Global Smart Sensors Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 55.86 Billion |

| Market Size (2029) | USD 129.42 Billion |

| CAGR (2024 - 2029) | 18.30 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Global Smart Sensors Market Analysis

The Smart Sensors Market size is estimated at USD 55.86 billion in 2024, and is expected to reach USD 129.42 billion by 2029, growing at a CAGR of 18.30% during the forecast period (2024-2029).

Sensors have become one of the most crucial and widely used components in various applications. The increasing demand for performance and efficiency has helped in the rising adoption of smart sensors over the past few years.

- Smart sensors can be used to record fluctuations in temperature or pressure acceleration, which are crucial for a process, and in advanced IT solutions like machine-to-machine communication and analytics. These technologies are also used in the automotive, defense, sports, and electronic industries, as well as smart grids, smart cities, and smart environments (forest fire suppression, snow level monitoring, and earthquake early detection).

- These sensors are a huge improvement over traditional sensors since they allow for the automatic collection of environmental data with a much-reduced error rate. Over the forecast period, the market for smart sensors is anticipated to rise due to rising IoT use and penetration, more vehicle automation, and smart wearable health monitoring devices.

- IIoT connectivity innovation is also being driven by long-range, low-power wide-area network (LPWAN) technologies, including NB-IoT, LTE-M, LoRa, and Sigfox. Low-power devices may transmit data packets wirelessly over a larger region with LPWANs for IoT sensors, which is necessary for a manufacturing facility.

- Additionally, governments all over the world are promoting market expansion through advantageous rules and incentives for international enterprises to invest, which is anticipated to accelerate market expansion.

- Additionally, following COVID-19, the market is anticipated to experience a recovery in its growth rate in the years to come as a result of companies increasing their focus on meeting the surge in demand for smart technologies brought on by the rapid acceleration of IoT-based infrastructures, such as smart cities and smart grids, around the world. Additionally, the pandemic has prompted more businesses to update their infrastructure with cutting-edge IoT technology in order to ensure that production is unaffected in the event that another epidemic strikes in the future.

- The COVID-19 outbreak was accelerating the adoption of Industry 4.0, driving businesses from all sectors into a more advanced state of IoT technology and workflow using sensors that have an impact on production, maintenance with altered service intervals, human resources with new job requirements, and marketing with new and in-depth knowledge of customers' individual use cases.

Global Smart Sensors Market Trends

This section covers the major market trends shaping the Smart Sensors Market according to our research experts:

Temperature Sensors to Witness High Growth

- A smart temperature sensor is an integrated device that consists of a temperature sensor, bias circuitry, and an analog-to-digital converter (ADC). A temperature sensor detects heat to ensure a process maintains within a specified range, ensuring safe application usage or satisfying a prerequisite while dealing with severe heat, risks, or inaccessible measuring places.

- The development of smart temperature sensors has been further accelerated by the emergence of IoT and IIoT as a result of the shift in electronics toward digitalization. Additionally, the digital revolution in the sensing industry has facilitated manufacturers' development of new temperature sensors using low-interface digital technology. The rising use of temperature sensors in the industrial sector further indicates that the market for temperature sensors will develop over the course of the projected period.

- Smart Sensors are regarded as an essential component of the home and building automation network since they assist smart devices in learning about their environment. The temperature sensor is among the most popular sensors used in home and building automation. These sensors are included in HVAC, fire detection alarm systems, lighting control systems, and smart thermostats to regulate and maintain temperature automatically.

- Temperature sensors are widely used in a variety of industries, including the automotive, residential, medical, environmental, food processing, and chemical ones, due to their low cost, compact size, and ease of use.

- The most typical application for temperature sensors in a smart home is a smart thermostat. Forecasts predict that demand for smart homes will rise sharply as a result of growing consumer interest, modest technological breakthroughs, and greater accessibility.

- For Instance, ABB introduced its new FusionAir Smart Sensor, a touch-free room sensor to lessen indoor air pollution, in October 2021. The best room control sensors can monitor the temperature, humidity, carbon dioxide (CO2), and volatile organic compounds (VOCs), which will enhance indoor air quality overall and lower the danger of exposure to viruses. This sensor offers healthy, secure, and cozy surroundings for users while addressing growing concerns about indoor air quality.

Asia Pacific to Witness the Significant Growth

- Asia-Pacific is anticipated to experience significant growth over the forecast period due to the development and expansion of various end-user sectors, including automotive, consumer electronics, and healthcare. Growing technological usage and the government's increased emphasis on infrastructure development will raise the need for smart sensors in this region.

- The region is anticipated to be the largest market for smart sensors due to China, India, Japan, South Korea, and other nations in the region exhibiting a significantly high demand. As the hub of production for numerous industries, such as semiconductors and automotive, which produce household appliances, cellphones, laptops, and peripheral gadgets, China's manufacturing sector has expanded dramatically over the past few years.

- As a result, there has been a significant increase in the manufacture and marketing of sensing devices in this area. IoT vehicle connectivity innovation is fueled by long-range, low-power wide-area networks (LPWAN) technologies like NB-IoT, LoRa, LTE-M, and Sigfox. As required by the automobile industry, LPWANs for IoT sensors enable low-power devices to wirelessly stream data packets across greater distances.

- India is a developing nation with significant government investment in cutting-edge technology and intelligent infrastructure. With such rapid advancements, smart sensors are being widely used in the nation's smartphones, cars, and healthcare systems, among other things. The use of high-end technological items in the nation has grown significantly over the last few years, including smartphones and wearables that heavily rely on smart sensors.

- India and China have seen a noticeable increase in the use of connected gadgets in recent years, including wearable technology, smart homes, connected autos, and autonomous vehicles. Over the coming years, the market for smart sensors is anticipated to be driven by the increase in demand for connected devices.

- Cisco predicts that there will be about 2.1 billion internet-connected gadgets in India by 2023. Due to the rising availability of inexpensive smartphones and more reasonable internet subscriptions, the number of internet users in the country is predicted to surpass 900 million. This increase in smartphone use will fuel the market's expansion.

- Furthermore, the political pressure on China to modernize its industries is driving up demand for smart manufacturing products, including wireless sensor networks and smart sensors. Chinese manufacturers of sensor technologies are currently experiencing a gold rush. High-end machine tools, intelligent sensors, and other technology are in high demand in China's industry.

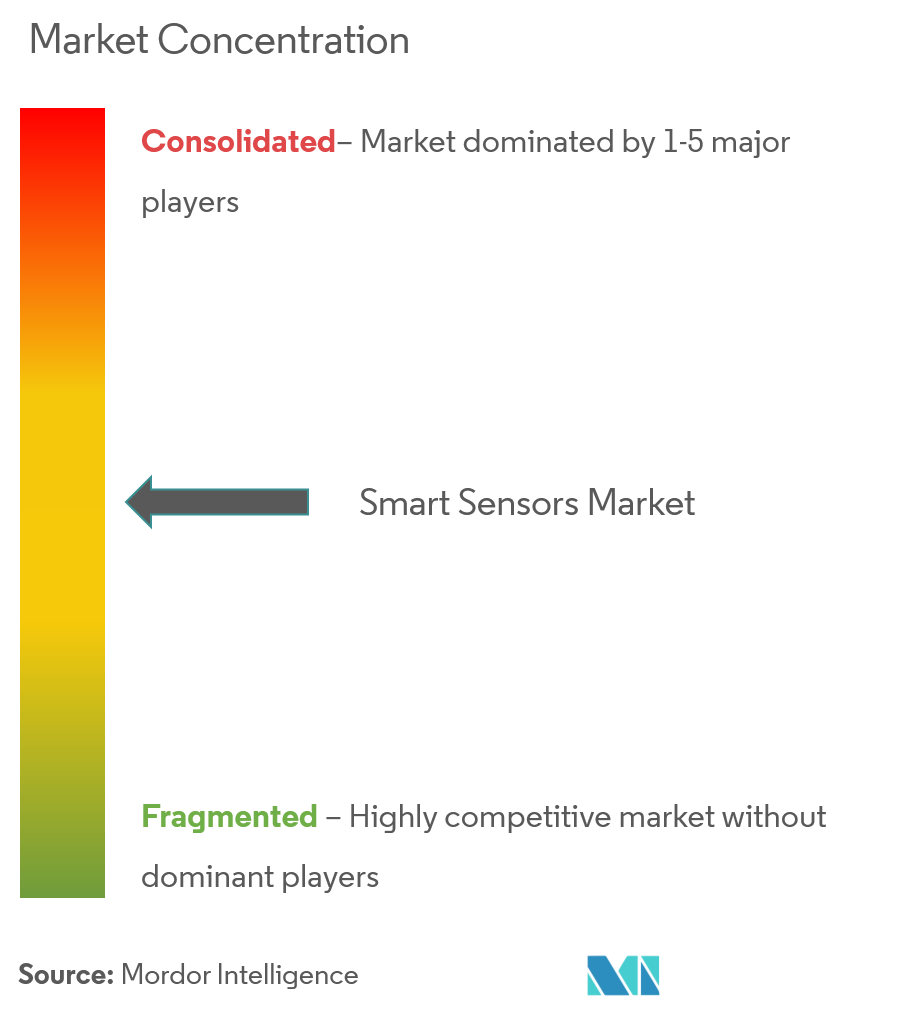

Global Smart Sensors Industry Overview

The smart sensors market is very competitive, with many national and international players in the market. The major players follow strategies like product innovation, mergers, and acquisitions to expand their reach and hold their market position. The major players in the market are Honeywell International, ABB Ltd, Analog Devices inc., and GE, among others.

In November 2022, Stirling Council's largest IoT smart sensor rollout gives 50K homeowners early notification of environmental issues and better energy consumption. Environmental sensors placed in every home will alert the council in real time of any moisture, mold, ventilation, or other potential issues and provide early warning. They will also let the tenant realize how much energy is needed to heat their home.

In September 2022, Advantech released WISE-2410 LoRaWAN Wireless Condition Monitor sensors that can independently detect equipment vibration, track the temperature of its surface over time, and ascertain its vibration characteristics. These sophisticated photoelectric sensors, such as sophisticated position sensors, are frequently employed in industrial automation. These sensors are extensively used in industrial, medical, and aeronautical applications because they can spot patterns and changes in an object's structure.

Global Smart Sensors Market Leaders

-

ABB Ltd

-

Honeywell International

-

Analog Devices Inc.

-

Siemens AG

-

General Electric

*Disclaimer: Major Players sorted in no particular order

Global Smart Sensors Market News

- October 2022 : Optomotive, a producer of advanced, high-performance cameras and 3D smart sensors, announced the debut of two new product lines at VISION 2022. will show off its fully engineered LOM series of 3D high-speed smart sensors. High-speed laser triangulation sensors from the LOM sensor line, which is based on Optomotive's FPGA camera technology, may be fully customized and user-programmed. The series is capable of inspection rates of up to 10 kHz and is designed for high-performance examination.

- November 2022 : Quanergy Systems, Inc., a major producer of smart sensors such as LiDAR sensors and smart 3D solutions, has announced enhancements to its QORTEX DTC and Q-View software solutions, which support the company's Flow Management portfolio, which includes its smart sensors MQ-8 family of LiDAR sensors.

Global Smart Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Demand for Energy Efficiency and Saving

- 4.2.2 Increasing Demand for Consumer Electronics Products

- 4.2.3 Higher Demand for Smart Sensors in the Healthcare and Automotive Industries

- 4.2.4 Technology Advancements in Miniaturization and Wireless Capabilities

-

4.3 Market Restraints

- 4.3.1 Relatively High Deployment Costs

- 4.3.2 Complex Design compared to Traditional Sensors

- 4.4 Value Chain Analysis

-

4.5 Industry Attractiveness - 'Porter's Five Forces Analysis'

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 COVID-19 Impact Analysis

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Flow Sensor

- 5.1.2 Humidity Sensor

- 5.1.3 Position Sensor

- 5.1.4 Pressure Sensor

- 5.1.5 Temperature Sensor

- 5.1.6 Other Types

-

5.2 Technology

- 5.2.1 MEMS

- 5.2.2 CMOS

- 5.2.3 Optical Spectroscopy

- 5.2.4 Other Technologies

-

5.3 Component

- 5.3.1 Analog-to-Digital Converter

- 5.3.2 Digital-to-Analog Converter

- 5.3.3 Amplifier

- 5.3.4 Other components

-

5.4 Application

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive and Transportation

- 5.4.3 Healthcare

- 5.4.4 Industrial Automation

- 5.4.5 Building Automation

- 5.4.6 Consumer Electronics

- 5.4.7 Other Applications

-

5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Honeywell International

- 6.1.3 Eaton Corporation

- 6.1.4 Analog Devices Inc.

- 6.1.5 Infineon Technologies AG

- 6.1.6 NXP Semiconductors N.V.

- 6.1.7 ST Microelectronics

- 6.1.8 Siemens AG

- 6.1.9 TE Connectivity Ltd

- 6.1.10 Legrand Inc.

- 6.1.11 General Electric

- 6.1.12 Vishay Technology Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityGlobal Smart Sensors Industry Segmentation

A smart sensor is a device that takes input from the physical environment and uses built-in compute resources to perform predefined functions upon detection of specific input and then process data before passing it on. A smart sensor is also a crucial and integral element in the Internet of Things (IoT)

The Smart Sensors Market is segmented By Type (Flow, Humidity, Position, Pressure, Temperature), Technology (MEMS, CMOS, Optical Spectroscopy), Component (Analog-to-Digital Converter, Digital-to-Analog Converter, Amplifier), Application (Aerospace and Defense, Automotive, and Transportation, Healthcare, Industrial Automation), and Geography (North America (United States, Canada), Europe (Germany, United Kingdom, France, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), Latin America, and Middle East & Africa).

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| Type | Flow Sensor | |

| Humidity Sensor | ||

| Position Sensor | ||

| Pressure Sensor | ||

| Temperature Sensor | ||

| Other Types | ||

| Technology | MEMS | |

| CMOS | ||

| Optical Spectroscopy | ||

| Other Technologies | ||

| Component | Analog-to-Digital Converter | |

| Digital-to-Analog Converter | ||

| Amplifier | ||

| Other components | ||

| Application | Aerospace and Defense | |

| Automotive and Transportation | ||

| Healthcare | ||

| Industrial Automation | ||

| Building Automation | ||

| Consumer Electronics | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| India | ||

| Japan | ||

| Rest Asia Pacific | ||

| Geography | Latin America | |

| Middle East and Africa |

Global Smart Sensors Market Research FAQs

How big is the Smart Sensors Market?

The Smart Sensors Market size is expected to reach USD 55.86 billion in 2024 and grow at a CAGR of 18.30% to reach USD 129.42 billion by 2029.

What is the current Smart Sensors Market size?

In 2024, the Smart Sensors Market size is expected to reach USD 55.86 billion.

Who are the key players in Smart Sensors Market?

ABB Ltd, Honeywell International, Analog Devices Inc., Siemens AG and General Electric are the major companies operating in the Smart Sensors Market.

Which is the fastest growing region in Smart Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Smart Sensors Market?

In 2024, the North America accounts for the largest market share in Smart Sensors Market.

What years does this Smart Sensors Market cover, and what was the market size in 2023?

In 2023, the Smart Sensors Market size was estimated at USD 47.22 billion. The report covers the Smart Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Smart Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Global Smart Sensors Industry Report

Statistics for the 2024 Global Smart Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Global Smart Sensors analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.