Market Trends of Safety Connection Devices Industry

This section covers the major market trends shaping the Safety Connection Devices Market according to our research experts:

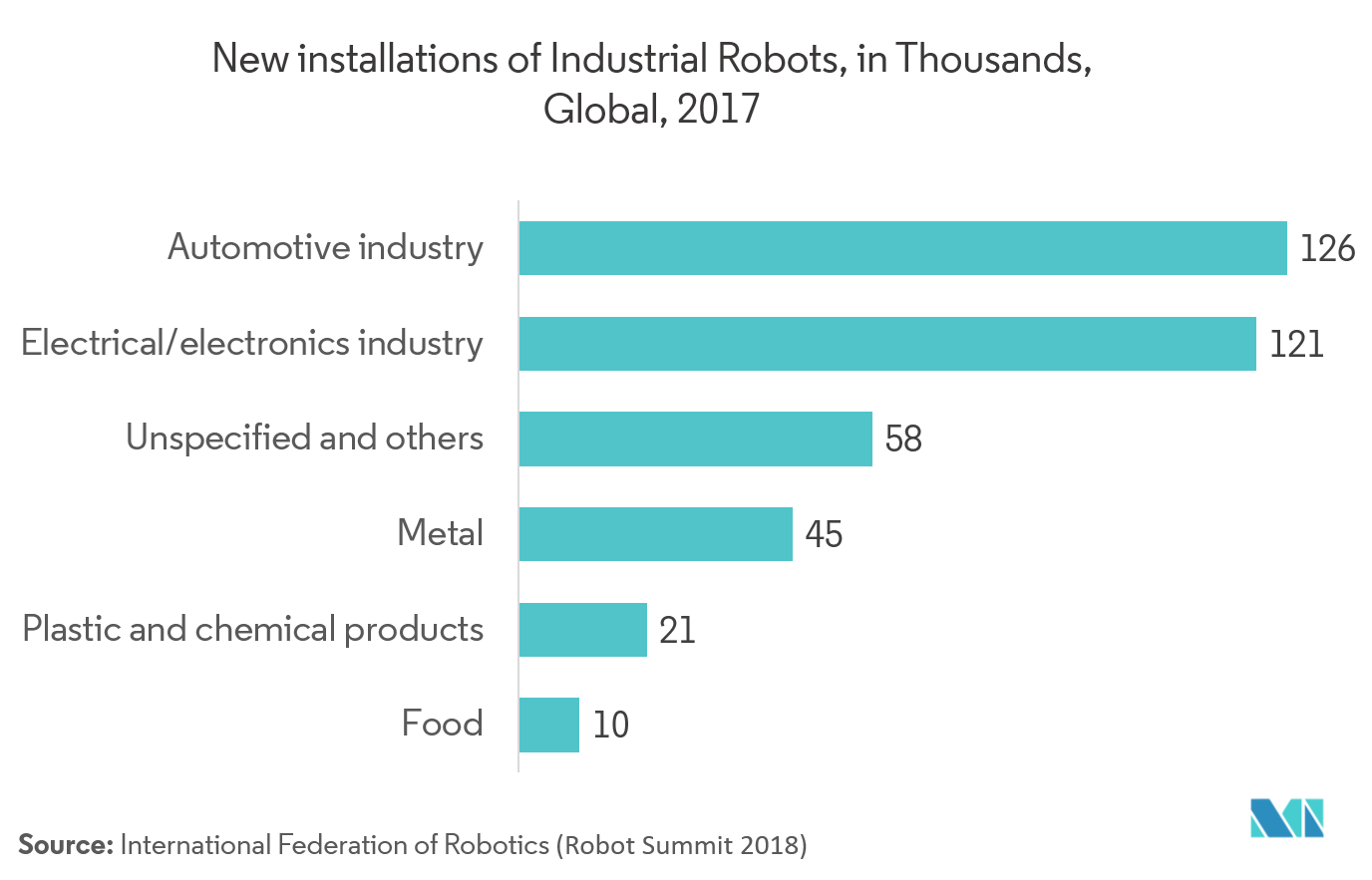

Automotive Industry to Drive the Market Growth

- The automotive industry is one of the fastest growing consumers of safety connection devices. With the growing demand for automobiles across the world, companies are pushing toward automated systems, to increase the productivity of the existing plants.

- Many automotive manufacturers are either establishing new manufacturing infrastructures across the world or moving the processes of automotive manufacturing from manual labor to robotic machinery. For instance, BMW is launching a new factory in Hungary by 2023, having a capacity of producing 150,000 vehicles per year.

- Thus, with the increase in the number of industrial robots and automation, there is a need for interfacing these systems with centralized controllers. In 2017, the automotive industry had 126,000 new installations of industrial robots, which is the maximum across the industries.

- The automotive industry is thus deploying safety connection devices, so as to make controllers, and other devices communicate with each other.

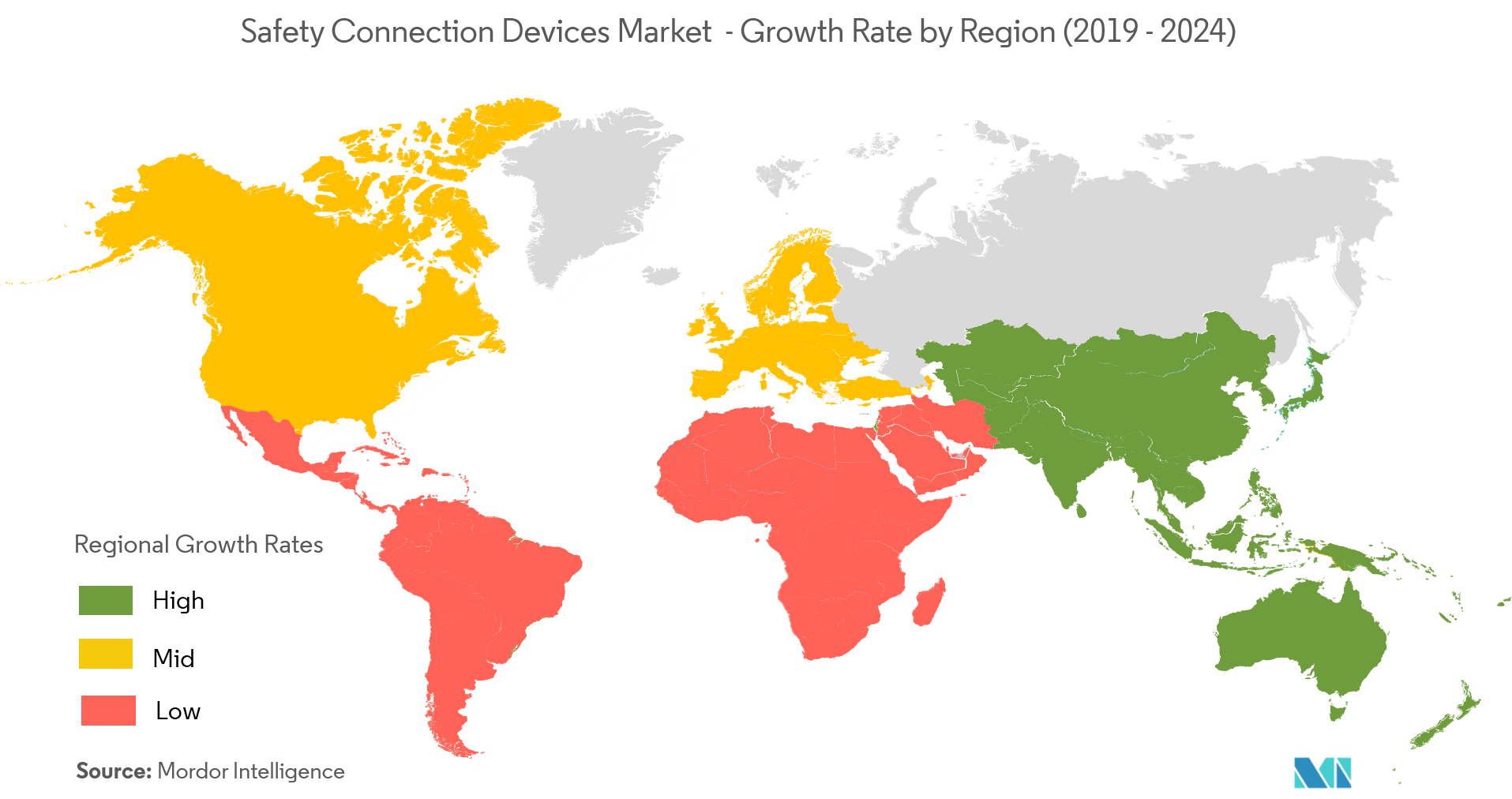

Asia-Pacific to Execute the Fastest Growth

- Asia-Pacific is estimated to be the fastest growing region for the safety connection devices market. The industries are adopting automation, thus making the machines more complex. This ultimately demands more secure and reliable connection devices for the applications.

- The presence of a large number of domestic and international manufacturing companies in the emerging economies of Asia-Pacific, rapid industrialization, and expanding manufacturing activities are projected to drive the machine condition monitoring market in this region.

- India is the third largest economy in the world and the government is taking up initiatives like 'Make in India' to make the country a manufacturing hub. It has a strong emphasis on transforming the domestic manufacturing sector and aims to pull up the GDP share to 25% from 16% by 2022.

- Moreover, the sales of new vehicles in China, which includes passenger vehicles, buses, and trucks, crossed 28 million units in 2018. Therefore, the automotive market in Asia-Pacific is driven strongly by production activities in countries, such as China and India, further demanding safety devices across industries.