RTD Temperature Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.68 % |

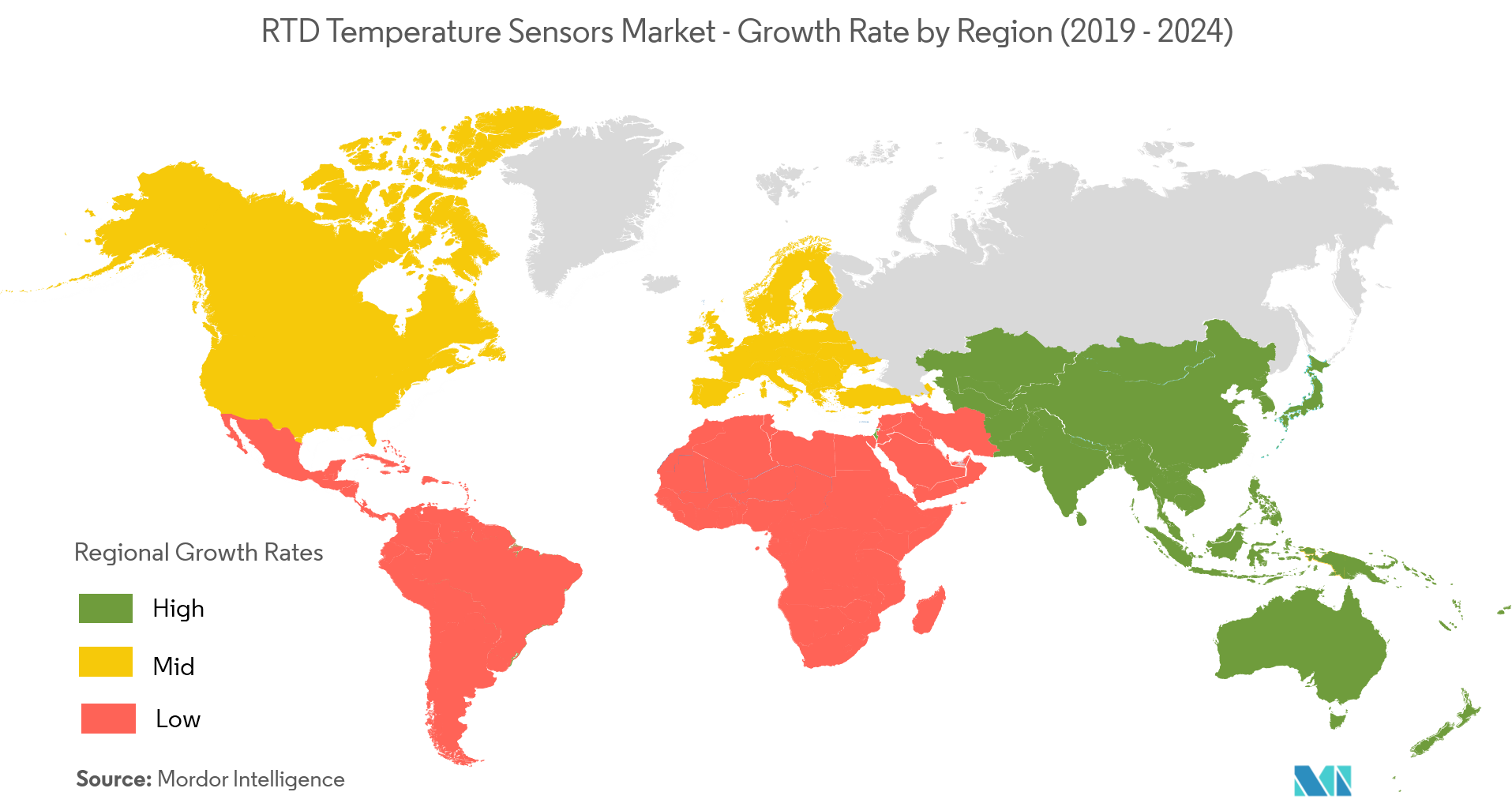

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

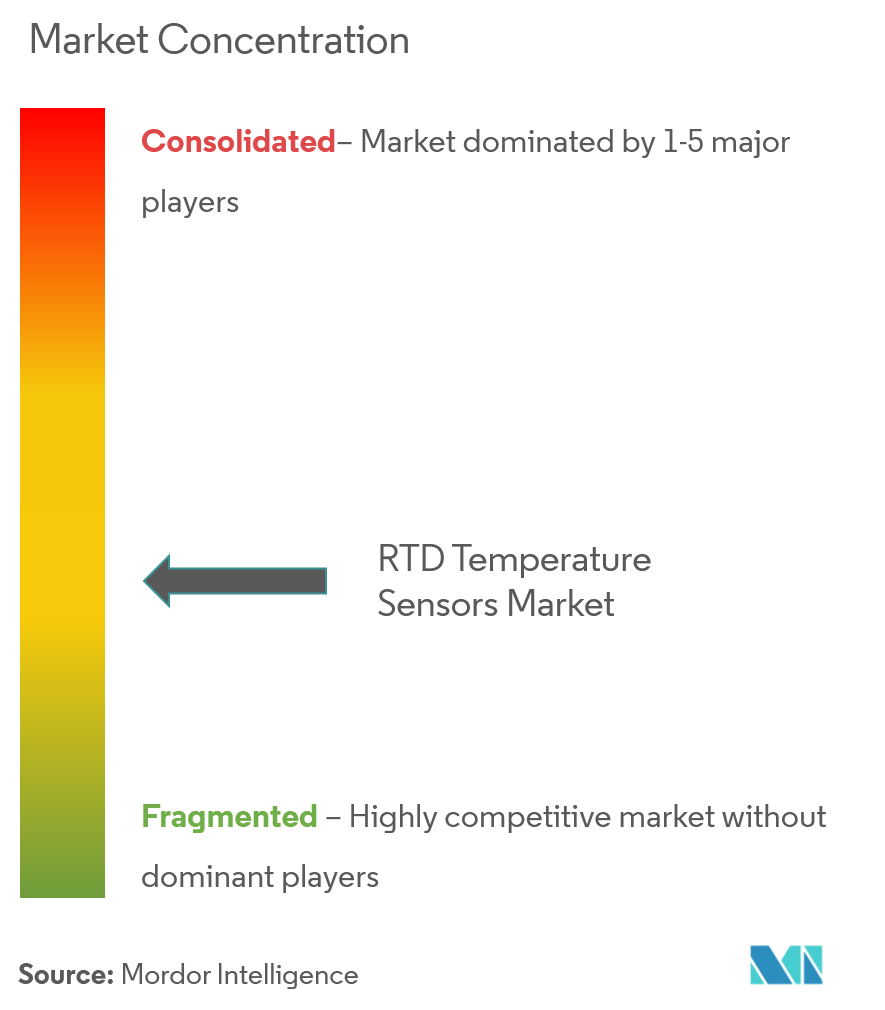

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

RTD Temperature Sensors Market Analysis

The RTD temperature sensors market registered a CAGR of 5.68% during the forecast period 2021-2026.

- A temperature sensor is basically an electronic device which measures the temperature through an electrical signal. These sensors are used in various systems and devices to measure the heat released/generated and alert the user. An RTD (Resistance Temperature Detector) is a variable resistor that changes its electrical resistance in direct proportion to changes in temperature in a precise, repeatable and almost linear manner.

- The RTD temperature sensor market is majorly driven by the benefits it presents such as durability, accuracy, and linear response. Furthermore, the growth of the market is supported by the stringent government regulations mandating the use of these sensors in various applications to overcome heating issues.

- Moreover, temperature measurement and control is very crucial for the steady performance of sophisticated consumer electronic products. These sensors provide long-term reliability, accuracy, and fast response times for the efficient operation of household electronics, such as home appliances, pool, and spa control, among other products.

- Owing to their high performance, RTDs are the primary sensors of choice for sophisticated HVAC applications. Highly efficient environmental building control systems require precision temperature measurements at numerous points within a project.

RTD Temperature Sensors Market Trends

This section covers the major market trends shaping the RTD Temperature Sensors Market according to our research experts:

Automotive Industry to Hold a Significant Market Share

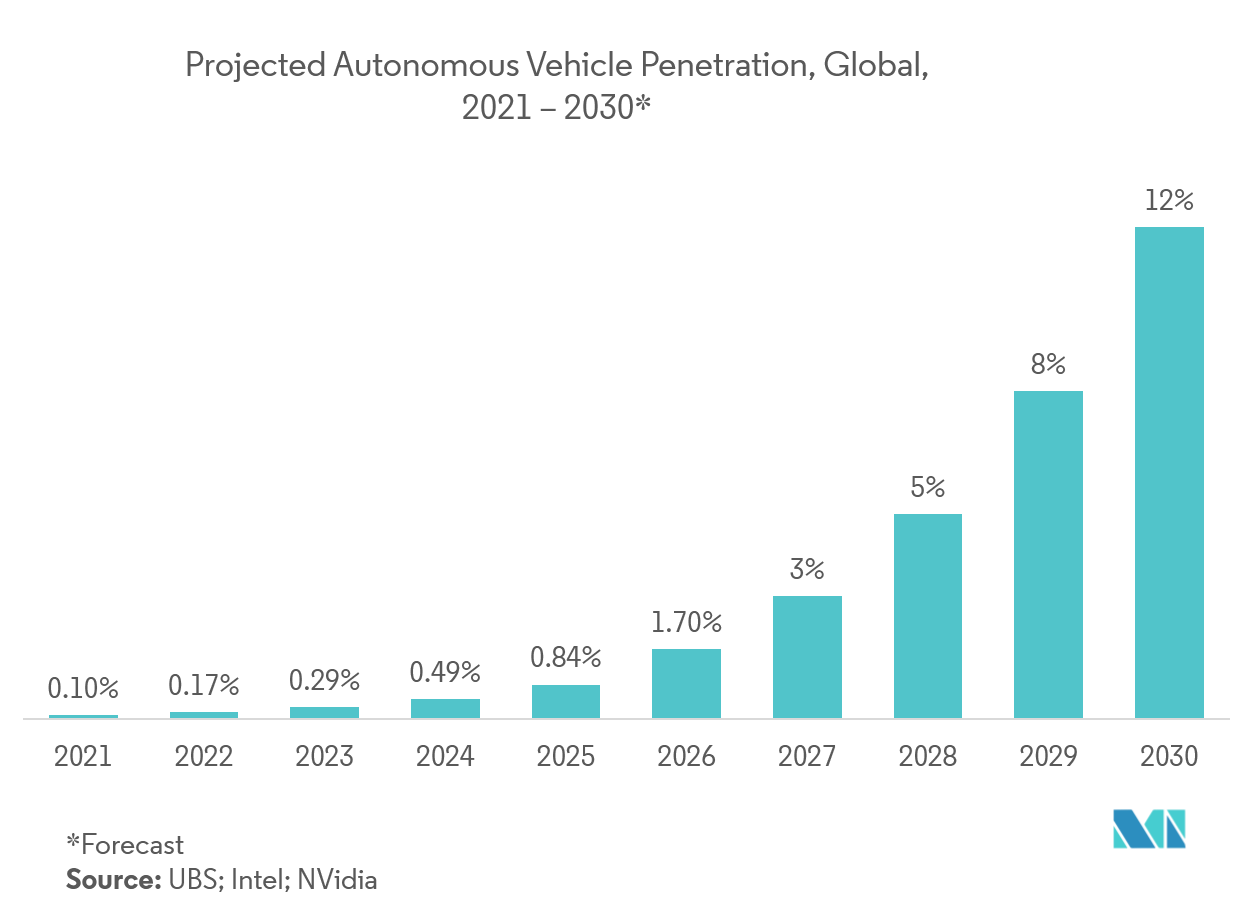

- The automotive industry is currently experiencing a passive market change. The rise of the sharing economy and new partnerships with disruptive tech companies are the factors resulting in the growth of automotive manufacturers.

- The temperature sensors incorporated in a vehicle are used for sensing the temperature of liquid and gases in a vehicle. These sensors are used in various types of components in a vehicle to sense and monitor the temperature.

- The major markets for automotive sales are the US, China, and Europe. The drive towards innovation and the emergence of autonomous vehicles is expected to further drive the growth of automotive industry significantly in these developed regions, while the developing economies have also witnessed a considerable rise in the consumer disposable income and can directly translate into an increase in the purchase of automobiles, which is further expected to drive the market.

North America Accounts for a Significant Market Share

- The North American region holds a significant share of the market owing to the booming manufacturing and food-processing industries in this region, especially in chamber application, where usually temperature (cold) is the only parameter monitored.

- RTDs are currently the most advanced versions of temperature measurement sensors that provide a highly accurate, stable, linear response for a moderate range of temperatures, however, they are energy inefficient, as they need external power.

- According to the US FDA, only two temperatures sensors are used in regulating the food and drug industry, namely resistance temperature detectors (RTDs) and thermistors. Moreover, with the growing number of employees in the chemical manufacturing industry it is evident that the chemical manufacturing industry is growing, thus, driving the market forward

RTD Temperature Sensors Industry Overview

The RTD temperature sensor market is highly competitive owing to the presence of many big and small manufacturers running their business in domestic as well as international market. The market appears to be moderately concentrated slowly moving towards the fragmented stage with the major players adopting strategies like product innovation, mergers, and acquisition. Some of the major players in the market areHoneywell International, Inc.,ABB Ltd.,Analog Devices, Inc. among others.

- February 2019 - STMicroelectronicsentered into a partnership with Hyundai Autron to launch a development lab for eco-friendly automotive sensor solutions. The collaboration will also provide the environment for engineers to collaborate on pioneering solutions for eco-friendly vehicles, with a focus on powertrain controllers.

RTD Temperature Sensors Market Leaders

-

Texas Instruments Incorporated

-

Honeywell International, Inc.

-

ABB Ltd.

-

Analog Devices, Inc.

-

Emerson Electric Company

*Disclaimer: Major Players sorted in no particular order

RTD Temperature Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growing Application of Temperature Sensors in Industries

- 4.3.2 Increasing Demand for Temperature Sensors in Consumer Electronics

-

4.4 Market Restraints

- 4.4.1 High Cost of the System

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type of Measurement

- 5.1.1 Surface Measurement

- 5.1.2 Liquid Measurements

- 5.1.3 Air and Gas Stream Measurements

-

5.2 By End-user Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive

- 5.2.3 Aerospace & Defense

- 5.2.4 Chemical

- 5.2.5 Oil & Gas

- 5.2.6 Energy and Power

- 5.2.7 Food & Beverage

- 5.2.8 Manufacturing

- 5.2.9 Other End-user Industries

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Texas Instruments Incorporated

- 6.1.2 Panasonic Corporation

- 6.1.3 Siemens AG

- 6.1.4 Honeywell International, Inc.

- 6.1.5 ABB Ltd.

- 6.1.6 Analog Devices, Inc.

- 6.1.7 General Electric

- 6.1.8 Emerson Electric Company

- 6.1.9 STMicroelectronics

- 6.1.10 NXP Semiconductors N.V.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityRTD Temperature Sensors Industry Segmentation

To greater or lesser degrees, all the electrical conducting materials have some amount of resistance to the flow of electricity. When a known electric voltage passes through a conductor, the resistance varies based on the temperature of the conductor. This resistance can be measured and will correspond to a specific temperature. An electronic readout device, such as a controller or digital indicator designed to measure resistance, is required for use with RTD sensors.

| By Type of Measurement | Surface Measurement |

| Liquid Measurements | |

| Air and Gas Stream Measurements | |

| By End-user Industry | Consumer Electronics |

| Automotive | |

| Aerospace & Defense | |

| Chemical | |

| Oil & Gas | |

| Energy and Power | |

| Food & Beverage | |

| Manufacturing | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

RTD Temperature Sensors Market Research FAQs

What is the current RTD Temperature Sensors Market size?

The RTD Temperature Sensors Market is projected to register a CAGR of 5.68% during the forecast period (2024-2029)

Who are the key players in RTD Temperature Sensors Market?

Texas Instruments Incorporated, Honeywell International, Inc., ABB Ltd., Analog Devices, Inc. and Emerson Electric Company are the major companies operating in the RTD Temperature Sensors Market.

Which is the fastest growing region in RTD Temperature Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in RTD Temperature Sensors Market?

In 2024, the North America accounts for the largest market share in RTD Temperature Sensors Market.

What years does this RTD Temperature Sensors Market cover?

The report covers the RTD Temperature Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the RTD Temperature Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

RTD Temperature Sensors Industry Report

Statistics for the 2024 RTD Temperature Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. RTD Temperature Sensors analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.