Wireless Occupancy Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 18.30 % |

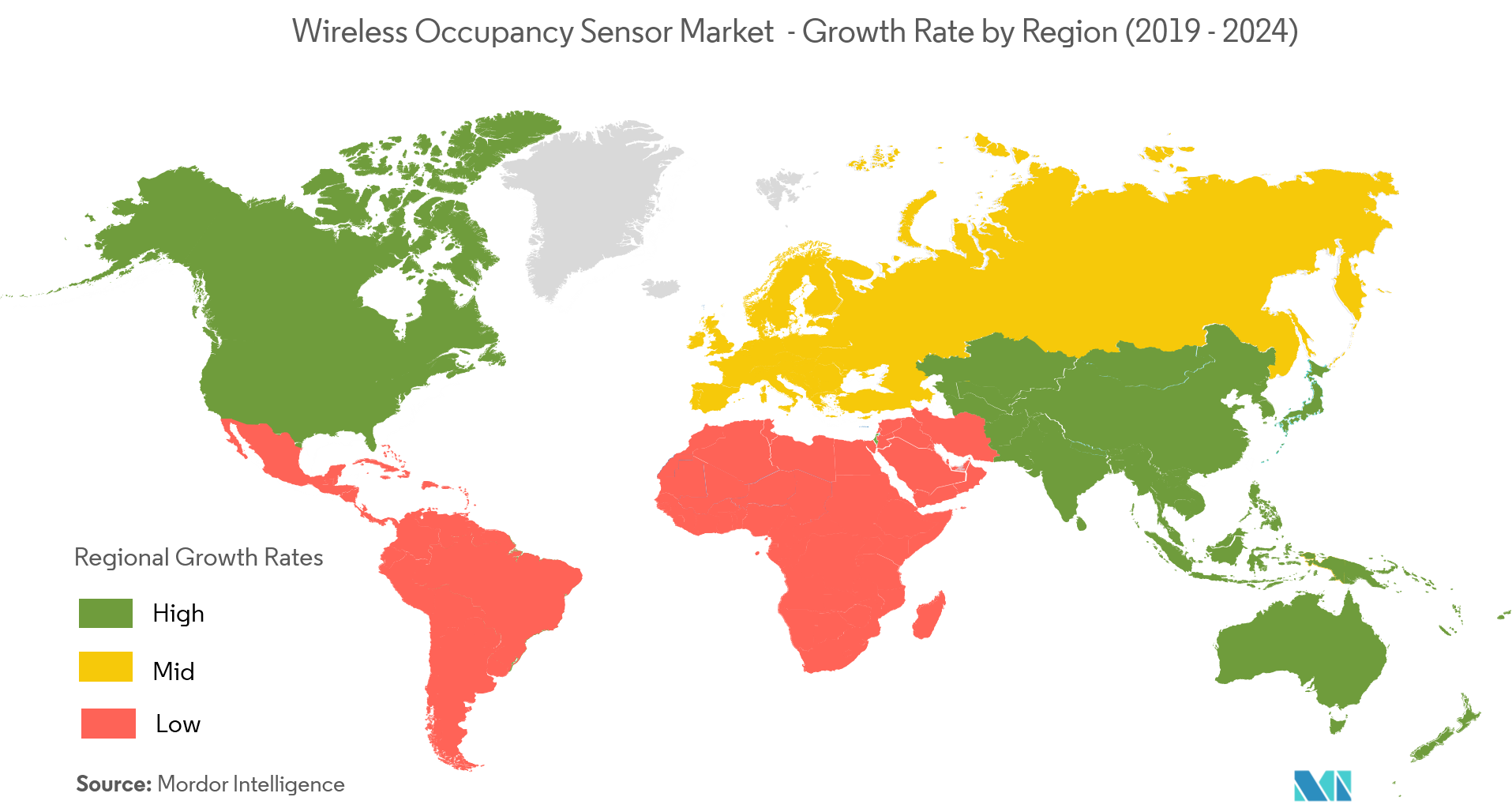

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Wireless Occupancy Sensors Market Analysis

The wireless occupancy sensors market is expected to register a CAGR of 18.3% over the forecast period (2021 - 2026). Energy-saving has been crucial for growth in any economy, as a result, the government is also coming with several policies to save energy, which will drive the market in the forecast period.

- The rising demand for energy-efficient devices is expected to drive the market. Wireless occupancy sensors play a vital role in reducing energy consumption. This is achieved through the sensors, which shuts down devices and other equipment on the basis of occupancy. These sensors help in reducing light pollution and they can be used for indoor and outdoor spaces.

- The demand for passive infrared is expected to continue in the future, due to the low cost, demand for energy-efficient devices, and less power requirement. It has a range of applications, such as lighting, spectrometers, gas, and fire detection systems, etc.

- Some of the major benefits of passive infrared sensors are accurate movement detection, reliable triggering, and cost-efficiency. Vending machine designers, for example, are now incorporating PIR sensors into their products so that their displays only light up when someone is standing in front of the unit or maybe waving their hand in front of a panel, which saves on operating costs.

- However, due to the false triggering of switch and inconsistency issues associated with wireless network system are anticipated to decrease the market growth during the forecast period.

Wireless Occupancy Sensors Market Trends

This section covers the major market trends shaping the Wireless Occupancy Sensors market according to our research experts:

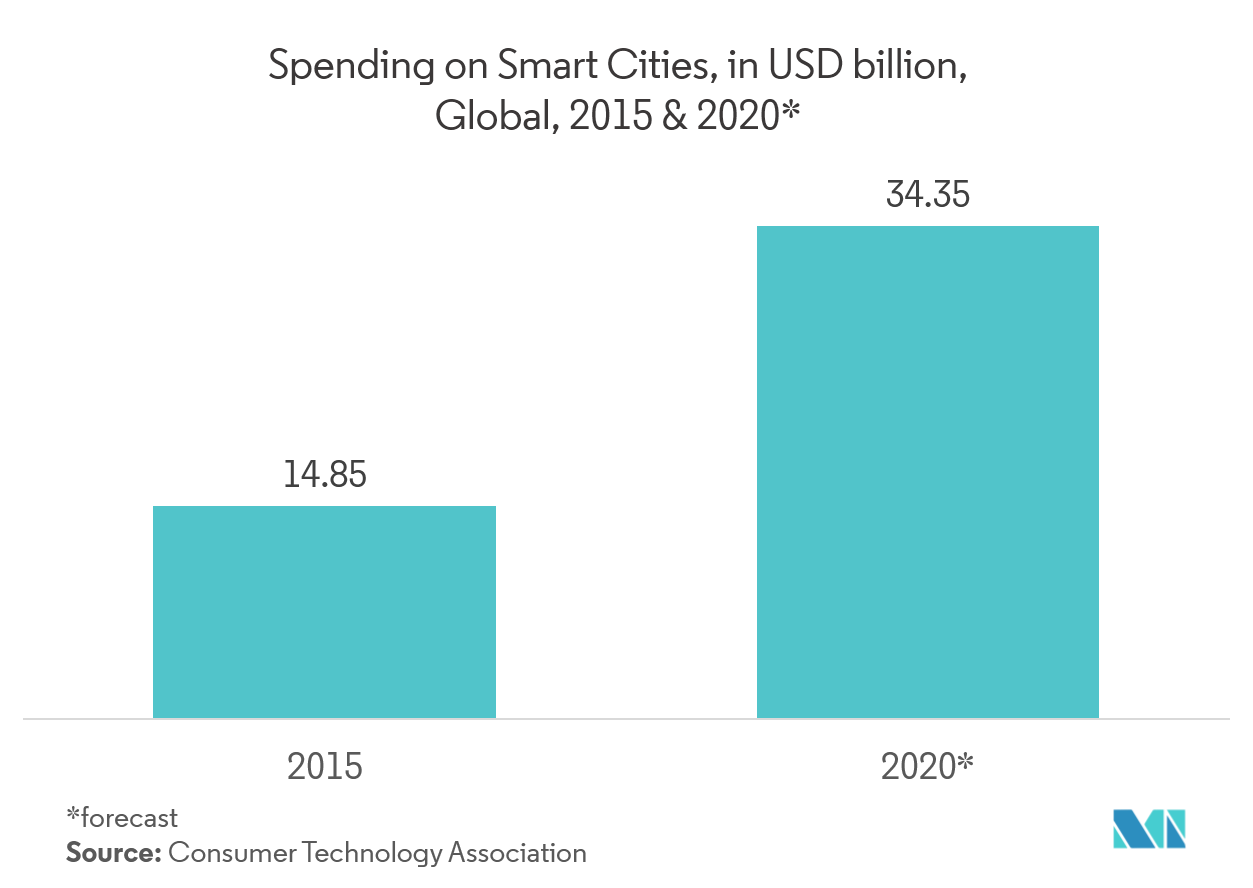

Smart City Initiatives to Stimulate the Growth of Wireless Occupancy Sensor Market

- The trend of urbanization is growing worldwide, and according to the United Nations, Department of Economic and Social Affairs, 60% of the population will be living in cities by 2050. With more population shifting to urban areas, cities across the world will be in trend to develop the smart city, which will enhance the growth of the market.

- A smart city can create an efficient and smart services delivery platform for public and municipal workers by installing sensors in the city and to create platforms that allow the share of information and give it for proper use to the public, city managers, businesses and professionals. The platform can have a typical data warehouse where different sensor system stores its information.

- An intelligent parking system should be not only aware of the occupancy status of each parking space but also be able to guide the user to it.

- Traffic congestion caused by vehicles is an alarming problem at a global scale, and it has been growing exponentially, where wireless occupancy sensors like IoT sensors and ultrasonic sensors play a significant role with the help of edge computing, where traffic patterns will help in managing the traffic problem very efficiently.

- Santander, the Spanish city, is embedded with more than 12,000 sensors that measure everything from the amount of trash in containers to the number of parking spaces available, to the size of crowds. Los Angeles has implemented a smart traffic solution to control traffic flow. Road-surface sensors and closed-circuit television cameras send real-time updates about the traffic flow to a central traffic management platform

- A vision-based occupancy sensing system with real-time data capture and analysis offers significant advantages over PIR and video systems, which will help smart city development in growing the occupancy sensor market due to its computing model.

North America to Account for a Significant Market Share

- The demand in North America is mainly driven by a higher focus on innovations and advancements in occupancy sensors such as image processing occupancy sensor (IPOS), intelligent occupancy sensor (IOS), and microphonics.

- The largest industry of occupancy sensors is in residential and commercial buildings due to massive growth in the construction sector in this region. The technology has a significant role to play in this sector due to the cost-effective matrix and results in a longer life cycle of products and systems, along with more excellent reliability.

- The United States is leading the market due to development in various sectors, such as commercial and residential and increase in the rise of wireless network infrastructure is driving the growth in the home automation, which is helping in the growth of occupancy sensor market. Similarly, the growing demand for HVAC systems in the US region is anticipated to play a crucial role in this market.

Wireless Occupancy Sensors Industry Overview

The major players include Honeywell International, Schneider Electric,Eaton Corporation,Legrand, Leviton, General Electric, Philips and among others. The market is fragmented since there issignificant competition in the market. Hence, market concentration will be low.

- Jan2019 -At CES 2019 in Las Vegas, EnOcean, the world leader in energy harvesting wireless technology launcheda new ceiling-mounted solar-powered occupancy sensor (PIR) for Bluetooth lighting control systems communicating via Bluetooth Low Energy (BLE). It will be the first self-powered Bluetooth occupancy sensor on the market integrating EnOcean’s field-proven energy harvesting technology and offering the best customer experience by being maintenance-free, freely positionable, highly flexible with easy installation.

Wireless Occupancy Sensors Market Leaders

-

Honeywell International

-

Eaton Corporation

-

Legrand Inc.

-

Schneider Electric SE

-

Johnson Controls

*Disclaimer: Major Players sorted in no particular order

Wireless Occupancy Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growing Demand for Green Energy

- 4.3.2 Growing Demmand for Easily Installable and Interoperable devices

-

4.4 Market Restraints

- 4.4.1 False Triggering of Switches

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. TECHNOLOGY SNAPSHOT

-

5.1 Wireless Occupancy Sensor Classification By Technology

- 5.1.1 Passive Infrared (Pir)

- 5.1.2 Ultrasonic

- 5.1.3 Dual Technology (Pir + Ultrasonic)

- 5.1.4 Other Technologies

- 5.2 Network Connectivity for Wireless Occupancy Sensor

6. MARKET SEGMENTATION

-

6.1 By Application

- 6.1.1 Lighting Control

- 6.1.2 HVAC

- 6.1.3 Security Surveillance

-

6.2 By Building Type

- 6.2.1 Residential Buildings

- 6.2.2 Commercial Buildings

-

6.3 By End-user Industry

- 6.3.1 Industrial

- 6.3.2 Aerospace & Defence

- 6.3.3 Healthcare

- 6.3.4 Consumer Electronics

- 6.3.5 Other End-user Industries

-

6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Russia

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Maxico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 United Arab Emirates

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East & Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Legrand SA

- 7.1.2 Schneider Electric

- 7.1.3 Acuity Brands Inc.

- 7.1.4 Eaton Corporation PLC

- 7.1.5 Leviton Manufacturing Co. Inc.

- 7.1.6 Johnson Controls Inc.

- 7.1.7 Koninklijke Philips NV

- 7.1.8 Lutron Electronics Co. Inc.

- 7.1.9 Honeywell International Inc.

- 7.1.10 General Electric Company

- 7.1.11 Hubbell Incorporated

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityWireless Occupancy Sensors Industry Segmentation

Wireless occupancy sensors can be defined as a system that turns off and on the light automatically depending upon the vacancy. It also controls the temperature and ventilation systems. It helps in making life convenient and easier and also saves energy. Various sensors used are the infrared, ultrasonic, microwave. humidity, and temperature, other sensors.

| By Application | Lighting Control | |

| HVAC | ||

| Security Surveillance | ||

| By Building Type | Residential Buildings | |

| Commercial Buildings | ||

| By End-user Industry | Industrial | |

| Aerospace & Defence | ||

| Healthcare | ||

| Consumer Electronics | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| France | ||

| Germany | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Maxico | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | Saudi Arabia |

| United Arab Emirates | ||

| South Africa | ||

| Rest of Middle East & Africa |

Wireless Occupancy Sensors Market Research FAQs

What is the current Wireless Occupancy Sensors Market size?

The Wireless Occupancy Sensors Market is projected to register a CAGR of 18.30% during the forecast period (2024-2029)

Who are the key players in Wireless Occupancy Sensors Market?

Honeywell International, Eaton Corporation, Legrand Inc., Schneider Electric SE and Johnson Controls are the major companies operating in the Wireless Occupancy Sensors Market.

Which is the fastest growing region in Wireless Occupancy Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Wireless Occupancy Sensors Market?

In 2024, the North America accounts for the largest market share in Wireless Occupancy Sensors Market.

What years does this Wireless Occupancy Sensors Market cover?

The report covers the Wireless Occupancy Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Wireless Occupancy Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Europe Wireless Healthcare Industry Report

Statistics for the 2024 Europe Wireless Healthcare market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Wireless Healthcare analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.