Hand Care Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 8.33 Billion |

| Market Size (2029) | USD 10.28 Billion |

| CAGR (2024 - 2029) | 4.31 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Hand Care Market Analysis

The Hand Care Market size is estimated at USD 8.33 billion in 2024, and is expected to reach USD 10.28 billion by 2029, growing at a CAGR of 4.31% during the forecast period (2024-2029).

- The market is mainly driven by the increasing need to maintain hand hygiene and the rising consumer expenditure power on health. Also, government organizations' awareness of clean and healthy lifestyles is increasing through social media and online channels. Even the United States Centers for Disease Control and Prevention (CDC) organized a 'Clean Hands Count' campaign to improve healthcare provider adherence, addressing the myths and misperceptions about hand hygiene.

- In 2018, World Health Organization (WHO) also organized a hand hygiene campaign, 'Make a Difference-Prevent Sepsis in Health Care,' which was conducted to substantially impact the burden of sepsis in health care. Therefore, every year World Hand Hygiene day is celebrated on the 5th of May globally. As a part of the campaign, they promote the idea, the actions, and the products associated with Hand Hygiene.

- Geographically, North America dominates the global hand care market, owing to high hygiene standards among the United States population. Moreover, Asia-Pacific is expected to witness the highest growth rate from the last decade, owing to an increase in concern towards health and wellness paired with a rise in disposable income.

- However, the main challenge in the hand care market growth is the allergies arising due to the chemical ingredients used in the products by a few of the companies. Manufacturers are adding natural components like aloe vera to their products to prevent the rough skin that alcohol-based hand sanitizers create. Key market players are pushing the usage of hand sanitizers/hand care products through media coverage, advertising, and promotional initiatives. This is assisting them in increasing their market share in the global market and attracting more customers.

Hand Care Market Trends

Growing demand for sanitizers and disinfectants

- The growing awareness of consumers regarding the need for sanitizer and its advanced effectiveness compared to normal soaps is driving market sales. Also, initiatives taken by the World Health Organization (WHO) and Food and Drug Administration (FDA) to make people aware of hand hygiene and harmful diseases associated with it, paired with product innovations by the key players such as the addition of organic ingredients and soothing fragrances are boosting the market growth.

- For instance, Purell, a GOJO Industries, Inc brand, launched a green hand sanitizer made with plant-based ethanol and sold in a recyclable PET plastic container. Amway India launched a liquid hand wash - Persona Germ Protection and Moisturizing, free from widely used preservatives such as sulfate, paraben, and triclosan.

- Additionally, the COVID-19 pandemic positively affected hand sanitizer sales worldwide. Anti-infection skincare products have increased demand as people's top concerns shifted to health and hygiene. To stop the infection from spreading, the WHO advised using hand sanitizers in addition to routine hand washing. Thus, these initiatives increased market demand.

- Consumers are becoming increasingly conscious of the necessity of hand hygiene and how it relates to their overall hygiene and health. Hand sanitizer use is necessary to stop the spread of infectious diseases, which is anticipated to promote market expansion. In addition, hand sanitizers' portability and convenience over hand washes and their success in preventing a variety of diseases attract a sizable consumer base and boost hand sanitizer sales.

Asia-Pacific to Witness Fastest Growth in the Market

- Asia-Pacific is witnessing significant growth in the market owing to the increased awareness training and campaigns spread by government organizations in schools and hospitals. For instance, hospitals such as Matilda International Hospital (MIH), Shiraz Nemazee Hospital, Tokyo Medical University Hospital, and Nakornping hospital, to name a few, have been participating in the promotion of hand hygiene through educational programs to ensure compliance on the part of healthcare providers.

- Also, in India, Hindustan Unilever Limited (HUL), in collaboration with Swachh Bharat Abhiyan Campaign, encouraged every citizen to wash their hands regularly before eating, cooking, and after using the toilet. Therefore, companies are launching innovative natural products. For instance, in March 2021, The AVA Group's flagship brand, Medimix, announced the release of a new line of hand sanitizer gel that is 100% natural and contains natural components like aloe vera and Tulsi, in addition to having antibacterial characteristics.

- The Asia-Pacific region has been identified as a hotspot for emerging infectious diseases, including the Nipah virus, novel cholera, and dengue fever. Biodiversity loss is considered to be a significant factor contributing to the emergence and spread of these diseases.

- Biodiversity loss can lead to the fragmentation and degradation of natural habitats, which forces wildlife to come into closer contact with people and their domestic animals. This increased proximity can facilitate the transmission of zoonotic diseases from animals to humans. Additionally, biodiversity loss can alter ecosystems, creating conditions that favor the proliferation of disease vectors like mosquitoes, which can spread diseases like dengue fever.

- Therefore, addressing biodiversity loss and protecting natural ecosystems is crucial to reducing the risk of emerging infectious diseases. Conservation efforts can help to maintain healthy ecosystems and reduce the frequency and severity of zoonotic disease outbreaks. Improved public health measures, such as disease surveillance and control, can also help to prevent and mitigate the impact of emerging infectious diseases.

- Thus, people have become more aware due to the rising occurrences and concerns about the spread of various diseases. This has resulted in implementing preventive measures like hand sanitizing, hand washing, and using various hand care products. Furthermore, due to the rising health consciousness among the people and the outbreak of numerous diseases, China is one of the largest hand sanitizer markets in Asia. The Centers for Disease Control (CDC) has advised using hand sanitizer to prevent getting sick. All the above-mentioned factors drive the hand care market in this region.

Hand Care Industry Overview

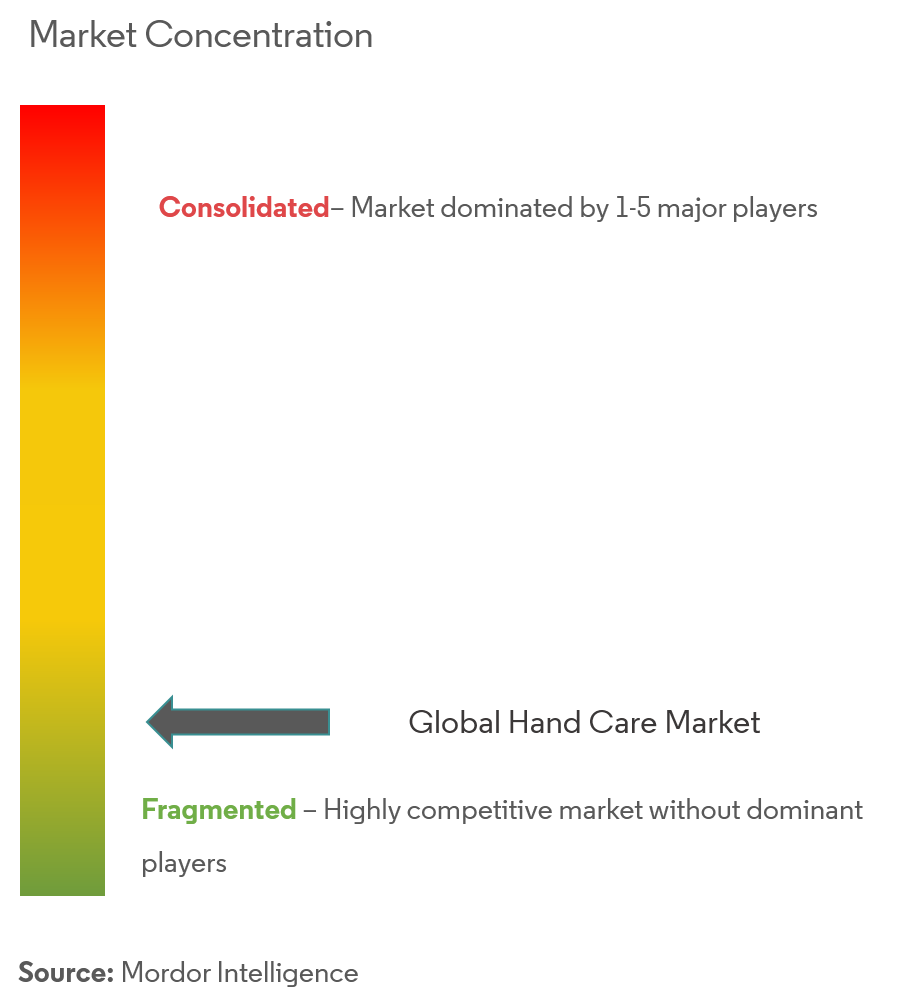

The global hand care market is fragmented due to large regional and domestic players in different countries. Emphasis is given to the companies' mergers, expansion, acquisitions, and partnerships to boost their brand presence among consumers. The key players are expanding their product lines in response to the customer shift towards hand care products produced with natural ingredients. Manufacturers are concentrating on introducing newer beneficial substances into disinfection solutions, such as aloe vera and tulsi, on providing protective hygiene solutions. Companies are also concentrating on investing in several types of skin washes, such as foam, gel, liquid, and sprays.

Hand Care Market Leaders

-

Unilever Plc.

-

Procter & Gamble

-

Johnson & Johnson

-

Reckitt Benckiser Group plc

-

Oriflame Cosmetics S.A.

*Disclaimer: Major Players sorted in no particular order

Hand Care Market News

- December 2022: An official letter of intent from NHS Supply Chain stated that SpectrumX, a United Kingdom-based healthcare and pharmaceutical company, obtained Spectricept Care+ Hands, a hand sanitizer listed on the Hand Hygiene and Associated Products and Services Tender within the non-alcohol-based hand disinfectant lot, which will be accessible in the market to customers from May 2023.

- July 2021: All 66 Westfield centers in the United Kingdom and European property portfolio were granted access to the Lifebuoy brand of hygiene soap owing to a five-year cooperation between Unibail-Rodamco-Westfield and Unilever PLC.

- March 2021: The launch of Cleancut's first-ever foamy hand sanitizer was announced. An FDA-approved disinfectant, the fragrance-free formulation was made with chemicals sourced from plants.

Hand Care Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Product Type

- 5.1.1 Hand Cream/Moisturizer

- 5.1.2 Hand Wash

- 5.1.3 Hand Sanitizers/Disinfectants

-

5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience/Grocery stores

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Unilever

- 6.3.2 Procter & Gamble

- 6.3.3 Johnson & Johnson

- 6.3.4 Reckitt Benckiser Group plc

- 6.3.5 Oriflame Cosmetics S.A.

- 6.3.6 L'Occitane, Inc.

- 6.3.7 Shanghai Jahwa United Co.

- 6.3.8 Whealthfields Lohmann

- 6.3.9 Himalaya Global Holdings Ltd.

- 6.3.10 Amway India Enterprises (P) Ltd

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. ABOUT US

** Subject To AvailablityHand Care Industry Segmentation

Hand care refers to taking care of your hands to maintain their health, cleanliness, and overall appearance. Hand care involves various practices such as washing your hands regularly, applying moisturizers, wearing gloves when working with harsh chemicals or materials, and avoiding habits that may damage the skin on your hands.

The global hand care market has been segmented by product type into hand cream/moisturizer, hand wash, and hand sanitizers/disinfectants, and by distribution channel into supermarkets/hypermarkets, convenience/grocery stores, online retail stores, and other distribution channels. Also, the study provides an analysis of the hand care market in emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.\

The report offers market size and forecasts in value (USD million) for the above segments.

| Product Type | Hand Cream/Moisturizer | |

| Hand Wash | ||

| Hand Sanitizers/Disinfectants | ||

| Distribution Channel | Supermarkets/Hypermarkets | |

| Convenience/Grocery stores | ||

| Online Retail Stores | ||

| Other Distribution Channels | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East and Africa |

Hand Care Market Research FAQs

How big is the Hand Care Market?

The Hand Care Market size is expected to reach USD 8.33 billion in 2024 and grow at a CAGR of 4.31% to reach USD 10.28 billion by 2029.

What is the current Hand Care Market size?

In 2024, the Hand Care Market size is expected to reach USD 8.33 billion.

Who are the key players in Hand Care Market?

Unilever Plc., Procter & Gamble, Johnson & Johnson, Reckitt Benckiser Group plc and Oriflame Cosmetics S.A. are the major companies operating in the Hand Care Market.

Which is the fastest growing region in Hand Care Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Hand Care Market?

In 2024, the North America accounts for the largest market share in Hand Care Market.

What years does this Hand Care Market cover, and what was the market size in 2023?

In 2023, the Hand Care Market size was estimated at USD 7.99 billion. The report covers the Hand Care Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Hand Care Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Hand Care Industry Report

Statistics for the 2024 Hand Care market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hand Care analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.