Pipeline Security Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.45 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

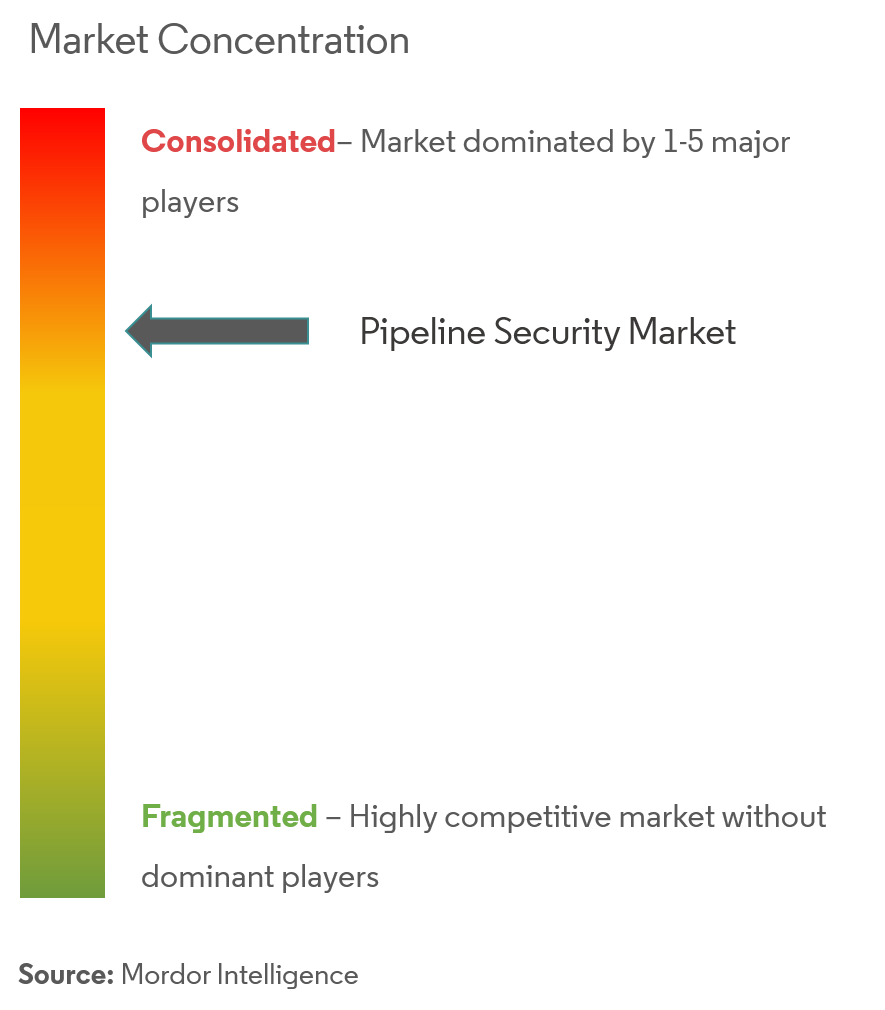

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Pipeline Security Market Analysis

The pipeline security market was valued at USD 7.66 billion in 2020 and is expected to reach USD 13.22 billion by 2026, at a CAGR of 9.45% over the forecast period 2021 - 2026. Pipeline systems have evolved to become the primary solution for commercial activities. The market for pipeline security has been boosted by the demand for sustainable use of resources and the rising frequency of breaches and theft of small quantities of the product being transported.

- The pipeline system is being used since the 18th century for commercial activities. The pipelines are considered the safest, reliable, and efficient means of transporting large quantities of natural gas, crude oil, chemicals, and water across nations. Pipeline installations are critical infrastructure of high importance and value, and a threat to it can significantly affect meeting people's and organizations' needs and can harm the environment.

- The pipeline installed for the transport of commodities is estimated to span across 3.5 million kilometers across 120 countries worldwide. Natural gas and crude oil pipelines are expected to be the most vulnerable to attacks. Hence, the increased spending by the oil and gas corporation to install robust security infrastructure to ensure security to the pipelines has been the primary reason for the market's growth globally.

- Demand for natural gas is anticipated to increase faster than the current demand for coal or oil in the future. This has been predicted with the consideration to adhere the carbon reduction targets set globally to move towards an eco-friendly industrial sector. The increasing natural gas usage is increasing demand for its pipeline security.

- Additionally, the oil and gas sector is the most affected by the robust state-sponsored cyber-espionage campaigns, which can affect the physical infrastructure as well. These vulnerabilities have pushed the industry players to divert significant amounts of funds for security.

- However, the high deployment and maintenance cost is incorporated with the pipeline security systems as the pipeline facility is diverse and scattered. This factor is restricting companies from pipeline security system adoption.

Pipeline Security Market Trends

This section covers the major market trends shaping the Pipeline Security market according to our research experts:

SCADA System Segment to Grow Significantly

- Supervisory Control and Data Acquisition (SCADA) software have experienced rapid growth over the past decade. SCADA system helps the end-user industry employees to analyse the data and make crucial decisions from a remote location. It further assists in mitigating the issues with a quick response as it processes, distributes, and displays the data, on Human Machine Interface (HMI).

- Pipeline SCADA systems detect different hazards as well as leaks immediately and effectively alarms the security forces or maintenance crews. It offers a unique solution for the detection of on and underground activities. The applications are specifically used for the detection of digging and leakage.

- The US alone has about 150,000 miles of pipelines for transporting petroleum products. To efficiently monitor and control this massive oil pipeline network SCADA systems are employed. The oil pipeline SCADA has several hundred RTU’s (remote terminal units) that are connected to field instruments that measure pressure, temperature, and rate of flow of the oil flowing through the pipes, as well as change the statuses of valves and pumps along the pipeline.

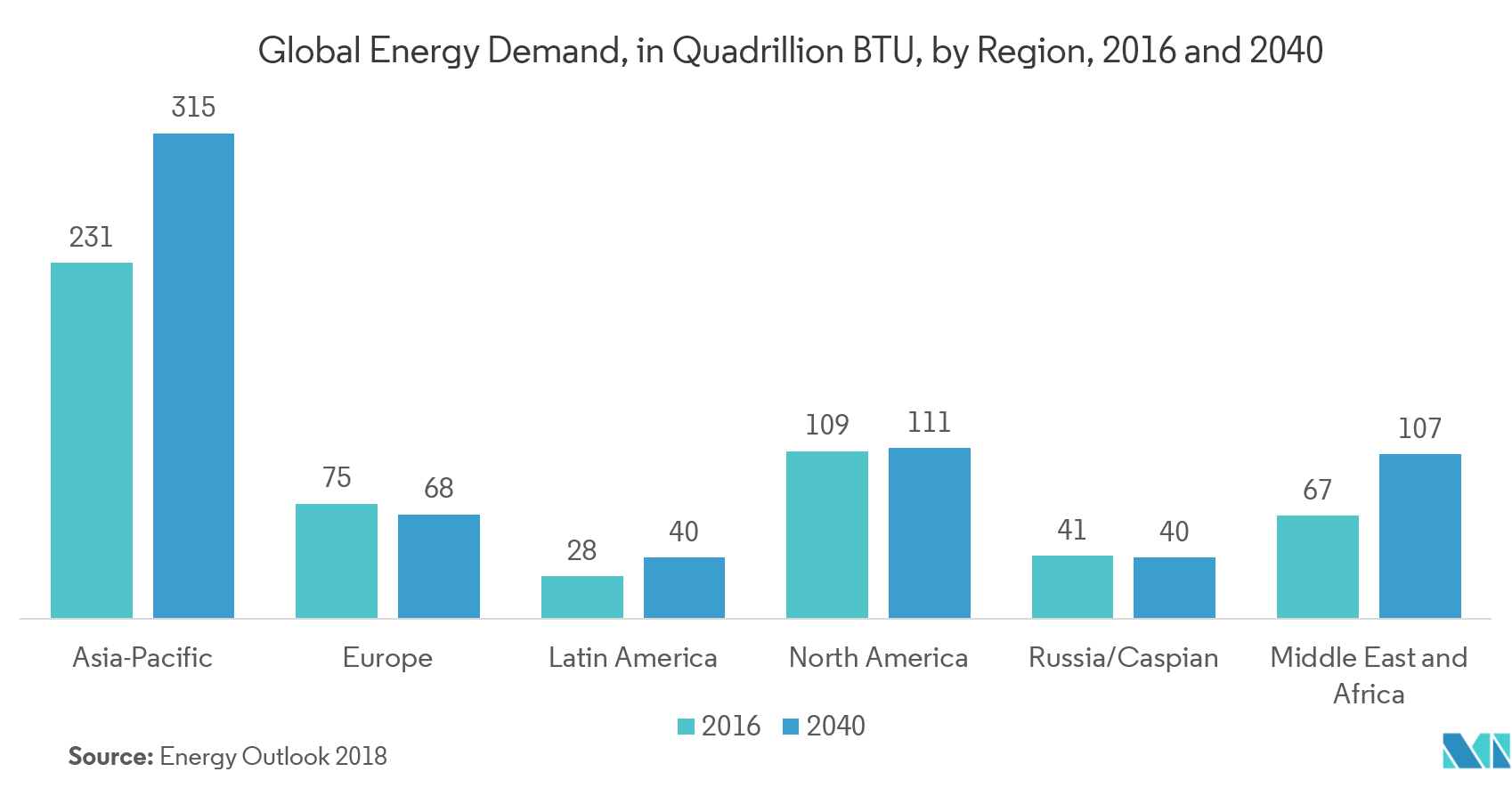

- According to EIA, the global demand for energy is expected to reach 681 quadrillions BTU by the year 2040. The increasing demand for natural gas production and supply globally to gain a reduction in carbon emission is demanding the need for their pipeline security systems.

Europe to Hold Significant Market Share

- The increasing investments in oil and gas are significantly contributing to the growth of the pipeline security market in the region. The European Union (EU) is highly dependent on external natural gas supplies and has experienced severe gas cuts in the past, mainly driven by the high-pressure natural gas system's technical complexity and political instability in some of the supplier countries.

- Declining indigenous natural gas production and growing demand for gas in the EU has encouraged investments in cross-border transmission capacity to increase the sharing of resources between the member states, particularly in the aftermath of the Russia–Ukraine gas crisis in January 2009.

- Amidst the growing need to cut operating costs, companies operating through pipeline in the region seek help from AI to automate functions, predict equipment problems, and increase the output of oil and gas.

- At present, European countries are among the primary consumers of Azerbaijani oil. Italy is Azerbaijan's leading trading partner in the sale of this oil on world markets. In the autumn of this year, Europe will also start consuming Azerbaijani gas. For this purpose, a 3,500-kilometer-long Southern Gas Corridor pipeline is being built and is nearing completion. Its last ring, the Trans-Adriatic Pipeline to the Adriatic Sea's Italian shores, is 97 percent completed. TAP is the Southern Gas Corridor's European section, enhancing Europe's energy security and contributing to decarbonizationand gas supplies diversification.

- In October 2020, the pipeline will start transporting Azerbaijani gas to Europe. Thus, Europe will begin importing natural gas from an entirely new source. The attack on Azerbaijan's Tovuz region shortly before this event is also considered an attack on Europe's energy security. Azerbaijan believes that one of Armenia's latest provocations' main goals is to destabilize the region and hinder the operating of these critical projects, which will allow Europe to access alternative energy sources and new markets.

Pipeline Security Industry Overview

The market trend moderately towards consolidation as a significant share of the market lies with the major market players. Innovation in the market requires the developers to have a better understanding of the industrial process to deliver a suitable solution and also drives close collaboration among the stakeholders during development, customisation to suit the end users need.

- Nov 2019 - Terra Drone Indonesia, a group company of Japan-based Terra Drone Corporation, conducted a demonstration to showcase the advantages of UAV-based pipeline monitoring to Indonesian oil and gas group Medco Energi Internasional Tbk PT. The demo was completed on November 15, 2019, in Purwakarta, West Java, using industry-leading Terra BRAMOR C4EYE UAS, manufactured by Terra Drone group company C-Astral.

- May 2019 - ABB launched a cloud-based SCADA system for offshore oil well drilling machines. This cloud-based visualisation system enables the small scale operators to gather insights about their onshore oil well drillings remotely similar to the big organisations without investing for the full on-premise SCADA system.

Pipeline Security Market Leaders

-

Honeywell International Inc.

-

General Electric Company

-

ABB Ltd.

-

Rockwell Automation, Inc.

-

Siemens AG

*Disclaimer: Major Players sorted in no particular order

Pipeline Security Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increased Spending of Oil & Gas Companies

- 4.2.2 Growing Worldwide Demand for Natural Gas

-

4.3 Market Restraints

- 4.3.1 Scattered Facilities

- 4.3.2 High Implementation and Maintenance Costs

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the impact of COVID-19 on the industry

5. MARKET SEGMENTATION

-

5.1 Product

- 5.1.1 Natural Gas

- 5.1.2 Crude Oil

- 5.1.3 Hazardous liquid pipelines/ Chemicals

- 5.1.4 Other Products

-

5.2 Technology and Solution

- 5.2.1 SCADA System

- 5.2.2 Perimeter Security/Intruder Detection System

- 5.2.3 Industrial Control Systems Security

- 5.2.4 Video Surveillance & GIS Mapping

- 5.2.5 Pipeline Monitoring

- 5.2.6 Other Technology and Solutions

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Lain America

- 5.3.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles*

- 6.1.1 Honeywell International Inc.

- 6.1.2 General Electric Company

- 6.1.3 ABB Ltd.

- 6.1.4 Rockwell Automation, Inc.

- 6.1.5 Siemens AG

- 6.1.6 Schneider Electric S.E.

- 6.1.7 Optasense Ltd.

- 6.1.8 Senstar Corporation

- 6.1.9 Huawei Technologies USA, Inc.

- 6.1.10 ESRI Inc.

- 6.1.11 Thales SA

7. INVESTMENT ANALYSIS

8. FUTURE OF THE MARKET

** Subject To AvailablityPipeline Security Industry Segmentation

The scope of the study for pipeline security market is limited to the type of security systems offered by the vendors for different commodity pipelines globally. The after sales service are not considered for market estimation.

| Product | Natural Gas |

| Crude Oil | |

| Hazardous liquid pipelines/ Chemicals | |

| Other Products | |

| Technology and Solution | SCADA System |

| Perimeter Security/Intruder Detection System | |

| Industrial Control Systems Security | |

| Video Surveillance & GIS Mapping | |

| Pipeline Monitoring | |

| Other Technology and Solutions | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Lain America | |

| Middle East and Africa |

Pipeline Security Market Research FAQs

What is the current Pipeline Security Systems Market size?

The Pipeline Security Systems Market is projected to register a CAGR of 9.45% during the forecast period (2024-2029)

Who are the key players in Pipeline Security Systems Market?

Honeywell International Inc., General Electric Company, ABB Ltd., Rockwell Automation, Inc. and Siemens AG are the major companies operating in the Pipeline Security Systems Market.

Which is the fastest growing region in Pipeline Security Systems Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Pipeline Security Systems Market?

In 2024, the North America accounts for the largest market share in Pipeline Security Systems Market.

What years does this Pipeline Security Systems Market cover?

The report covers the Pipeline Security Systems Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Pipeline Security Systems Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Pipeline Security Systems Industry Report

Statistics for the 2024 Pipeline Security Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Pipeline Security Systems analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.