Thermocouple Temperature Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 3.68 % |

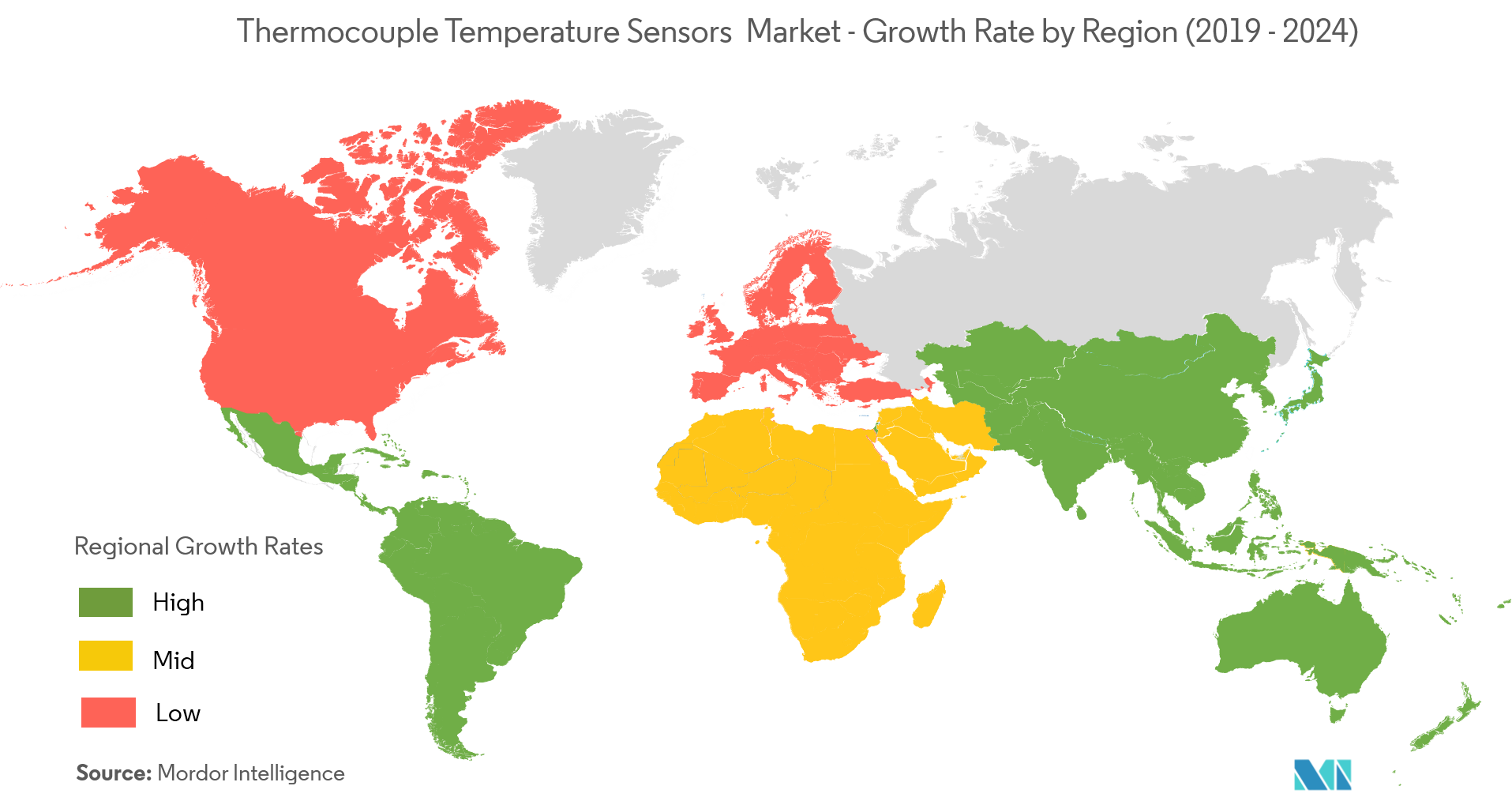

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Thermocouple Temperature Sensors Market Analysis

The thermocouple temperature sensors market was valued at USD 709.89 million in 2020 and expected to reach USD 882.3 million by 2026 and grow at a CAGR of 3.68% over the forecast period (2021 - 2026). The increasingly popular trend of the development of smart cities in countries is contributing to the high growth of the electronic security market.

- Further, the introduction of advanced technologies in the global sensors market, along with the constantly growing trend of digital transformation in the industrial world, has resulted in the rising demand for sensors, especially for smart sensors.

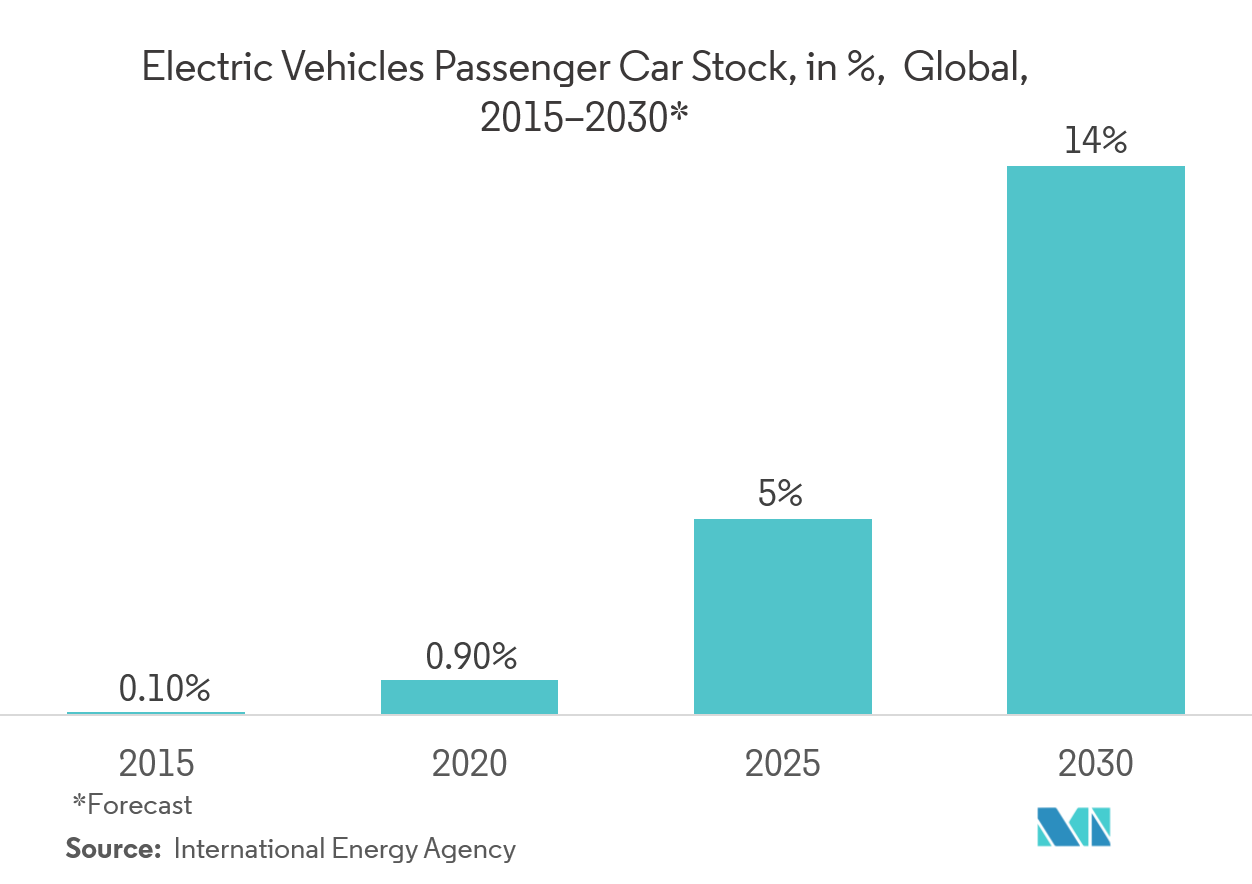

- Thermocouple temperature sensors are mainly used for thermal management and automatic transmissions systems in the automotive industry. Therefore, the stringent emission norms for automobiles, aggressive development in an autonomous vehicle, and increasing penetration of electric vehicle (EV), globally, are some of the major factors driving the market growth. For instance, the Indian government is focusing on creating charging infrastructure and policy framework, so that by 2030, more than 30% of vehicles are electric vehicles.

- In February 2019, STMicroelectronics' entered into a partnership with Hyundai Autron, to launch a development lab for eco-friendly automotive sensor solutions. The collaboration will provide the environment for engineers to collaborate on pioneering solutions for eco-friendly vehicles, with a focus on powertrain controllers.

- However, technical awareness about sensor and heating issues in the extreme condition is the key restraints which hamper the market growth.

Thermocouple Temperature Sensors Market Trends

This section covers the major market trends shaping the Thermocouple Temperature Sensors Market according to our research experts:

Automotive Industry is Expected to Register a Significant Growth

- The need for temperature sensors for safety and precision measurements of the smart automotive equipment, to analyze and produce timely sensor data, is likely to increase because of the miniaturization of the intelligent sensor technology. This is expected to fuel the demand for thermocouple temperature sensors in this application.

- Further, Automatic Temperature Control (ATC) is a common feature in most of the electric vehicles and high-end models in the mid-range segment. The increased sales of electric vehicles among high disposable income regions, such as the United States, Germany, and China, provides an opportunity for the growth of the thermocouple temperature sensors market.

- The battery charges used for charging multiple devices in the automotive segment are equipped with temperature-sensing elements that regularly check and monitor heating issues, as this is a common problem with batteries mostly used in automated vehicles. This helps in increasing the life of devices and decreases damage. Thereby, ensuring that the batteries are sufficiently charged.

- The increasing production of electric vehicles is expected to drive the demand for thermocouple temperature sensors.

North America Holds the Largest Market Share

- The United States is expected to have a prominent share in the thermocouple temperature sensor market. The country is one of the largest automotive markets in the world and is home to over 13 major auto manufacturers. Electric vehicle use in the United States has risen rapidly, with an estimated 1% of automotive sales in the US market for electric vehicles.

- California dominates the US market in terms of sales of electric vehicles (EVs). It's Zero Emission Vehicle (ZEV) program is driving the demand for EVs, by requiring automakers in the states to sell a certain percentage of electric cars. The US auto market is likely to further pressurize automakers to expand their affordable EV offerings. Hence, fueling the demand for thermocouple temperature sensors in the country.

- Further, US aerospace manufacturers are very competitive internationally. In 2017, the aerospace industry contributed USD 143 billion in export sales to the US economy. Companies in the aerospace sector, such as Boeing, won contracts worth USD 12 billion in 2018, to supply 47 new 787 Dreamliner jets to American Airlines. Similarly, the company signed a deal with Singapore Airlines for the delivery of 39 new wide-body jets, worth USD 13.8 billion, in 2017. The above-mentioned trends are expected to drive the demand for thermocouple temperature sensors in the country.

Thermocouple Temperature Sensors Industry Overview

The thermocouple temperature sensors market is highly competitive and consists of several major players. Some of the key players areTexas InstrumentsInc.,STMicroelectronics,Honeywell InternationalInc.,Danfoss Group, among others.These companies are leveraging their strategic collaborative initiatives to increase their market share and profitability.The companies operating in the market are also acquiring start-ups working on thermocouple temperature sensortechnologies to strengthen their product capabilities.

- January 2019 - Honeywell Home introduced two new T-Series smart thermostats. The greatest difference between the new thermostats and earlier T-Series models is support for wireless Smart Room Sensors to balance and prioritize temperature in the home. Smart Room Sensors monitor temperature, humidity, and motion and use that information to prioritize different areas in a home. Prioritizing lets you configure which room or rooms are most important. The entire heating and cooling system will be managed, so the temperature and humidity in the higher priority rooms and areas take precedence over lower priority locations.

Thermocouple Temperature Sensors Market Leaders

-

Maxim Integrated Inc.

-

Keyence Corporation

-

NXP Semiconductors NV

-

Honeywell International Inc.

-

Danfoss Group

*Disclaimer: Major Players sorted in no particular order

Thermocouple Temperature Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rising Trends of Security and Surveillance

- 4.3.2 Rapid Technological Developments

-

4.4 Market Restraints

- 4.4.1 Dominance of Legacy Temperature Sensor Technologies

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Food and Beverage

- 5.1.2 Power Generation

- 5.1.3 Automotive

- 5.1.4 Petrochemicals and Chemicals

- 5.1.5 Oil and Gas

- 5.1.6 Metals and Mining

- 5.1.7 Aerospace

- 5.1.8 Other Applications (Plastics, Water and Wastewater Management, Electrical, Life sciences)

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Maxim Integrated Inc.

- 6.1.2 Keyence Corporation

- 6.1.3 NXP Semiconductors NV

- 6.1.4 Honeywell International Inc.

- 6.1.5 Danfoss Group

- 6.1.6 Texas Instruments Inc.

- 6.1.7 Microchip Technology

- 6.1.8 STMicroelectronics

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityThermocouple Temperature Sensors Industry Segmentation

| By Application | Food and Beverage | |

| Power Generation | ||

| Automotive | ||

| Petrochemicals and Chemicals | ||

| Oil and Gas | ||

| Metals and Mining | ||

| Aerospace | ||

| Other Applications (Plastics, Water and Wastewater Management, Electrical, Life sciences) | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | |

| Middle East & Africa |

Thermocouple Temperature Sensors Market Research FAQs

What is the current Thermocouple Temperature Sensors Market size?

The Thermocouple Temperature Sensors Market is projected to register a CAGR of 3.68% during the forecast period (2024-2029)

Who are the key players in Thermocouple Temperature Sensors Market?

Maxim Integrated Inc., Keyence Corporation, NXP Semiconductors NV, Honeywell International Inc. and Danfoss Group are the major companies operating in the Thermocouple Temperature Sensors Market.

Which is the fastest growing region in Thermocouple Temperature Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Thermocouple Temperature Sensors Market?

In 2024, the North America accounts for the largest market share in Thermocouple Temperature Sensors Market.

What years does this Thermocouple Temperature Sensors Market cover?

The report covers the Thermocouple Temperature Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Thermocouple Temperature Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Thermocouple Industry Report

Statistics for the 2024 Thermocouple market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Thermocouple analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.