Safety Relays & Timers Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR (2024 - 2029) | 4.50 % |

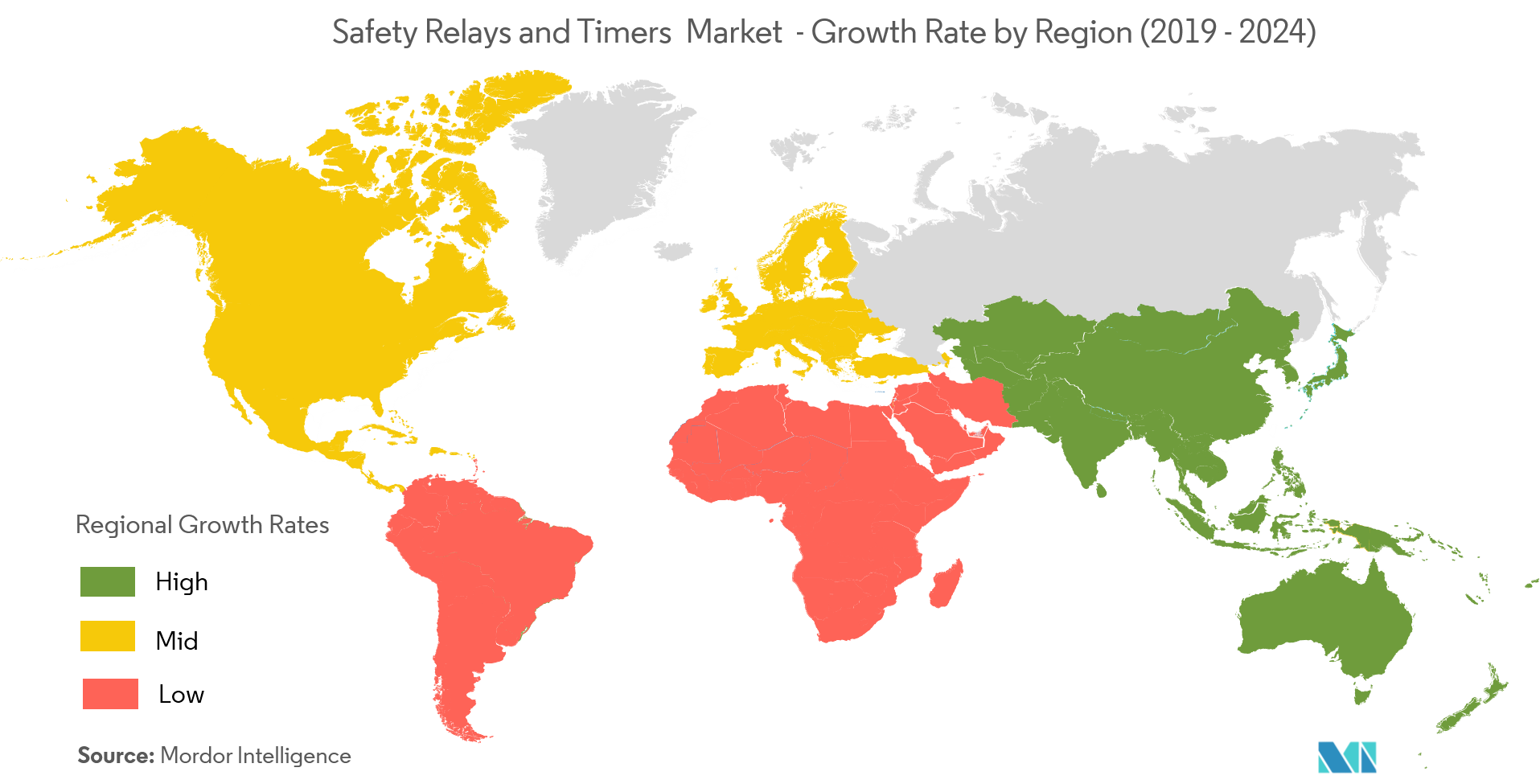

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

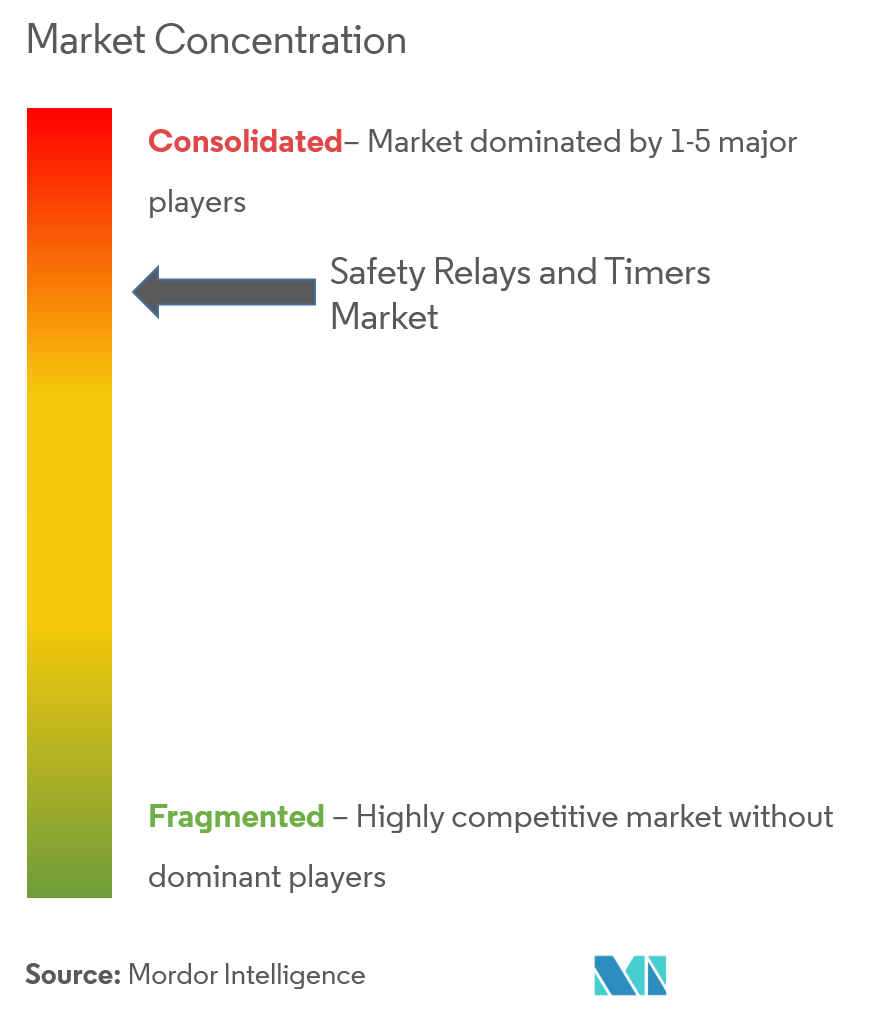

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Safety Relays & Timers Market Analysis

The Safety Relays And Timers Market is expected to register a CAGR of 4.5% during the forecast period.

- Safety Relays help in checking and monitoring a safety system and allows the machine to either start or execute the commands to stop the machine. The upcoming designs of safety relays have made it capable of saving up on a lot of machines startup time as well as manual efforts.

- The Single-Function Safety Relays are most economical when compared to the modular & configurable safety relays. The former is preferred for smaller machines that require dedicated logic devices to complete the safety functions, while the latter is preferable where large and diverse safeguarding devices and minimal zone controls are required.

- The increasing use of safety relays and timer devices in the oil and gas, chemical, and petrochemical industries and high demand for these devices in the automotive and food and beverage industries will drive the market growth.

- Factors such as the growing usage of industrial relays and timers for applications such as storage and pumping and the availability of modular and configurable monitoring safety relays will contribute to the growth of this industry segment in the future.

- However, the complexity of standards and high market competition will hinder the growth of safety relay and timers market.

Safety Relays & Timers Market Trends

Safety Relays to Have High Demand Across Various Industries

- In the oil and gas sector, safety relays and timers are used in applications such as controlling, starting, and protecting circuits. Safety relays is an integral component of the oil and gas industry as it requires heavy machinery that must be controlled through safety relays. Industrial timers are suitable for use in material handling, machine tools, and process control in various process machines.

- The deployment of process machines has increased due to the considerable rise in offshore oil and gas exploration activities. Offshore oil and gas exploration activities require complex drilling operations, making it challenging in terms of logistics and operations.

- In the chemical and petrochemical industry, the safety relay is used in the application such as pumping and storage. Increase in chemical and petrochemical plants boost the use of safety relays and timers.

- In the power industry, with the increase in connected and electronic devices, there has been a rise in power generation. Also, industries are widely using automation in their process line which is creating demand for safety relay and timers.

- In the United Kingdom, there was an increase in sales of relays over the past few years compared to previous years due to the increase in usage in construction, manufacturing, oil and gas, energy and power and semiconductors industries.

Asia-Pacific to be the Fastest Growing Market

- In APAC, countries like China, India are the major market for the safety relay and timers due to rapid development in construction, energy and power, automotive, manufacturing sectors.

- The shift of manufacturing industries to Asia, the growing dispensable income among the middle class, and the developments in South East Asia, including the ‘Make in India’ campaign by the Indian government, will boost the safety relays & timers market in Asia.

- For instance, In May 2018, India ranked 4th in the Asia Pacific region out of 25 nations on an index that measures their overall power. The Indian power sector is undergoing a significant change that has redefined the industry outlook. Sustained economic growth continues to drive electricity demand in India.

- The Government of India’s focus on attaining ‘Power for all’ has accelerated capacity addition in the country. At the same time, the competitive intensity is increasing at both the market and supply sides (fuel, logistics, finances, and manpower). The total installed capacity of power stations in India stood at 350.16 Gigawatt (GW) as of February 2019. Thus, power sector drives the safety relays and timers market too.

Safety Relays & Timers Industry Overview

The safety relays and timers market are consolidated due to a major share of the market that isoccupied by top players.Some of the key players includeRockwell Automation, OMRON Industrial Automation, SICK AG,Eaton Corp.,Siemens AG,ABB Group,TE Connectivity,Altech Corp., Pilz GmbH & Co. KG, among others.

- March 2019 - Pilz launchedPNOZ, PNOZmultithat stands for refreshingly easy operation by a graphics configuration software tool. Complex processes can be programmed intuitively with our PLC control system PSS Universal PLCof automation system PS 4000.

- January 2019 -Rockwell Automation, Inc. acquired Emulate3D, an innovative engineering software developer whose products digitally simulate and emulate industrial automation systems. By using accurate simulation models to improve systems planning and decision-making, followed by emulation trials that test the control system before installation, Emulate3D’s software enables customers to virtually test machine and system designs before incurring manufacturing and automation costs and committing to a final design.

Safety Relays & Timers Market Leaders

-

Rockwell Automation

-

OMRON Industrial Automation

-

Eaton Corp.

-

Siemens AG

-

ABB

*Disclaimer: Major Players sorted in no particular order

Safety Relays & Timers Market News

- August 2024 - Relay, a cloud-based platform that has replaced traditional two-way radios and standalone panic buttons, has unveiled its latest offering, RelayX. RelayX boasts unparalleled redundant connectivity and caters to manufacturing, warehousing, hospitality, and healthcare teams. It aims to simplify and empower users in navigating the unforeseen challenges of frontline work.

- January 2024 - Fanox presented the SIR-C Overhead Control and Feeder Protection system. According to the company, the SIR-C is an Overhead Control / RTU and Feeder Protection Relay, incorporating capacitive and resistive low-power voltage sensors. Furthermore, the relay has an auxiliary power supply of 24 to 230 Vdc/ac and supports multiple industrial protocols such as DNP3.0 and Modbus RTU, IEC60870-5-104, IEC60870-5-103, and IEC61850 to ensure robust and reliable performance.

Safety Relays & Timers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Industry Safety Standards

- 4.2.2 Demand for Functional Safety

- 4.2.3 Minimal Time & Labor Effort Requirements

- 4.2.4 Cost-effective Systems

-

4.3 Market Restraints

- 4.3.1 High Market Competition

- 4.3.2 Complexity of Standards

-

4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Snapshot

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Single-Function Safety Relays

- 5.1.2 Modular & Configurable Safety Relays

-

5.2 By Contact

- 5.2.1 Normally Closed, Time Open (NCTO)

- 5.2.2 Normally Closed, Time Closed (NCTC)

- 5.2.3 Normally Open, Time Open (NOTO)

- 5.2.4 Normally Open, Time Closed (NOTC)

-

5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Energy & Power

- 5.3.3 Manufacturing

- 5.3.4 Pharmaceutical

- 5.3.5 Construction

- 5.3.6 Semiconductors

- 5.3.7 Oil & Gas

-

5.4 Geography***

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles*

- 6.1.1 Rockwell Automation

- 6.1.2 OMRON Industrial Automation

- 6.1.3 SICK AG

- 6.1.4 Eaton Corp.

- 6.1.5 Siemens AG

- 6.1.6 ABB

- 6.1.7 Pilz GmbH & Co. KG

- 6.1.8 TE Connectivity

- 6.1.9 Altech Corp.

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySafety Relays & Timers Industry Segmentation

Safety relays are electromechanical switching devices which implement safety functions. At the time of hazard, a safety relay reduces the risk to an acceptable level by initiating a safe and reliable response. It also monitors a safety system and allows the machine to start or stop based on a command. A safety timer is either used to produce precise time delay or used to repeat an action after a certain period. Safety timers are processors that not only generate time delays but are also used as counters where these are used to count an activity or event.

| By Type | Single-Function Safety Relays |

| Modular & Configurable Safety Relays | |

| By Contact | Normally Closed, Time Open (NCTO) |

| Normally Closed, Time Closed (NCTC) | |

| Normally Open, Time Open (NOTO) | |

| Normally Open, Time Closed (NOTC) | |

| By End-user Industry | Automotive |

| Energy & Power | |

| Manufacturing | |

| Pharmaceutical | |

| Construction | |

| Semiconductors | |

| Oil & Gas | |

| Geography*** | North America |

| Europe | |

| Asia | |

| Australia and New Zealand | |

| Latin America | |

| Middle East and Africa |

Safety Relays & Timers Market Research FAQs

What is the current Safety Relays and Timers Market size?

The Safety Relays and Timers Market is projected to register a CAGR of 4.5% during the forecast period (2024-2029)

Who are the key players in Safety Relays and Timers Market?

Rockwell Automation, OMRON Industrial Automation, Eaton Corp., Siemens AG and ABB are the major companies operating in the Safety Relays and Timers Market.

Which is the fastest growing region in Safety Relays and Timers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Safety Relays and Timers Market?

In 2024, the North America accounts for the largest market share in Safety Relays and Timers Market.

What years does this Safety Relays and Timers Market cover?

The report covers the Safety Relays and Timers Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Safety Relays and Timers Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Safety Relays and Timers Industry Report

Statistics for the 2024 Safety Relays and Timers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Safety Relays and Timers analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.