Wireless Charging for Electric Vehicle Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 152.30 Million |

| Market Size (2029) | USD 762.5 Million |

| CAGR (2024 - 2029) | 38.40 % |

| Fastest Growing Market | Europe |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Wireless Charging For Electric Vehicle Market Analysis

The Wireless Charging For Electric Vehicle Market size is estimated at USD 152.30 million in 2024, and is expected to reach USD 762.5 million by 2029, growing at a CAGR of 38.40% during the forecast period (2024-2029).

Wireless electric vehicle (EV) charging is an innovative technology that enables EVs to be charged without needing a physical connection between the vehicle and the charging station. Wireless EV charging has several advantages over traditional wired charging. Firstly, it eliminates the need for cables and connectors, which can be inconvenient and time-consuming to handle. Secondly, it reduces the risk of electric shock or fire hazards caused by damaged cables or improper connections. Finally, it offers a more streamlined and user-friendly charging experience, as drivers can simply park their vehicle over the charging pad, and the charging process begins automatically.

• Wireless vehicle charging is one of the latest technologies that is being significantly developed, and it is also likely to boost the electric car industry.

• Setting up a charging station and chargers often increases land availability challenges in urban areas. With the inception of wireless charging, the challenges have been eased, and thus, charger operators have witnessed improved sales bars.

• Even though wireless charging is a must-have for electric vehicles, a few drawbacks need to be considered, like energy loss while charging, lack of availability of proper charging infrastructure, and high cost.

• The increase in the sale of electric vehicles across the globe is anticipated to drive the demand for wireless charging stations. Governments across the world, in countries like the United Kingdom, Norway, Japan, and the United States, as well as in developing countries like China, are providing purchasers with incentives.

• A limited number of countries are working on wireless charging for electric vehicles. For instance, in September 2022, a Japanese construction company announced the joining of cooperation with Denso Corporation to help build road pavement offering wireless EV charging points by the end of 2025. This came after realizing the necessity of constructing a proper station that includes the land.

Wireless Charging For Electric Vehicle Market Trends

Increasing Passenger Car Sales To Propel The Market Growth

As more people become aware of the environmental impacts of traditional gasoline-powered cars, there is a growing interest in electric cars. Additionally, rising fuel prices have slowed the penetration of electric vehicles in the automobile industry, which plays a significant role in stimulating the demand for charging stations.

This has forced automakers to increase their expenditure on R&D of electric vehicles, which eventually allowed them to market electric vehicles in the future. This strategy strongly impacted people, as there was a considerable change in the purchase pattern from conventional IC engine vehicles to electric vehicles. The change has not decreased the sales of IC engine vehicles but created a promising market for electric vehicles in the present and future.

Globally, the sales of electric cars increased by around 55.5% in 2022 compared to 2021, crossing 10 million for the first time, even though car sales were less than the previous year. As a result, 1 in every 7 passenger cars bought globally in 2022 was an EV, according to the International Energy Agency (IEA).

Further, the ride-hailing and car-sharing markets are expected to increase the demand for charging stations. Ride-hailing and car-sharing vehicles are typically used for longer periods and experience higher utilization rates than privately owned vehicles. This means that they need to be charged more frequently, which increases the demand for charging stations.

Electric vehicles have reached par (sometimes surpassed) with IC engine vehicles in terms of performance, maintenance, and the initial cost of purchase.

The growth of passenger electric vehicles is anticipated to increase the need for charging equipment and wireless charging, which claims to reduce the effort put into charging the vehicle. Wireless charging is expected to gain popularity and have a growing market in the near future.

Europe is the Fastest Growing region in the Market

Europe is expected to be the largest manufacturing hub and the largest market for wireless charging stations. This growth owes to the availability of viable infrastructures to support electric vehicle sales. Electric vehicles are considered a viable option for customers who purchase a vehicle. The sales of electric cars in the European region have been on the rise for the last five years. The sales are forecasted to increase, thereby opening opportunities for technologies like wireless charging infrastructure for electric vehicles.

Germany, the United Kingdom, and France will be the biggest markets for wireless charging due to a combination of economies of scale, high levels of income, and being an automotive manufacturing hub. In countries like Belgium and the United Kingdom, surveys have demonstrated that vans, buses, and taxis are more likely to accept wireless charging of vehicles, as these particular segments require a high range with convenient charging methods.

Moreover, in March 2023, ABT e-Line and WiTricity had announced plans to deliver aftermarket wireless EV charging in Europe. ABT e-Line plans to initially upgrade the VW ID.4 to support wireless charging from WiTricity, with the availability targeted for early 2024. The company plans to expand to additional EV models thereafter.

The foundation for the market for wireless charging is already visible from the yearly increasing sales of electric vehicles in European countries, like Germany, the Netherlands, and the United Kingdom, among many others.

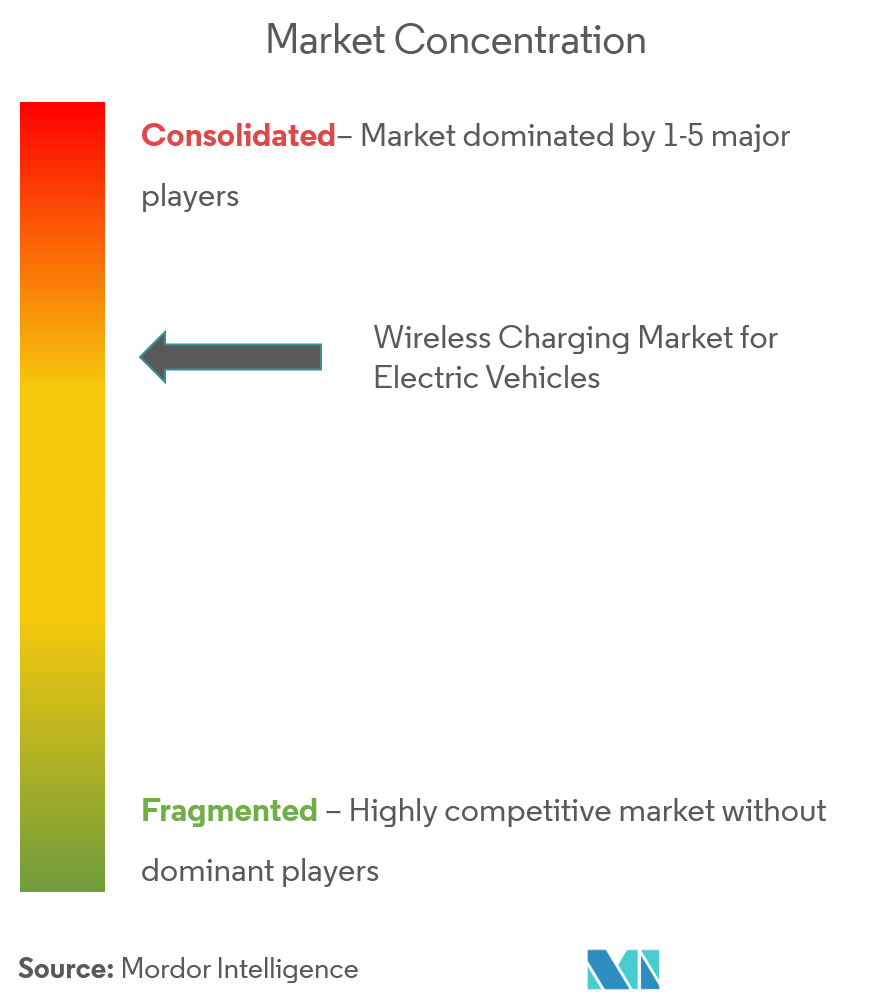

Wireless Charging For Electric Vehicle Industry Overview

Some of the major players, like Qualcomm, WiTricity, Momentum Dynamics, Hevo, Primove (Bombardier), Continental, etc., have captured significant shares in the market. These major players focus on partnerships, the launching of new products, and R&D to achieve a higher penetration into the regional markets. For instance,

• In November 2023, Electron, in partnership with the Michigan Department of Transportation, announced the deployment of a wireless-charging public roadway. Using technology from Electreon, Detroit’s 14th Street is now equipped with inductive-charging coils between Marantette and Dalzelle streets that will charge electric vehicles equipped with Electreon receivers as they drive on the road.

Wireless Charging for Electric Vehicle Market Leaders

-

WiTricity

-

Evatran Group Inc.

-

Momentum Dynamics Corporation

-

HEVO Inc.

-

EFACEC

*Disclaimer: Major Players sorted in no particular order

Wireless Charging For Electric Vehicle Market News

- In December 2022, Electreon Germany GmbH, a subsidiary of Electreon Wireless LTD, a provider of wireless charging solutions for electric vehicles, started their project of public wireless charging infrastructure for electric cars in Germany. The company will also install two static charging stations along a 1 km stretch of road, and the two locations will be chosen based on the bus route and the stops the bus makes while operating.

- In 2022, WiTricity purchased Qualcomm Halo™, adding certain Wireless Electric Vehicle Charging (WEVC) patents owned by Qualcomm and the exclusive license from Auckland UniServices.

Wireless Charging for Electric Vehicle Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Drivers

- 4.1.1 Increased Adoption Of Electric Vehicles

- 4.1.2 Government Support And Incentives

-

4.2 Market Restraints

- 4.2.1 Higher Cost May hinder the Market Growth

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

-

5.2 By Application Type

- 5.2.1 Residential

- 5.2.2 Commercial

-

5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Australia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles

- 6.2.1 Hella Aglaia Mobile Vision

- 6.2.2 Witricity Corporation

- 6.2.3 Momentum Dynamics Corporation

- 6.2.4 Elix Wireless Inc.

- 6.2.5 Mojo Mobility

- 6.2.6 EFACEC

- 6.2.7 ZTE Corporation

- 6.2.8 Evatran Group Inc.

- 6.2.9 HEVO Inc.

- 6.2.10 Tgood Electric Co

- 6.2.11 Continental AG

- 6.2.12 Robert Bosch GmbH

- 6.2.13 Hella Kgaa Hueck & Co.

- 6.2.14 Toyota Motor Corporation

- 6.2.15 Toshiba Corporation

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

-

7.1 Collaboration And Partnerships

- 7.1.1 Technological Advancements

Wireless Charging For Electric Vehicle Industry Segmentation

Wireless electric vehicle (EV) charging is an innovative technology that enables EVs to be charged without needing a physical connection between the vehicle and the charging station. The Wireless Charging for Electric Vehicle Market covers the latest wireless charging demand trends, technological development, government policies, manufacturers' development, etc. It also covers the market share of major wireless charging providers across the world.

The report covers the future scope of wireless charging for electric vehicles, and the market is segmented by vehicle type (Passenger cars and commercial vehicles), application type (Residential and commercial vehicles), and geography. The report offers market size forecasts for the wireless electric vehicle (EV) charging market in value (USD) for all the above segments.

| By Vehicle Type | Passenger Cars | |

| Commercial Vehicles | ||

| By Application Type | Residential | |

| Commercial | ||

| By Geography | North America | United States |

| Canada | ||

| Rest of North America | ||

| By Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| By Geography | Asia-Pacific | China |

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| By Geography | Rest of the World |

Wireless Charging for Electric Vehicle Market Research FAQs

How big is the Wireless Charging For Electric Vehicle Market?

The Wireless Charging For Electric Vehicle Market size is expected to reach USD 152.30 million in 2024 and grow at a CAGR of 38.40% to reach USD 762.5 million by 2029.

What is the current Wireless Charging For Electric Vehicle Market size?

In 2024, the Wireless Charging For Electric Vehicle Market size is expected to reach USD 152.30 million.

Who are the key players in Wireless Charging For Electric Vehicle Market?

WiTricity, Evatran Group Inc., Momentum Dynamics Corporation, HEVO Inc. and EFACEC are the major companies operating in the Wireless Charging For Electric Vehicle Market.

Which is the fastest growing region in Wireless Charging For Electric Vehicle Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Wireless Charging For Electric Vehicle Market?

In 2024, the North America accounts for the largest market share in Wireless Charging For Electric Vehicle Market.

What years does this Wireless Charging For Electric Vehicle Market cover, and what was the market size in 2023?

In 2023, the Wireless Charging For Electric Vehicle Market size was estimated at USD 93.82 million. The report covers the Wireless Charging For Electric Vehicle Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Wireless Charging For Electric Vehicle Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Wireless EV Charging Industry Report

Statistics for the 2024 Wireless EV Charging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Wireless EV Charging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.