Safety Sensor Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 3.24 % |

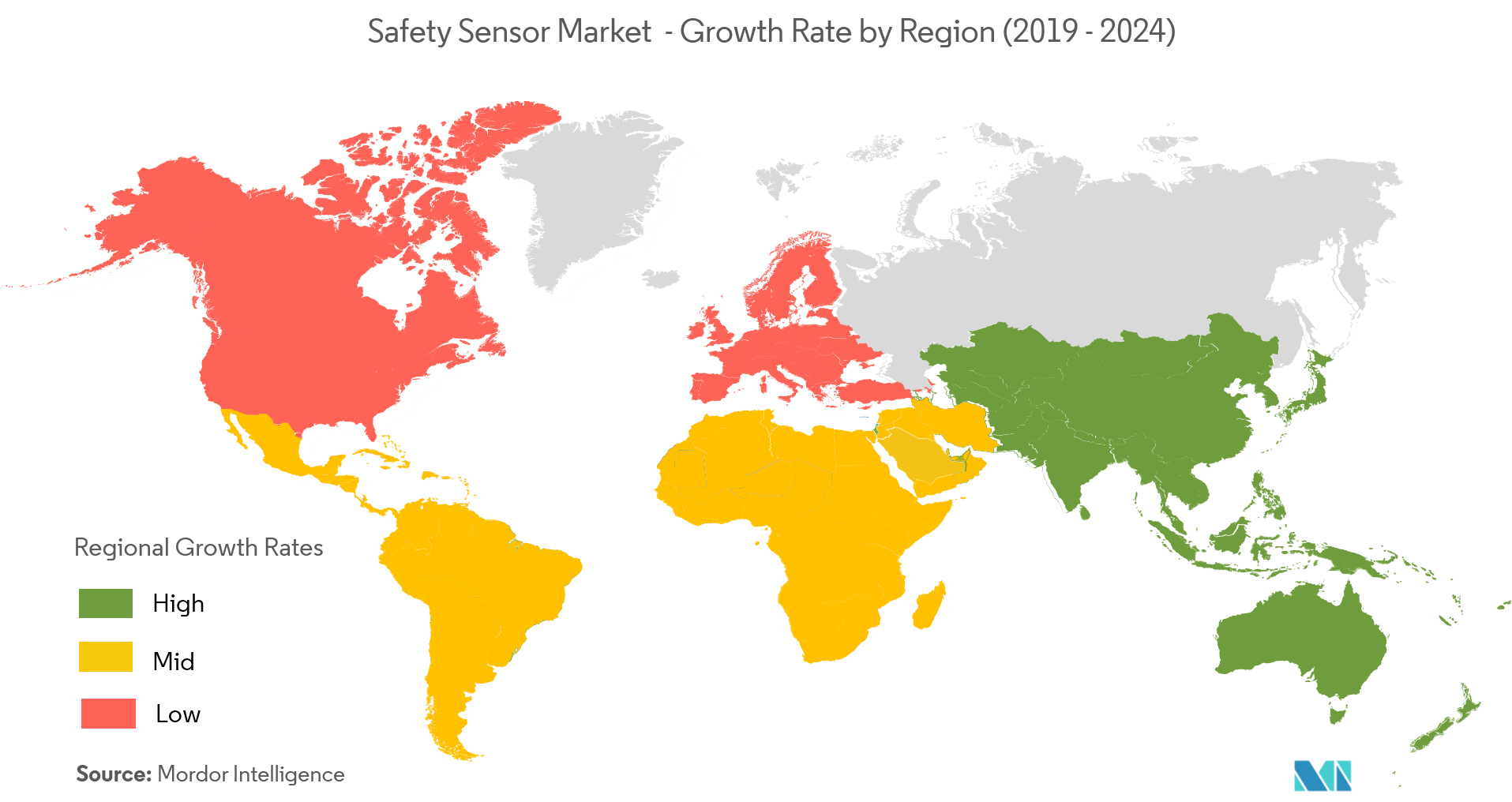

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

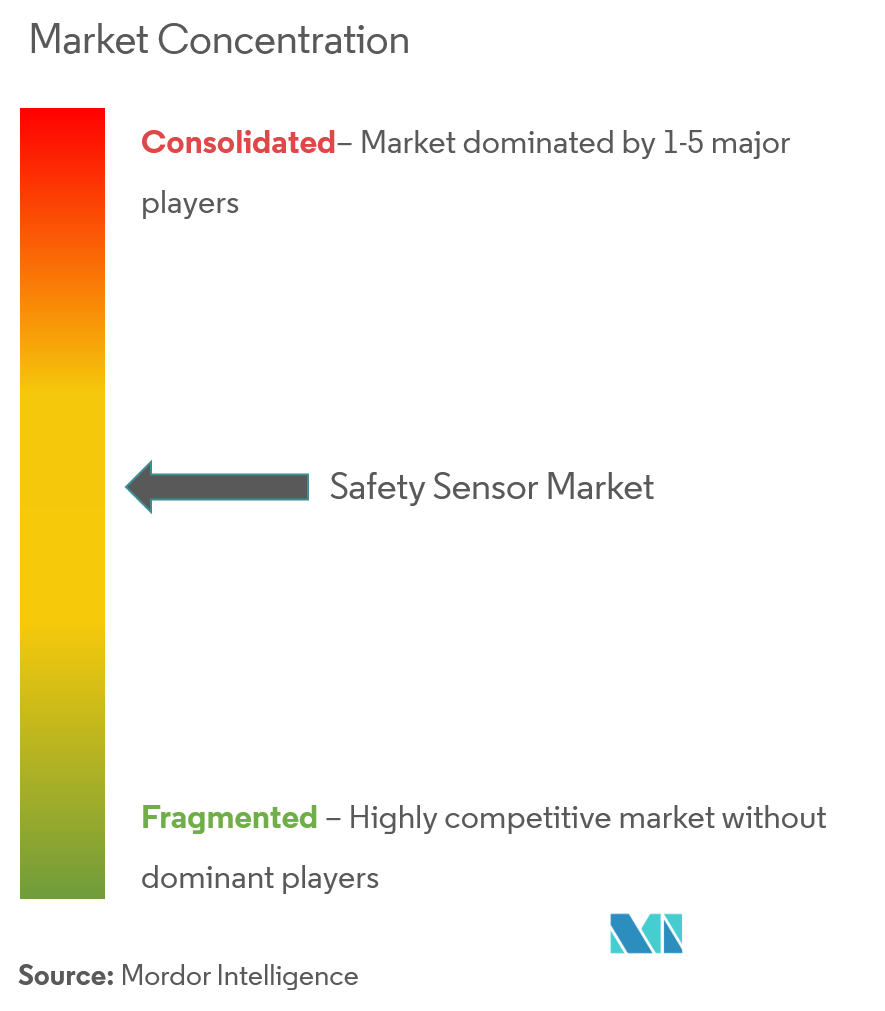

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Safety Sensor Market Analysis

The safety sensors market was valued at USD 544.47 million in 2020 and is expected to reach a value of USD 660.24 million by 2026 at a CAGR of 3.24 %, over the forecast period (2021 - 2026). The increase in safety automation and boom of Industrial 4.0 will lead to safety sensor market.

- There has been an increasing emphasis on safeguarding factories, due to rising fatalities and injuries in manufacturing. The growing investments by the stakeholders in the industry to increase safety have led to a decrease in these accidents.

- Moreover, the specifications and safety requirements posed by the safety associations are putting pressure on end-user industries to increase their safety investments further.

- There is an increasing demand for diagnostic LED's to be deployed on the sensors to indicate various errors, misalignment, and door open/closed signaling. These systems are expected to gain further traction as the advanced systems will be used along with RFID for accurate and advanced safety features.

- Integration of mechanical systems with IT technology is frequently being used to standardize reliable production systems to provide effortless monitoring, waste reduction, and increase the speed of production, which are some of the significant advantages of automated manufacturing processes.

- The stringent government policies and regulations for employee and machinery safety are driving the market.

Safety Sensor Market Trends

This section covers the major market trends shaping the Safety Sensor Market according to our research experts:

Automotive End User Hold a Significant Market Share

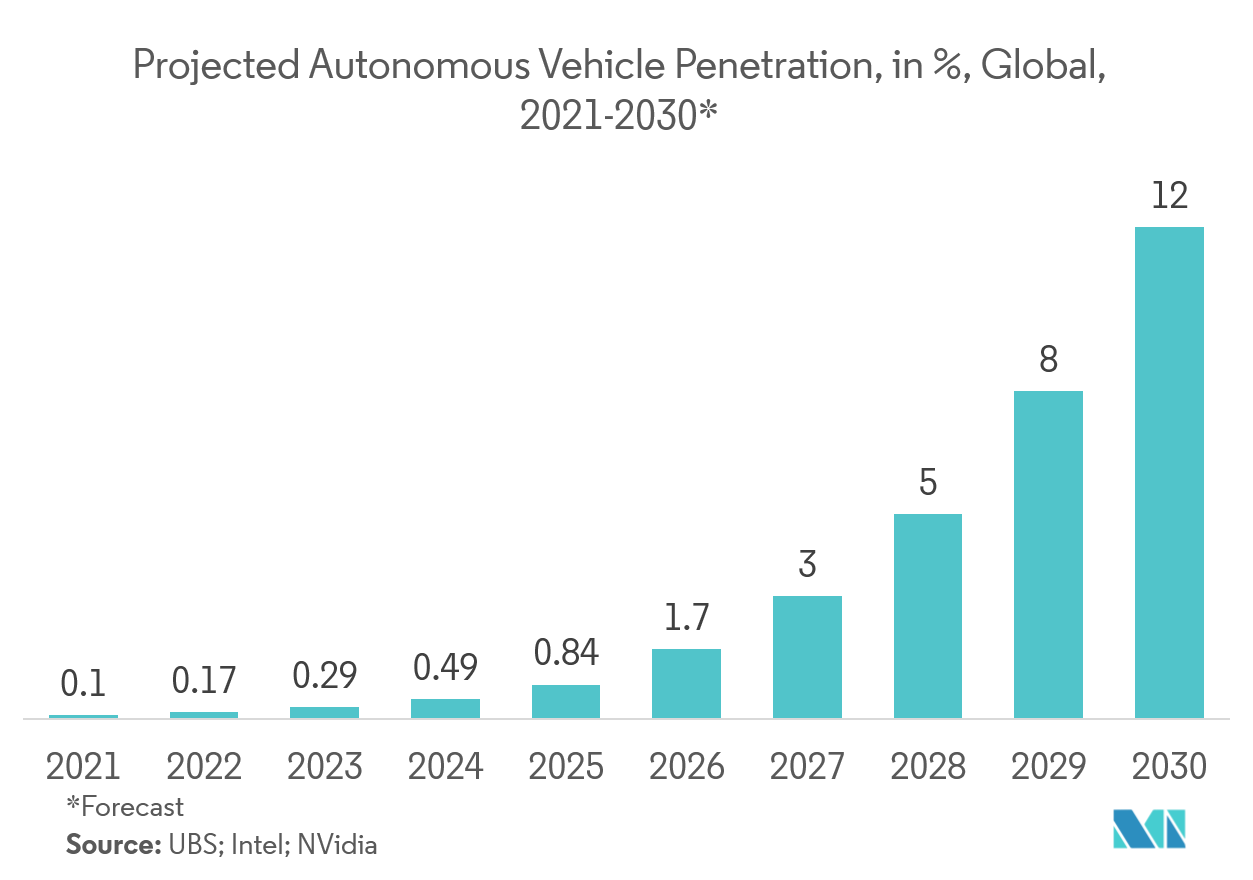

- The automotive industry is the fastest growing end-user segment for safety sensors. The increased usage of automation solutions and the production of autonomous vehicles are the key driving factors for growth in demand form this sector.

- Traditionally, safety sensors such as light curtains and safety mats are popular amongst the automakers for a long time now. But as the manufacturing establishments had evolved over time, there has been an increased demand for advanced safety sensors that take robotic solutions used in the assembly line into account.

- It is estimated that in the same year, the automobile industry consumed about 38% of the total supply of industrial robots. It is estimated the usage of new materials such as carbon fiber, increased production of electric cars and high competition in all major car markets will push the manufacturers for investments into industrial robots despite the existing overcapacities.

- Apart from increased automation, high rate of accidents in the manufacturing and servicing establishments of the automotive sector is another primary driver for the need for smart sensors in this sector.

North America Account for Significant Market Share

- In North America, the manufacturing industry is thriving, offering employment to over 12 million people, thus leading to USD 6 trillion nominal gross domestic product in the first quarter of 2017 alone and is expected to grow in the forecast period.

- New technologies, such as safety sensors, are already playing their part in making factories more efficient, cost-effective, safe, and easier to manage. The move towards greater automation is the unavoidable flow of change.

- The US Department of Labor Occupational Health and Safety Administration (OSHA) oversees requirements that make workplaces safer. However, The challenge remains in changing the approach to workplace safety by emphasizing prevention instead of detection. By including safety sensors in the factory assembly line, proper preventive measures are being taken.

- Since 1950, safety mats have been the standard form of area protection in the factories throughout North America. However, safety mats are subject to physical and environmental abuse and can wear out with repeated long-term use. Nevertheless, safety mats are widely used in modern automated factories throughout the United States.

Safety Sensor Industry Overview

The major players include are ABB Group, Rockwell Automation, Panasonic, Schnieder Electric, BEI Sensors.Siemens AG, SICK AG, Pepperl+Fuchs, PlzGmbH & Co.among others. The market is nighter fragmented nor consolidated because there is no major competition in the market. Therefore market concentration will be moderate.

- January 2018- Banner Engineering Corp.launched cost-effective safety light curtain for simple OEM Applications, EZ-Screen LS Basic. It consumes 30% less energy than the standard ones. Its low cost does not take a toll on its longevity, it has a 5mm recessed window protected by a 3mm thick Aluminum housing and metal caps.

- January 2018- Siemens building technologies division introduced a dust sensor, which can be utilized in buildings, rounding out its product offering for a healthy indoor climate. The sensor can be used to monitor and visualize particle pollution and is easy to integrate into building management systems.

Safety Sensor Market Leaders

-

Rockwell Automation

-

ABB Limited

-

Panasonic Electric Co. Ltd

-

BEI Sensor

-

Schneider Electric

*Disclaimer: Major Players sorted in no particular order

Safety Sensor Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Industrial 4.0 Revolution Leading to Increasing Emphasis on Safety Automation

- 4.3.2 Stringent Government Policies and Regulations for Employee and Machinery Safety

-

4.4 Market Restraints

- 4.4.1 Deployment in Legacy System is Time and Cost Intensive

- 4.5 Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Safety Light Curtain

- 5.1.2 Safety Laser Scanner

- 5.1.3 Safety Mat

- 5.1.4 Safety Edge

- 5.1.5 Others (Hand Detection Safety Sensor)

-

5.2 By End User

- 5.2.1 Pharmaceutical

- 5.2.2 Food & Beverage

- 5.2.3 Automotive

- 5.2.4 Others End Users

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Omron Corporation

- 6.1.2 Rockwell Automation

- 6.1.3 Keyence Corporation

- 6.1.4 Banner Engineering Corporation

- 6.1.5 ABB Limited

- 6.1.6 Siemens AG

- 6.1.7 Panasonic Electric Works Co., Ltd.

- 6.1.8 SICK AG

- 6.1.9 Pepperl+Fuchs

- 6.1.10 Pilz GmbH & Co.

- 6.1.11 Autonics Corporation

- 6.1.12 BEI Sensor

- 6.1.13 Hans Turck GmbH & Co. KG

- 6.1.14 Larco

- 6.1.15 Schneider Electric

- 6.1.16 Leuze electronic GmbH

- 6.1.17 Pinnacle Systems, Inc.

- 6.1.18 Balluff GmbH

- 6.1.19 Contrinex

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySafety Sensor Industry Segmentation

| By Type | Safety Light Curtain |

| Safety Laser Scanner | |

| Safety Mat | |

| Safety Edge | |

| Others (Hand Detection Safety Sensor) | |

| By End User | Pharmaceutical |

| Food & Beverage | |

| Automotive | |

| Others End Users | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Safety Sensor Market Research FAQs

What is the current Safety Sensors Market size?

The Safety Sensors Market is projected to register a CAGR of 3.24% during the forecast period (2024-2029)

Who are the key players in Safety Sensors Market?

Rockwell Automation, ABB Limited, Panasonic Electric Co. Ltd, BEI Sensor and Schneider Electric are the major companies operating in the Safety Sensors Market.

Which is the fastest growing region in Safety Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Safety Sensors Market?

In 2024, the North America accounts for the largest market share in Safety Sensors Market.

What years does this Safety Sensors Market cover?

The report covers the Safety Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Safety Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Safety Sensors Industry Report

Statistics for the 2024 Safety Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Safety Sensors analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.