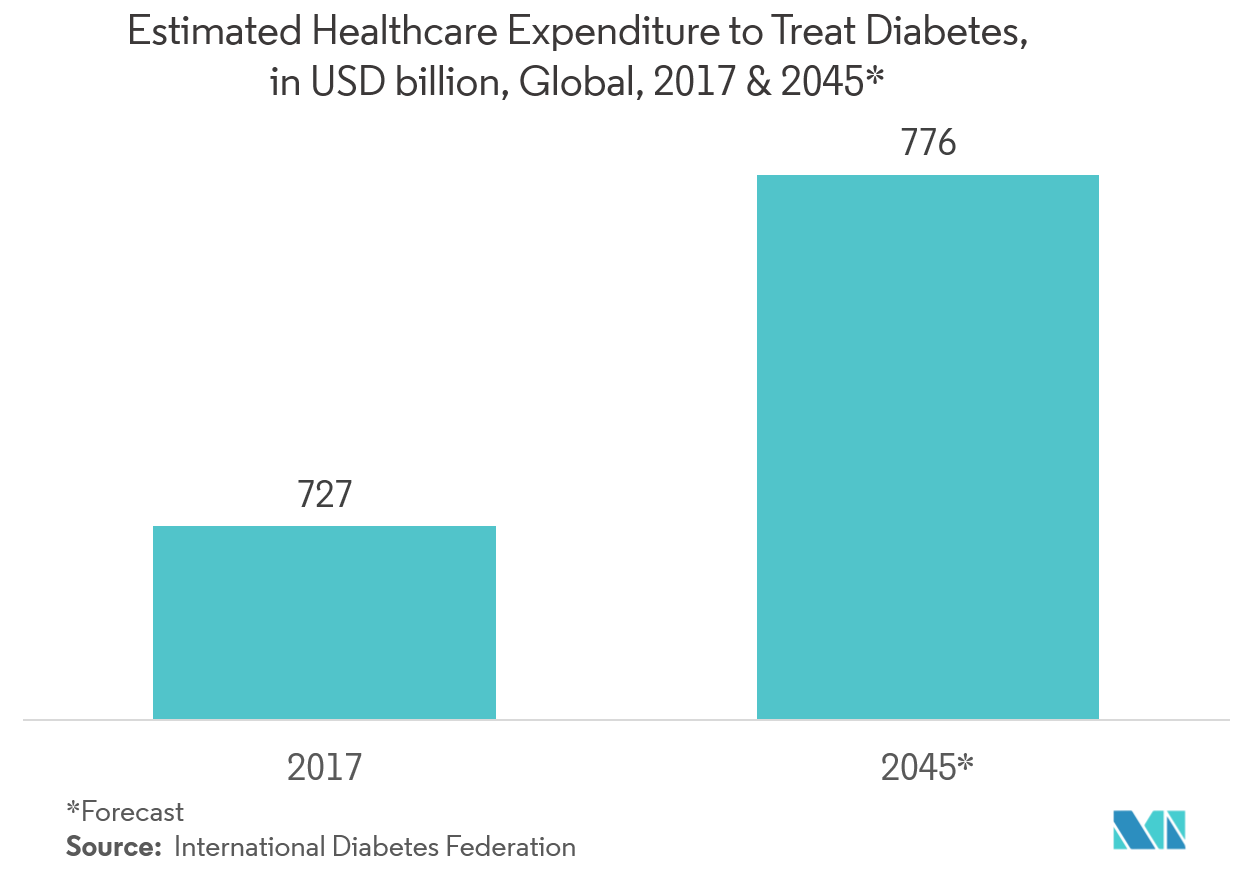

- Owing to the growing requirement for compact, rapid, accurate, and portable diagnostic sensing systems, the healthcare industry has been one of the major adopters for nanosensors. Nano biosensors have the capabilities to fulfill these requirements, which can be used to treat various chronic diseases. The aging population further increases the need for nanotechnology in healthcare. Nanotechnology has been used to treat various chronic diseases, like diabetes, hypertension, cardiovascular diseases, and asthma.

- The rising pace of nanosensors innovations in healthcare and life sciences will further bolster this segment's growth in the coming years. For example, Nanowear Inc. takes an innovative approach and embeds its sensors into its products. The company has developed a cloth-based diagnostic monitoring nanosensor technology. Its first developed product, an FDA-approved device called SimplECG, is a remote cardiac monitoring undergarment that collects continuous multichannel ECG, heart rate, and respiratory rate data from the garment and transfers it to a web-based portal for review by a physician, by way of a mobile application.

- The European Commission has prompted a quick response to focus research efforts on the diagnosis and treatment of the COVID-19 disease. In March 2020, both the European Commission and the Spanish Ministry of Science and Innovation have announced the awarding of 17 research projects through this special call.

North America Dominates the Market

- North America occupies the highest market share due to innovation activities unddertaken by the government and research institutions. According to the World Health Organization, diabetes has been rising alarmingly in recent decades, with the fastest increase in lower and middle-income countries that could affect 580 million people by 2035.

- Thus, in November 2019, US and Brazilian scientists developed a glasses-based biosensor capable of measuring blood glucose levels through a person’s tears, offering a less invasive test for diabetics.

- In May 2020, San Diego-based Roswell Biotechnologies and nano innovator Imec collaborated to make the first molecular electronics biosensors chips commercially available in 2021. Such chips would be useful in detecting COVID-19 and other diseases and for precision medicine, as well as low-cost genome sequencing, on portable or even handheld devices.

- Furthermore, in November 2019, a team of researchers at Iowa State University (ISU) has made significant progress in the development of a graphene-enhanced sensor that can identify organophosphates (e.g., pesticides) at levels 40 times beneath the United States Environmental Protection Agency (EPA) recommendations. The sensors created by the technology can detect contaminants as small as 0.6 nanometres in length, which is remarkably low, coming in lower than the EPA standard of 24 nanometres and Canada’s standard of 170 nanometres.

Nano Biosensors Industry Overview

The market is neither fragmented nor consolidated since there is no competition between major players. Hence, the market concentration will be moderate. The major players keep on innovating in order to sustain their market share and enter into strategic partnerships.

- September 2020 - Abbott introduced the glucose sport biosensor, called Libre Sense Glucose Sport Biosensor, which is designed for athletes to continuously measure glucose to better understand the correlation between their glucose levels and their athletic performance. The Libre Sense biosensor is based on Abbott's world-leading FreeStyle Libre continuous glucose monitoring technology, which was originally developed for people living with diabetes. Based on that technology, this is the first personal-use product that allows for use beyond diabetes.

- Feb 2020 - Researchers of the University of Twente and Wageningen University developed a nanosensor that accurately detects biomarkers for cancer in an extremely broad range of concentrations, from 10 particles per microliter to 1 million particles per microliter. The sensor looks like two combs are woven into each other on the nanoscale, which leaves gaps between the teeth, the electrodes of around 120 nanometres. This small gap size provides amplification of the signal.

- Feb 2019 - The iQ Group Global introduced the Saliva Glucose Biosensor. This innovative technology is one of the world's few non-invasive, saliva-based glucose tests for diabetes management that measures glucose in saliva rather than blood. The saliva-based glucose test is being developed to improve the quality of life for over 425 million people living with diabetes globally.

Nano Biosensors Market Leaders

-

ACON Laboratories, Inc.

-

Abbott Point of Care, Inc.

-

Agilent Technologies, Inc.

-

Nanowear, Inc.

-

AerBetic

*Disclaimer: Major Players sorted in no particular order

Nano Biosensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholders Analysis

- 4.4 Impact of COVID-19 on the Market

-

4.5 Market Drivers

- 4.5.1 Rise of Miniaturization Trend

-

4.6 Market Restarints

- 4.6.1 Complex Manufacturing Process

- 4.7 Patent Landscape

5. MARKET SEGMENTATION

-

5.1 Type (Qualitative Analysis)

- 5.1.1 Optical Sensor

- 5.1.2 Electrochemical Sensor

- 5.1.3 Acoustic Sensor

- 5.1.4 Other Types

-

5.2 End-user Vertical

- 5.2.1 Healthcare

- 5.2.2 Food & Beverage

- 5.2.3 Other End-use Verticals

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World (Latin America, Middle East and Africa)

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 ACON Laboratories, Inc.

- 6.1.2 Abbott Point of Care, Inc.

- 6.1.3 Agilent Technologies, Inc.

- 6.1.4 Nanowear, Inc.

- 6.1.5 AerBetic

- 6.1.6 Instant NanoBiosensors Co., Ltd

- 6.1.7 LamdaGen Corporation

- 6.1.8 Vista Therapeutics, Inc.

- 6.1.9 Bruker Corporation

- 6.1.10 GBS Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. FUTURE OF THE MARKET

** Subject To AvailablityNano Biosensors Industry Segmentation

A nano-biosensor is a sensing device made up of nanomaterials that can detect the presence of a chemical substance that combines a biological component with a physicochemical detector via biological interactions. The market study is focused on the trends affecting the market in the major regions like North America, Europe, Asia Pacific, and Rest of the World which consists of Latin America, and Middle East and Africa.

| Type (Qualitative Analysis) | Optical Sensor |

| Electrochemical Sensor | |

| Acoustic Sensor | |

| Other Types | |

| End-user Vertical | Healthcare |

| Food & Beverage | |

| Other End-use Verticals | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World (Latin America, Middle East and Africa) |

Nano Biosensors Market Research FAQs

What is the current Nano Biosensors Market size?

The Nano Biosensors Market is projected to register a CAGR of 10% during the forecast period (2024-2029)

Who are the key players in Nano Biosensors Market?

ACON Laboratories, Inc., Abbott Point of Care, Inc., Agilent Technologies, Inc., Nanowear, Inc. and AerBetic are the major companies operating in the Nano Biosensors Market.

Which is the fastest growing region in Nano Biosensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Nano Biosensors Market?

In 2024, the North America accounts for the largest market share in Nano Biosensors Market.

What years does this Nano Biosensors Market cover?

The report covers the Nano Biosensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Nano Biosensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Nano Biosensors Industry Report

Statistics for the 2024 Nano Biosensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Nano Biosensors analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.